A strong return of leisure travel has created much cause for celebration during the early months of 2021. In the U.S., hotel room demand in March was the country’s highest level recorded since the start of the pandemic. To fully recover, however, the industry needs both leisure and the various segments of business travel to return.

Will business travel return?

To track evolving trends in the tourism and hospitality industry, and examine everchanging attitudes to travel, STR conducted a quantitative survey in February 2021 among 1,333 respondents from its Traveler Panel. In this latest installment of Tourism After Lockdown, we look at the potential recovery path of business travel.

In this research, travelers primarily represented the United Kingdom, other countries in Europe, and North America. Sentiment about business travel was captured among those who had previously traveled for business pre-pandemic.

Yes, but…

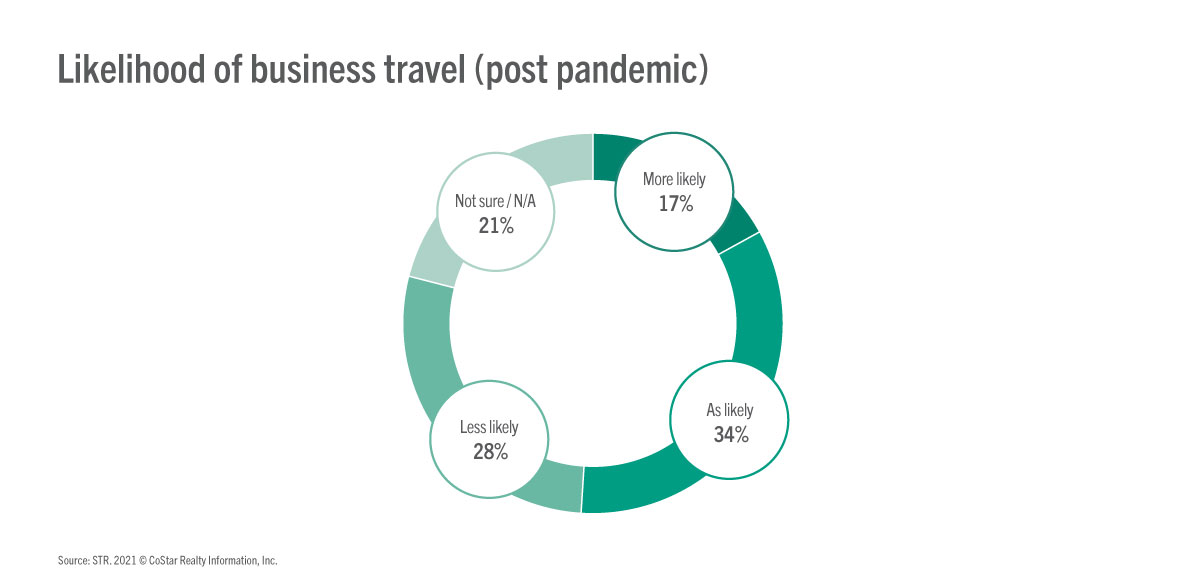

Business travel will return, but not to its pre-pandemic levels. When respondents were asked to think about their likelihood to travel for business once the pandemic is completely over, the results were more negative than positive. More planned to travel less for business compared with their pre-pandemic levels.

Over one-quarter stated that they were less likely to travel once the pandemic was over. The cost savings realized by companies in 2020 with most of their workforce working from home, and the success of using video technology as a substitute for face-to-face meetings, were the primary reasons stated by business travelers who said they would be less likely to travel post-pandemic.

There was a smaller group (17%) stating that they would be more likely to travel influenced in part by the pent-up desire to reconnect with clients/prospects and make up for lost time. This group also wants to reach their clients before the competition and expressed a need for remote teams to connect in person after a year of being separated.

Notable is that one in five respondents stated that they were “not sure” about their level of business travel post-pandemic. This was due in part to the fact that these individuals are currently still working from home and find it hard to predict their post-pandemic business travel.

Reason for optimism

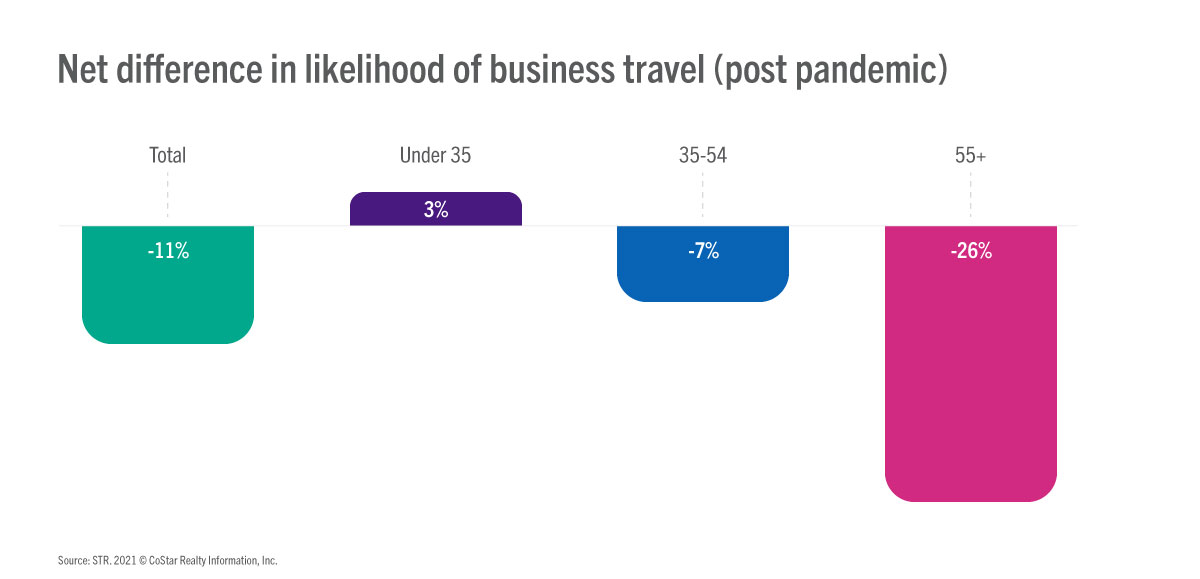

While the business travel forecast may not be all sunshine, there are some bright spots. Younger travelers appear to want to travel broadly at the same rate as before the pandemic.

The chart below shows the net difference in the likelihood of business travel by subtracting those who said they were less likely to travel from the ‘more likely’ to travel group. There was a net -11% for all business travelers and a +3% for younger business travelers. It is reassuring to see greater optimism about the return of business travel among younger travelers. Perhaps their enthusiasm will set a trend to be followed by all travelers as the scars of the pandemic fade into the background.

It is too soon to know for sure

Realistically, it is probably too soon to know for sure. With most of the global population still working from home, it is difficult to predict levels of business travel in the coming years. According to a recent poll by the Pew Research Center, 71% of Americans are currently working from home compared with 20% who worked from home before the coronavirus outbreak. Over half would want to continue working from home after the pandemic. The first step in understanding the path to recovery for business travel is to understand what the “office” environment and working culture will be post-pandemic.

As we seek to identify the “next normal” for business travel, we must first understand the transition back to the office. Monitoring shifts in working culture and behavior in our new COVID-19 world is likely to serve as a great predictor in shaping the future of business travel.

Measuring current sentiments and behavioral changes can help you navigate the current market climate. Click here to learn more about how STR can help you gain a rich understanding of your target audience.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.