In order to properly assess the performance of companies across borders, it is important to understand the different macroeconomic contexts in which the companies are operating. Consumer Edge recently enhanced its dashboard tools for industry and subindustry-level data, allowing for easier analysis of 26 industries and over 100 subindustries on both sides of the Atlantic.

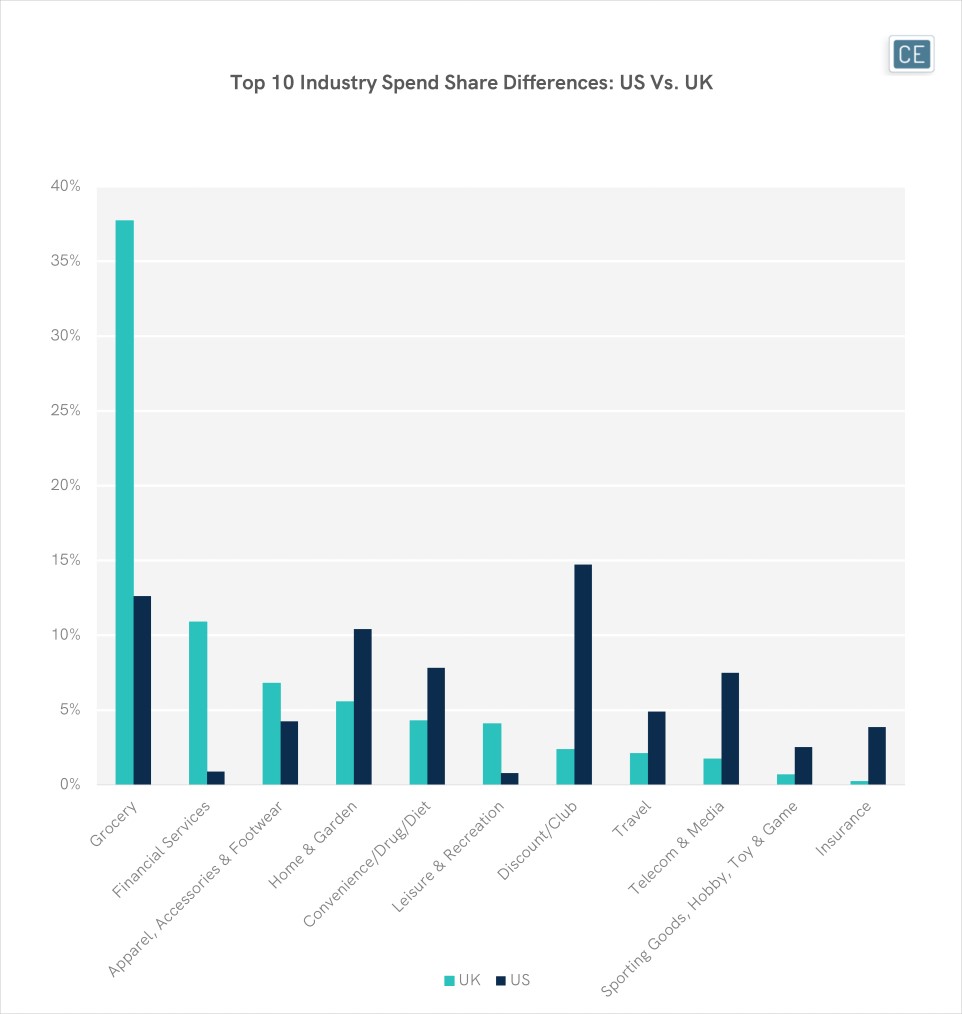

Major differences emerge in the spend breakdown between the US and UK over the last year. Among our tracked brands, the Grocery industry made up over a third of spend in the UK, versus only 13% in the US. US shoppers instead buy more necessities at Discount/Club stores as well as Convenience/Drug/Diet chains. UK shoppers also have more financial services transactions show up on their credit cards than US shoppers. For discretionary items, UK shoppers were more likely to spend on Apparel, Accessories, and Footwear, while US shoppers were more likely to spend on Home & Garden items.

Industry Spend Share

Note: UK data for the 364 days ending 2/3/2021; US data for the 364 days ending 2/13/2021

