In contrast to what many anticipated in the earlier days of COVID, the off-price retail space has witnessed a significant recovery pattern throughout the pandemic, both in foot traffic and reported revenue. But as the sector quickly paves its way back to normalcy, leading off-price brands face new challenges and pandemic-driven shifts that can significantly impact their growth rate.

In our latest Off-Price Retail Dive whitepaper, we dove into some of the significant shifts shaping the industry during the pandemic and their impact on its impressive rise. Below is a taste of what we found.

Competition Intensified

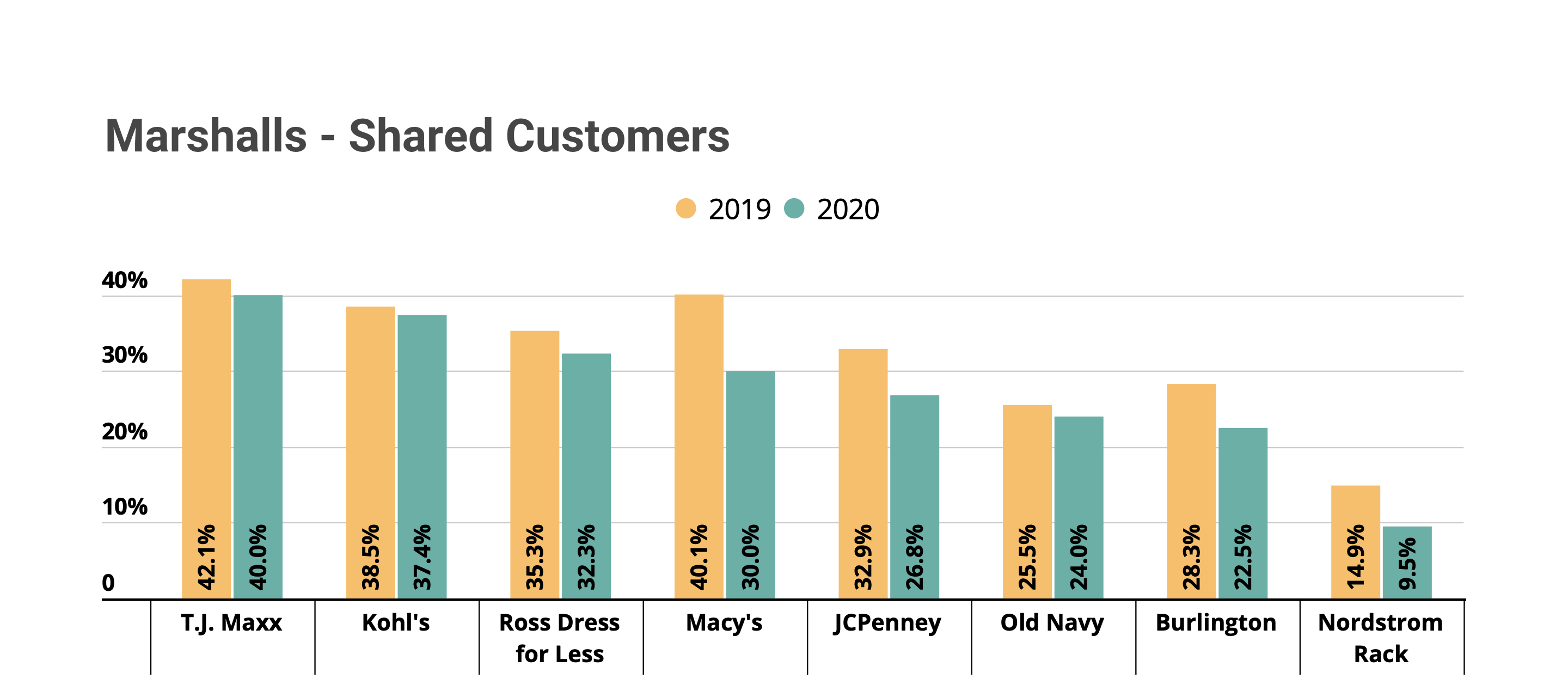

Location data has shown that during 2020, off-price leaders had experienced an overall decrease in the percentage of their shared customers with other leading off-price and apparel brands. For example, Marshalls saw an average decrease of 3.2% in cross-shopping with other leading off-price brands year over year.

