There’s been no shortage of content to watch as the streaming platforms have exploded during the last year. And, although most people have been able to watch movies on their TV’s or phones, in the comfort of their living rooms, there’s just nothing like the experience of a darkened theater, 30 foot screen, body-shaking surround sound, and a bucket of buttery popcorn that gives you a stomachache near Act III. And as we round the corner back to normalcy, we take a look back at how movie theaters digital marketing reacted and adapted to the pandemic.

The Big 4

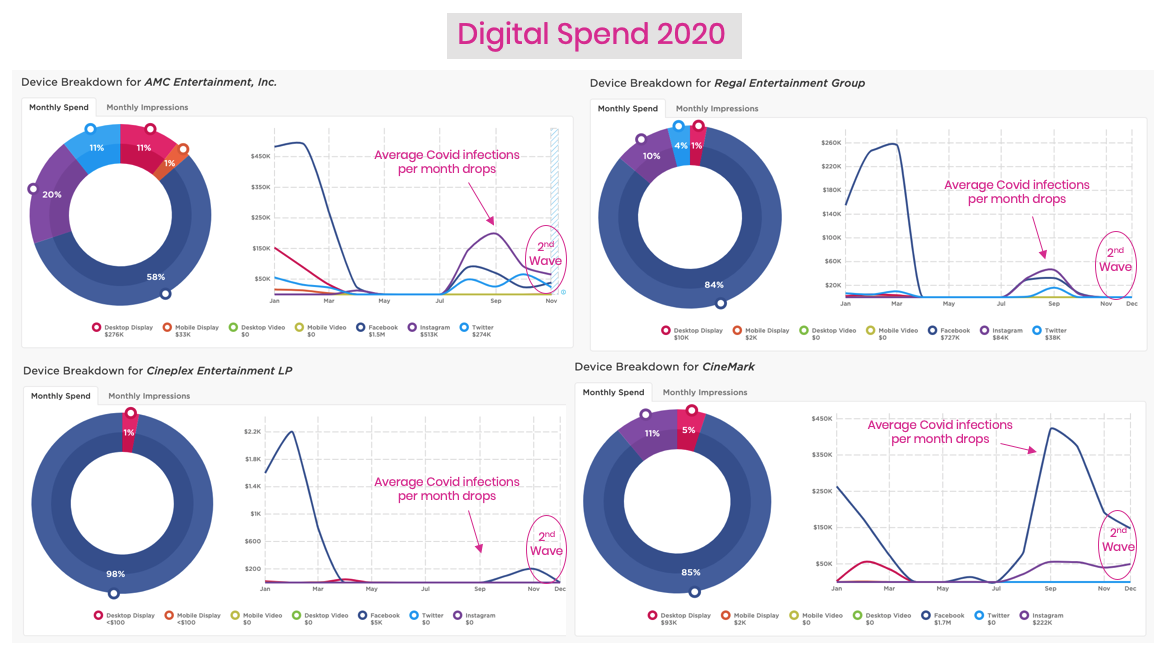

Across the US, there are 4 major theater chains: AMC, Cineplex, Regal and CineMark. And, when quarantine hit, not only did theaters have to shutter their doors, but Movie Studios were left with a decision to wait it out, or recoup their losses with streaming deals. The result: Digital Marketing plummeted in 2020. In fact, we can basically track major covid events that corresponded to their spend, as covid cases dropped in September, prompting states to allow limited re-openings, and similarly, dropped again for each brand in November/December, when cases dramatically increased during a second wave of the virus.

The Show Must Go On

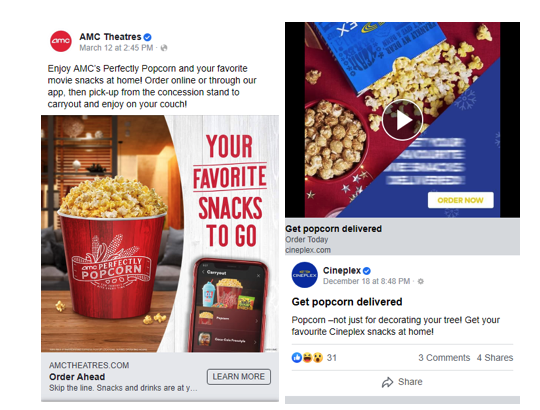

With the serious loss of revenue for an industry that was already dealing with major change, the advertisers began adapting anyway they could. Both CineMark and AMC released creatives, advertising their spaces to rent for private showings.

