In this Placer Bytes, we dive into the surprisingly strong performance of Best Buy, Big Lots ongoing opportunity, and the trajectory of Sprouts and Kroger.

Best Buy’s Strong Start

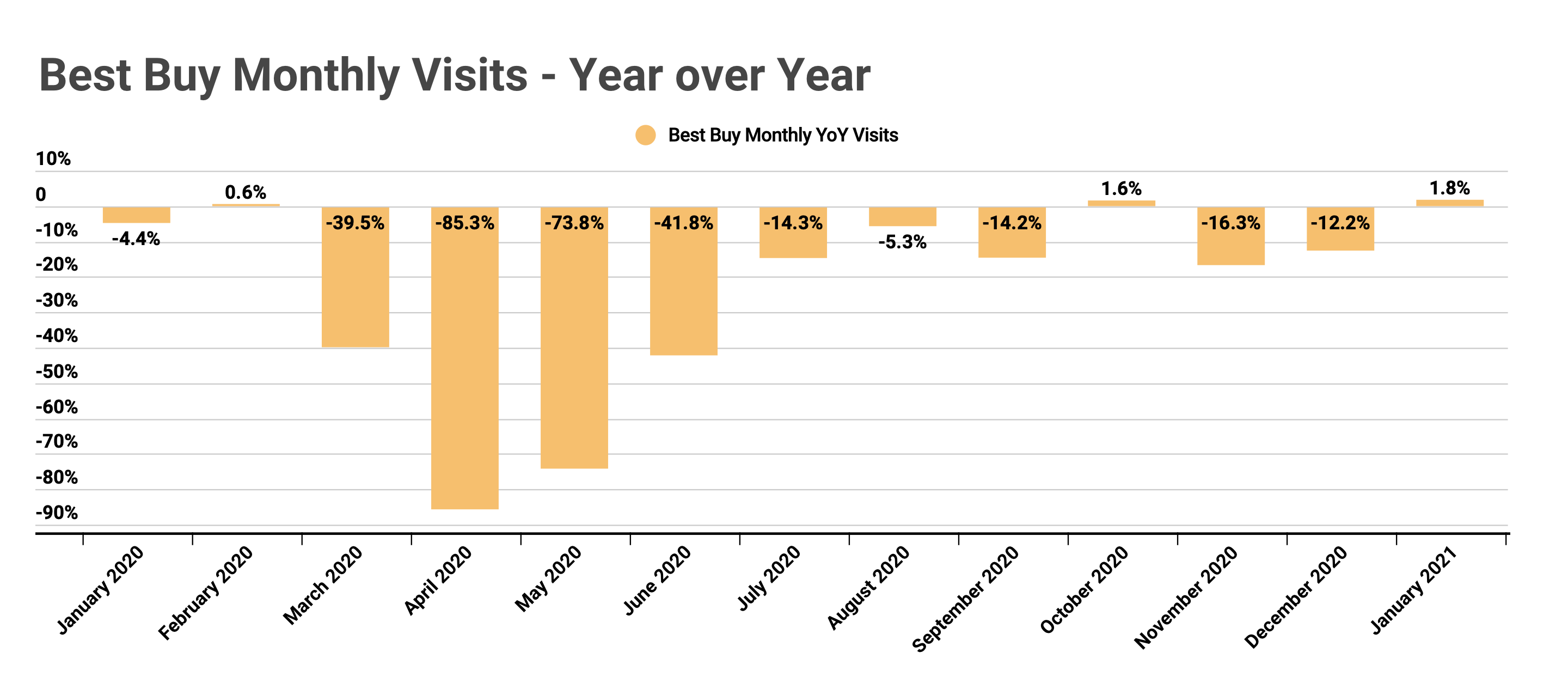

A resurgence of COVID cases right before Black Friday should spell doom for a brand that is heavily oriented around that specific day. Yet, while Best Buy certainly felt the impact in offline visits, the company seems to have weathered the storm quite effectively. After seeing year-over-year visit growth in October, visits dropped 16.3% in November. But by December the gap had already shrunk to just 12.2% and visits in January were actually up 1.8% year over year – the best mark since the start of 2020.

