In this Placer Bytes, we dive into Starbucks and its impressive recovery and the resiliency of New York retail.

Don’t Bet Against Starbucks

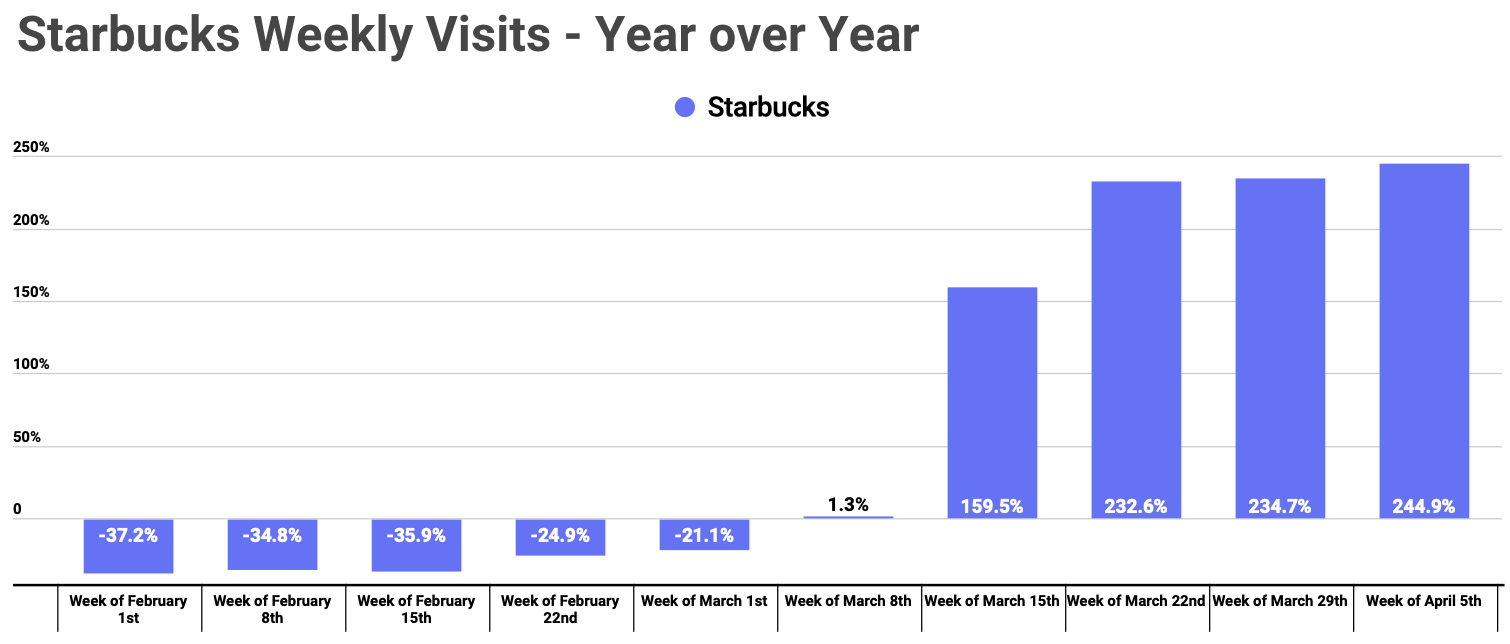

As if another reminder was necessary, the latest metrics from Starbucks have reiterated the problematic nature of betting against the brand. Looking at weekly visits year over year shows that the significant declines seen throughout the pandemic have normalized with visits up throughout March. And while this is clearly a misleading metric, they do signify the rebound.

