In this Placer Bytes, we dive into Dollar General’s continued strength and the recoveries of Gap and Old Navy.

Dollar General’s Growth Continues

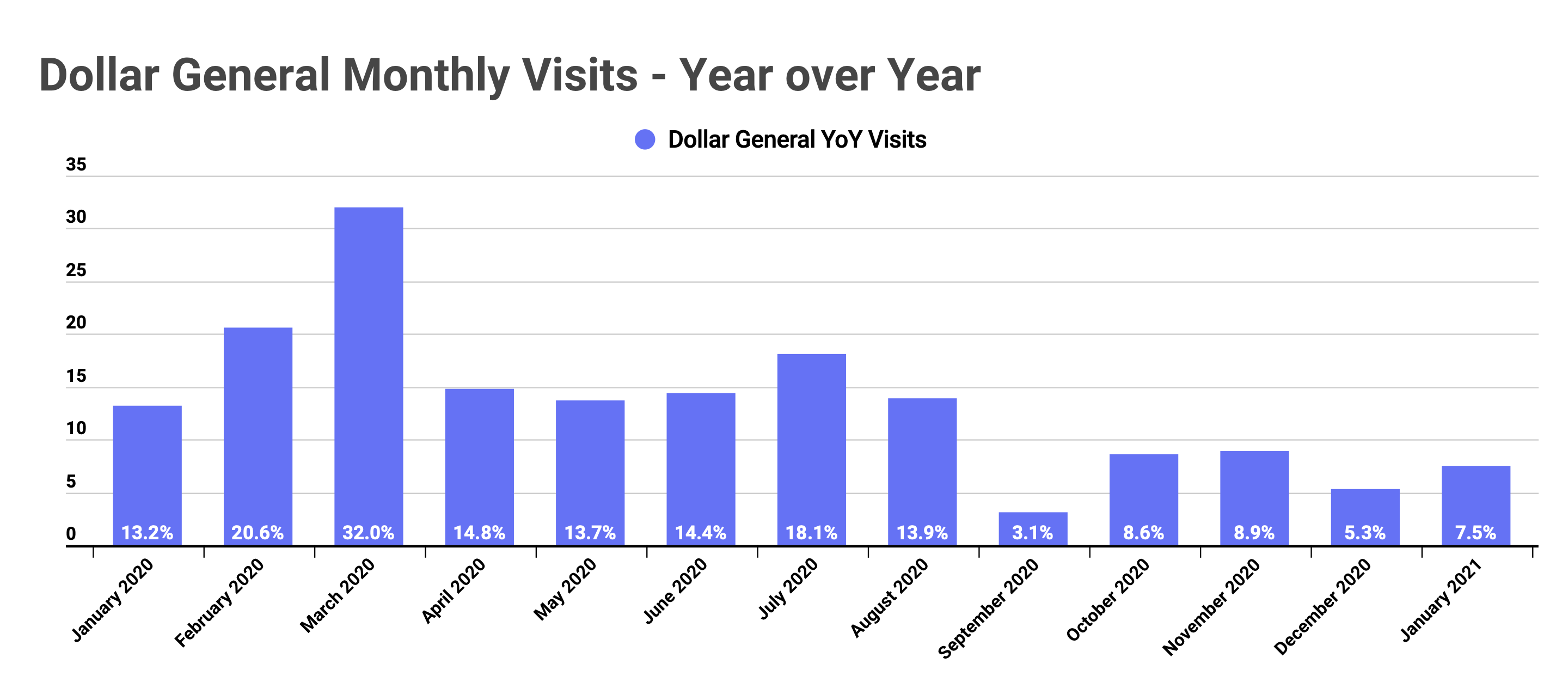

Dollar General has seen exceptional growth in the last year with every month since January 2020 showing year-over-year increases. And while the jumps themselves are good enough, it’s the continuity of these increases that makes them all the more impressive. Even as COVID cases surged in November, visits continued to remain up 8.9% year over year, and this continued with December and January up 5.3% and 7.5% respectively.

