Introduction

Millennials are officially the nation’s largest generation,[1] and spanning the ages of 24 to 39, they are now in their prime home-buying years.[2] But for as long as they have been old enough to buy homes, millennials have lagged previous generations in fulfilling that goal. In this study, we combine data from the Census Bureau’s Current Population Survey and our annual Apartment List Renter Survey to assess whether millennials are catching up, or if they are truly less likely to attain homeownership than prior generations. Though the millennial homeownership rate is rising, we find that a generational homeownership gap persists and the impacts of the ongoing COVID-19 pandemic are likely to reinforce the trend in years to come.

Millennials Homeownership Lags Older Generations

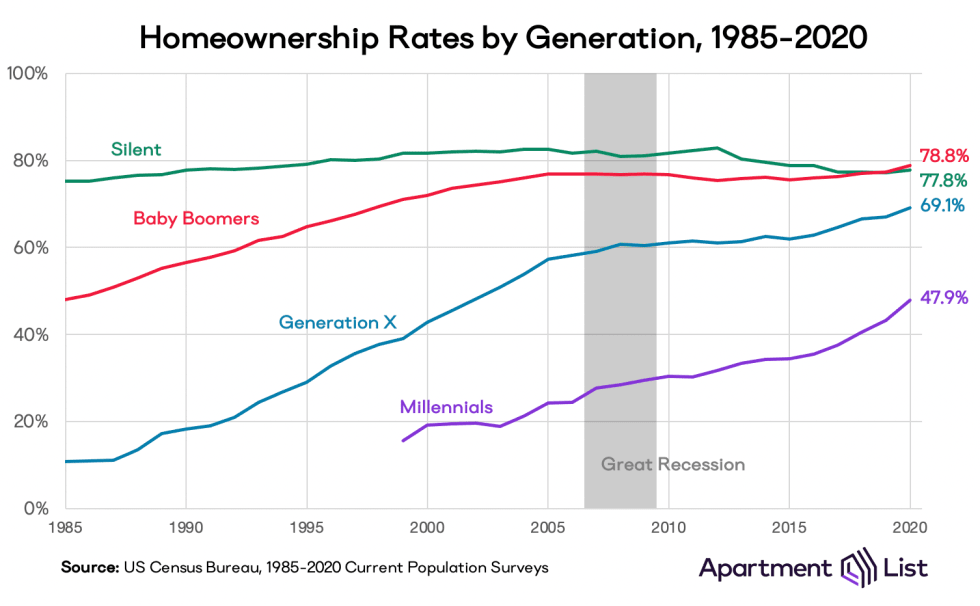

The 2020 millennial homeownership rate stands at 47.9 percent according to the most recent data from the Census Bureau’s Current Population Survey.[3] For members of Generation X (ages 40 to 55 in 2020), the homeownership rate is over 20 percentage points higher at 69.1 percent. The Silent Generation - the children of the Great Depression - have a homeownership rate of 77.8 percent, after dipping slightly over the previous decade as some elderly Americans give up their owned homes to live with family or in group settings. Today, it is the Baby Boomers who enjoy the nation’s highest homeownership rate: 78.8 percent and higher than ever before.