AMC and Cineplex also advertised a service where customers could order movie snacks from their mobile app and pick them up at their local theater.

Facebook Gets Top-Billing

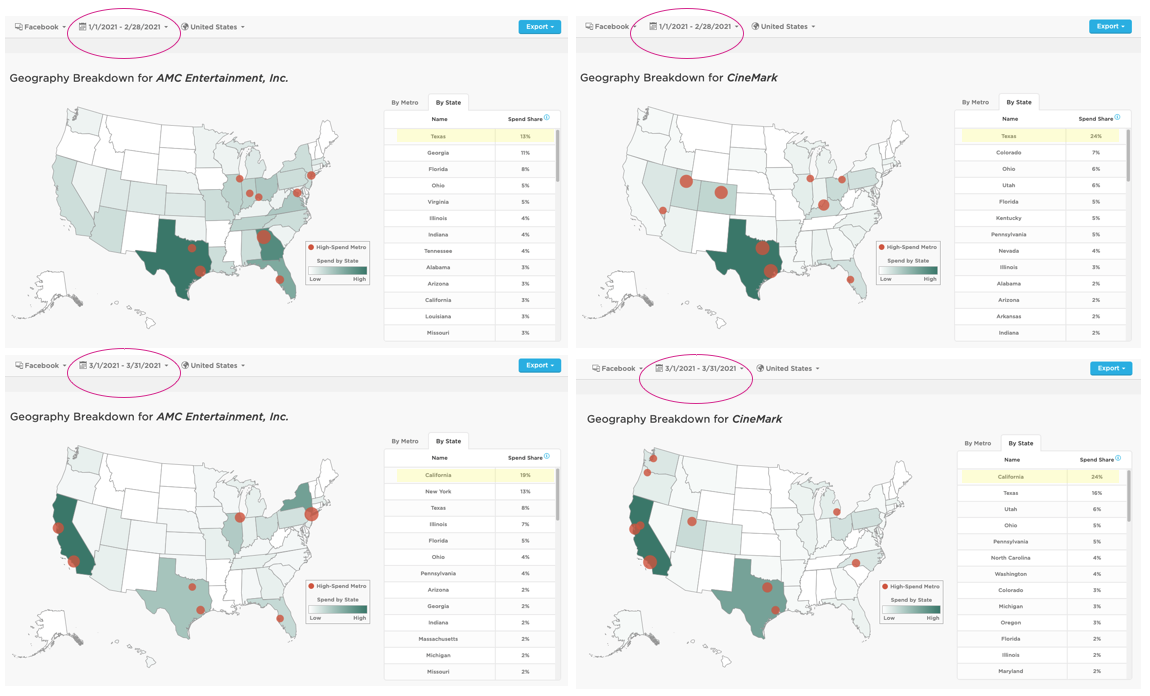

Even before the pandemic, Facebook carried the lions share of digital spend for the theater brands, and 2021 appears no different. However, more interesting - where and when they were spending. Both AMC and CineMark focused major Facebook spend in Texas and California, two states on opposite ends of implementing covid restrictions.

But taking a closer look, the date range is a significant indicator. From January 2021 through February 2021, California was ranked 11th with 3% investment from AMC, and 20th with 1% investment from CineMark. However, Texas, and its relaxed restrictions, garnered the most Facebook spend from both, in the same date range, with 13% and 24%, respectively.

Fast forward to March, where California has opened limited theater capacity: 19% investment for AMC and 24% for CineMark - both in the top spot.

