Source: https://insights.consumer-edge.com/2021/02/the-amazon-giant-straddles-both-sides-of-the-pond/

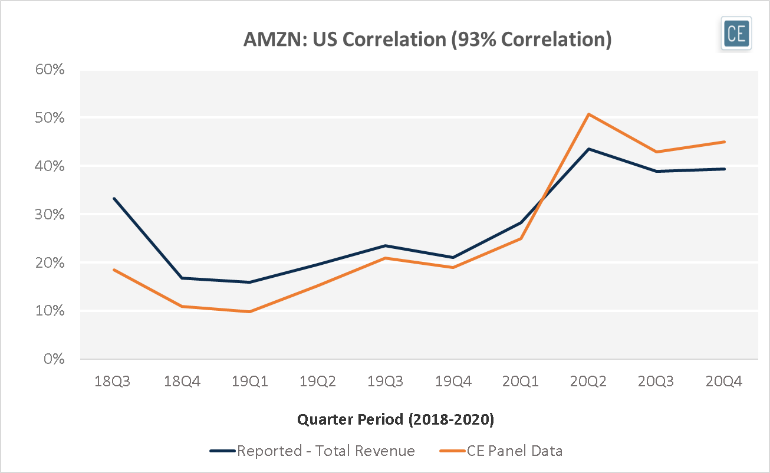

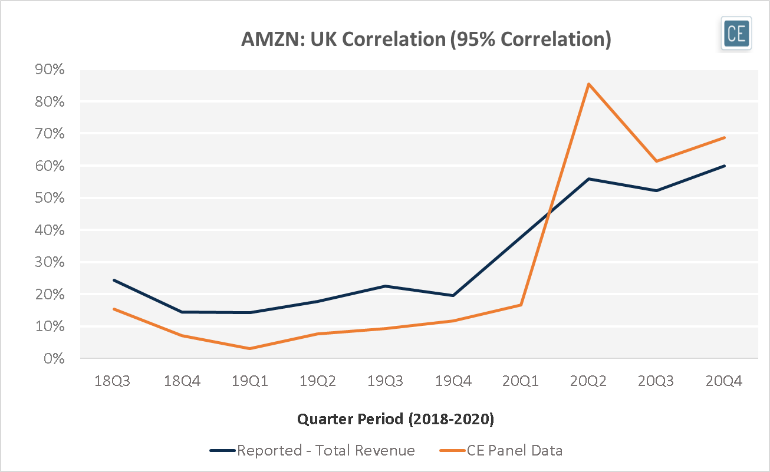

Consumer Edge’s recently launched UK dataset is very complimentary to our existing US data, and has proven to be highly predictive for US-based companies, such as AMZN, in both markets. In today’s Insight Flash, we examine how trends in the two countries have differed, including spend growth, average ticket, and the importance of Prime Day.

