Source: https://www.advan.us/blog.php

It’s been a year now into full or partial lockdowns, social distancing rules and work from home as a result of the COVID crisis which unequivocally forced people to spend more time into their homes and consequently to change their shopping habits - reconsidering what is essential and therefore set new priorities on what to buy.

One of the new essentials seems to be – not surprisingly – bedding products as people seek extra comfort at home. Mattress sales soared in the second half of 2020 since many Americans decided to upgrade their sleeping setup.

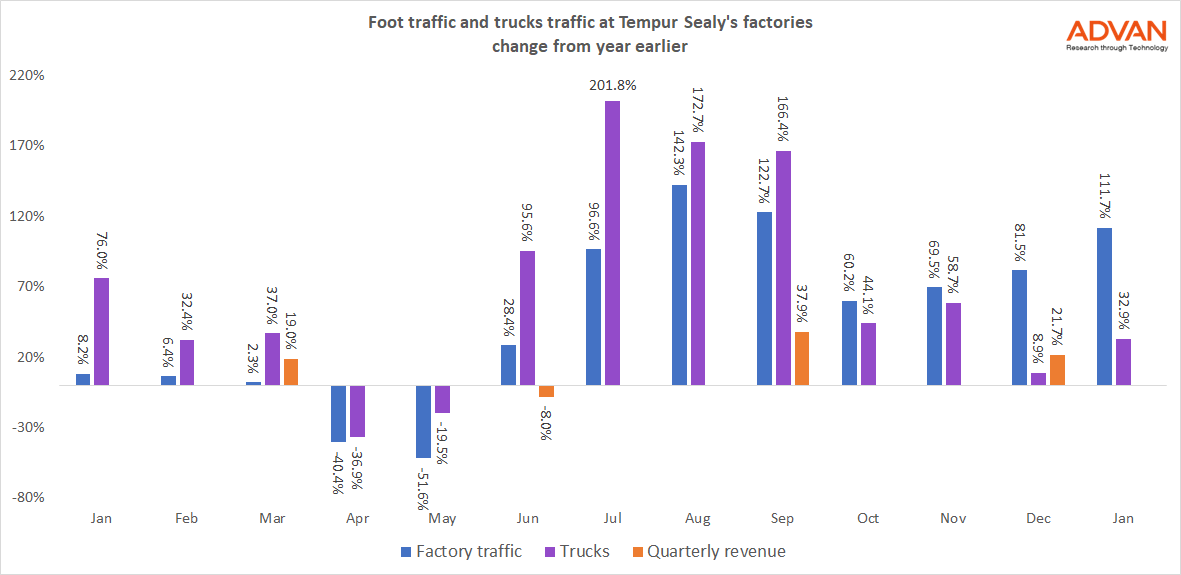

On Thursday February 11, 2021, Tempur Sealy (NASDAQ:TPX) posted record revenues of $1.06bn for the quarter ending December 2020, surpassing the consensus estimate of $985mm and in the same direction as Advan’s forecast. The company said its global sales grew 21% year-over-year and their online sales in the US doubled compared to prior year. It is noteworthy that Tempur Sealy’s top line revenue and Advan’s foot traffic at its factories have a correlation of 0.85 over the last 16 quarters. The mattress maker is among others which is overwhelmed with the spike in demand caused by COVID crisis to the point that exceeded the manufacturing capacity (read our recent blog for shortages in other industries).

We looked at the foot traffic at Tempur Sealy’s factory sites and saw the traffic were almost doubled from June 2020 to Jan 2021 compared to year earlier. By using our “Trucks” product, we also saw the truck traffic hitting 202% increase in July and not falling below 150% throughout the summer, an indicator that summer months were the busiest in terms of production and order shipments. Things started cooling down a little bit since October with the traffic to fall (still up) to 60% YoY, with the trend going upwards – January 21’ closed with 112% increase in traffic compared to January 2020.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.