ATTOM Data Solutions, curator of the nation’s premier property database, today released its Q1 2021 Single Family Rental Market report, which ranks the best U.S. markets for buying single-family rental properties in 2021.

The report analyzed single family rental returns in 495 U.S. counties, each with a population of at least 100,000 and sufficient rental and home price data. Rental data came from the U.S. Department of Housing and Urban Development, and home price data from publicly recorded sales deed data collected and licensed by ATTOM Data Solutions (see full methodology below).

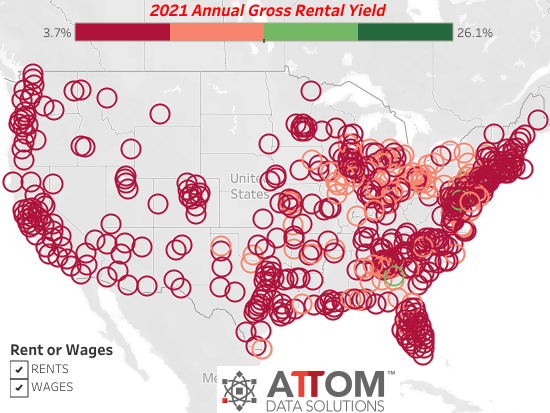

Single Family Rental Returns by County: 2021

The average annual gross rental yield (annualized gross rent income divided by median purchase price of single-family homes) among the 495 counties is 7.7 percent for 2021, down from an average of 8.4 percent in 2020. Within that group of counties, the yield declined from 2020 to 2021 in 87 percent of counties. However, it’s not all bad news for rental property investors.

“Offsetting the declining yields are improved financing terms for such rental properties and portfolios”, said Maksim Stavinsky, co-founder of Roc360, a FinTech platform that is parent to Roc Capital and Haus Lending, both companies specializing in loans to real-estate investors nationwide. “Across our platform, rates that we are quoting to borrowers have more than offset the waning cap rates on a YoY basis, with the highest-tier rental loan borrowers seeing terms in the low 4% range. This is happening despite a yield curve that has been steepening of late.”

At the same time, home prices are rising faster than rents in most of the country, which could start making home ownership less affordable and put upward pressure on rents.

“The single-family home rental business is less profitable this year compared to last year across most of country, with yields on the average deals decreasing. That’s happening as home prices on properties that investors are paying for, in most areas, are rising considerably faster than rents, which is cutting into their profit margins,” said Todd Teta, chief product officer at ATTOM Data Solutions. “Nevertheless, returns on single-family rentals still generally remain strong and there are pockets, especially in the Midwest, where yields top 10 percent. There also are some signs that things could improve this year given that home prices are increasing faster than rents.”

Top rental returns in Pottsville, Macon, Baltimore, Ottawa and Jamestown areas, as well as Midwest region

Counties with the highest potential annual gross rental yields for 2021 are Schuylkill County, PA, in the Pottsville metro area (26.1 percent); Bibb County, GA, in the Macon metro area (18.1 percent); Baltimore City/County, MD (16.2 percent); La Salle County, IL, in the Ottawa metro area (14.1 percent) and Chautauqua County, NY, in the Jamestown metro area (13.7 percent).

The highest potential annual gross rental yields in 2021 among counties with a population of at least 1 million are Cuyahoga County (Cleveland), OH (9.9 percent); Dallas County, TX (8 percent); Tarrant County (Fort Worth), TX, (8 percent); Franklin County (Columbus), OH (7.9 percent) and Bexar County (San Antonio), TX (7.9 percent).

Among the top 50 rental returns for counties analyzed in 2021, 25 are in the Midwest, 15 in the South and 10 in the Northeast.

Rental returns decrease from a year ago in almost 90 percent of counties analyzed

Potential annual gross rental yields for 2021 decreased compared to 2020 in 430 of the 495 counties analyzed in the report (86.9 percent), led by Baltimore City/County, MD (yield down 43.9 percent); St. Louis City/County, MO (down 35.5 percent); St. Louis County, MO (down 29.3 percent); Bonneville County (Idaho Falls), ID (down 26.7 percent) and Fairfield County (Stamford), CT (down 24 percent).

