After an auspicious start to its performance recovery, Mumbai’s hotel industry appeared ready to continue setting the trend for urban markets in 2021. However, a second wave of COVID-19 cases has called a temporary halt to the market’s success. Fortunately, strong domestic demand and corporate confidence, the drivers behind the market’s earlier recovery in 2020, remain poised to push performance again once cases are under control.

Current conundrum

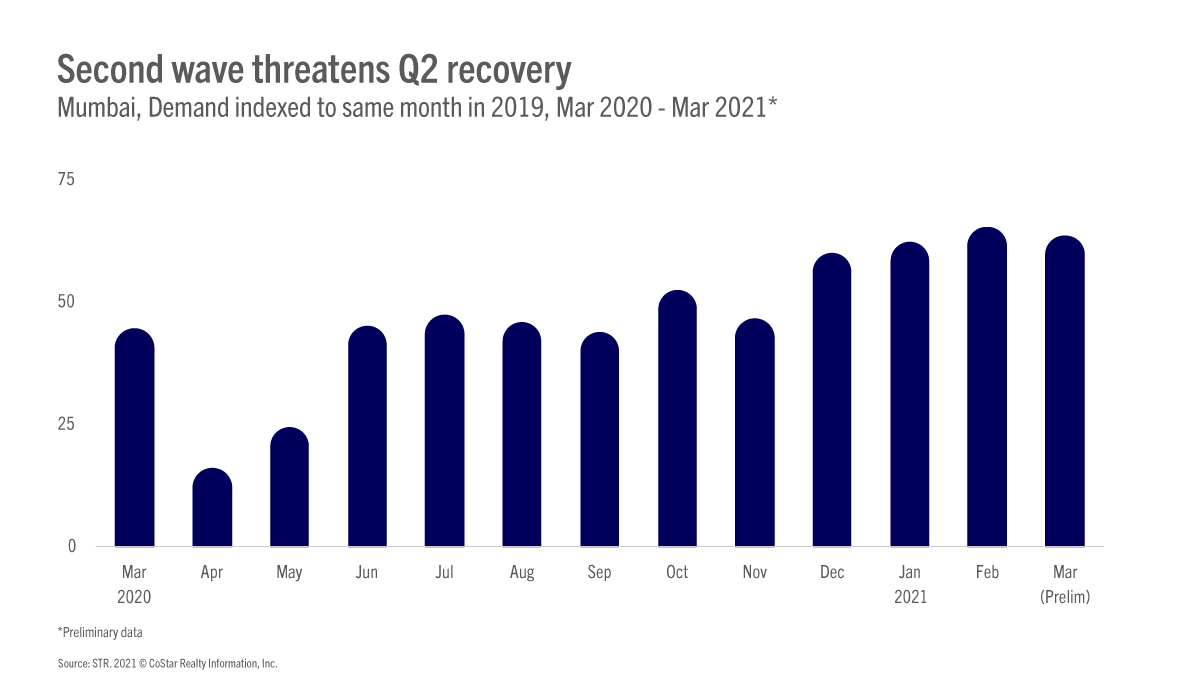

More recently, Mumbai welcomed back corporate travelers, which helped lift demand in the first quarter of 2021. An institutional quarantine requirement helped drive demand as well, as travelers arriving from or transiting through several major world regions were required to undergo a 10-day institutional quarantine.

Between quarantine guests and business travel, February hotel demand reached 65% of its 2019 level, the market’s highest indexed level to this point. Perhaps even more surprising, group demand, which in most markets worldwide remains near almost nonexistent, surpassed 70% of its pre-pandemic levels in February.

However, Mumbai’s tenuous recovery faces a new challenge as caseloads are once again on the rise, and preliminary March data reveals a demand slowdown compared with the previous month. Recently announced restrictions, including weekday curfews and complete weekend lockdowns, spell the end of business travel to Mumbai until the second wave can be contained.

Future facing

Despite headwinds, Mumbai hotels should expect moderate recovery in 2021. According to Tourism Economics, even prior to the pandemic international arrivals contributed to only 23% of nights spent in Mumbai, and in the break between COVID waves, the market’s strong reliance on domestic guests helped drive demand more than halfway to its pre-pandemic highs. A strong domestic demand base will be key to early recovery as international travel remains fraught with difficulties.

