Subscription boxes have been booming during the pandemic, enabling consumers to shop for products such as food, alcohol, beauty, and clothing from the comfort of homes. As schools nationwide transitioned to remote learning–with several remaining online into 2021–another area that’s been experiencing renewed interest is subscription boxes for kids.

Over the past few years, several big-name retailers have introduced kids’ subscription services. For example, Amazon Prime offers a book box for kids and Nike introduced a kids’ footwear subscription. Fashion box company Stitch Fix also offers a children’s line. However, other companies have entered the DTC subscription industry with products that cater exclusively to kids. Consumer transaction data reveals that during the COVID-19 pandemic, sales for kids’ subscriptions that focus on educational and play-based activities have increased significantly.

Sales for education-based kids’ boxes have grown during the pandemic

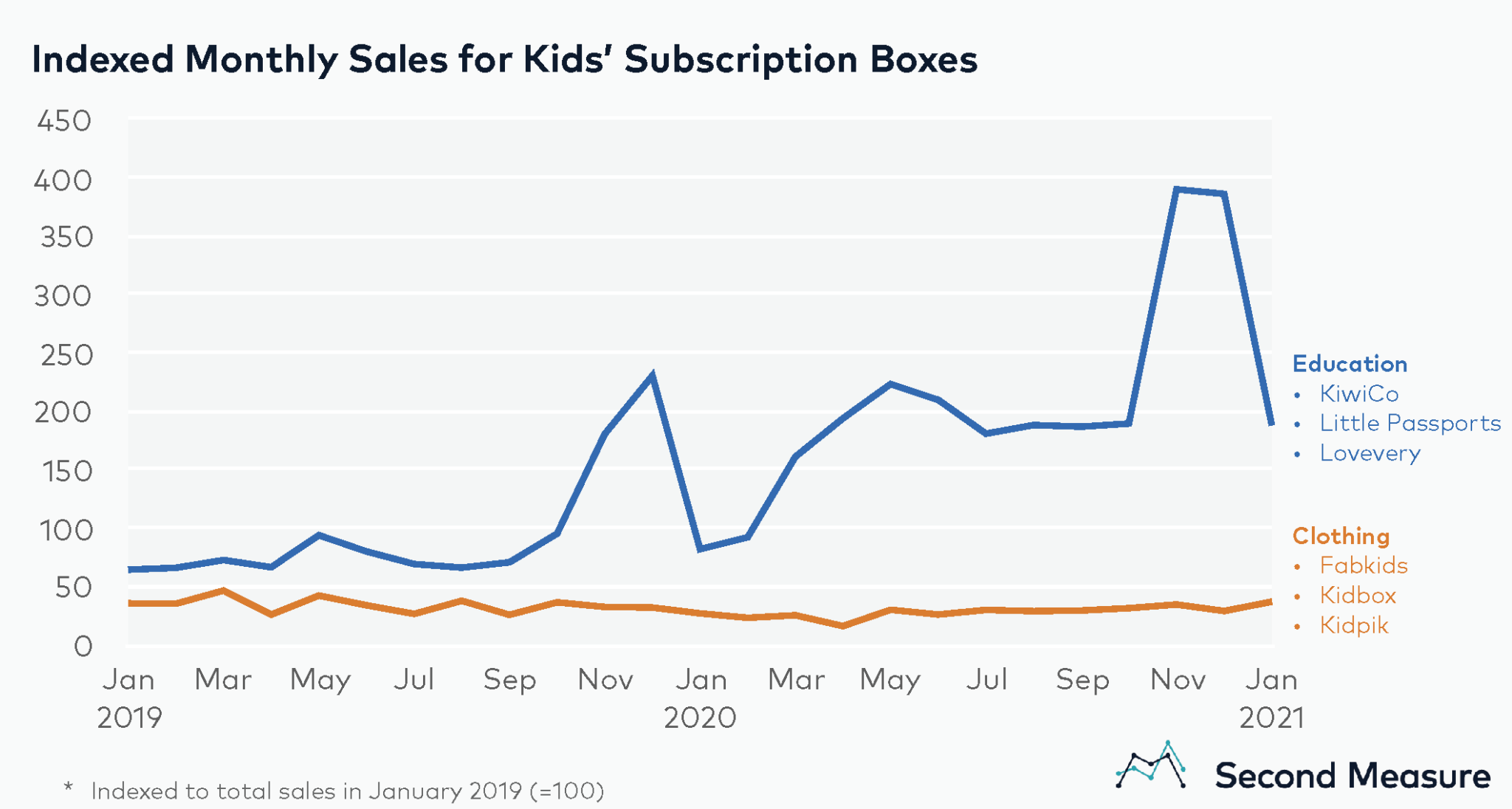

Within the kids’ subscription box category, education and play-based boxes such as KiwiCo, Little Passports, and Lovevery have experienced strong growth over the past year. In fact, year-over-year sales growth for these education boxes averaged 123 percent in 2020. By contrast, sales for kids’ clothing boxes such as Kidpik, Kidbox, and FabKids decreased, with an average year-over-year decline of 17 percent in 2020. Both educational and clothing subscriptions for kids started strong in January 2021, with year-over-year growth rates of 129 percent and 37 percent, respectively.

While sales for kids’ education boxes have grown over the past two years, the biggest spikes occurred around the holidays and at the beginning of the pandemic. KiwiCo, which offers STEM and STEAM projects for children ages 0 through 14, had the highest sales volume during these periods, accounting for an average of 67 percent of the education box sales between December 2019 and December 2020. Notably, the spring 2020 sales growth corresponded with when schools transitioned to remote learning. Sales for education boxes also remained elevated throughout the summer and fall, likely in part because parents needed to keep kids entertained at home. These subscription boxes provide analog, hands-on activities for children, which can be an attractive feature for parents who have concerns about increased screen time during COVID-19.

