The Oil & Gas sector was in trouble even before the first Covid lockdown, and it was one of the worst credit performers in 2020. A perfect storm of falling oil prices, the spectacular rise of alternative energy sources, and the effective collapse of global tourism took many oil companies to the brink of bankruptcy and pushed some of them over the edge. Recent agency downgrades have cited climate change and permanently higher oil price volatility; agency ratings for some of the US majors are now aligned with the more conservative bank consensus.

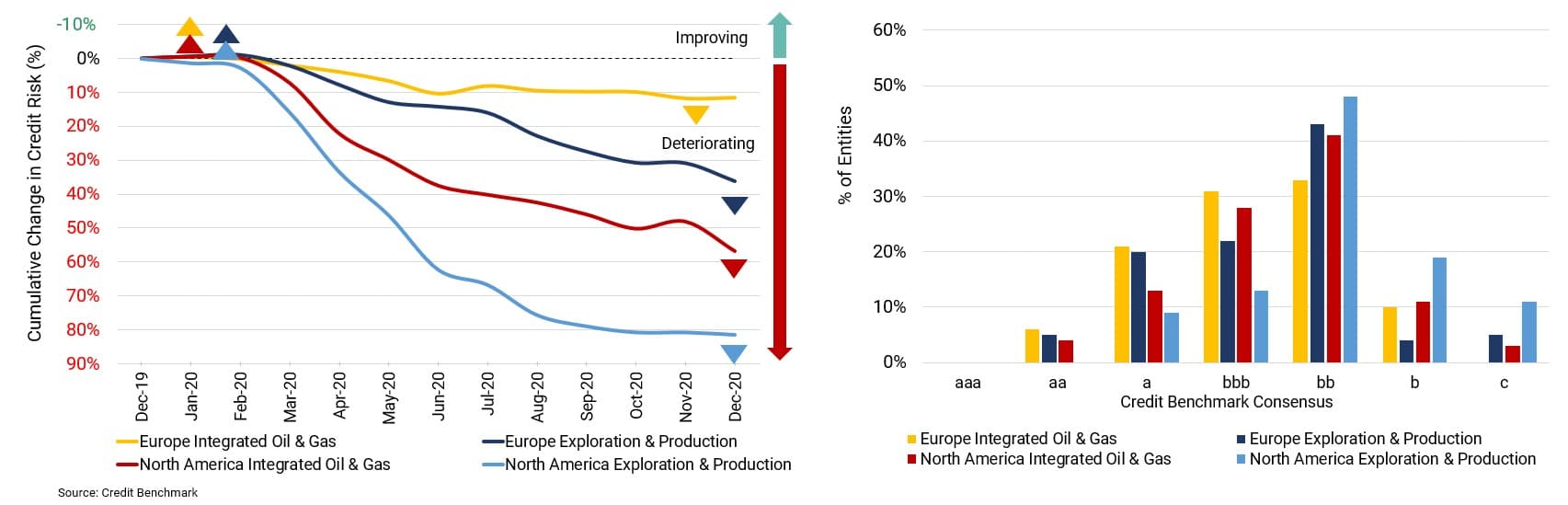

Figure 1 compares trends and the current credit distributions for Europe and North America.

Figure 1: Credit trends for Oil & Gas, Europe and North America, Integrated vs. E&P

North American E&P credit risk increased about 80% since the Covid crisis began (US E&P increased nearly 100%) against an increase of 60% for Integrated firms. E&P credit risk in Europe increased by about 40% – half that of North America – while the risk of Integrated companies in Europe increased by only 10%.

As the distribution chart shows, the majority of the constituents of these aggregates are in the bb category, although many of the Integrated firms in Europe are still investment grade. 10% of the North American E&P sector are in the c category.

The Oil & Gas sector faces a long recovery, but crude futures are climbing (up 15% – 20% so far in 2021). If this persists, then companies with the most leveraged exposure to oil prices – such as the North American E&P universe – might be able to put the worst of the 2020 credit deterioration behind them.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.