The performance across these three months was especially important as it marked year-over-year growth over months in 2019 and 2020 that had been exceptionally strong in their own right. The result is a powerful sign that Dollar General may actually be capable of sustaining this level of growth over the long term.

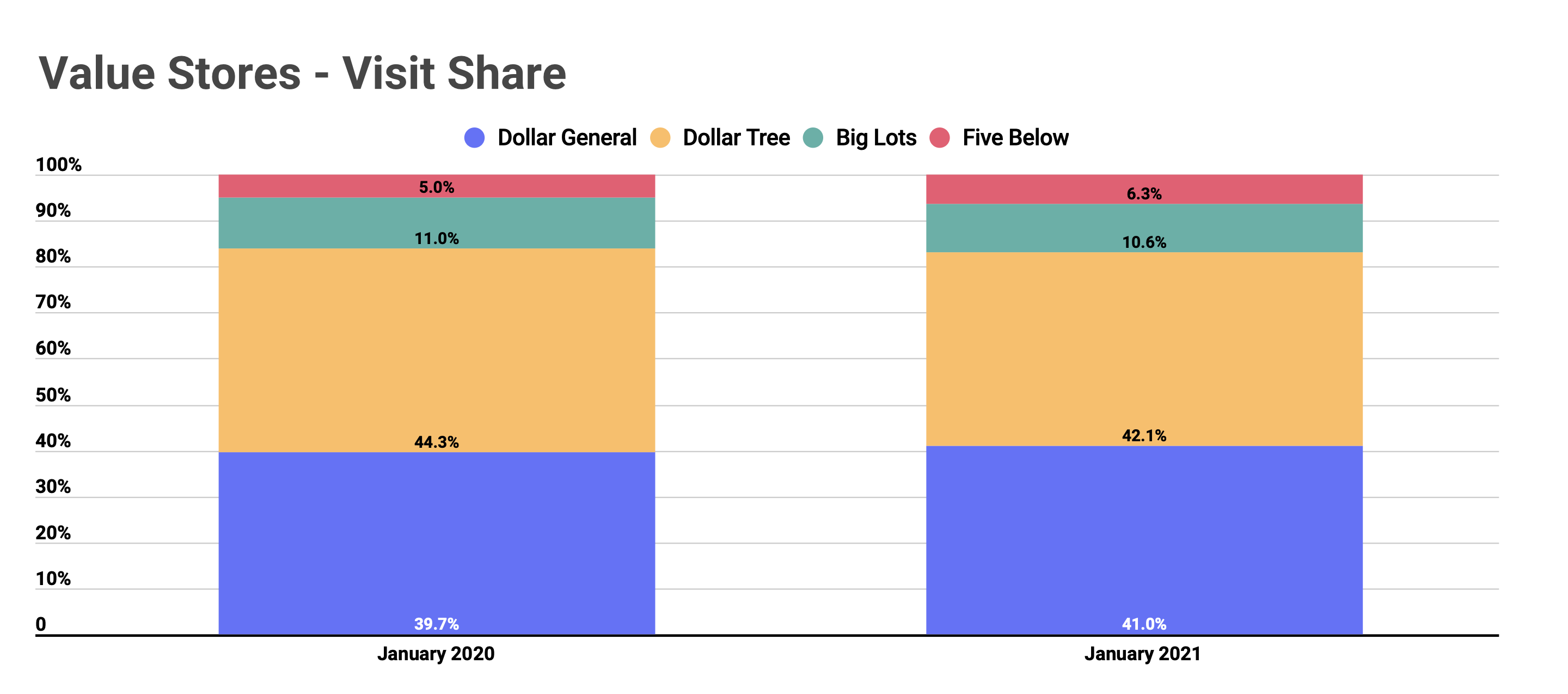

And while the brand certainly benefited from wider trends that boosted other value-oriented retailers, they actually saw visit share grow compared to key competitors. In January 2020, Dollar General had 39.7% of overall visits that went to Dollar General, Dollar Tree, Big Lots, and Five Below locations. Yet, in January 2021, that number had increased to 41.0% of the overall visit share. This indicates that while the wider sector saw a lift, Dollar General’s growth was uniquely strong.