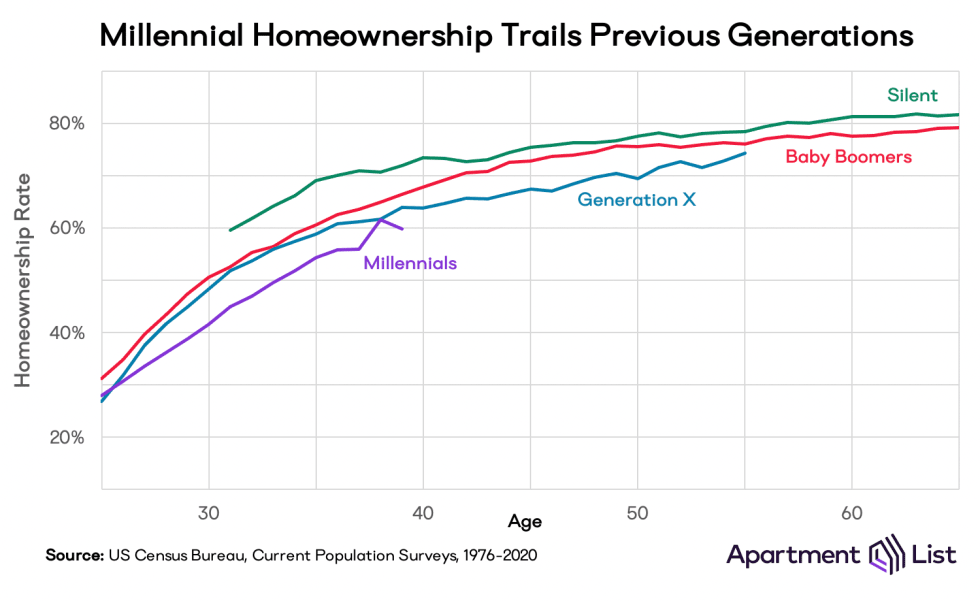

Over the past half-decade, the millennial homeownership rate has increased faster than that of other generations. But this is largely reflective of the stage of life that millennials are currently inhabiting; there are simply more new first-time homeowners in their 30s than their 60s. Controlling for age provides a more apples-to-apples comparison across generations and per the chart below, shows that despite recent increases, millennial homeownership continues to lag both Generation X and Baby Boomers. At age 30, 42 percent of millennials own homes. In comparison, 48 percent of gen Xers and 51 percent of boomers owned homes when they were the same age.

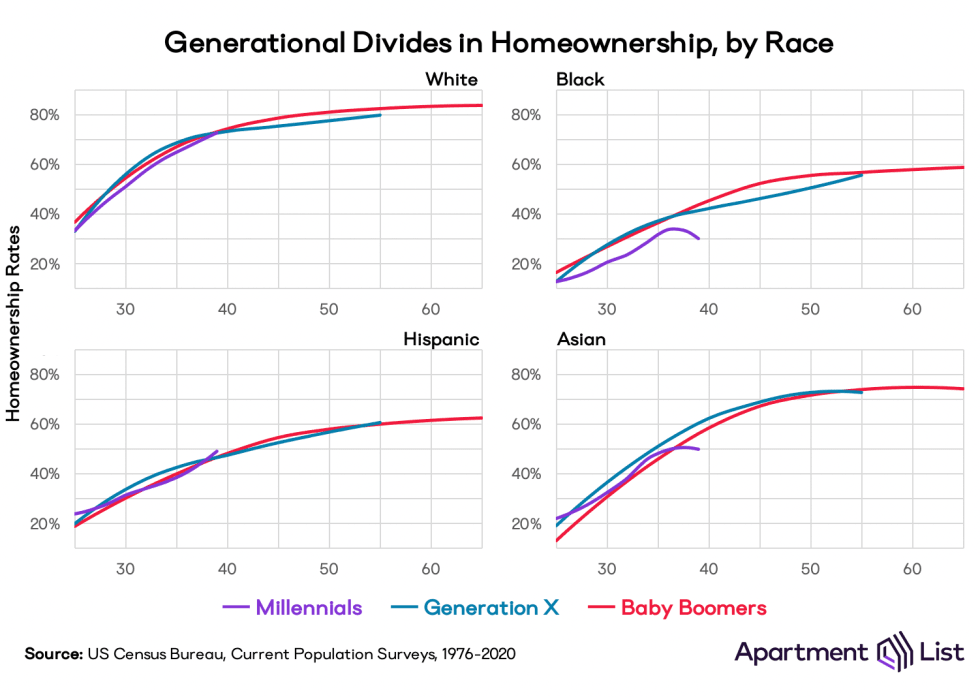

The millennial housing struggle is not uniform. The United States suffers from massive wealth inequality, and one of the major contributing factors is a low rate of minority homeownership, particularly among millennials. White millennials maintain a homeownership rate that is substantially higher than non-white groups, and only barely lower than previous generations. Hispanic and Asian homeownership trails well behind, despite not having significant gaps between generations. But for Black Americans, not only is homeownership lower than the rest, millennials face the largest generational divide. By age 30, the white millennial homeownership rate (51 percent) is already 2.5x higher than the rate for black millennials (20 percent).

Millennials Will Struggle to Catch Up with Previous Generations

Despite ingrained racial disparities, millennials as a whole performed well in the housing market in 2020. Per the charts above, their homeownership rate rose faster than previous generations, and today millennials account for more than half of all new mortgages. The market was aided by historically-low interest rates that drove a record number of home purchases this year.

But the data do not show a disproportionate surge in millennial homeownership that is likely to close the generational gap. As millennials progress in their careers and their purchasing power improves, they have become responsible for a slightly larger share of the nation’s home purchases each year, from 34 percent in 2017 to 38 percent in 2020. First-time home purchases - typically dominated by younger adults - have grown in a similar fashion, from 31 to 33 percent over the past three years. But they come nowhere close to rates from the homeownership boom that preceded the Great Recession, when more than half of all home purchases were made by first-timers.[4]

Meanwhile, for the majority share of millennials who have yet to purchase a home, the surrounding economic conditions that determine homeownership opportunity took a nosedive. The economy recessed, and as income loss falls disproportionately on the shoulders of younger generations, home prices remain high. Among millennial renters, there is declining optimism about the prospect of homeownership. In 2020, 18.2 percent of millennial renters say they plan to rent forever, up for the third consecutive year from 12.3 percent in 2019 and 10.7 percent in 2018.