And this fast start may be a strong sign of things to come. While COVID’s effects will hopefully dissipate, the shift to a greater focus on work from home is unlikely to return fully. And Best Buy has deepened its role as a go-to provider of the home office experience. Additionally, the brand has shown the creativity necessary to stay ahead of the curve with everything from appointment shopping during the early stages of the reopening to a greater focus on health and wellness technologies. So, while betting against Best Buy may never be a smart decision, it could be especially foolish now.

Big Lots

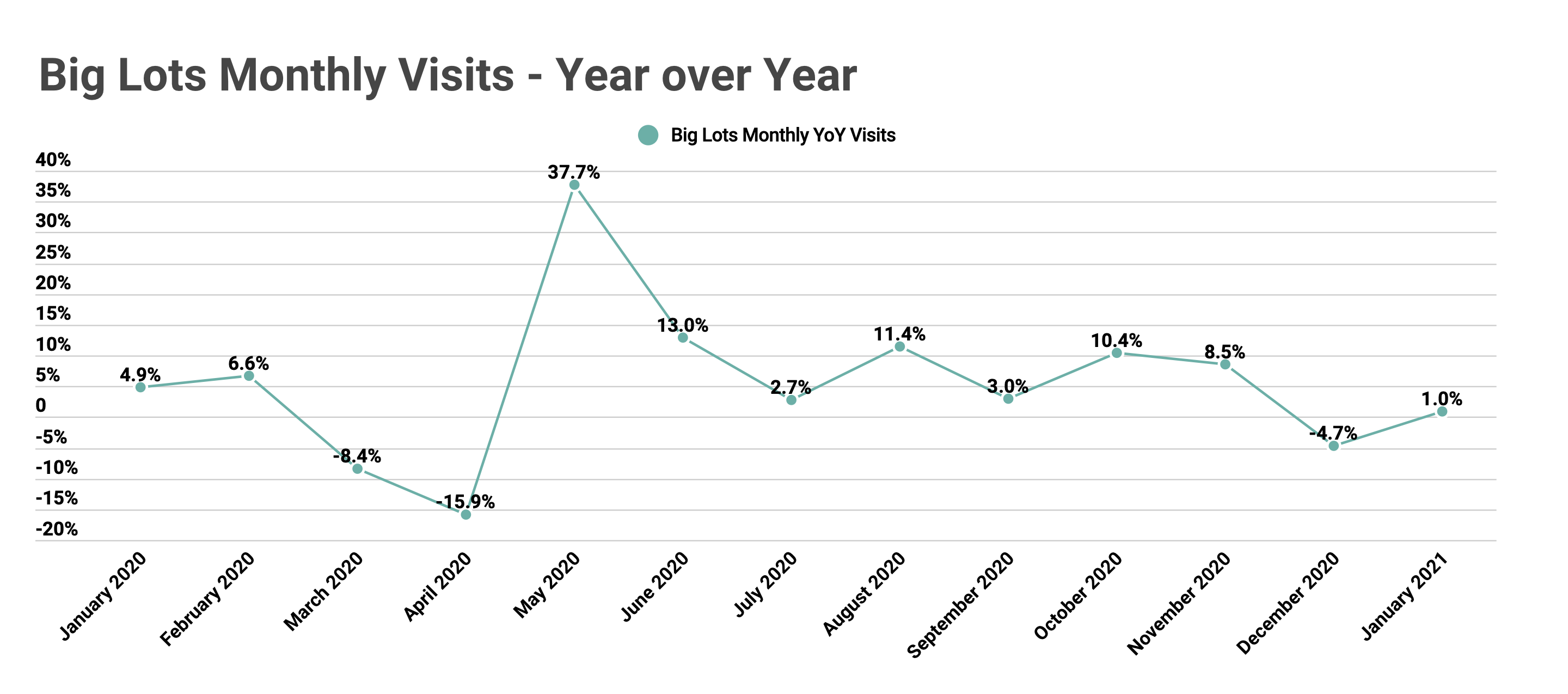

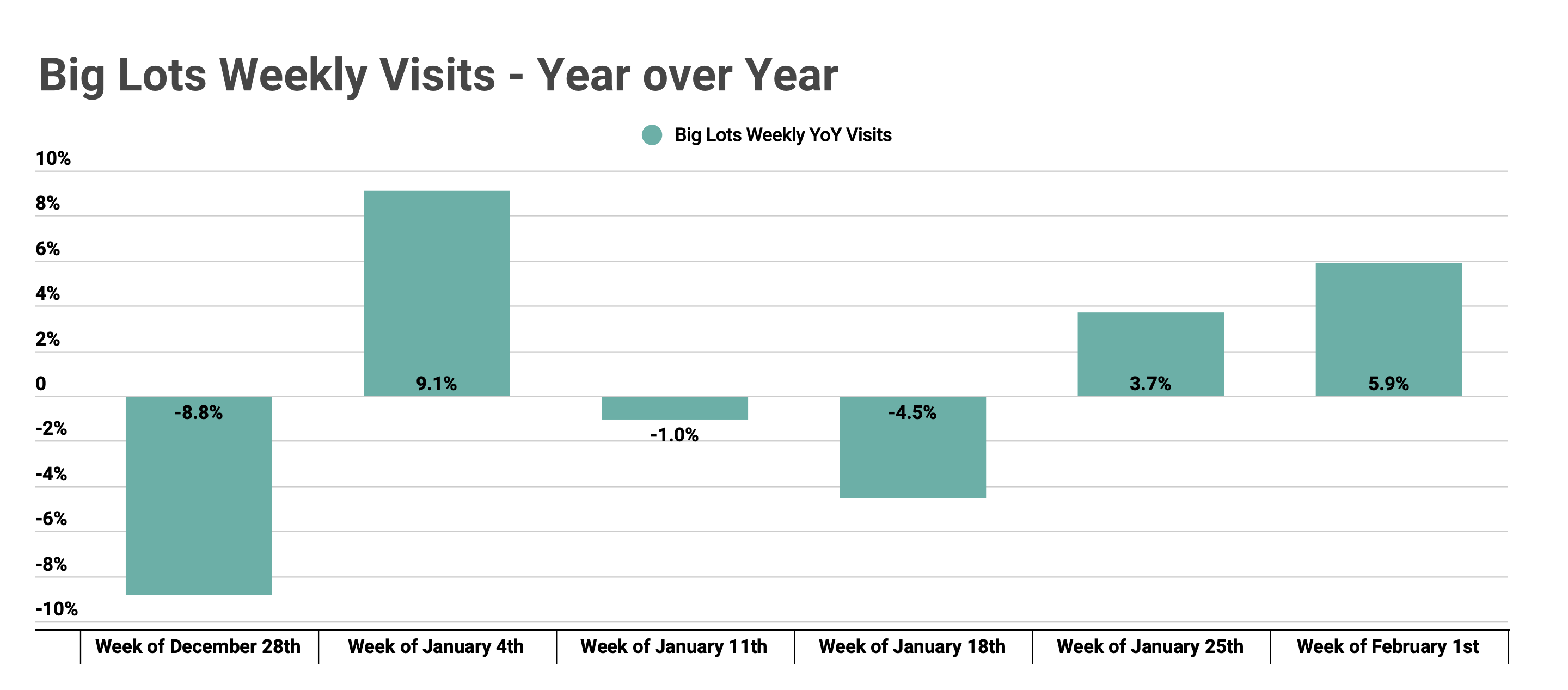

Big Lots sits at the nexus of several positive trends that could bring a lot of value to the brand, and while Q3 may have driven a bigger year over year peak, the company ended the year with strength. Visits to Big Lots locations were up 8.5% in November, and while visits did decline 4.7% year over year in December, they returned to year-over-year growth in January.

And even more importantly for Big Lots, the momentum does appear to be picking up. Visits the weeks beginning January 25th and February 1st saw visits up 3.7% and 5.9% respectively. Should this trend hold, the coming months could provide a significant lift for the brand as it attempts to replicate its 2020 success.

Sprouts and Kroger – Grocery Trends Continuing?

