Once upon a time, people could only buy deodorant and cold medicine from their local pharmacy or wholesale club. That was then. Now, Consumer Packaged Goods (CPG) have carved out a nice space for themselves in the online marketplace. So much so that close to one in four U.S. households buy their food and beverages exclusively online. Even more, the number of consumers ordering their health and hygiene products online could double within a year.

Gone are the days of one-way marketing messages in the form of banner ads and magazine spreads. CPG brands are ambitiously experimenting with social media and other digital channels to reach their target market. Let’s look at how the top three CPG brands fared in the first month of the new year.

P&G Dominates January ad spend

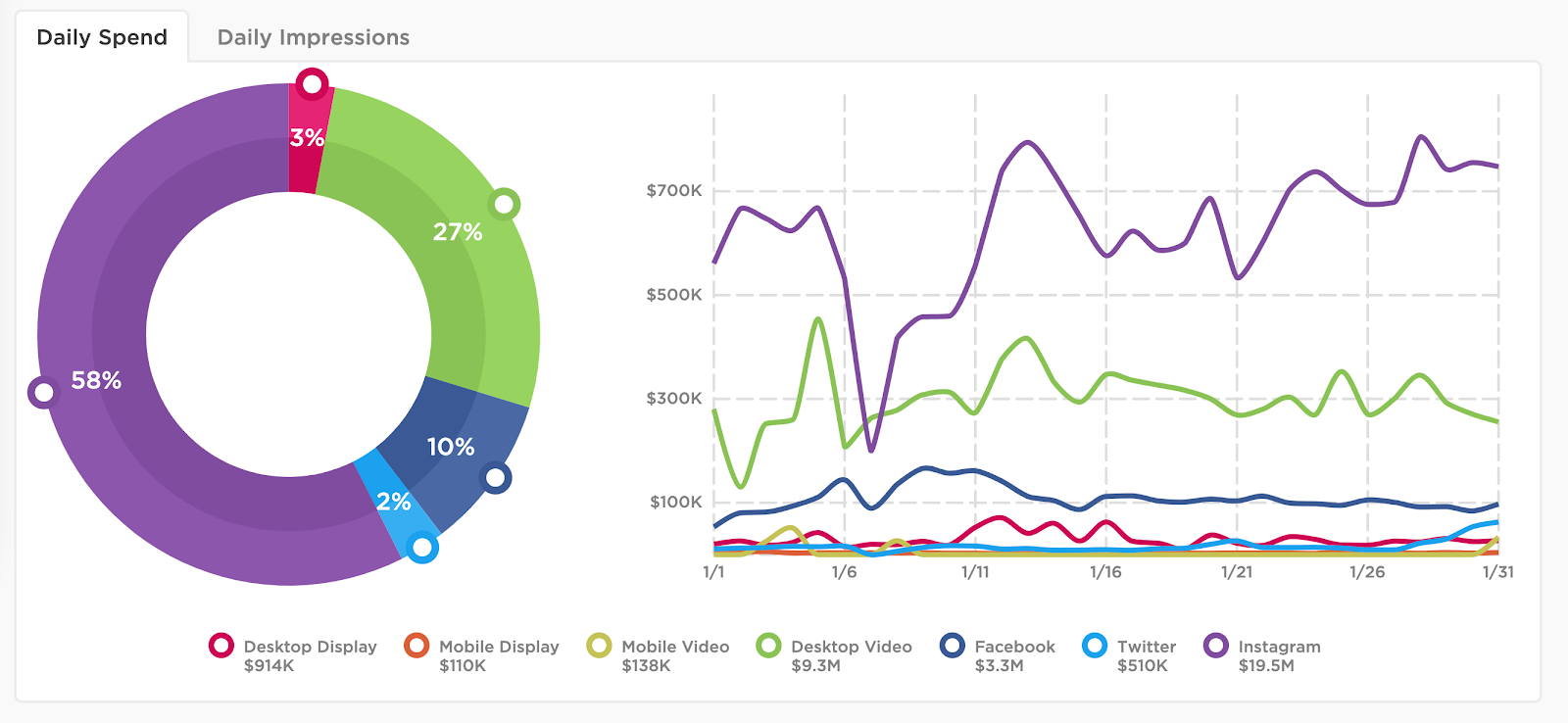

P&G hit the ground running by channeling over $33 million into digital ads - over three times more than Unilever and eight times more than Johnson & Johnson. Vicks, Old Spice and Pampers were the top three P&G properties advertised in January.

Popular creatives included a Super Bowl-centric Old Spice spot and Vicks social media placements to reinforce brand preference during flu season.

