The COVID-19 pandemic has changed shopper behaviors dramatically over the last year, especially in accelerating the adoption of online shopping. As vaccines roll out to more and more consumers, will this behavior revert back? In this week’s Insight Flash, we take advantage of our demographic variables to dig into changes in spending habits, particularly among the 65+ age group that is getting the vaccine first in most states.

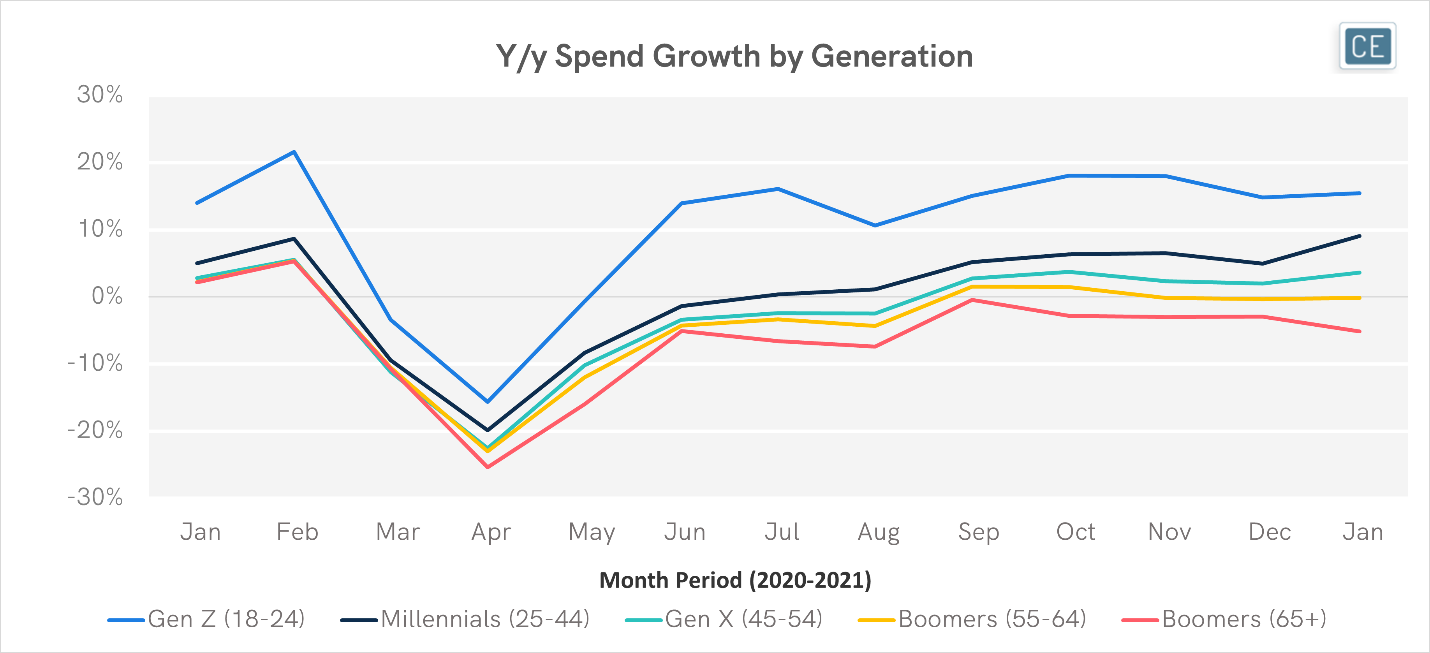

The 65+ age group showed the sharpest drop in spend at the beginning of the Pandemic, and y/y spend has declined every month since then while spend for other age groups has turned positive. While one might have expected early vaccine distribution for this age group in January to be a booster for purchasing, instead it was the only age group to show a deceleration in spend growth last month.

