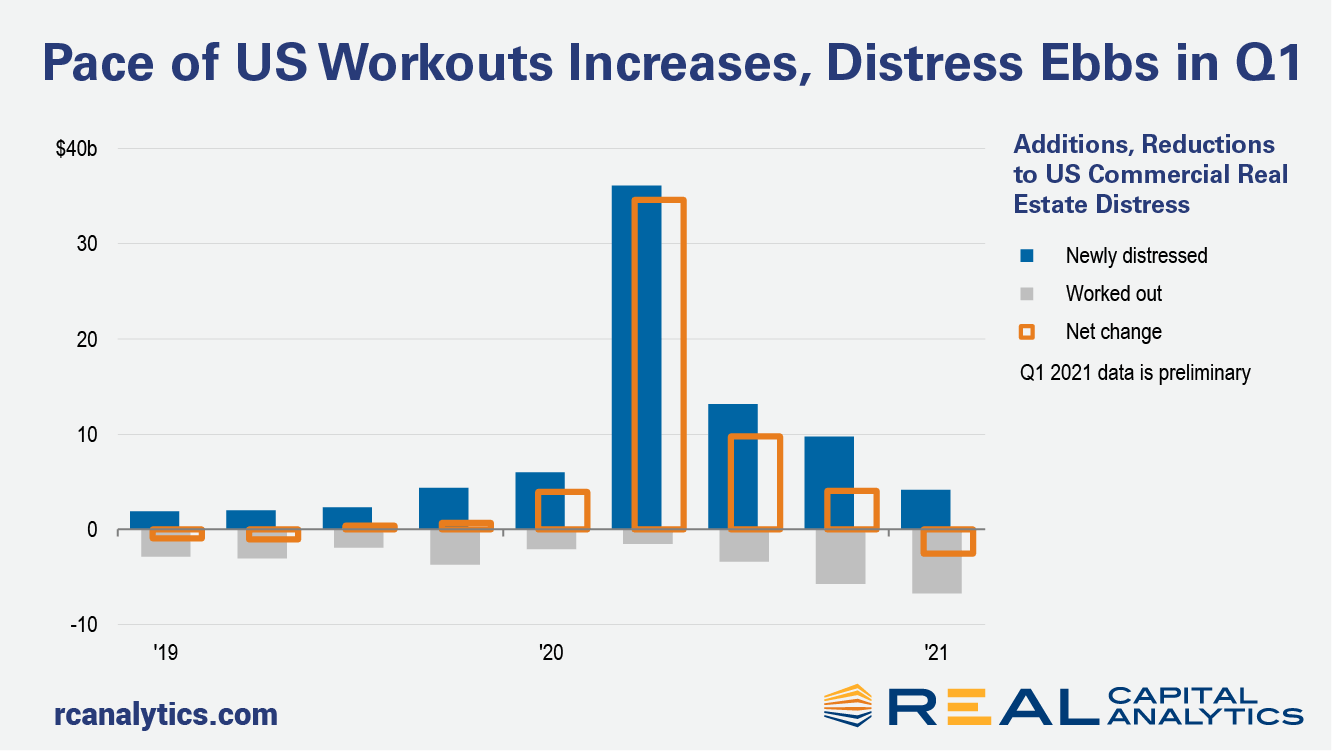

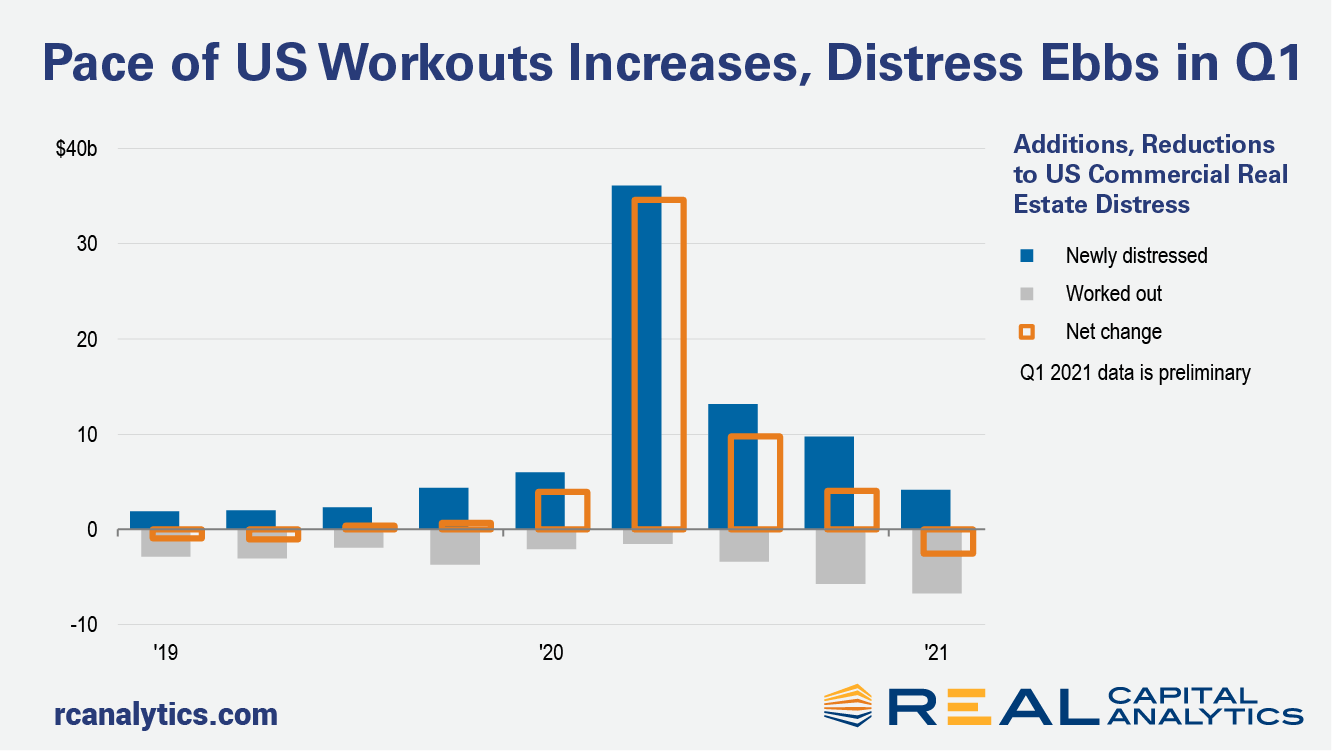

More U.S. commercial real estate distress was worked out than arose in the first quarter of 2021, preliminary Real Capital Analytics data shows. All other things being equal, this change in behavior would be an important sign of a transition in the marketplace. We are not finished with all aspects of distress, however. There is a looming supply of potentially distressed loans that still may have an impact.

The pace of workouts will play an important role in the process of price discovery for commercial properties. Deal volume has contracted sharply over the last year as owners and potential buyers disagree on how assets should be priced. To the extent that there are more loan workouts, information from these negotiations will adjust buyer and seller expectations on prices that can be achieved.

The process of price discovery may well work out more in the favor of current owners if the headline figures are correct and we turned the corner in Q1 2021. As fewer distressed loans come to light, there may be few significant discounts on offer. In such a case, buyers would need to step up to seller expectations on prices if they want to place money in the sector.

However, the stock of potential distress is sizeable. These are principally loans in forbearance or in other sticky situations that could lead to a distressed situation down the road. Final figures for Q1 2021 are not yet settled, but preliminary figures suggest that the stock of potentially distressed loans is as big as one business quarter’s worth of commercial real estate sale activity in the 2016-19 period. If all of this potential distress is realized, deal volume would begin to correct as sellers cut price expectations given the evidence from distressed sales.

The challenge with so much of the potential distress is that all participants are taking a wait-and-see attitude. Lenders do not want to foreclose on properties since that approach generally guarantees a loss of some sort. With vaccines going into arms and some sort of normality approaching, delaying hard decisions still looks like a good idea to many lenders.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.