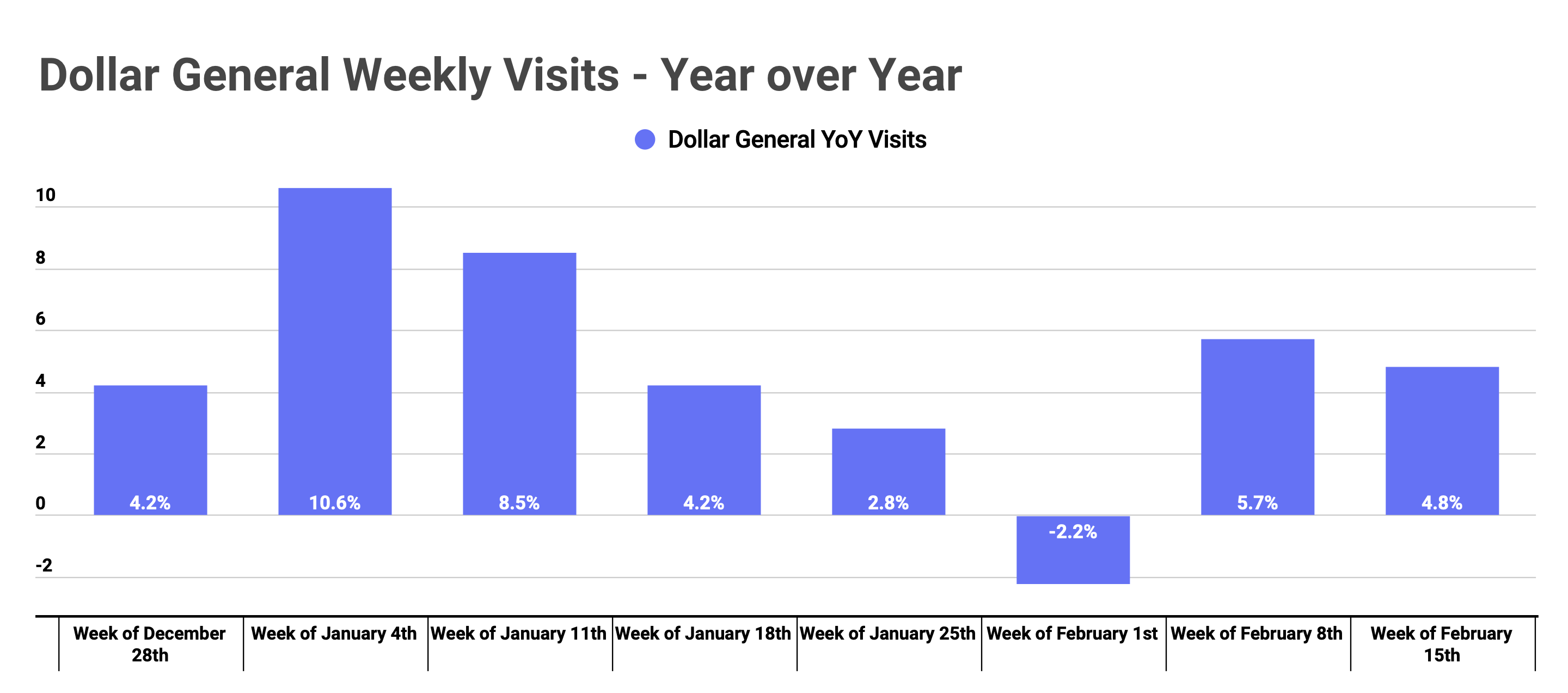

A final indicator of this growing strength becomes clear when breaking down weekly visits. While the wider retail sector saw visits heavily affected by inclement weather conditions across the country, Dollar General saw year-over-year growth in all weeks but one. This ability to persevere even through difficult scenarios speaks to the value of the brand’s expansion and the geographic distribution that allows them to push through challenges to specific areas. This unique strength combined with the wider economic trends that place added value on the Dollar General offering and approach should position the brand for another exceptional year.