Spend Growth by Age Group

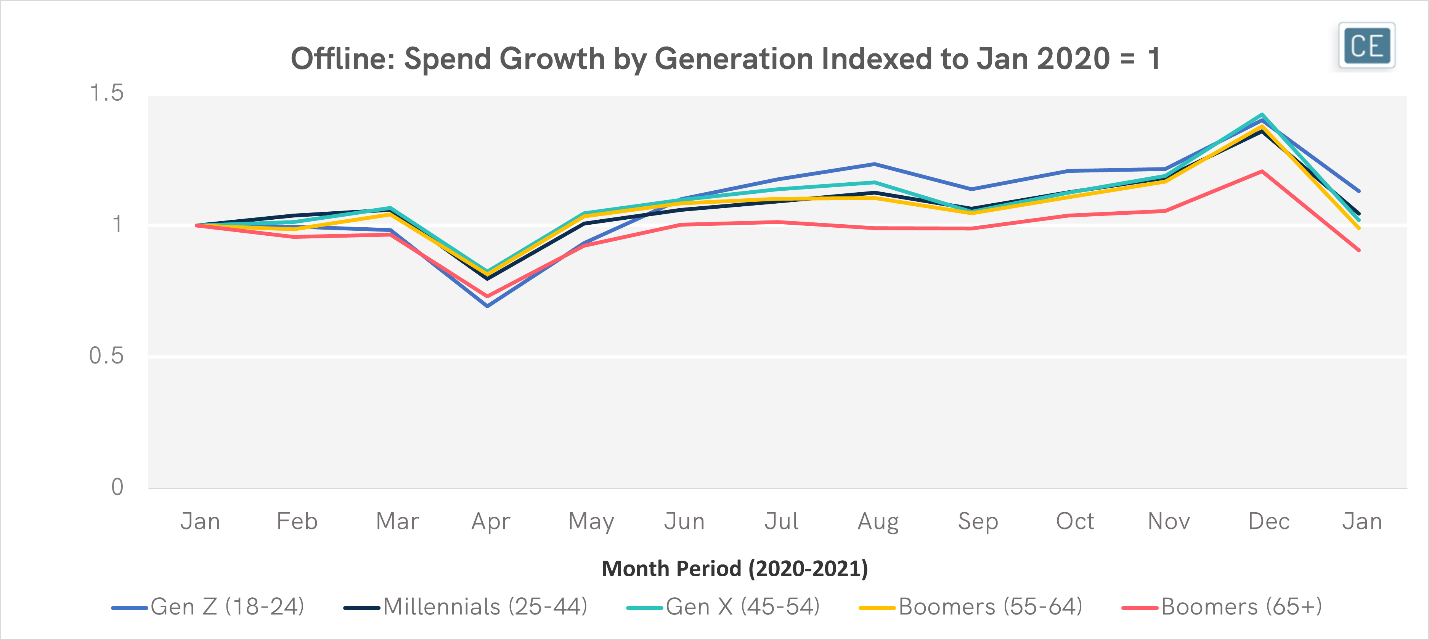

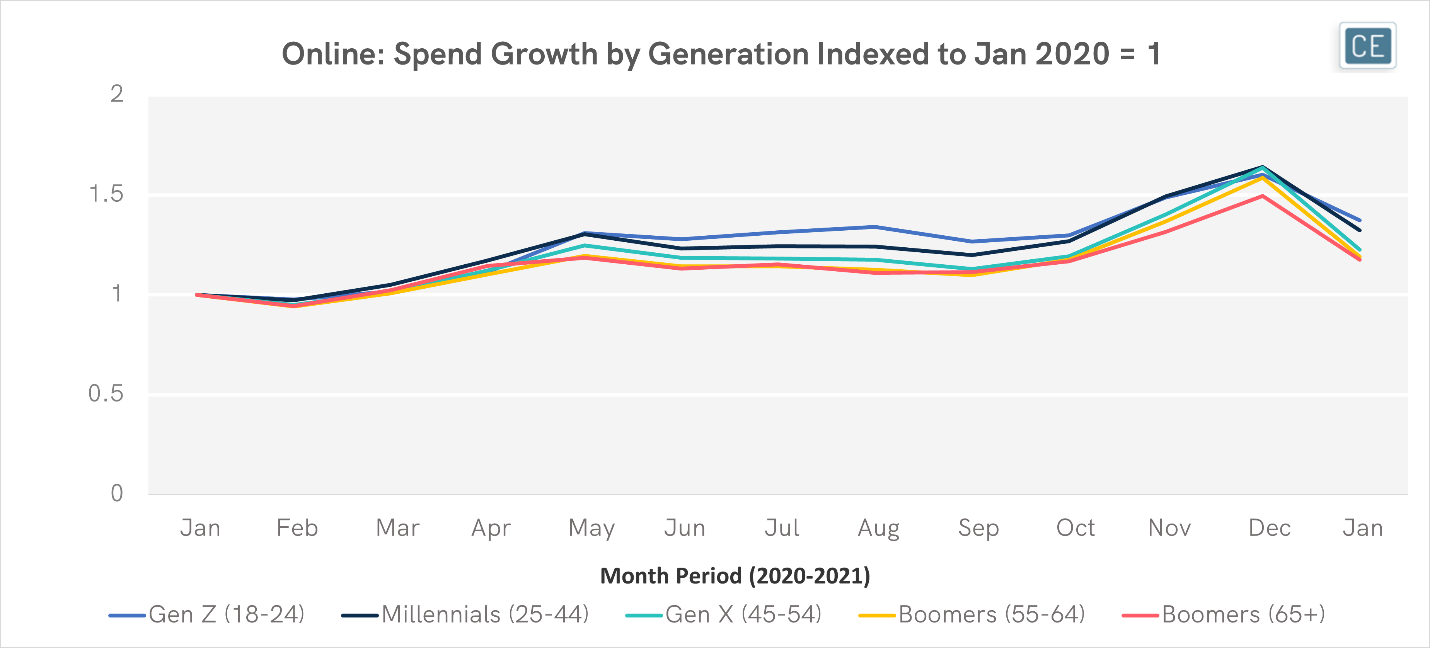

Even though spend is decreasing, the shift to online shopping for older adults may be here to stay. Despite being more likely to receive early vaccinations in January 2021, those aged 65+ still avoided stores and spent 10% less offline than in January of the prior year. Those aged 55-64 were the only other group to spend less offline. Yet, those aged 65+ spent 17% more online and those aged 55-64 spent 19% more, above the average for both of these groups even at the height of the pandemic in April – July.

