In this Placer Bytes, we dive into two retail segments that seem impervious to the pandemic’s effects – pets and shoes.

Privileging Pets

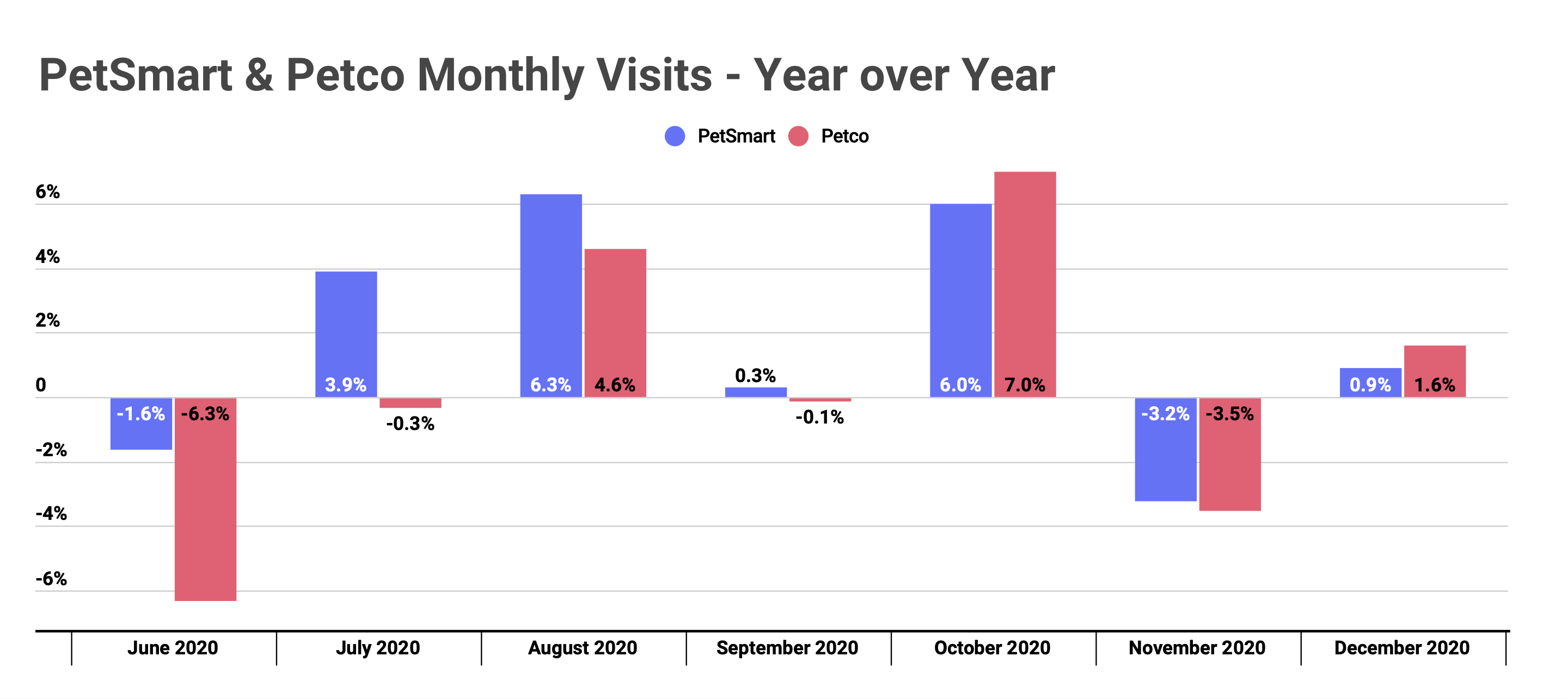

While it may seem obvious that our pets hold center stage amid the pandemic, the results have still been impressive. The sector has ridden a similar wave to the rest of retail, with recoveries offset by a step back in November, yet this specific space is riding much higher levels of strength than most retail players. Looking at visits for sector leaders PetSmart and Petco shows strong Q4 performances with monthly visits up an average of 1.2% for PetSmart and 1.7% for Petco, even with the COVID-driven November dip.