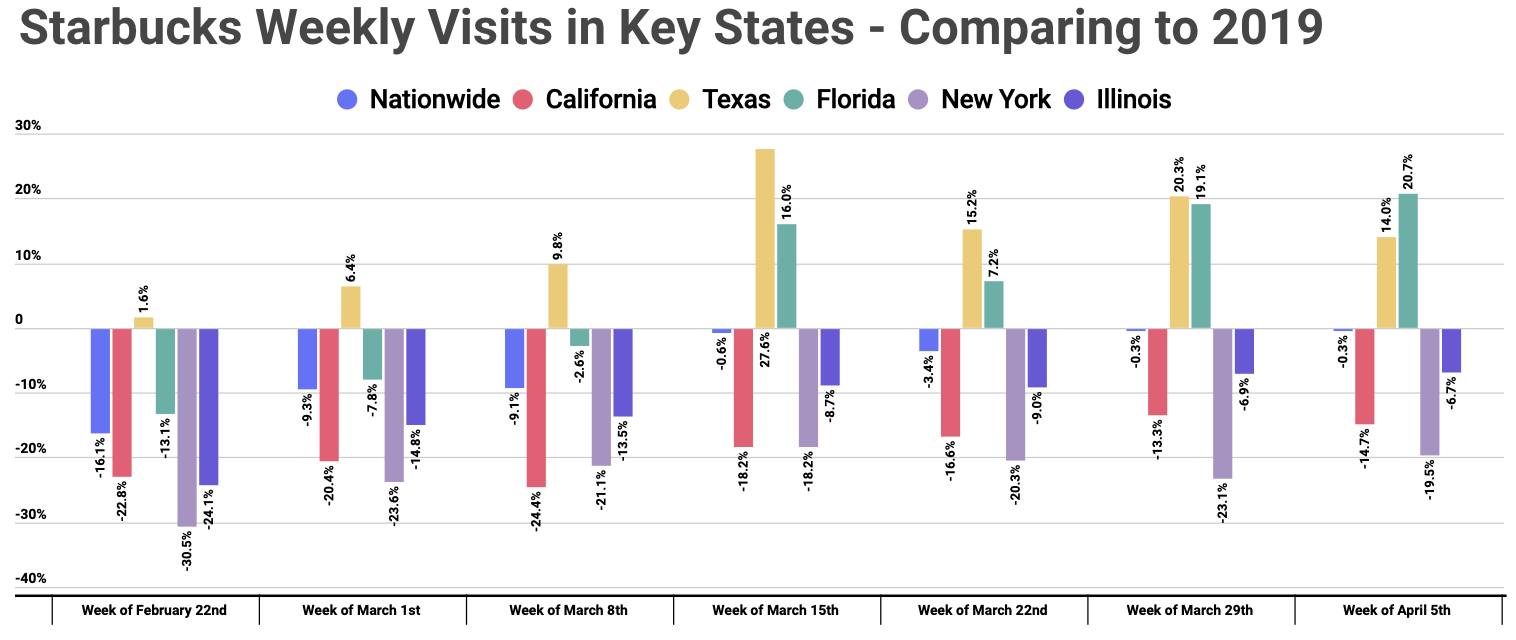

But to better understand and contextualize the rebound, it’s necessary to compare these same weekly visit numbers to the equivalent weeks in 2019. And here too, the growth is clear. While visits were down 16.1% nationwide the week beginning February 22nd, they were down just 0.3% the weeks beginning March 29th and April 5th.

And while this is a positive sign in its own right, there is even more reason for optimism when looking at the regional breakdowns. Locations in states like Texas and Florida, which are further along in their respective re-openings, have seen visits up compared to the equivalent weeks in 2019 since the week of March 15th. The magnitude of this also shows that the combination of pent-up demand and returning routines could have a significant impact. But this also ignores that California and Illinois, two of the states with the largest number of locations, are still seeing visits down. As the recovery deepens in these states, the direct impact on Starbucks’s overall growth could be notable.

