In our latest report, produced by App Annie and commissioned by Facebook, we examine consumer usage of mobile apps with similar features to understand the extent of switching between them.

What’s Happening:

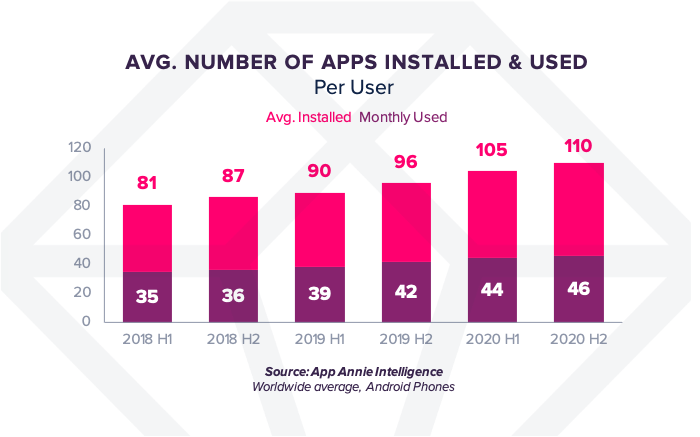

The average mobile consumer has an increased number of apps downloaded on their mobile device. In H2 2020, the average consumer had 110 apps installed, an increase from 87 apps during the same period 2 years ago.

The pandemic accelerated this behavioral change hitting a peak in hours spent during H1 of 2020 (when lockdowns were at their peak). Time spent in apps remains high even as many consumers are now able to venture out in a post-lockdown period.

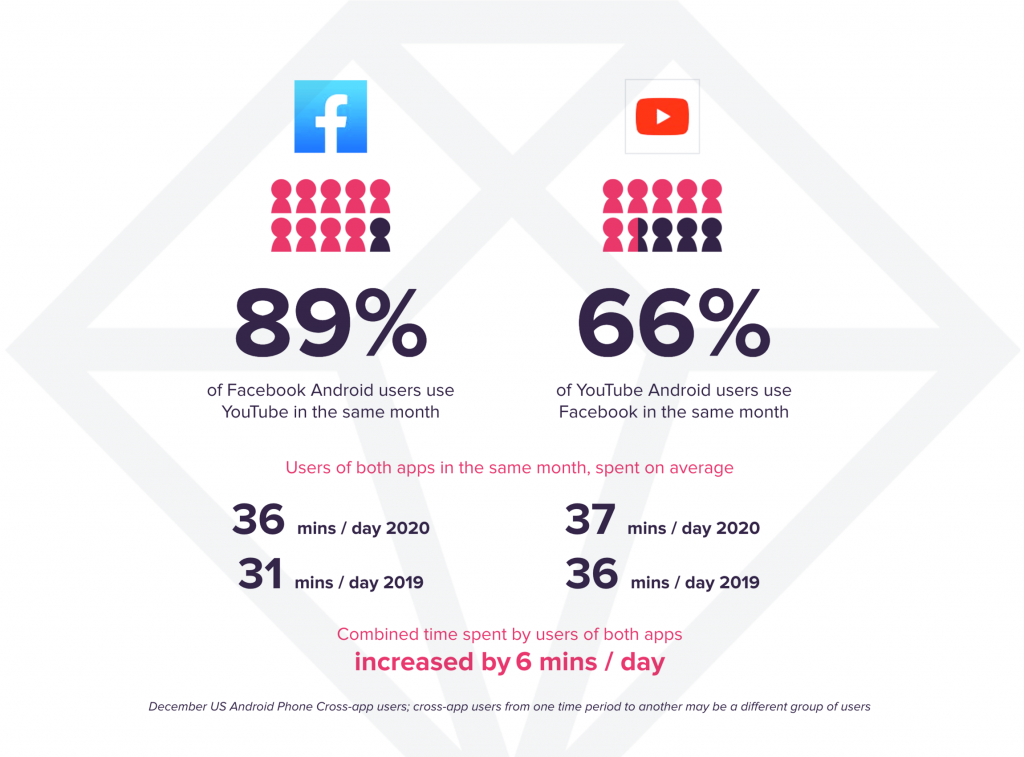

Consumers are using multiple similar apps from the Entertainment and Communication categories. Of the 10 communication apps downloaded, 5 are actively used monthly to stay connected. When we looked at this closer, we found that 9 out of 10 users of Facebook users also regularly use YouTube in a month. A similar usage trend can be found between TikTok and Snapchat, with 50% of TikTok users dividing almost an hour each day between them.

Time Spent Using Similar Apps Should Continue to Grow Post-Pandemic

The pandemic has been undoubtedly influential in accelerating this growth, especially for entertainment and communication apps. With more of their day spent engaged with mobile apps, even as lockdowns are lifted post-pandemic, the trend of using multiple similar apps will continue as consumers look to communicate and entertain themselves.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.