Remodeling at Highest Rate Since 2006, Creating Boom in Construction

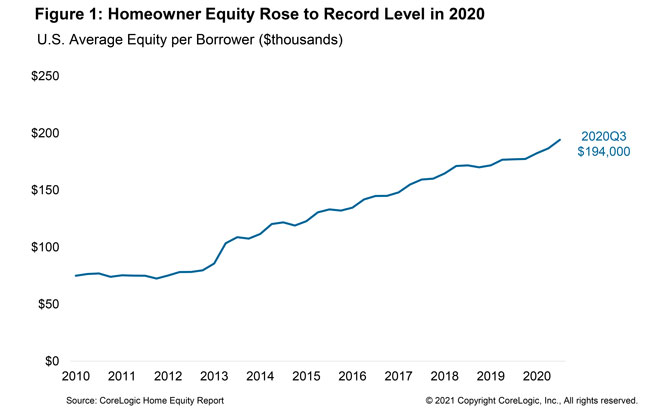

Home prices in the U.S. have been rising consistently for nearly 10 years, and the pace of home price growth quickened in 2020, leading to record levels of home equity. The latest CoreLogic Home Equity Report found that the average amount of equity per borrower was nearly $200,000 at the end of Q3 2020, a gain of $17,000 from a year earlier and over $100,000 from 10 years earlier.

Home equity provides a buffer to protect homeowners if they experience financial difficulties, keeping foreclosure rates low. Home equity can also support spending on home improvements and improve the balance sheets of households who extract equity to consolidate their debt.

With mortgage rates plummeting in 2020, many homeowners opted to use cash out refinances to extract equity instead of home equity lines of credit. The dollar amount of home equity lines of credit decreased by about 15% in the first three quarters of 2020, however, cash out refinances increased by 58%[1].

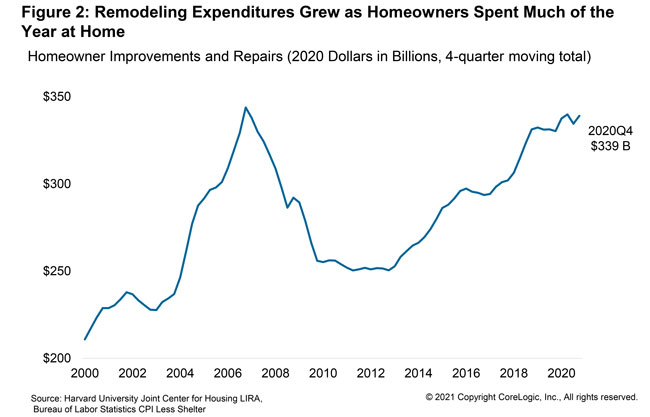

Homeowners used their home equity to support remodeling and additions to their homes as they spent much of 2020 working and schooling from home. Remodeling expenditures rose to $339 billion in Q4 2020, the most since 2006, and are expected to continue to increase in 2021. Remodeling spending also contributed to increases in construction employment, further supporting the housing industry. Residential construction employment was higher at the end of 2020 than it was just prior to the pandemic.

Borrower equity rose to a new high in 2020 and has more than doubled in the last ten years. While we expect the pace of home price growth to ease in 2021, this increase in prices will continue to support home equity growth. We can expect this, combined with low interest rates, to support continued spending on home improvements and remodeling.

© 2021 CoreLogic, Inc, All rights reserved.

[1] CoreLogic public records data show the dollar volume of cash out refinance loans increased by 58% in the first nine months of 2020 compared with the first nine months of 2019. During the same period, the dollar volume of rate-and-term refinance increased by 191%; thus, the cash out percent of refinance loans declined from 32% to 20%.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.