Lovevery had the biggest boost in new customers from Q1 through Q3

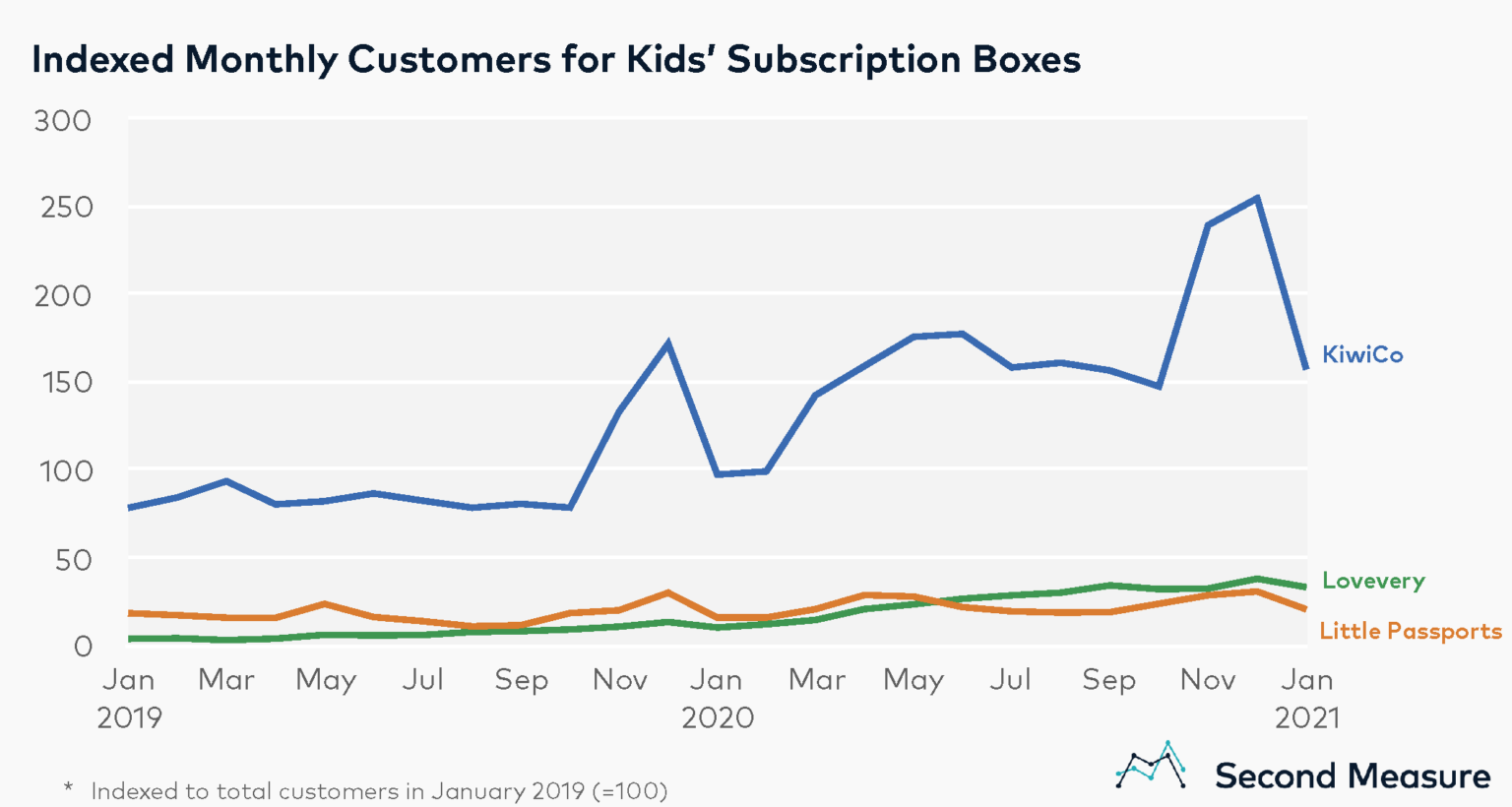

Zooming in on educational and play-based subscription boxes for kids, all three companies in our analysis experienced a boost in customers in March and April 2020. For KiwiCo and Little Passports, the number of customers tapered off during summer and early fall, while customers at Lovevery continued to rise. In June 2020, the number of customers at Lovevery surpassed that of Little Passports.