Age Group Spend by Channel

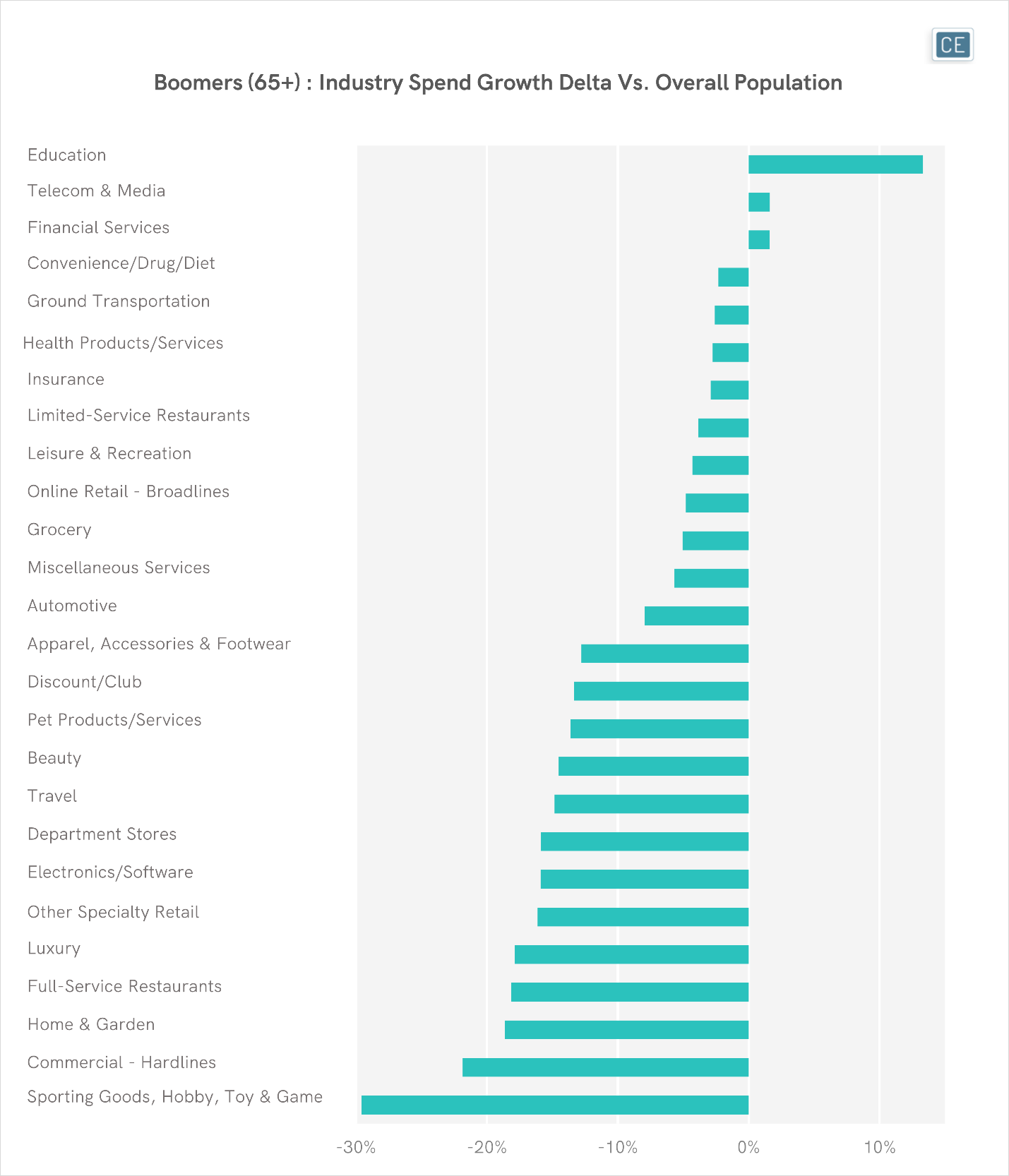

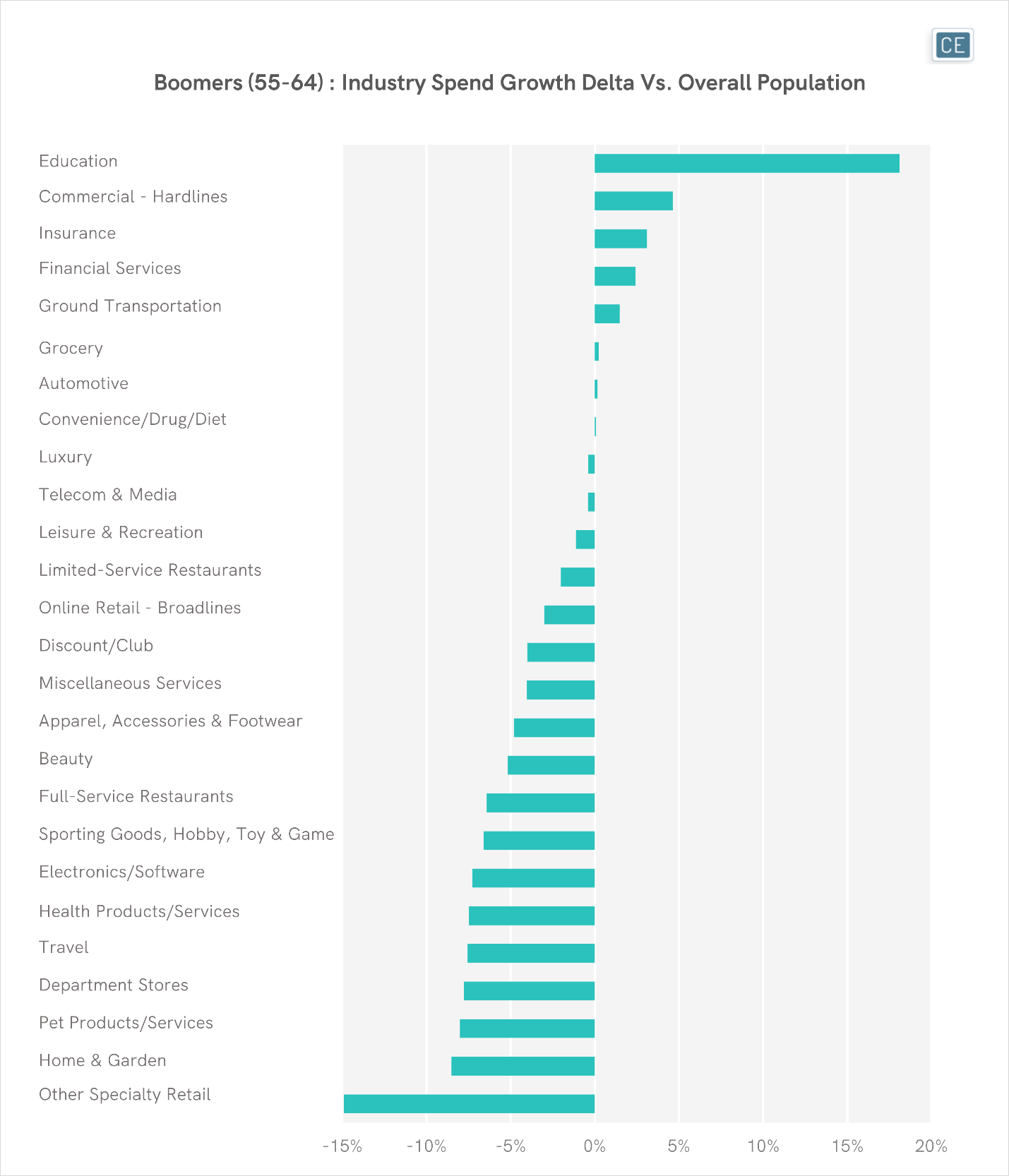

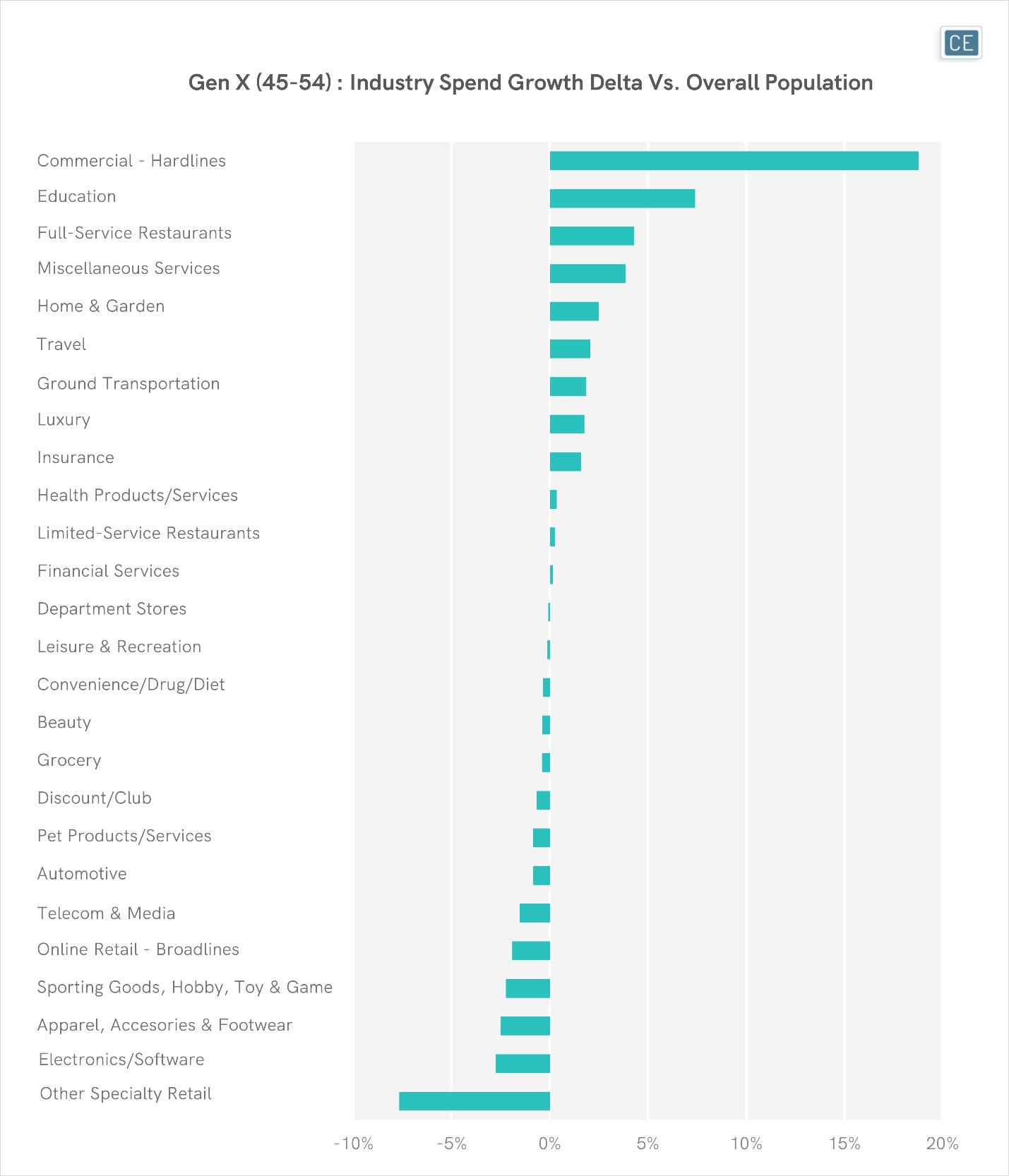