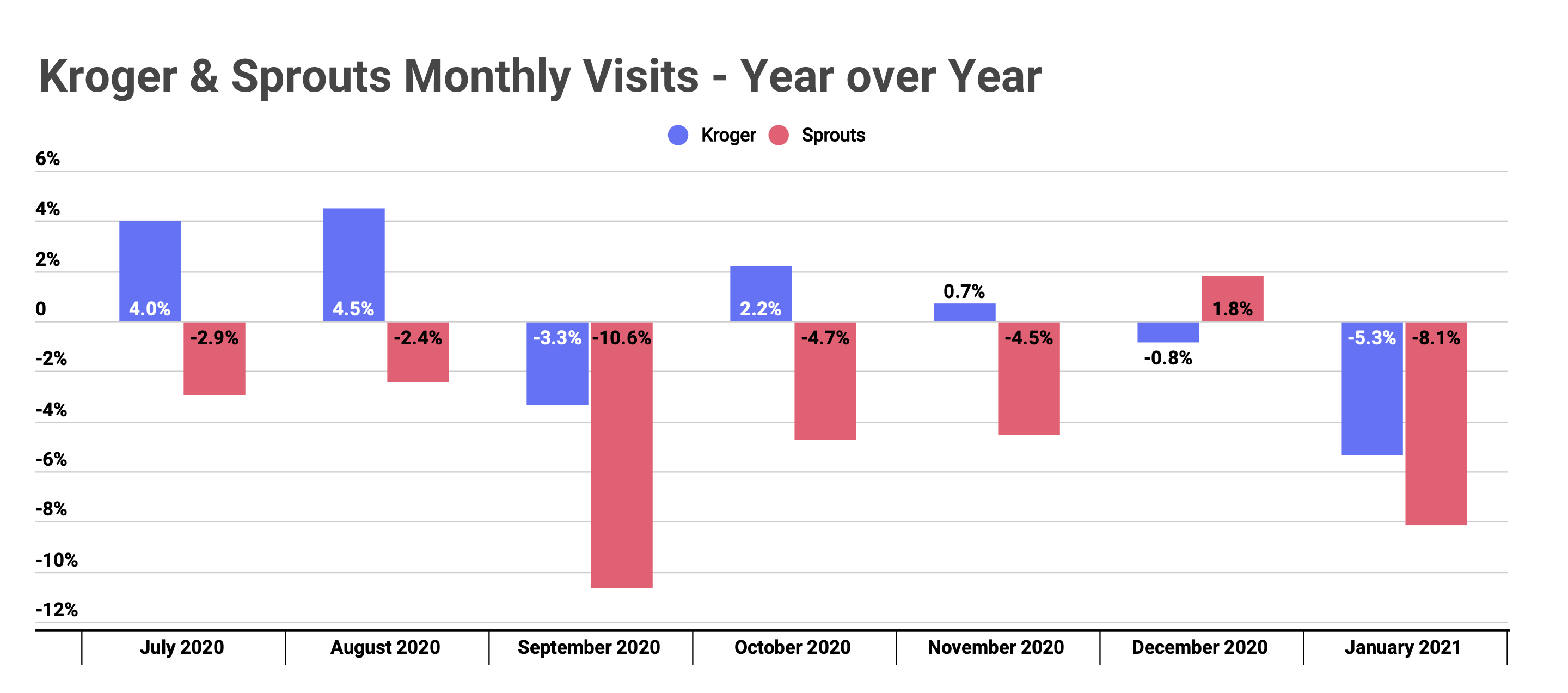

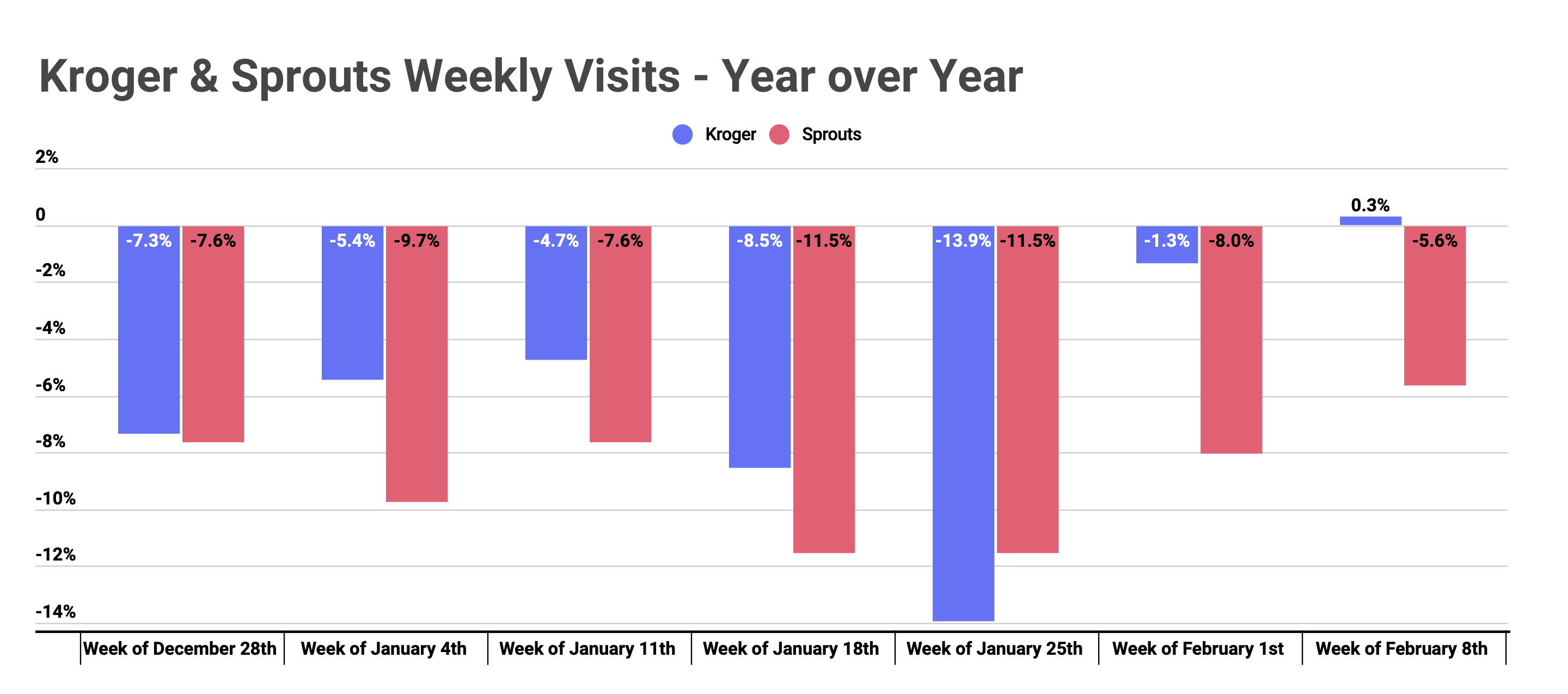

One of the big retail questions heading into 2021 centered around the ability of top grocery brands to sustain their unique strength into the new year. And early data does indicate that some players may prove capable of just that. Looking at visits to Kroger and Sprouts shows that visits to both chains dipped in late 2020. While Kroger saw visits up 0.7% in November, the visit gap increased slightly to 0.8% in December and 5.3% in January. For Sprout, the peaks were slightly different with November seeing a 4.5% year-over-year visit decline leading to 1.8% year-over-year visit growth in December and an 8.1% decline in January.

But the rebound is already taking place. Kroger saw visits down just 1.3% the week beginning February 1st and saw visits up 0.3% the week beginning February 8th. Sprouts saw a positive turn those weeks as well with the best monthly output since the week beginning December 28th coming the week beginning February 8th. While there are many factors potentially responsible for the visit dip – from a resurgence of COVID cases and a return to mission-driven shopping to inclement weather – it is clear that grocery brands are well-positioned to handle the shifts. And Kroger continues to prove that it could be among the sector’s stronger performers in 2021.

Will Best Buy and Big Lots continue to outperform? Can Kroger drive a rebound into February?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.