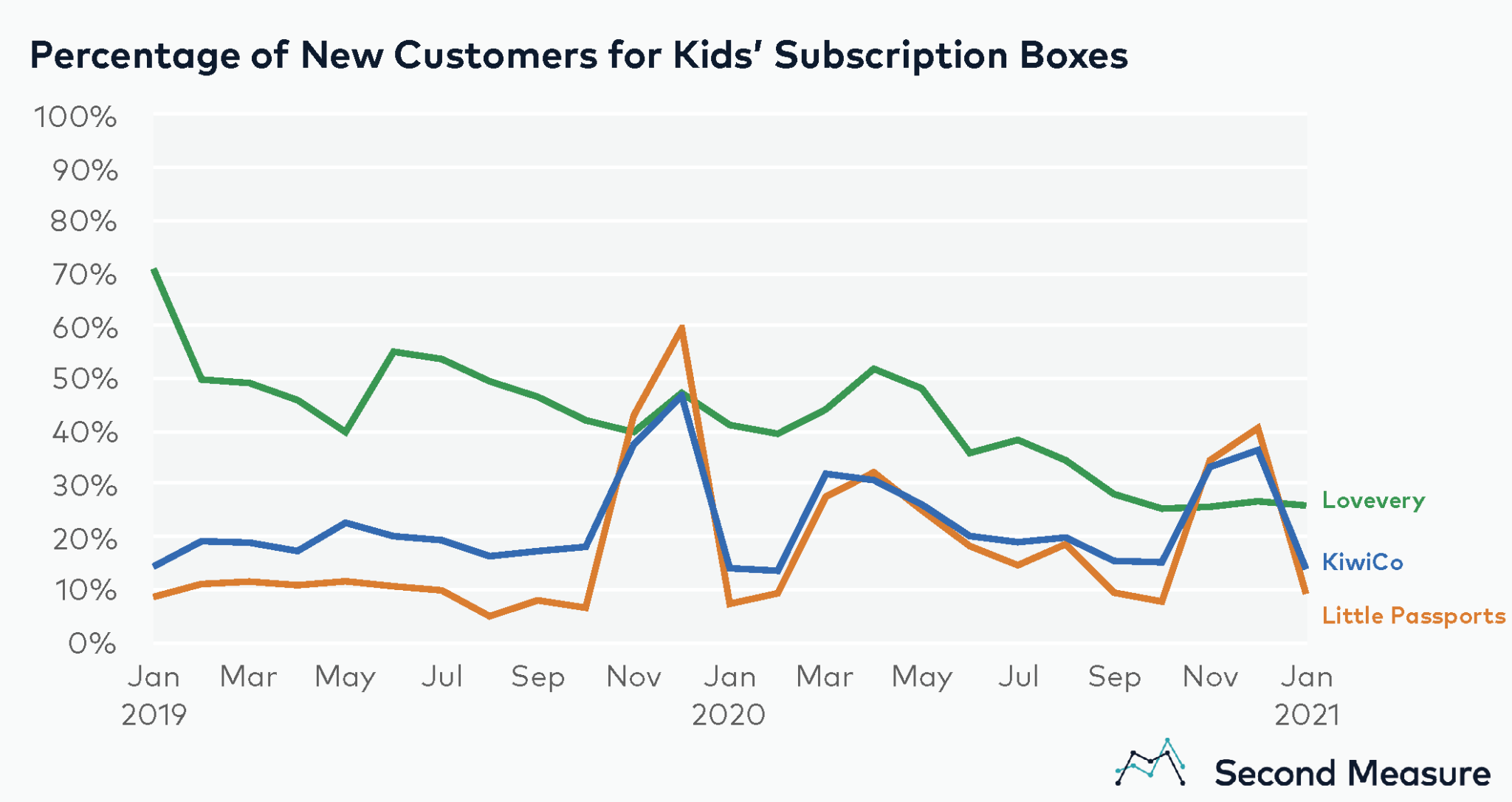

Lovevery, which specializes in play kits for infants and toddlers, had the highest percentage of new customers throughout most of 2019 and 2020. However, this percentage has been steadily decreasing over the past two years, going from 49 percent in 2019 to 37 percent in 2020. Conversely, Little Passports had a higher average percentage of new customers in 2020 compared to 2019 (20 percent vs. 16 percent). KiwiCo remained the same at 22 percent for both years.

Although Lovevery’s percentage of new customers exceeded that of its competitors for most of the year, Little Passports and KiwiCo experienced bigger spikes in the percentage of new customers in November and December, reinforcing the companies’ marketing emphasis on gifting subscriptions for the holidays.