Daily spend from January shows P&G allocated more than half of ad share to Instagram. Ad placements on Instagram yielded three billion impressions with Youtube coming in second at 400 million impressions.

Unilever focuses ad strategy on self-care and health brands

Most properties under the Unilever parent company fall within the personal care or wellness category. Unilever took a unique approach to market to COVID weary consumers. The CPG brand injected $800,000 into the air purifier Blueair.

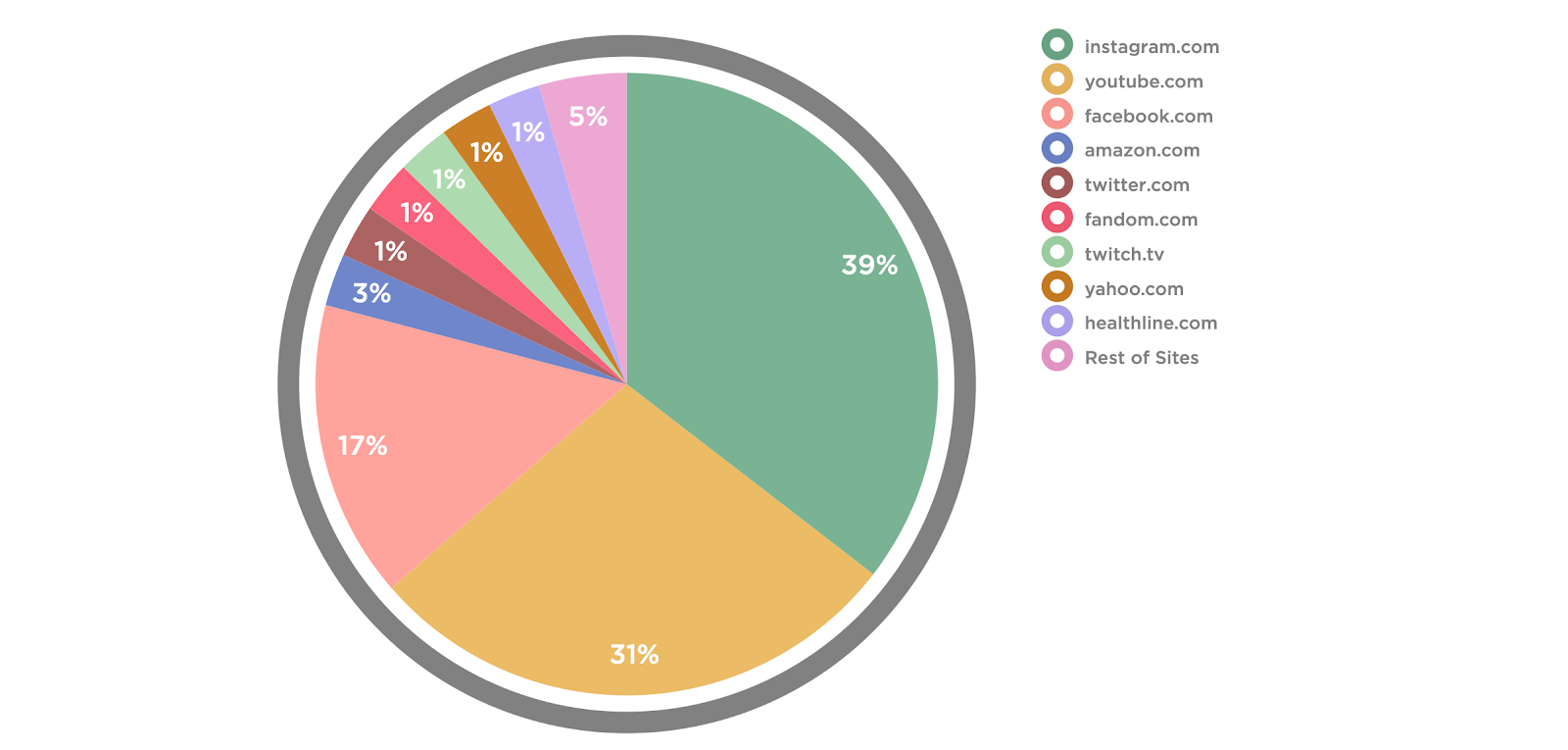

Unilever pursued a different strategy with their ad spend than P&G, with 39% funneled into Instagram, followed by Youtube at 30% and Facebook with 17%. Over one-third of all ad impressions generated in January came from Dollar Shave Club and Dove ad campaigns.