In other words, many consumers who in the past would have visited two or more off-price stores began to visit just one. With a growing competition over once-shared customers, the need to leverage competitive advantages has also increased. This also speaks to the huge potential for the sector in 2021, as this mission-driven shopping orientation is likely to become a remnant of the COVID era.

Loyalty on the Rise

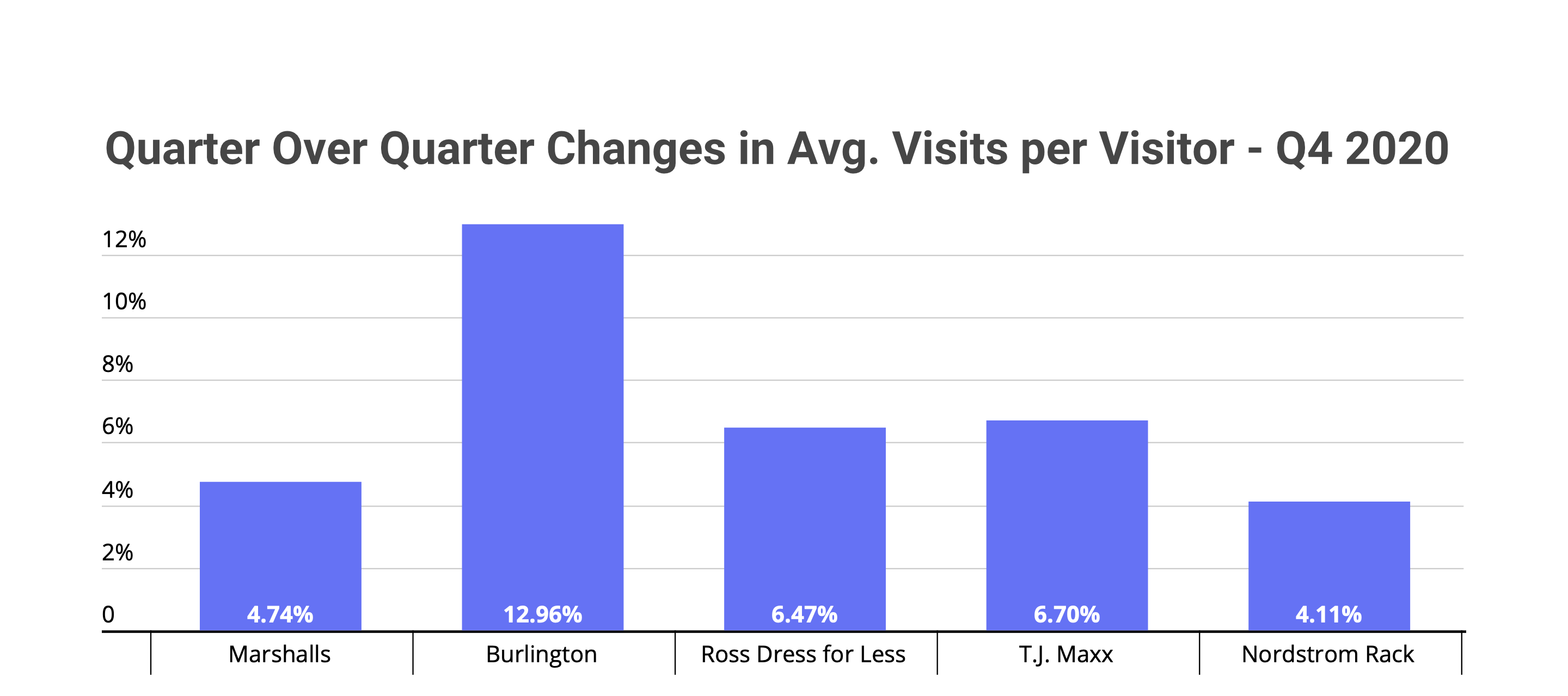

The dramatic jump in year-over-year visits during the last quarter of 2020 was not the only significant recovery sign that off-price leaders saw. In Q4, they also experienced a substantial increase in the average number of visits per visitor compared to the previous quarter. This is an encouraging indication that foot traffic will continue to grow with the increase in returning customers and loyalty rates, despite direct competition growth. The rise in these metrics in Q4 is especially impressive as it came during a wider decline for the overall retail landscape as COVID cases surged ahead of the holiday season.