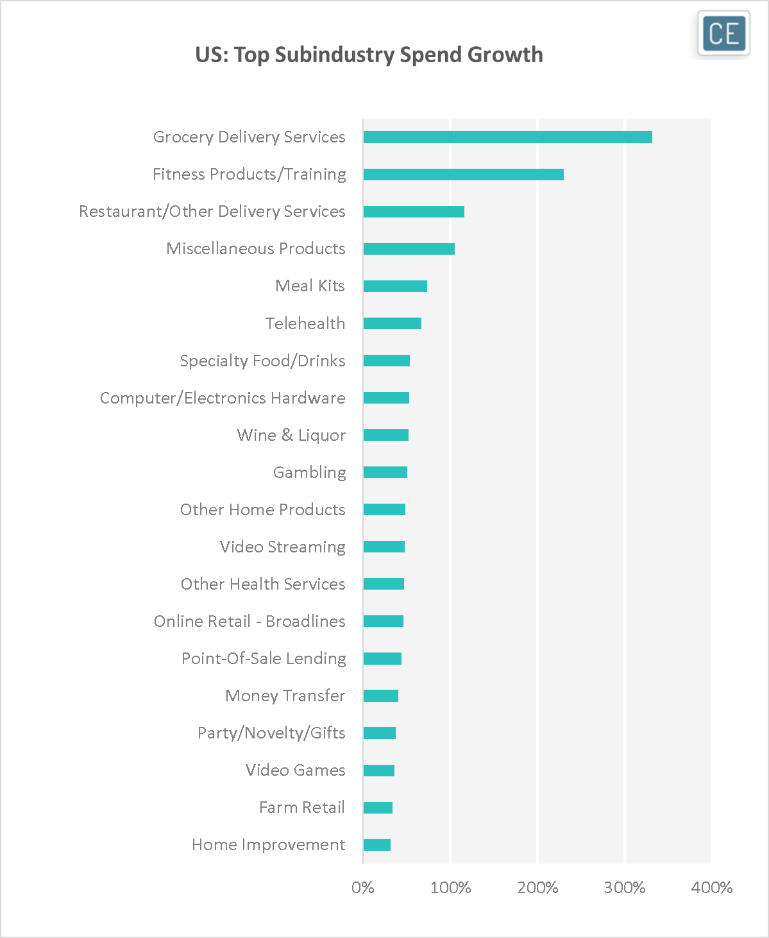

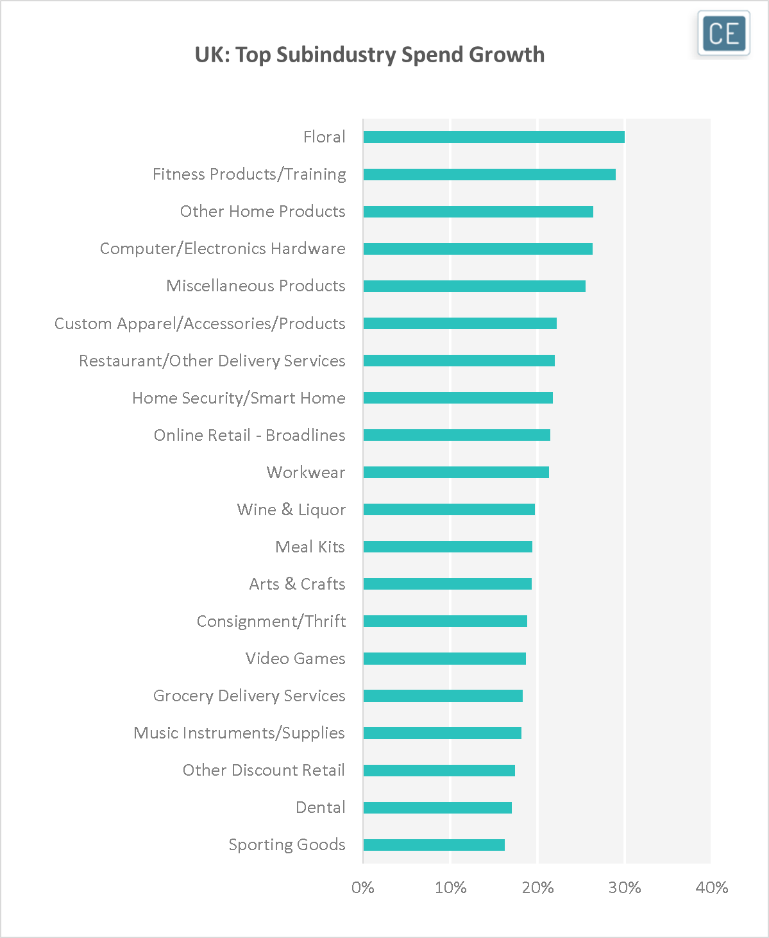

But where are the trajectories headed in each country? In the US, over the last year the top growth has been in Grocery Delivery, followed by Fitness Products/Training and Restaurant/Other Delivery Services as the pandemic has driven consumers to find at-home options to replace grocery shopping, gyms, and dining out. In the UK, the pandemic has led to the desire for cheer over necessities with Floral item spend growing the fastest y/y. And while Fitness Products/Training took the second slot for highest growth in the UK as it did in the US, that was followed by more cheer in the form of Other Home Items.

US Subindustry Growth

Note: 364 days ending 2/14/2021 vs. 364 days prior

UK Subindustry Growth

Note: 364 days ending 2/4/2021 vs. 364 days prior

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.