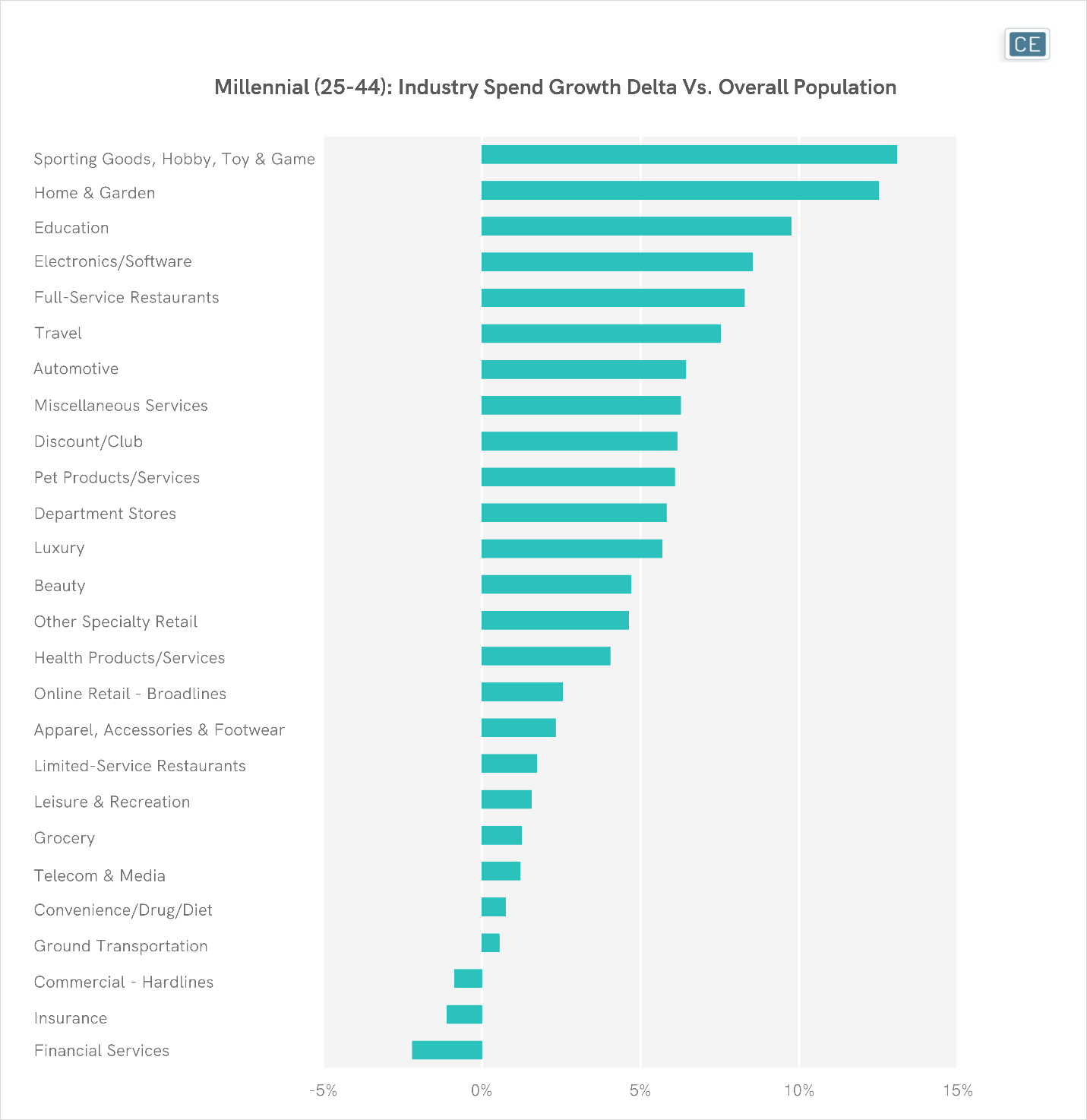

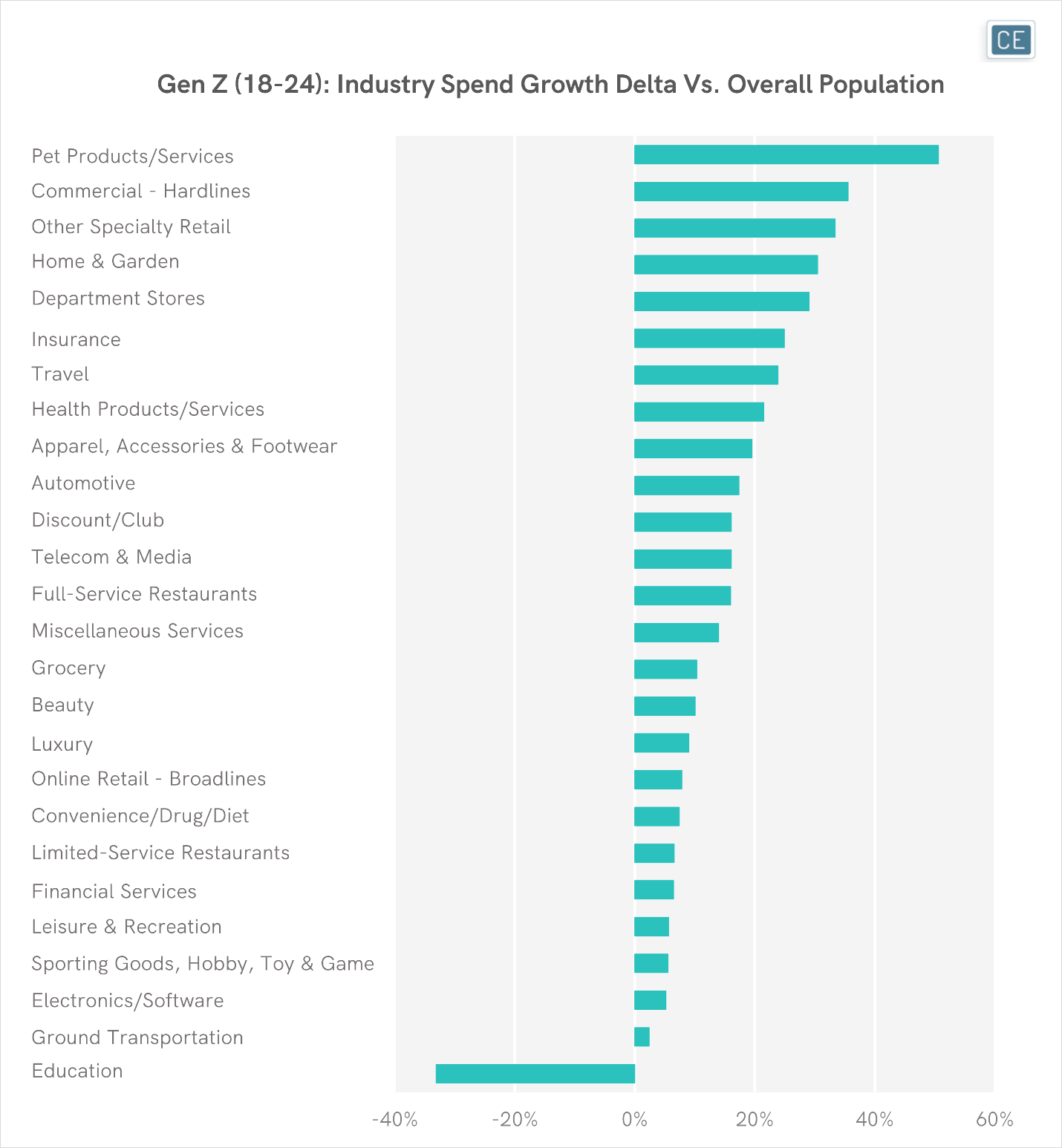

Spend growth for each age group by industry paints an even more interesting picture. Although overall those aged 65+ spent less at the beginning of the year as they began to get vaccines, the two top categories they were more likely to spend on than the overall population were Education and Telecom & Media, implying they were still seeking at-home entertainments. They spent less on outdoor activities like Sporting Goods, Hobby, Toy & Game and Home & Garden vs. the overall population.

Industry Growth

Note: 2021/01/01-2021/02/21 vs. 2020/01/03-2020/02/23

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.