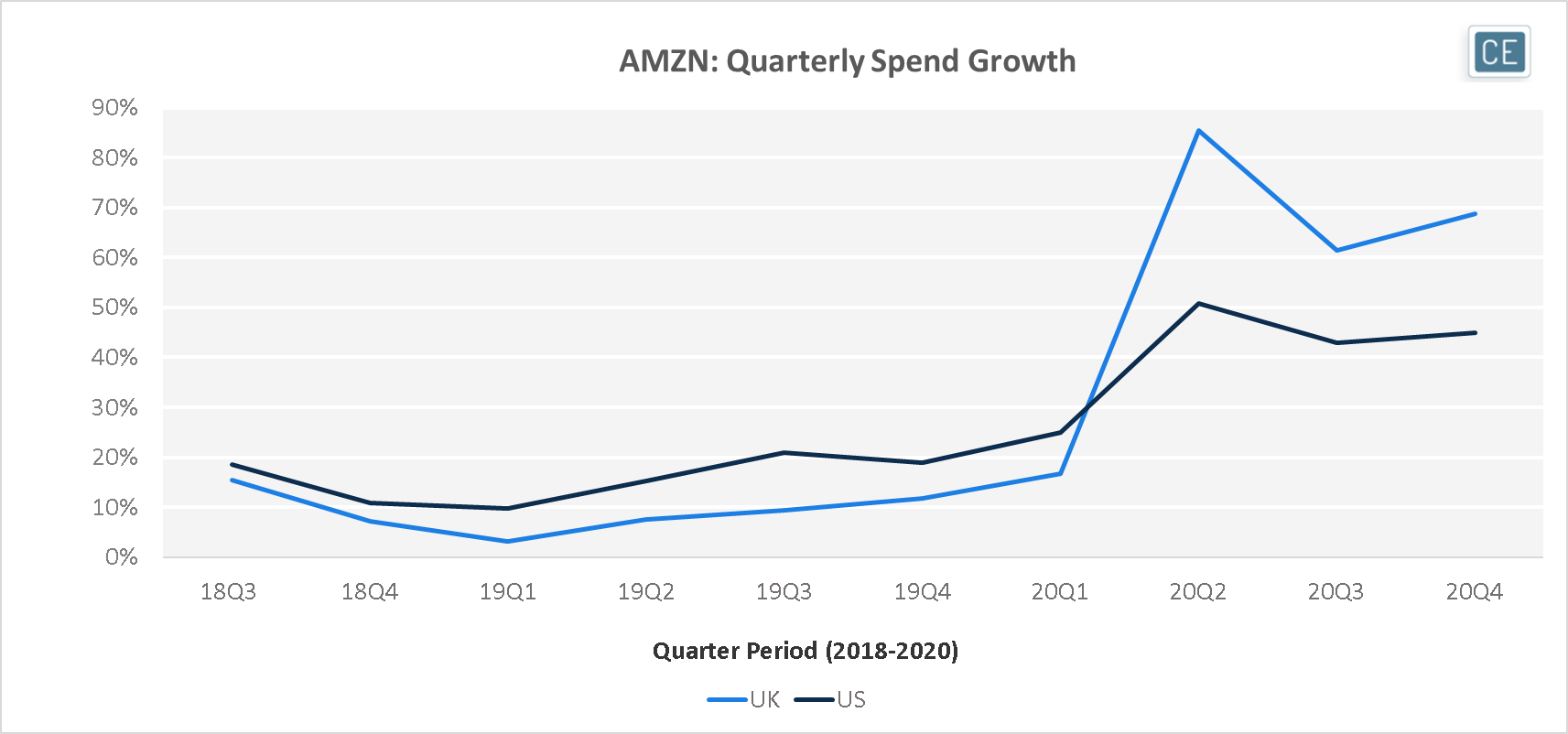

Despite the fact that it has been around for much longer, AMZN’s business in the US was far from saturated and spend growth outpaced UK spend growth at the end of 2018 and all through 2019. COVID-19 reversed these trends, with UK spend growth skyrocketing in 2020Q2 to a peak of 85%, compared to a US peak of 51% in the same quarter.

AMZN Spend Growth US vs. UK

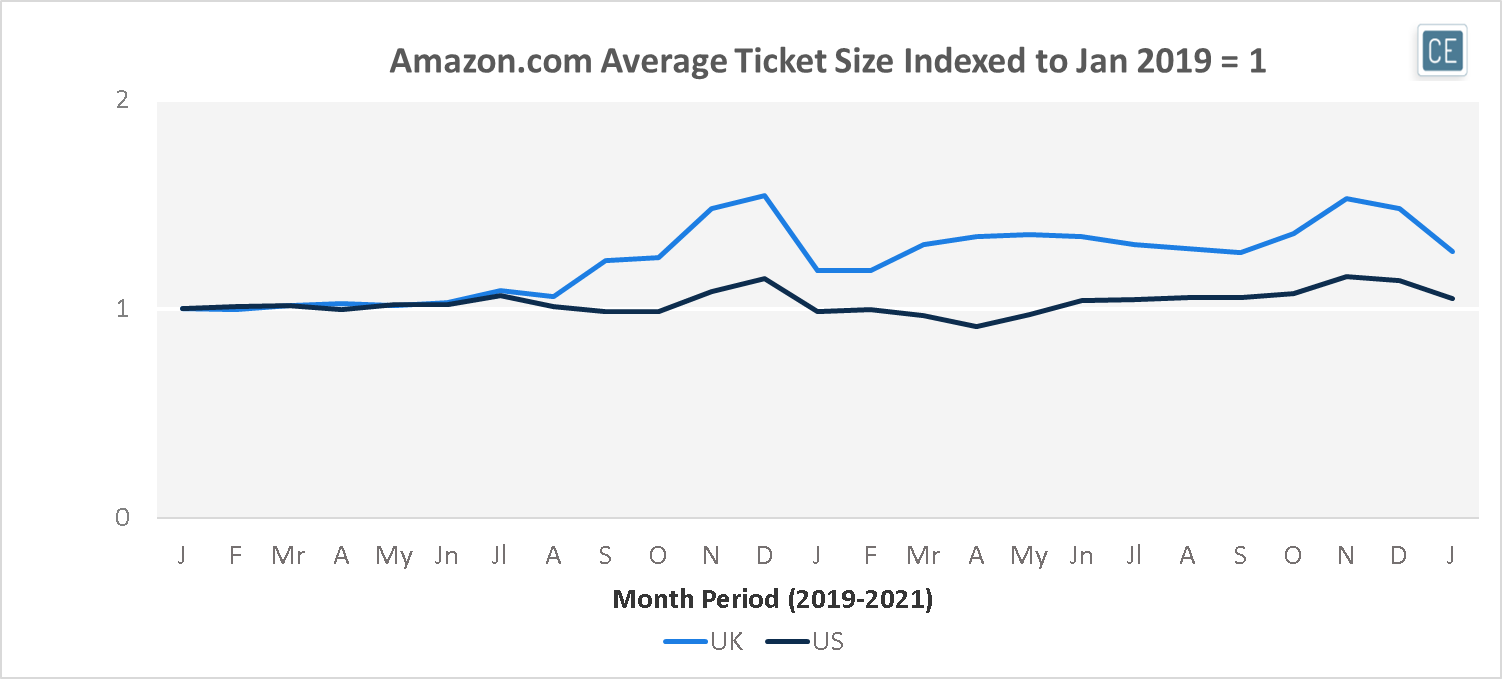

Interestingly, however, the UK business had been trending upward much earlier when it came to order sizes. UK transaction size on Amazon.com started taking off in fall of 2019, growing from January 2019 levels by 25% in September/October and 50% in November/December. Average ticket levels stayed elevated by about 30% for much of the COVID-19 pandemic, rising even higher for holiday shopping in Novembers and December. In contrast, in the US order size barely budged even as the pandemic hit in March, with only a small uptick in November/December of 2020.

Amazon.com Average Ticket US vs. UK

Some of this may be driven by the fact that US shoppers are more trained to wait for a sale. Looking at Prime Day sales in both countries (and the week after to account for the fact that cards are charged when an item is shipped, not when it is ordered), US shoppers much more overwhelmingly embraced the October 13-14 event. The week ending October 18 saw sales only 30% higher than an average week for Amazon.com in the UK, vs. 40% higher in the US.

Prime Day Impact US vs UK

Note: Specified week sales indexed to total 2020 sales divided by 52.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.