Big Apple Rebound

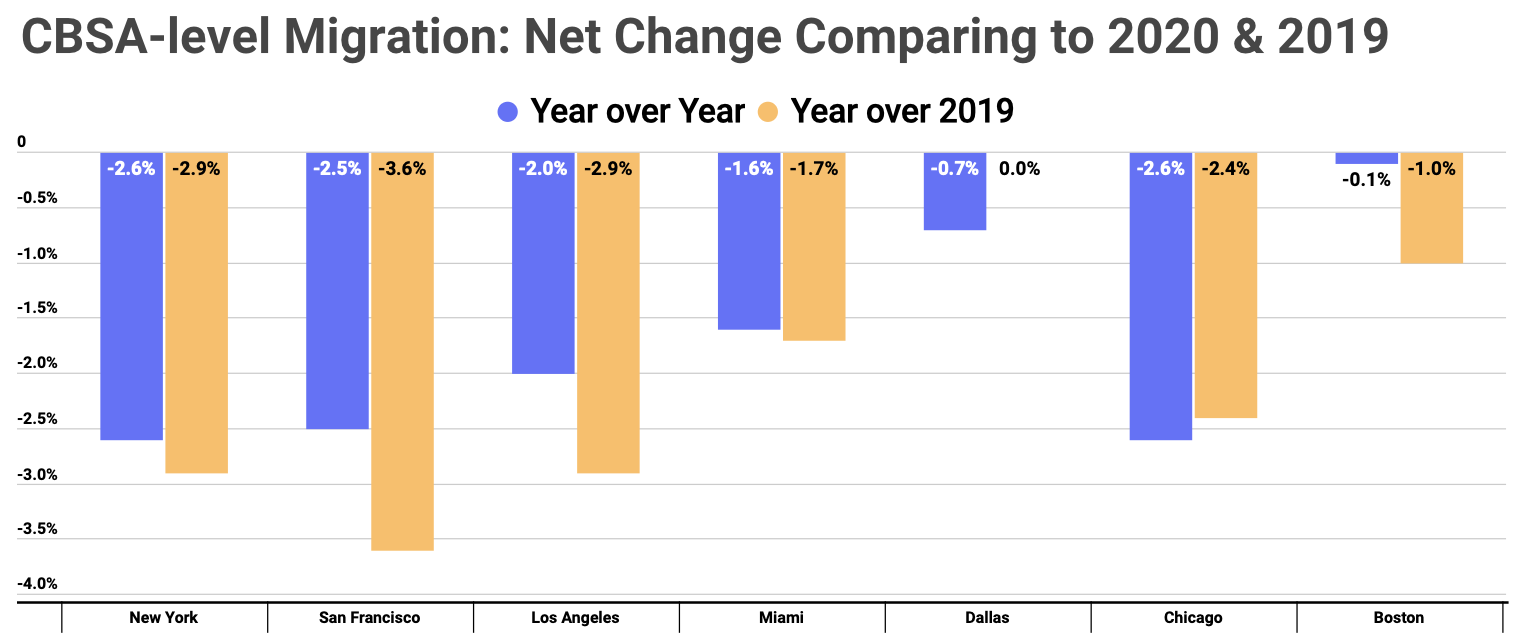

New York City was one of the hardest-hit cities throughout the pandemic, leading to questions about the ability to bounce back effectively in the near term. Comparing New York to other top CBSAs throughout the country shows comparisons of March migration data to both 2020 and 2019 net losses were over 2%.