Broadening Product Range

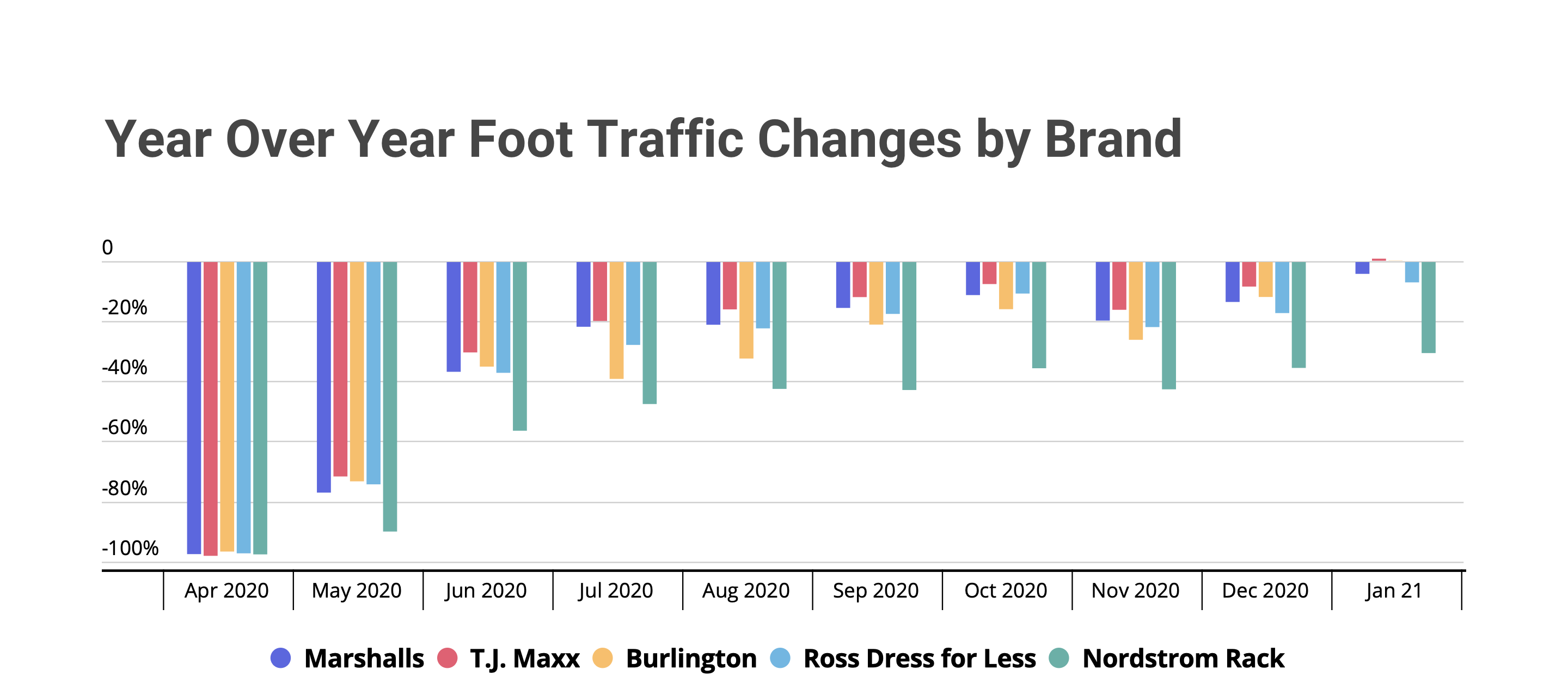

When analyzing brand foot-traffic performances throughout the pandemic, TJX Group’s T.J. Maxx and Marshalls stood out more than others in their ability to shrink their year-over-year visit gaps. In September, Marshalls and T.J. Maxx saw year-over-year visits down only 15.2% and 11.6%, respectively, while Ross, Burlington, and Nordstrom Rack experienced declines of 17.2%, 20.8%, and 42.5%.

Some analysts suggest that one of the reasons behind TJX Group’s relative success during the pandemic is the wider range of off-price product categories it carries, most important among them being the home goods category. The recent shift in demand from apparel to home goods, beauty, and other categories is estimated to continue beyond 2020. Off-price retailers that plan on broadening their product range are likely to benefit.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.