The Light at The End of The Projector

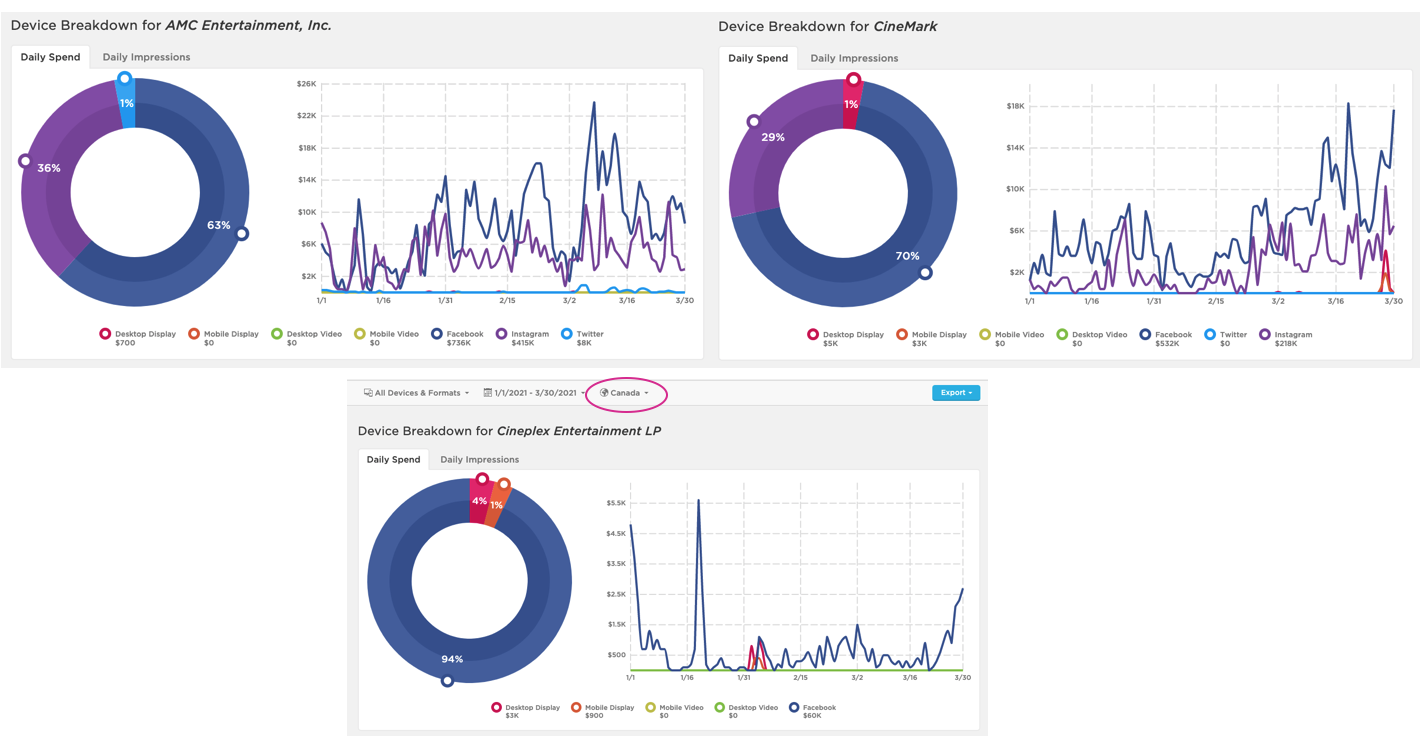

While stock in each of the companies fell significantly, the new year has shown signs of life for both AMC and CineMark, who’s digital spend began steadily increasing through the end of March. Cineplex, however, headquartered in Canada, hasn’t invested much in the US, though has advertised in its home country, where the pandemic restrictions have been different than the States.

Regal Entertainment unfortunately, struggled more than the others during the pandemic, facing chapter 11 bankruptcy, and a last minute loan from its creditors to reorganize. That also meant no investment in digital advertising for 2021.

While many industries will face an uphill climb after a history-making year, we’re glad the movie-going experience will endure for the next generation. That is…until they have to pivot to virtual reality theater experiences. But that’s at least 6 months away?

So, get your popcorn ready.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.