A Tale of Two Brands

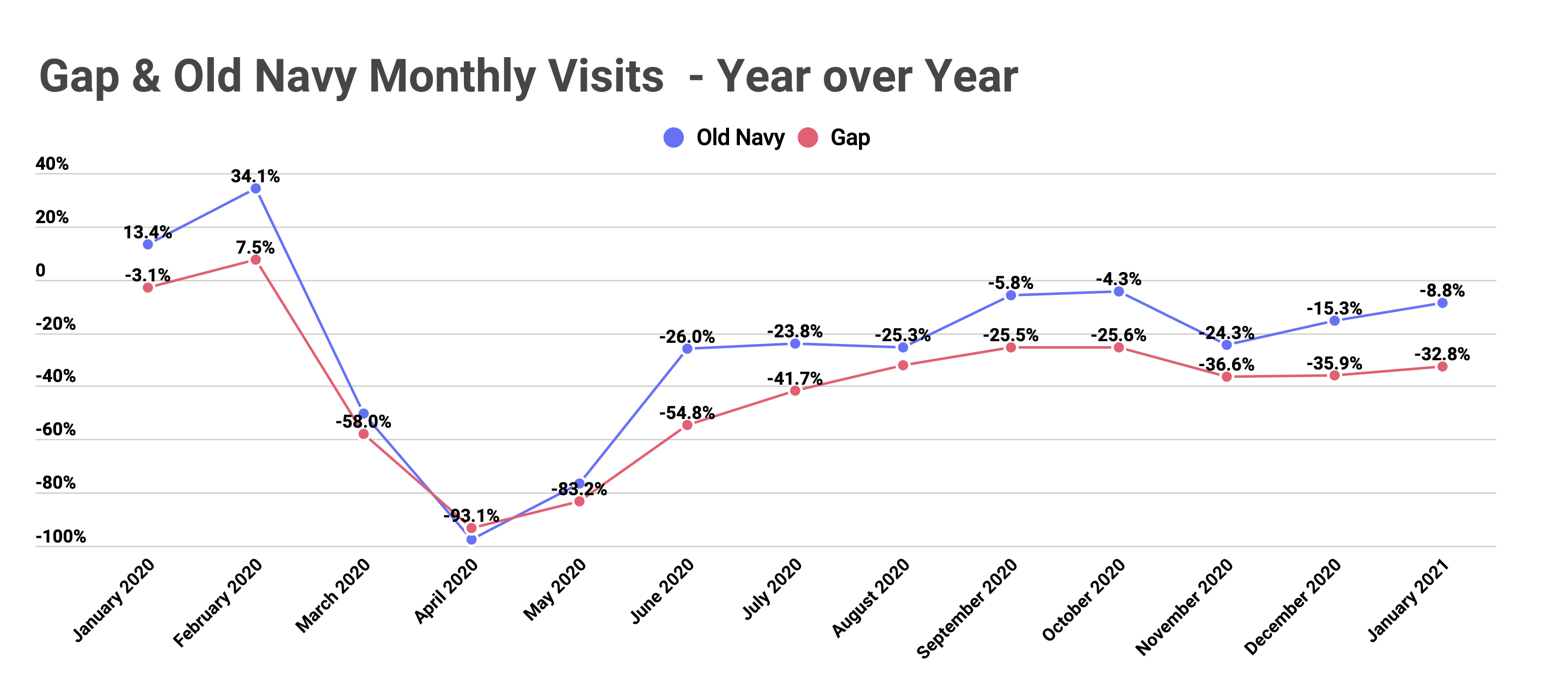

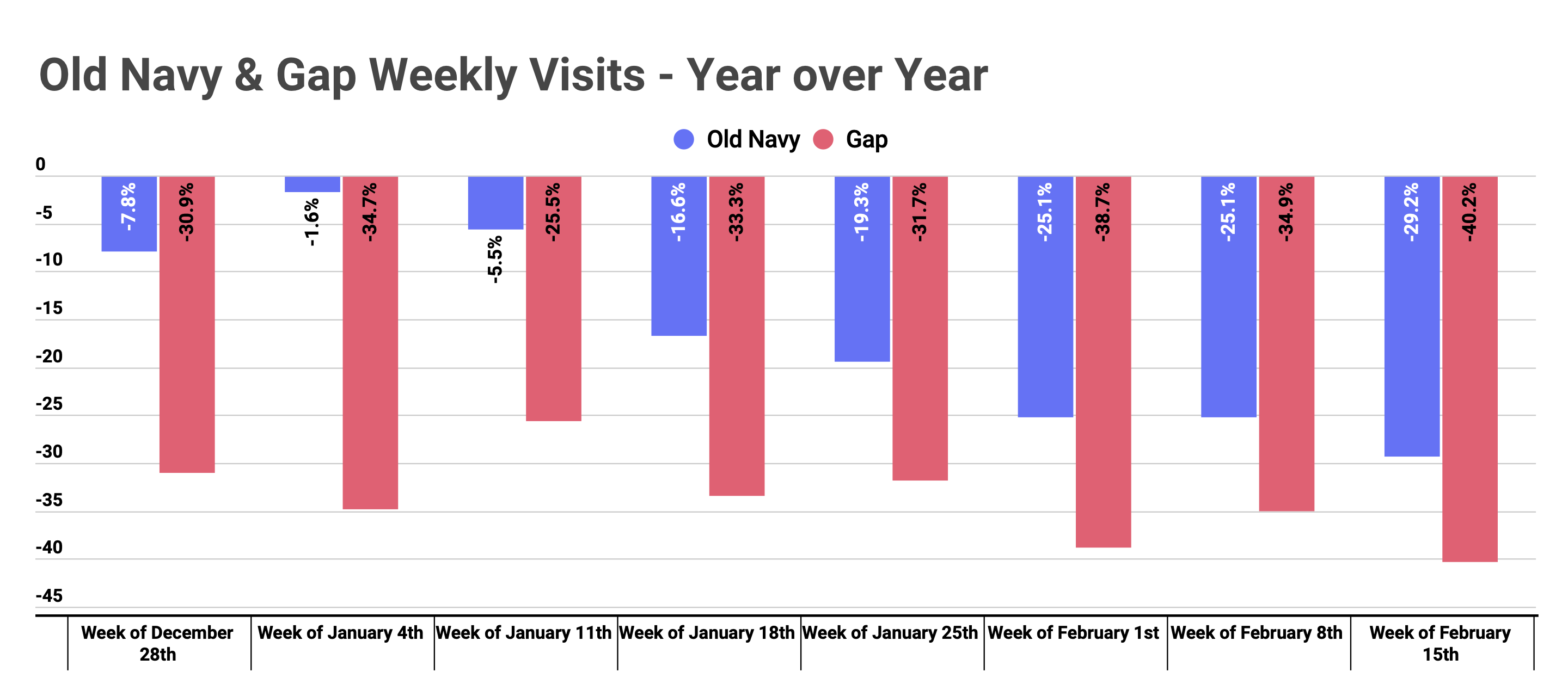

The decision to keep Old Navy under the Gap umbrella appears smarter all the time. While Gap has seen its recovery pace closely with the wider apparel sector, Old Navy has been within striking distance of normal visit levels since September. Following a decline in November as COVID cases surged and visits were being compared with the normal holiday season peaks, Old Navy visits recovered once again with visits down 15.3% year over year in December and just 8.8% in January. Gap followed a similar pattern with visits dropping in November before recovering slightly in December and January.

Yet, February brought challenges for both brands with the highs of January being offset by weather-induced challenges to offline retail. But the true test will likely come in early March as improved weather and a hopefully dissipating pandemic will push both brands to drive their recovery efforts forward.

Can Dollar General continue to drive growth? Will Old Navy continue its impressive recovery?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.