A second round of stimulus checks issued by the US government has led to a boost in spending across the US economy. In today’s Insight Flash, we dig into trends by income level in order to understand where the biggest impact has been – by shopper, by geography, and by subindustry.

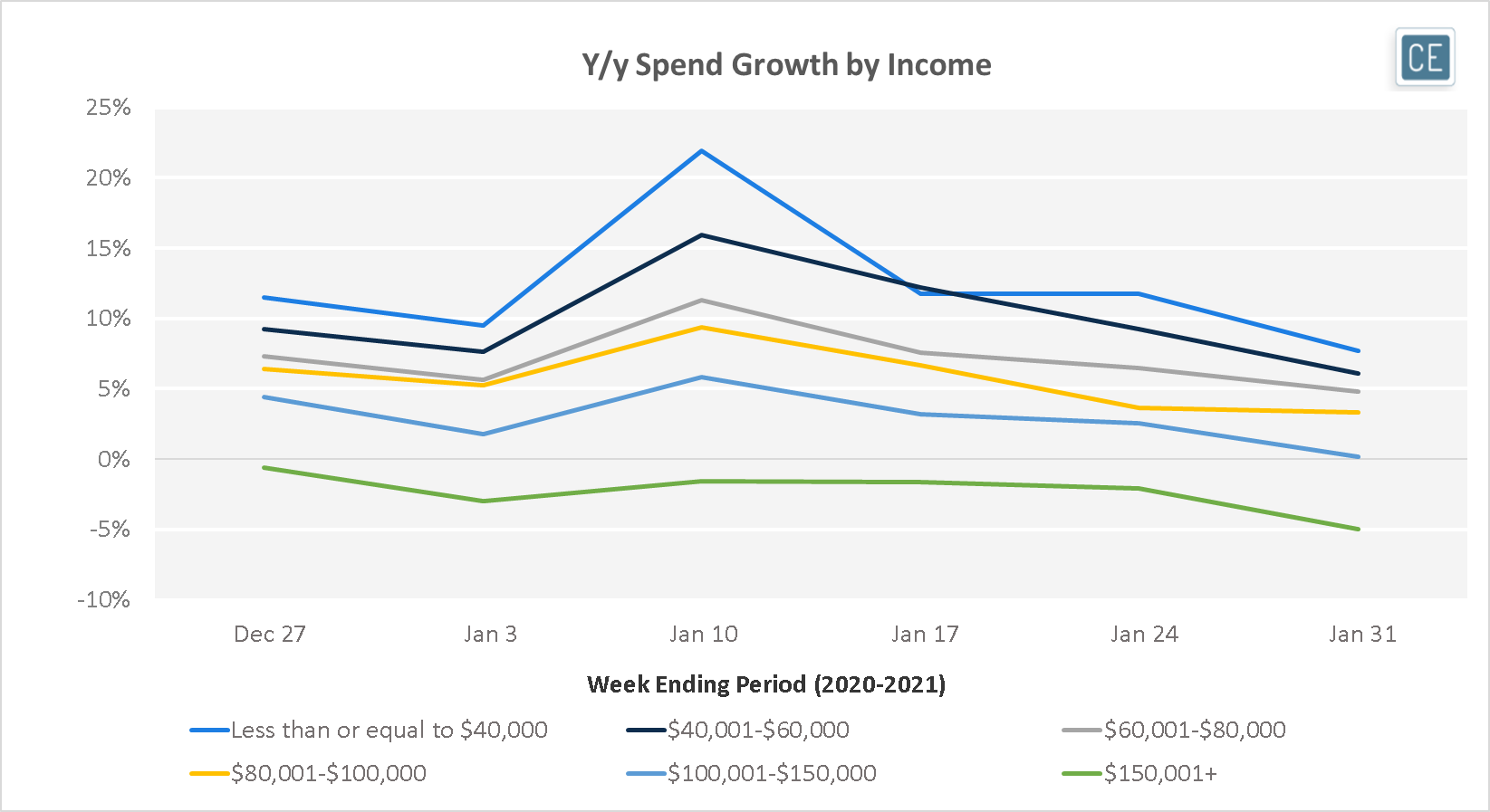

An analysis of overall spending by income group shows that the stimulus really hit its mark. The lowest income groups showed the largest increase in spend growth throughout the month. Those making under $40,000 per year showed especially strong growth, peaking at 22% the week ending January 10th. Those making over $150,000 per year were the only group to spend less than they had the prior year.