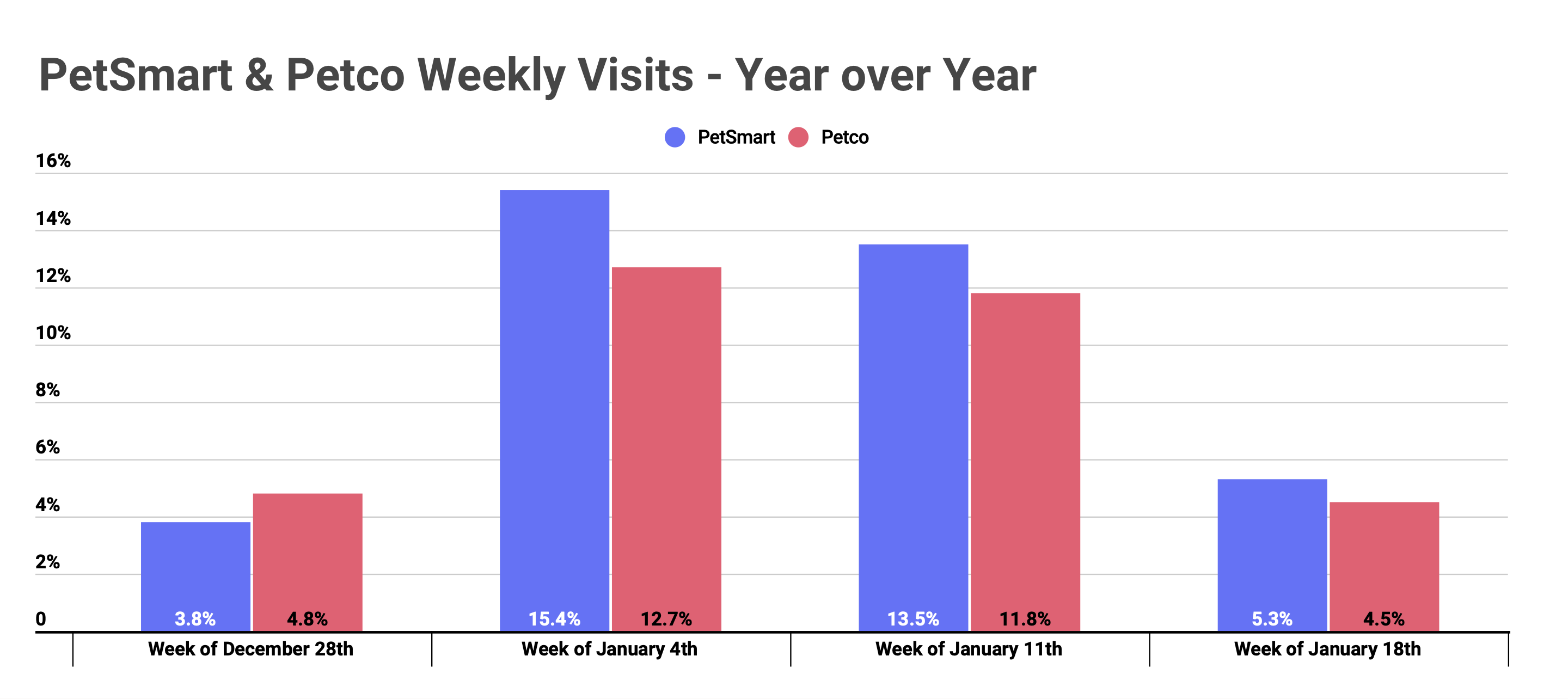

And the new year looks to have kicked off with even more strength. In the four weeks from the week beginning December 28th, visits to both retailers have been up year over year each week. This culminated in the week of January 4th and 11th, when weekly visits for the two brands were up 14.4% and 12.3% on average year over year. This was a massive kickoff to a year that could drive significant returns for the sector.