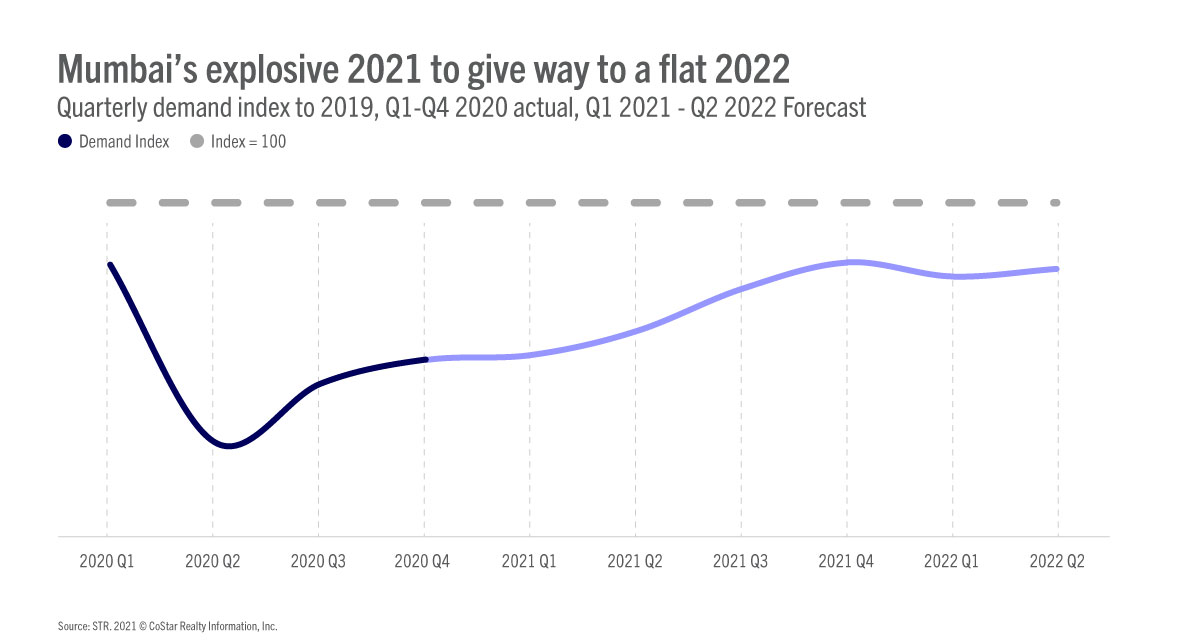

In the short-term, a second wave of COVID-19 and the commensurate lockdowns have already started to slow recovery. Slower-than-anticipated vaccine rollouts are unlikely to curb the new wave, thus necessitating strict lockdown measures expected to remain in place through April.

The new wave has not yet impacted corporate confidence in Mumbai’s future, as 10 conventions remain on the calendar in the second half of 2021. Cancellations remain a distinct possibility, however. The International Cricket Council has admitted to “back up plans” for the rescheduled ICC Men’s T20 World Cup 2021, which is set to take place across India over October and November, and vaccination rollout remains a crucial factor for hosting events of any size.

While 2021 may be shaping into a feast-or-famine year for hotel demand, hoteliers can anticipate a more sedate 2022, with demand recovery peaking in Q4 2021—just above 2013 levels. For the following two quarters, demand is expected to dip slightly as travel normalizes and then as seasonal travel patterns return.

The flatter trend does not represent a setback in recovery but does herald the end of the initial recovery boom, with demand growth expected to continue at a more moderate pace in the medium- to long-term.

Conclusion

Although Mumbai has not escaped the impacts of COVID-19, the market has performed exceedingly well for a major metropolitan area in a world which currently prefers rural, nature-based destinations. Further bucking global trends, business and even group demand returned early to India’s financial capital, lending hope for a second swift recovery to hoteliers as the market contends with a second wave of COVID cases. STR’s second quarter forecast update, due out in late May, will provide additional insight into the rapidly changing situation in India’s largest market.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.