Lovevery has the highest lifetime sales per customer among the competitive set

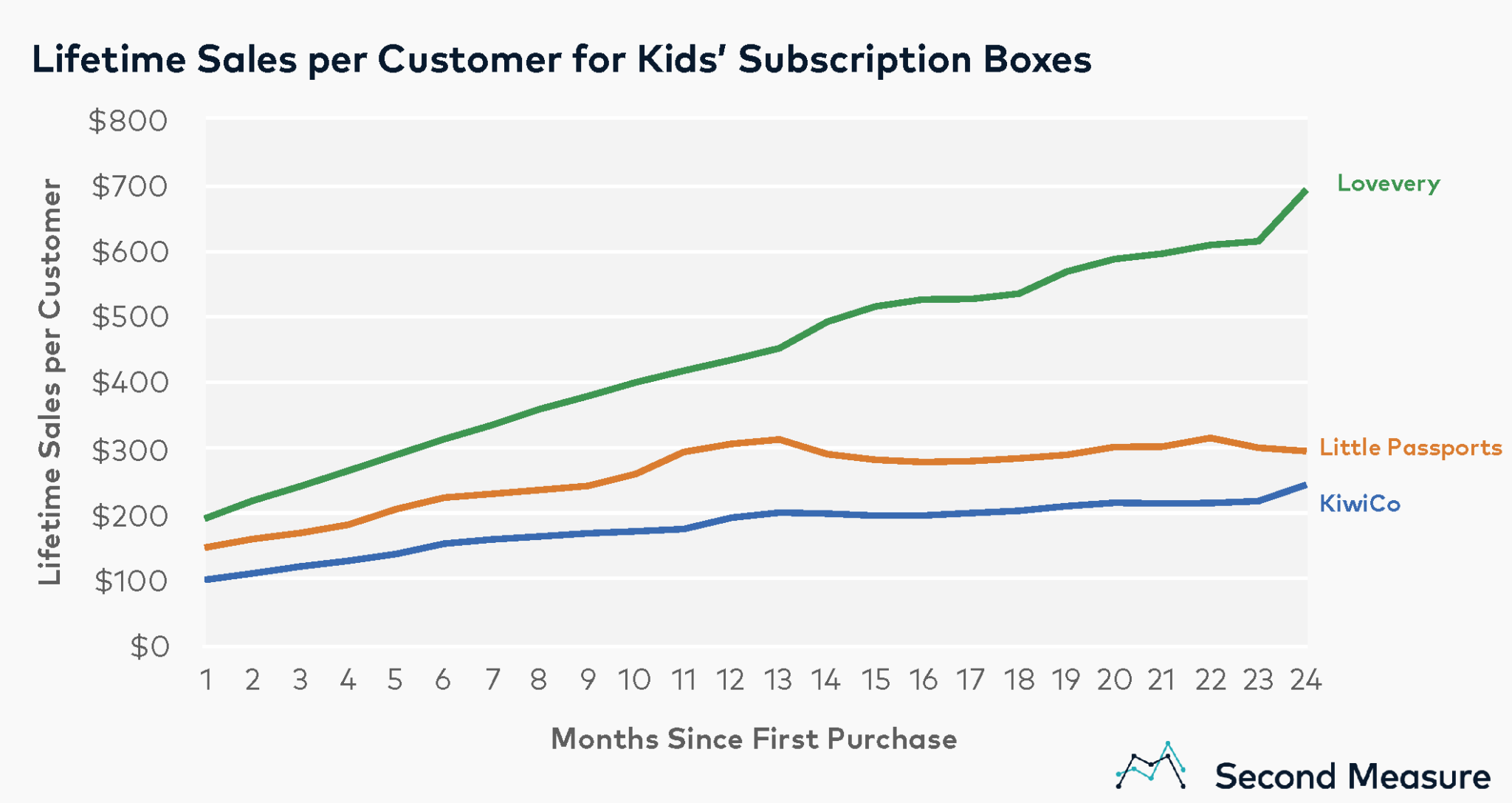

Price points for kids’ subscriptions vary across companies, but an analysis of lifetime sales per customer illustrates trends related to customer value over time. Lovevery’s life sales per customer has a higher rate of growth than its competitors, a trend that accelerates around 13 months as Lovevery’s sales continue to increase while competitors’ lifetime sales plateau. After 24 months, the lifetime sales per customer at Lovevery was $692.38, more than double that of Little Passports and KiwiCo. At that point, Lovevery’s lifetime sales per customer have tripled compared to the first month after purchase while lifetime sales per customer for Little Passports and KiwiCo have simply doubled.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.