Nevertheless, optimism remains high for the groups that have been historically excluded from the housing market. White homeownership has exceeded minority homeownership for generations, but white millennials who do not own homes are less likely to say that they plan to buy in the future. According to our survey, the share of millennial renters who expect to rent forever is highest among whites (20 percent), compared to Blacks (17 percent), Asians (17 percent), and Hispanics (14 percent). This speaks to the role of homeownership as a vehicle for wealth creation in America. A separate Apartment List survey found that nearly 90 percent of adults view homeownership as important for personal success and financial security. As the wealth gap widens between white and non-white Americans (and between homeowners and renters), more non-white renters recognize that purchasing a home can improve economic security for themselves and their families.

The COVID-19 Pandemic Has Worsened Affordability

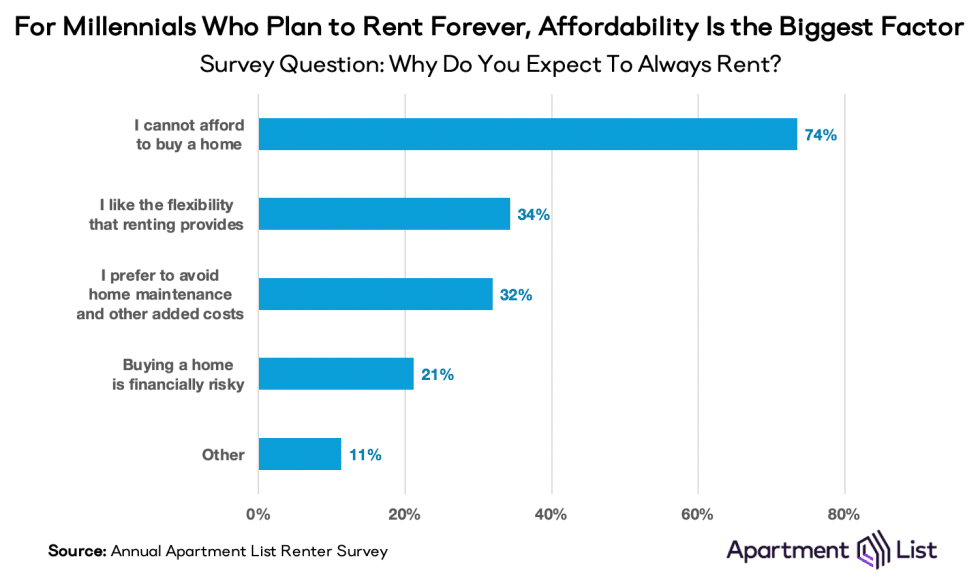

2020 saw a rise in both unemployment and home prices, so it comes as no surprise that affordability remains the biggest roadblock to prospective millennial homebuyers. To shield the housing market from a volatile economy, interest rates were dropped to near-record lows this year. This makes it easier to finance a home, but only for those who can afford the upfront cost of a down payment. And many millennial renters cannot. Among those who plan to always rent, 74 percent say they cannot afford homeownership, significantly more than those who cite the potential lifestyle benefits of renting, including added flexibility (34 percent) and avoiding unforeseen maintenance and expenses (32 percent). And despite a bullish housing market that has seen prices rise for over a decade, some millennial renters whose young adult years were mired by the Great Recession remain skeptical; 21 percent of committed renters say that buying a home is financially riskier than renting one.

Affordability is also a big hurdle for millennials who plan to buy a home in the future; over three-quarters say they are waiting until they have the financial means, over three times the share who say they are waiting to settle down in a single place, or waiting to get married or commit to homeownership with a life partner. And for a significant share (40 percent), the COVID-19 pandemic has had a direct effect on their homeownership plans, including 21 percent who are now delaying homeownership altogether. For most, this delay is driven purely by economics: a result of partial or total income loss (67 percent), a reduction of down payment savings (21 percent), or a concern that homeownership is no longer a prudent decision in a volatile economy.

Interestingly, a second group of renters has emerged who are delaying homeownership because they are less certain of their housing preferences in a post-COVID world. The pandemic has forced everyone to consider the pros and cons of their current living situation, whether it be price or location or amenities. For millennials whose homeownership plans are now delayed, 28 percent are reconsidering what type of home they want to purchase, while 27 percent are rethinking where they want to buy entirely. An economy increasingly built on remote work instead of physical offices can have a big impact on where millennials want to invest in the housing market.

