Will the Divide Between US and UK Retail Become a Chasm?

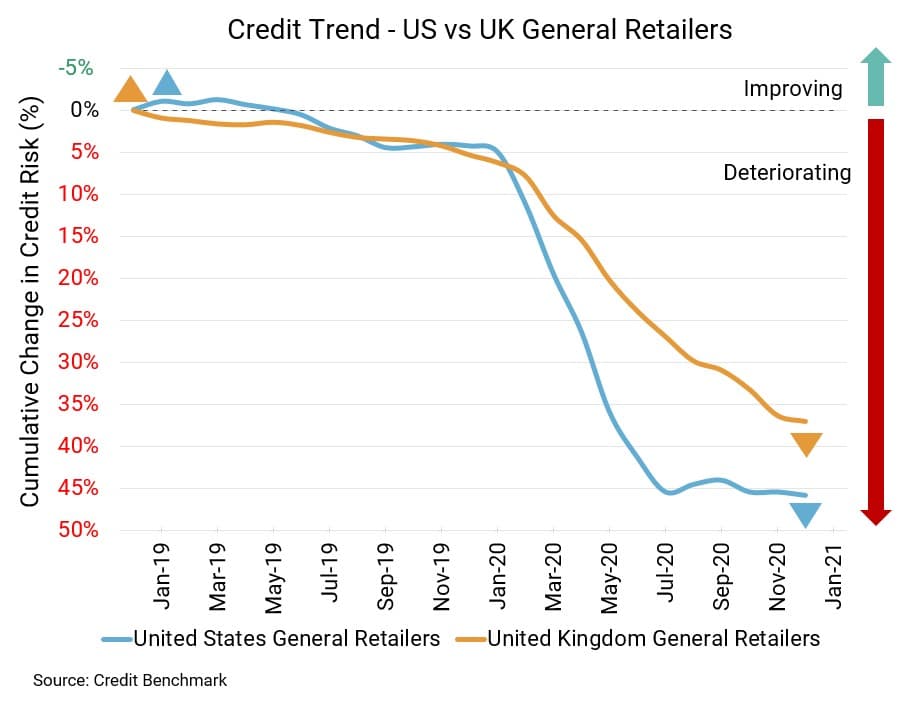

A growing divide in credit quality and default risk for the US and UK retail sectors emerged in recent years. Since Credit Benchmark began tracking data on the retail sector, default risk has been higher for the UK than for the US, a trend that persists with the latest monthly update.

In recent months the gap in default risk between US and UK retailers has been getting wider. Average probability of default for the sector is currently about 104 bps for the UK and about 67 bps for the US, leading to a difference of about 37 bps, the widest gap since the data began tracking in 2015. At the same point last year, that gap was about 31 bps. Two years prior, it was about 29 bps.

Though the overall credit trend line looks worse for US firms, this only reflects cumulative change in credit quality in the given time frame (with a steep drop for both groups coinciding with the start of the COVID pandemic). Declining credit quality equates to a rise in default risk, but the recent trend suggests that risk for US firms has levelled off, whereas UK risk continues to increase. The months ahead will reveal if this trend is accelerating or if it will settle into something resembling a new normal.

US General Retail Firms

The news continues to be relatively positive for the US retail sector. Changes in credit quality and default risk have levelled off. The latest data show declines in credit quality of 40% year-over-year and 7% from six months prior, but essentially no change compared to last month. Default risk for this sector is 67 bps, unchanged from the prior month and compared to 63 bps six months prior and 48 bps at the same point last year. Even with this recent stabilization, prior declines in credit quality have left this sector with a weak overall CCR rating at bb+. Approximately 80% of firms in this sector have a CCR rating of bbb or lower.

UK General Retail Firms

As a nation-wide lockdown continues, the credit situation for the UK retail sector continues to be grim. The latest update shows a decline of 2% from last month, 14% from six months prior, and 31% year-over-year. Default risk for the UK was already higher than in the US, and at 104 bps, the surge shows little sign of moderating. Average probability of default was 101 bps last month, 91 bps six months prior, and 79 bps at the same point last year. This sector also has a worse overall CCR rating at bb. Roughly 92% of firms in this sector have a CCR rating of bbb or lower.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 55,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 90% of the entities covered are otherwise unrated.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.