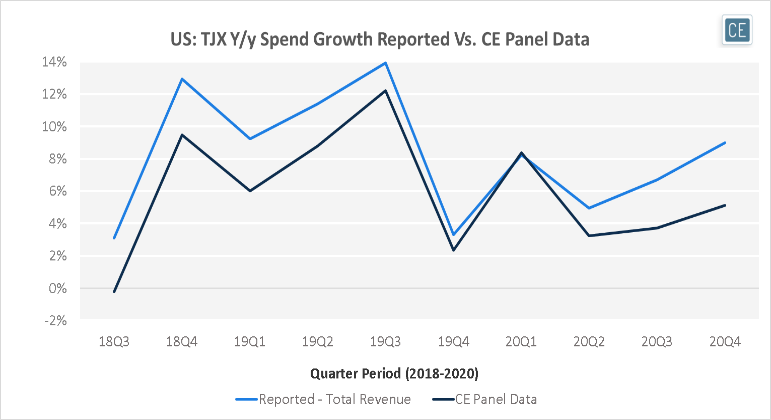

When TJX reported sales performance recently, investors were surprised to learn that while US sales were strengthening, international sales were weaker due to new rounds of store closures. Our data picked up on the trends in both geographies, allowing both investors and corporations to appropriately understand business trends worldwide.

Growth in the US has generally been stronger for TJX than in the UK. Throughout 2019 and into the first two months of 2020, growth in the US outpaced growth in the UK by an average of 4% per month. Pandemic store closures hit the UK harder than the US, and UK growth has been negative every month since then, while US growth was positive in September and October of 2020, and then again in January 2021.

US vs. UK Spend

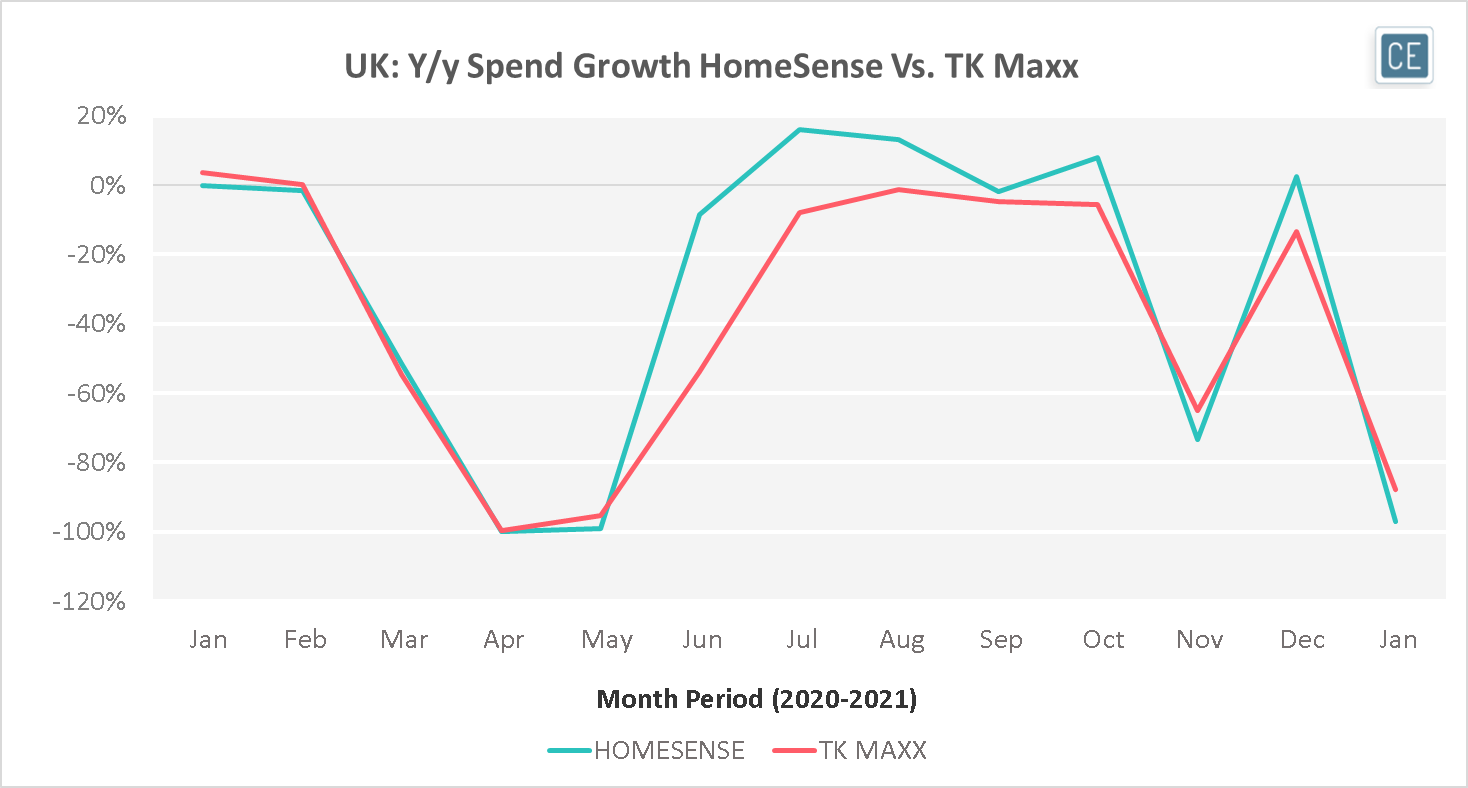

The TJX business does have one thing in common across the two geographies, however. The company’s home-oriented banners have consistently outpaced their other banners in both countries. In the US, this was true even pre-pandemic, with pandemic stay-at-home trends catapulting HomeGoods to spend growth as high as 30% above that at Marmaxx. In the UK, HomeSense was lagging the TK Maxx business pre-pandemic, but spend growth has been positive for several post-pandemic months while TK Maxx spend growth has been consistently negative.

US vs. UK Brand Comparison

Looking at the spend distribution across the last year, one thing that stands out is the importance of the holiday season in the US. The company showed strong spend in November in the US even as UK sales plummeted. Both countries had their strongest month of 2020 in January.

Seasonality

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.