January Spend Growth

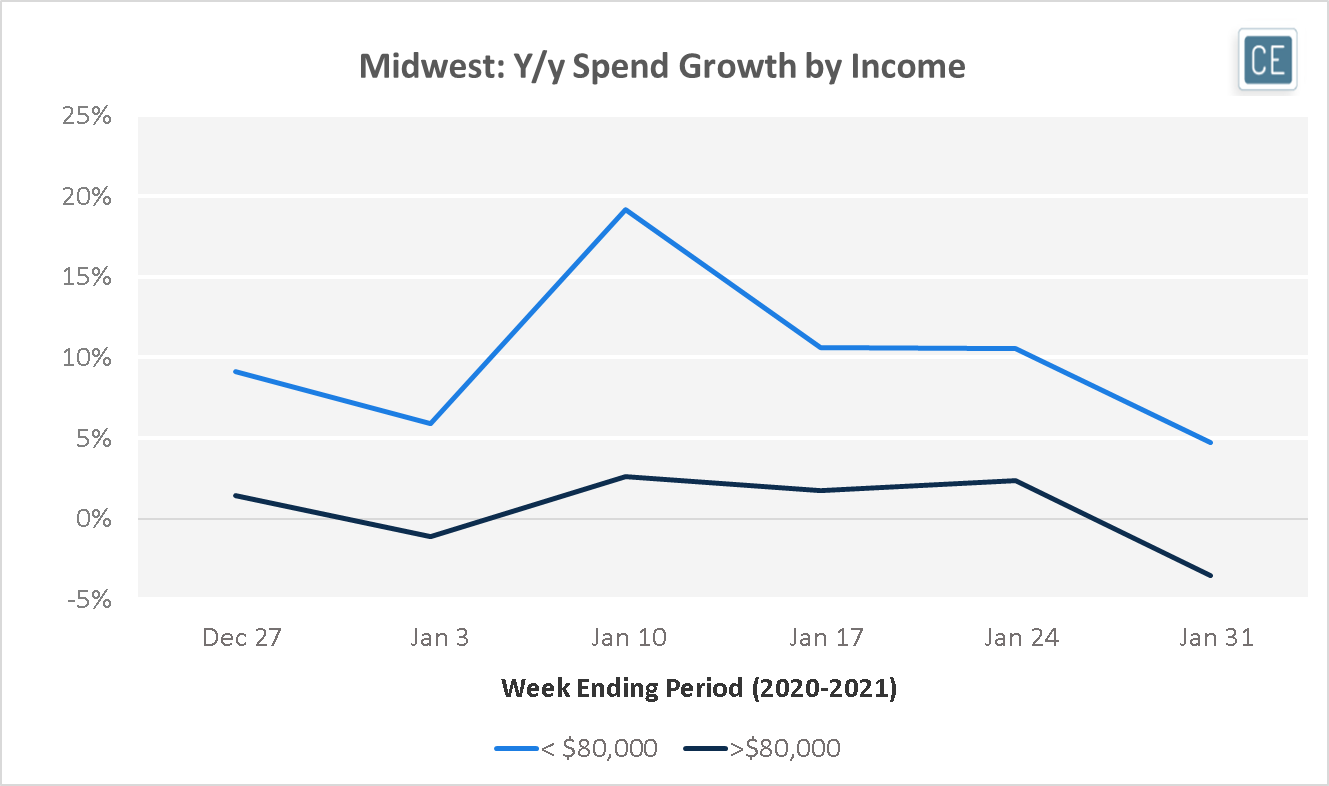

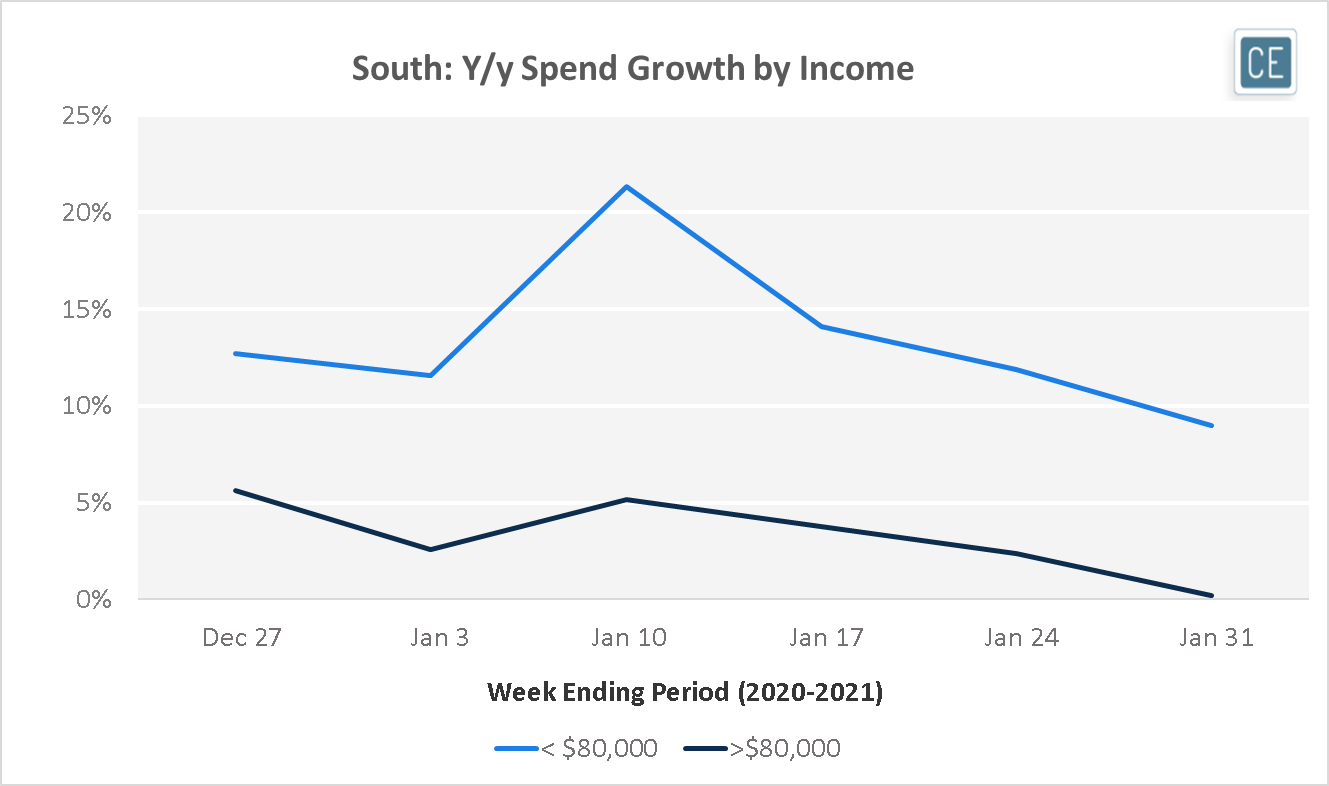

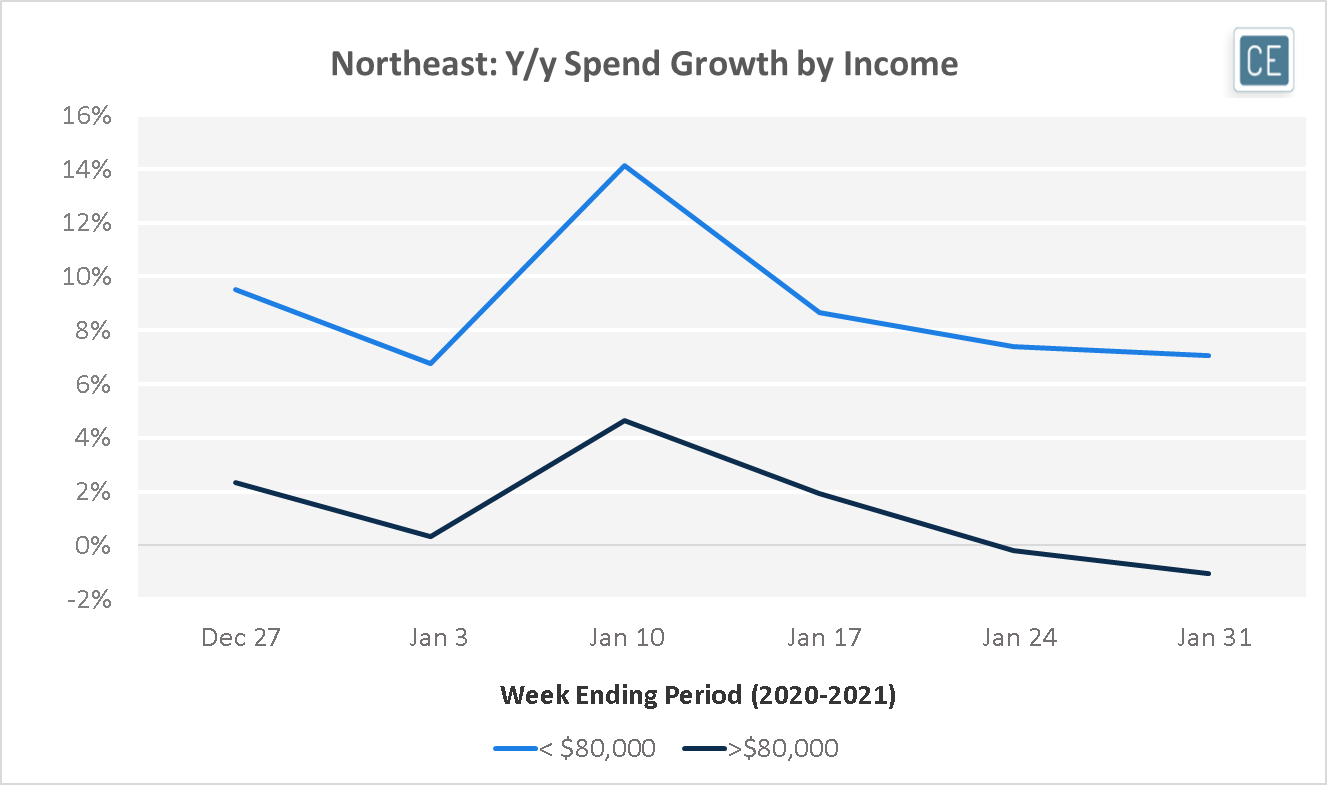

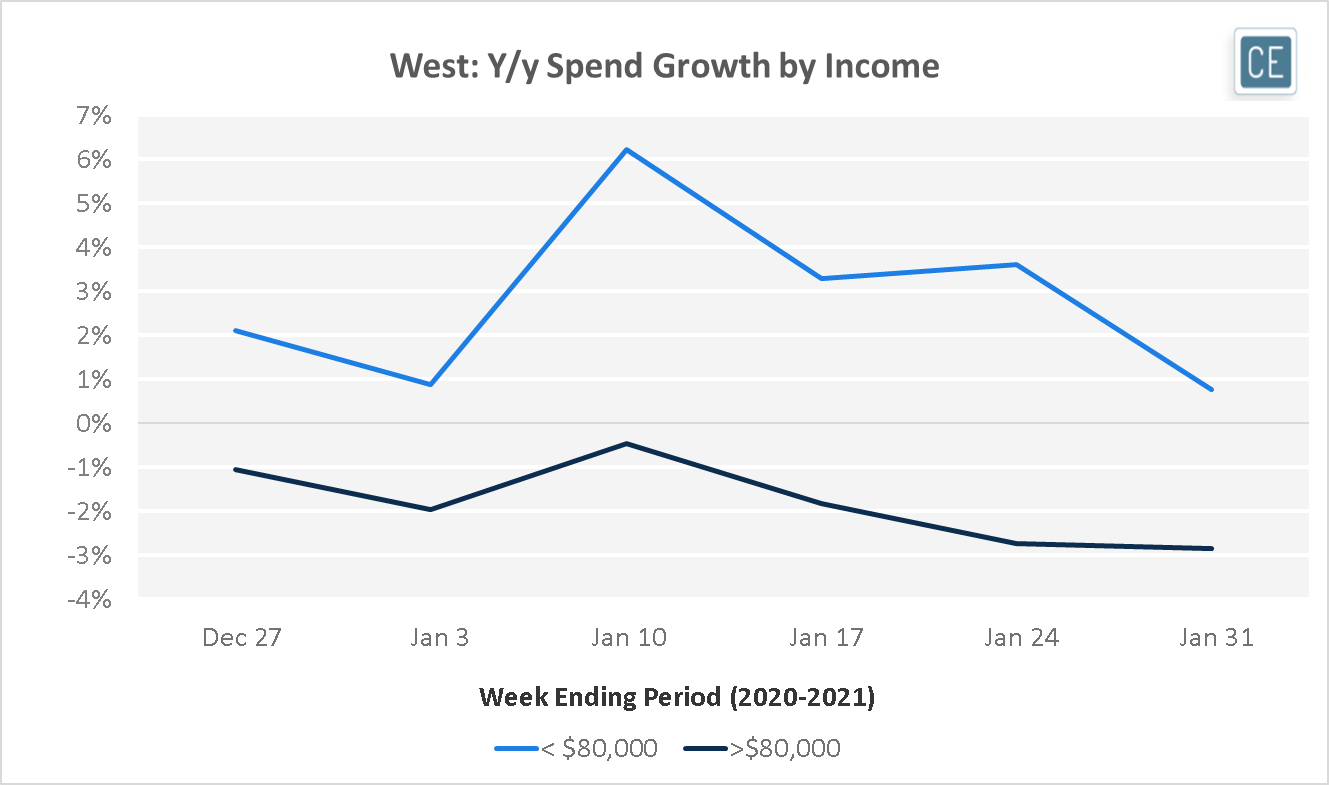

These income trends are consistent across geographies, with lower income spend growth outpacing higher income spend growth in all four US Census regions. The gap was most pronounced in the South, where those making under $80,000 per year outspent those making above $80,000 per year by a delta of 16% the week ending 1/10, and 10% the weeks ending 1/17 and 1/24. The Midwest saw gaps in spend growth between the two income groups that were almost as large, while the difference was more subdued but still sizeable in the Northeast and smallest in the West.