Getting Their Kicks

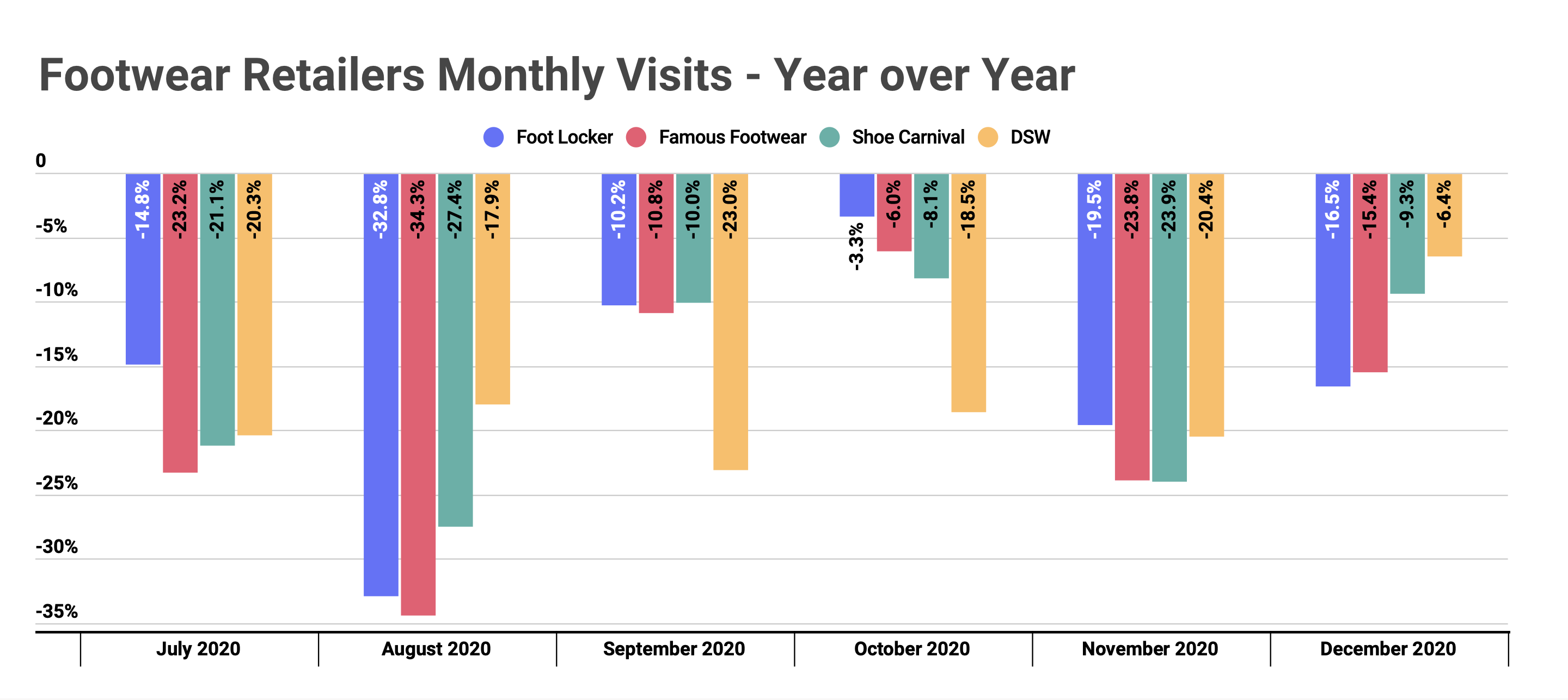

And while pet strength may be obvious, a more surprising performance has come from the footwear space. Whether driven by more running and at-home workouts, or a greater focus on footwear overall, the sector has performed relatively well.

Visits to Foot Locker locations were within 3.3% of 2019 levels in October before falling to 19.5% in November and bouncing back to 16.5% down in December. Famous Footwear and Shoe Carnival saw similar swings with visits hitting a nadir in November following a significant shrinking of the year-over-year visit gap in October. They both also saw positive movement in December. DSW, however, shirked this trend with the visit gap seeing only a minor increase from October to November, before visits dropped significantly in December to just 6.4%.

And this too could have staying power as these brands align with a few key trends. Firstly, the move to more casual attire because of an increase in work from home not only speaks well for shoes, but also the apparel options these locations tend to have. Secondly, while the work from home bump might not demand a lot of equipment, it definitely incentivizes owning a good pair of shoes. Should these two ideas hold deeper into 2021, the impact on the brands could be significant.

Will pets and shoes continue to drive visits?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.