Among counties with a population of at least 1 million, those with the biggest decreases in potential annual gross rental yields from 2020 to 2021include Miami-Date County, FL (down 19.9 percent); Oakland County, MI, in the Detroit metro area (down 18.6 percent); King County (Seattle), WA (down 17.4 percent); Palm Beach County, FL, in the Miami metro area (down 14.2 percent) and Fulton County (Atlanta), GA (down 13.3 percent).

Counties in San Francisco, San Jose, Nashville and Maui metros and others in the West post lowest rental returns

Counties with the lowest potential annual gross rental yields for 2021 are Williamson County, TN, in the Nashville metro area (3.7 percent); Santa Clara County, CA, in the San Jose metro area (3.8 percent); San Mateo County, CA, in the San Francisco metro area (3.8 percent); San Francisco County, CA (3.9 percent) and Maui County, HI (3.9 percent).

Among counties with a population of at least 1 mission, along with Santa Clara County, those with the lowest potential annual gross rental yields in 2021include Kings County (Brooklyn), NY, (4.3 percent); Orange County, CA, in the Los Angeles metro area (4.6 percent); Los Angeles County, CA (4.7 percent) and King County (Seattle), WA (4.8 percent).

In the bottom 50 rental returns, among counties analyzed for 2021, 30 are in the West, 10 are in the South, seven are in the Northeast, and three are in the Midwest.

Wages rising faster than rents in 77 percent of markets

Wages are rising faster than rents in 379 of the 495 counties analyzed (76.6 percent), including Los Angeles County, CA; Cook County (Chicago), IL; Maricopa County (Phoenix), AZ; San Diego County, CA; and Orange County, CA, in the Los Angeles metro area.

Rents rose faster than wages in 116 of the 495 counties analyzed (23.4 percent), including Harris County (Houston), TX; Tarrant County (Fort Worth), TX; Sacramento County, CA; Bronx County, NY and Mecklenburg County (Charlotte), NC.

Home prices rising faster than rents in 87 percent of markets

Single-family home prices are rising faster than rents in 430 of the 495 counties analyzed (86.9 percent), including Los Angeles County, CA; Cook County (Chicago), IL; Harris County (Houston), TX; Maricopa County (Phoenix), AZ and San Diego County, CA.

Rents rose faster than single-family home prices in 65 of the counties analyzed (13.1 percent), including Duval County (Jacksonville), FL; San Francisco County, CA; San Mateo County, CA, in the San Francisco metro area; Fort Bend County, TX, in the Houston metro area and Kane County, IL, in the Chicago metro area.

Prices rising faster than wages in 79 percent of markets

Prices are rising faster than wages in 391 of the 495 counties analyzed (79 percent), including Los Angeles County, CA; Cook County (Chicago), IL; Harris County (Houston), TX; Maricopa County (Phoenix), AZ and San Diego County, CA.

Wages rose faster than prices in 104 of the counties analyzed (21 percent), including Orange County, CA, in the Los Angeles metro area; King County (Seattle), WA; Santa Clara County, CA, in the San Jose metro area; Middlesex County, MA, in the Boston metro area and Hennepin County (Minneapolis), MN.

Best SFR growth markets include Milwaukee, Memphis, Rochester and Birmingham

The report identified 61 “SFR Growth” counties where average wages grew over the past year and the potential 2021 annual gross rental yields are 10 percent or higher.

The 61 SFR Growth markets include Milwaukee County, WI; Shelby County (Memphis), TN; Monroe County (Rochester), NY; Jefferson County (Birmingham), AL; and Baltimore City/County, MD.

Methodology

For this report, ATTOM Data Solutions looked at all U.S. counties with a population of 100,000 or more and with sufficient home price and rental rate data. Rental returns were calculated using annual gross rental yields: the 2021 50th percentile rent estimates for three-bedroom homes in each county from the U.S. Department of Housing and Urban Development (HUD), annualized, and divided by the median sales price of residential properties in each county.

ATTOM Data Solutions also incorporated weekly wage data from the Bureau of Labor Statistics and demographic data from the U.S. Census into the report.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.