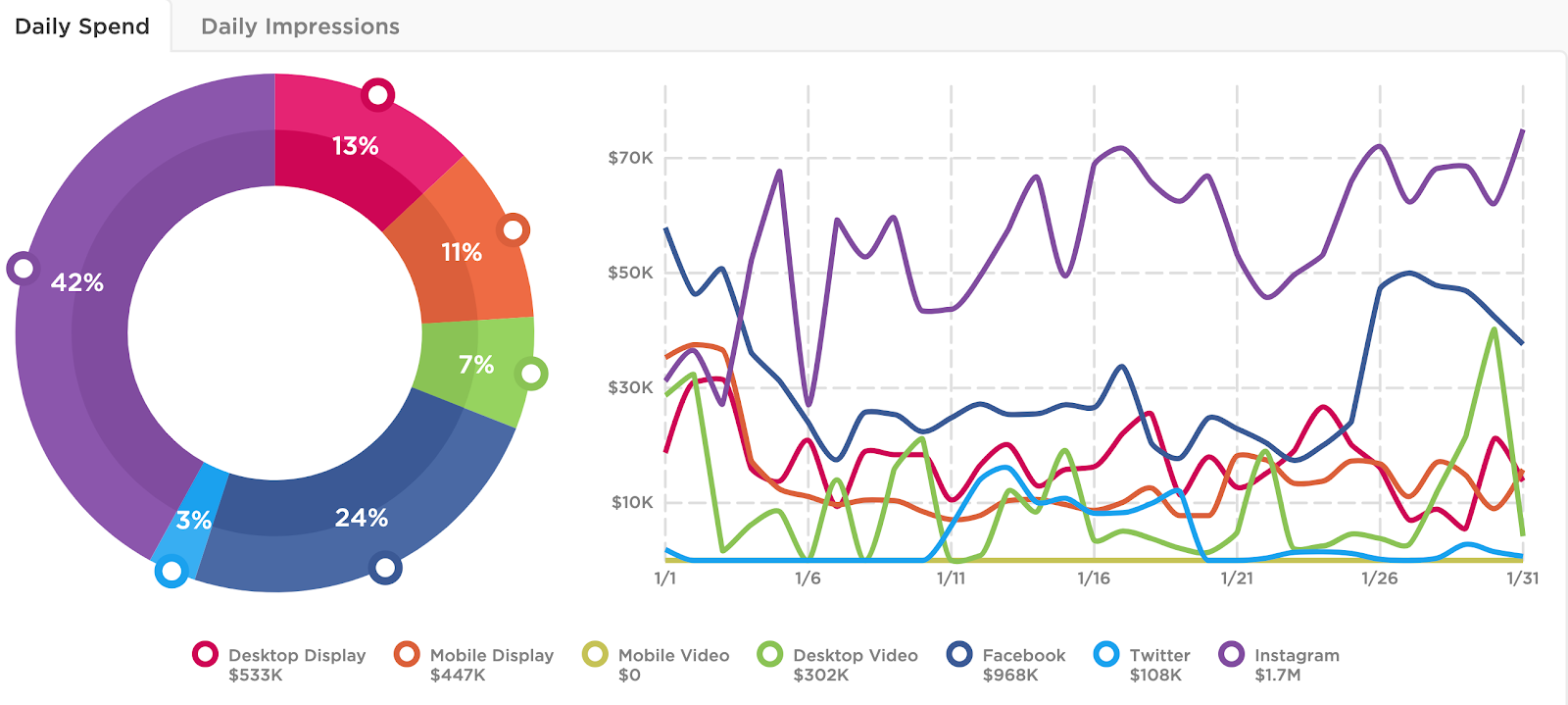

Johnson & Johnson throw big bucks behind Aveeno

J&J’s ad strategy mirrored Unilever’s in pushing self-care products and one big-ticket health item. The winter season brings cold, dry days and even drier, hot air throughout our homes. Knowing this, J&J put nearly 50% of its January ad share into Aveeno. The skincare brand had a big month, raking in 265 million impressions, followed by Zarbees with 66 million impressions and Listerine at 58 million impressions. Oral care is a market that’s expected to grow by 4% in 2021, so it comes as no surprise why J&J decided to invest over $400,000 alone into Listerine ad placements.

Digital marketing strategy for CPG brands is evolving every day. The competition is intense and the rules are changing fast. How can you keep up? Stay ahead of the curve by investing in a tool that offers insights into these markets. That’s where we come in (hi!).

Pathmatics recently revamped how we classify categories and brands with our new taxonomy. This project was an enormous undertaking and we started by tackling one of our most popular categories, Consumer Packaged Goods (CPG). Pathmatics users now have access to deeper brand layers, spend breakdowns across a parent company’s brands, and even more insights into creatives, brand marketing strategy, and ad campaigns.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.