Millennial Savings Rates Are Alarmingly Low

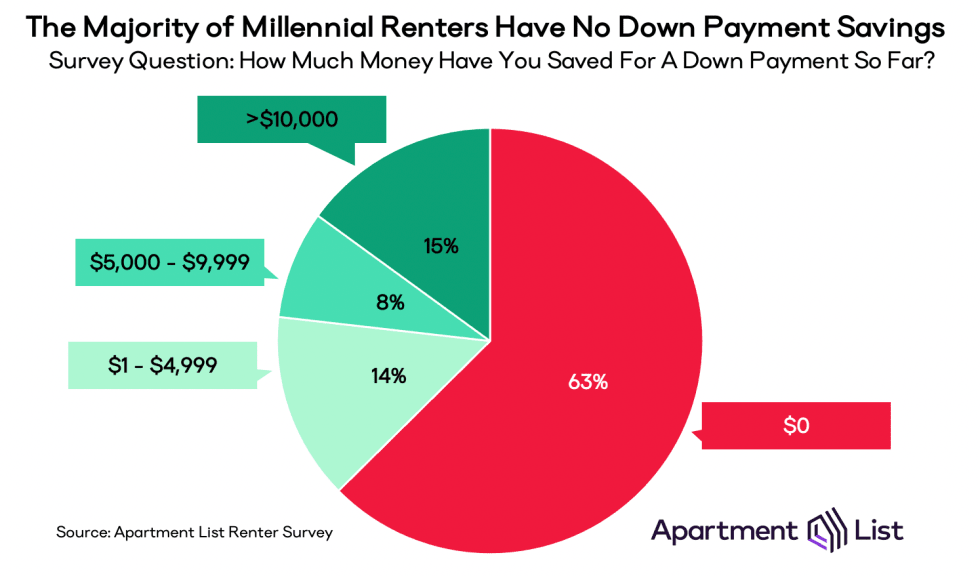

Despite the fact that over 80 percent of millennial renters plan to buy a home in the future, many are still a long way from realizing their goal. Our survey finds that 63 percent do not have any dedicated down payment savings set aside, and only 15 percent have saved over $10,000 which is still not enough to cover a 20 percent down payment on a median-priced condo.[5] While it is true that lenders tend to be more lenient in their down payment requirement for first-time home buyers, the up-front costs of homeownership remain a massive roadblock for many renters. 62 percent said the down payment is a reason they are waiting, compared to just 31 percent who cited recurring monthly payments.

To overcome a lack of personal savings, many millennials are turning to their parents for help. In this year’s survey, over 20 percent said they are expecting down payment assistance from family, highlighting how wealth in one generation can affect wealth in the next. But for the remaining 80 percent, homeownership may be realistic only if their personal savings increase dramatically and/or they narrow their search to some of the nation’s most affordable markets.

Conclusion

Following the Great Recession, home prices recovered and appreciated significantly faster than household incomes,[6] worsening the affordability crisis that has prevented many renters from buying homes. The COVID recession has the potential for an even more-disproportionate recovery, as incomes have suffered while home prices have continued uninterrupted growth. For the renters priced out of homeownership, some will take comfort in the fact that median rents have dropped in 2020, but many of those rent drops are concentrated in the nation’s most expensive markets that will remain prohibitively expensive.

Beyond millennials, the COVID-19 recession is a watershed economic moment for the following generation, Z. Currently ages 23 and younger, many are coming of age at a time of great economic uncertainty. And despite their youth, the share of Gen Z renters who expect to rent forever is already 18 percent, similar to older millennials renters who have lived through the affordability crisis first-hand. Whether the Gen Z homeownership rate continues the existing trend and falls short of the millennial rate remains to be seen. But the economic inequalities that contribute to low millennial homeownership are strengthening, not weakening. One thing that remains to be seen is the extent to which remote, decentralized working arrangements prevail in a post-COVID economy. This may provide Gen Z a unique opportunity to access good jobs and affordable homes at the same time, even if the two exist physically in different places.

[1] Pew Research Center: Millennials overtake Baby Boomers as America’s largest generation

[2] Generation definitions are adopted from the Pew Research Center. For details, see the chart titled “The Generations Defined” in this report.↩

[3] COVID-19 impacted data collection and quality for the 2020 Current Population Survey, including the Annual Social and Economic Supplement which asks about homeownership status. Historically, data are collected with a mix of in-person and over-the-phone surveys, but in 2020 nearly all collection was done by phone, potentially resulting in an over-estimate of the homeownership rate. For more information, see this FAQ from the Census Bureau.↩

[4] National Association of Realtors, REALTORS® Confidence Index Survey.↩

[5] National Association of REALTORS®: Median Sales Price of Existing Apartment Condo-Coops Homes for Metropolitan Areas↩

[6] According to the Census Bureau, from 2010 to 2019 the median home sales price rose 44 percent while the median household income rose only 19 percent.↩

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.