Geographical Breakdown by Income

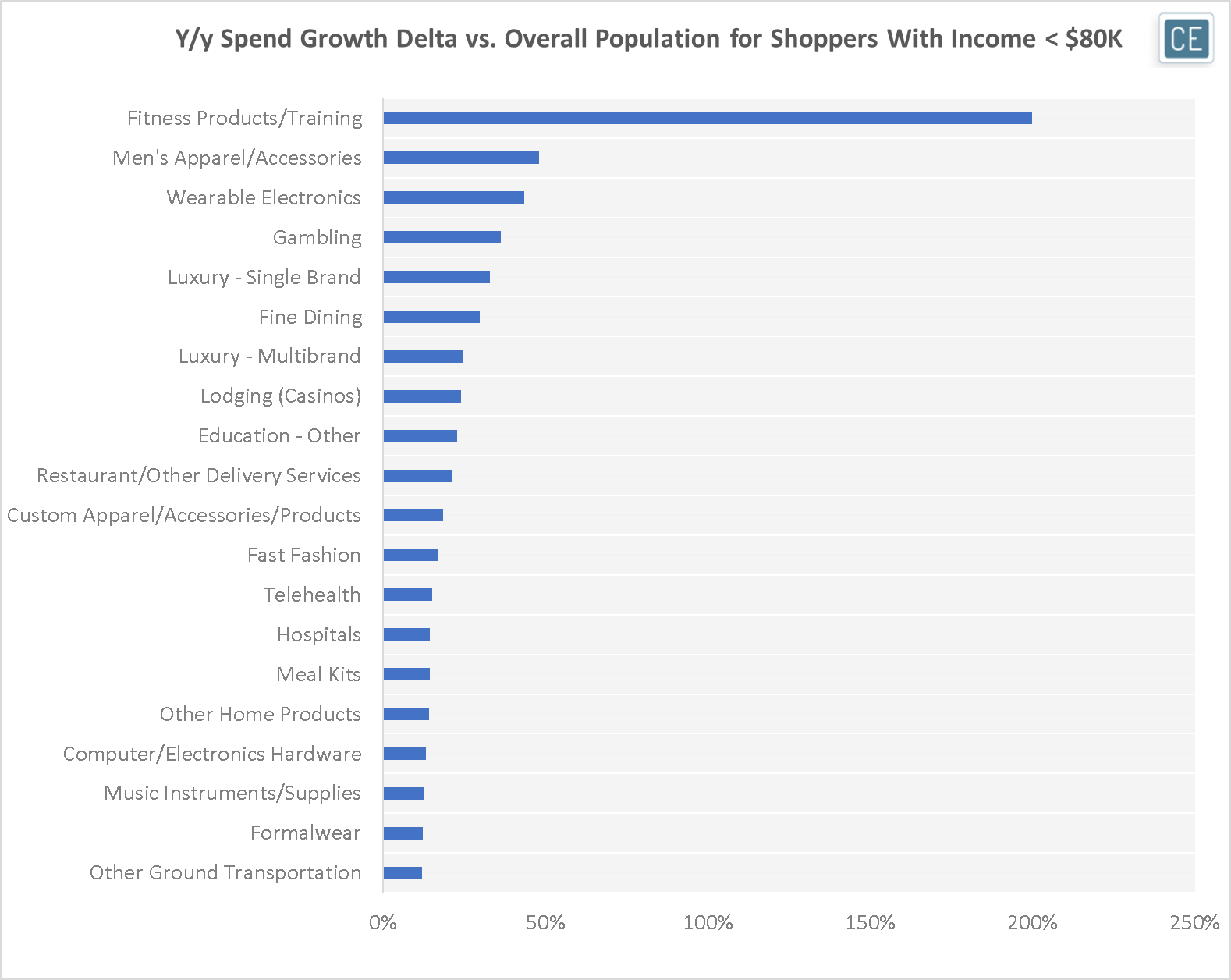

Stimulus checks didn’t only lead to a difference in how much lower income shoppers spent, but also where they spent. Lower income shopper spend growth for the very popular Fitness Products/Training subcategory outpaced overall spend growth by 200%. Men’s Apparel and Wearable Electronics also saw outsized growth among the lower income group, as did Gambling and Casinos. Finally, big-ticket items like Luxury products and Fine Dining seemed to be a popular destination for stimulus check income, as they experienced dramatically higher growth among lower income shoppers than among the overall population.

Subindustry Trends

Note: Subcategory spend growth for those making <80K per year minus subcategory spend growth for overall population; calendar January

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.