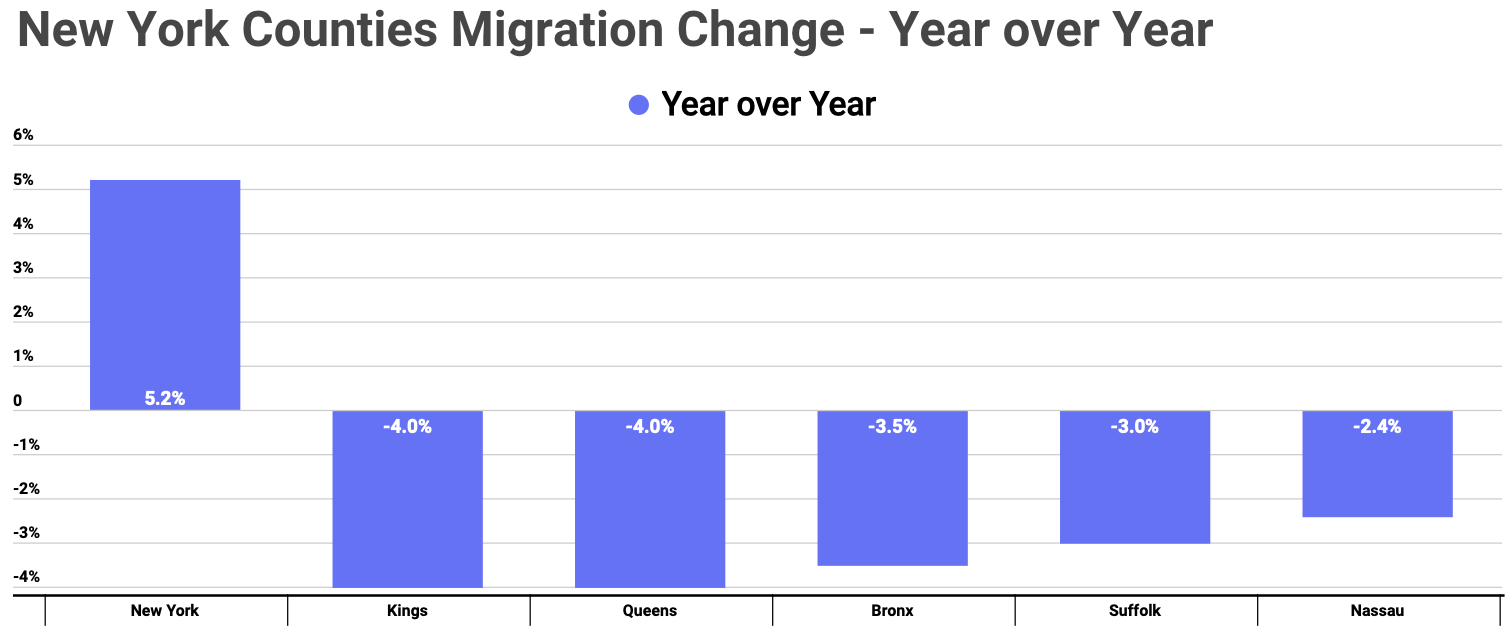

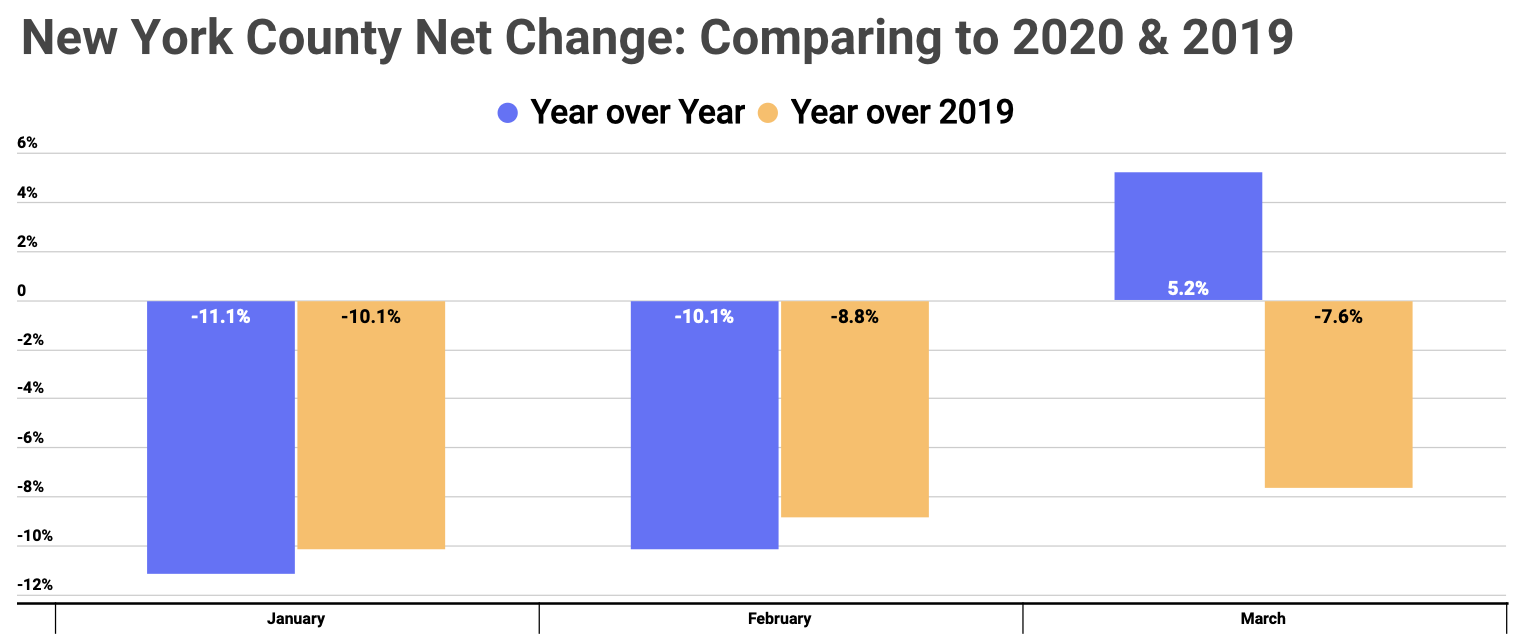

Yet, there are clear and significant signs of recovery. Looking at county-level data, New York County, which covers Manhattan, saw a 5.2% year-over-year increase in net migration. This shows that either people are returning to the city, or the number of newcomers are starting to outweigh those leaving.

This is further solidified when looking at New York County net migration in March compared to 2020 and 2019. While the 2019 comparison is likely most accurate for understanding the true picture, there is a demonstrable and marked recovery taking place. While net change was -10.1% in January 2021 compared to 2019, February and March saw those gaps drop to just 8.8% and 7.6% respectively. This indicates something very important. While there are obviously those who left the city for good, and the overall number of residents remains down, a recovery is clearly taking place.

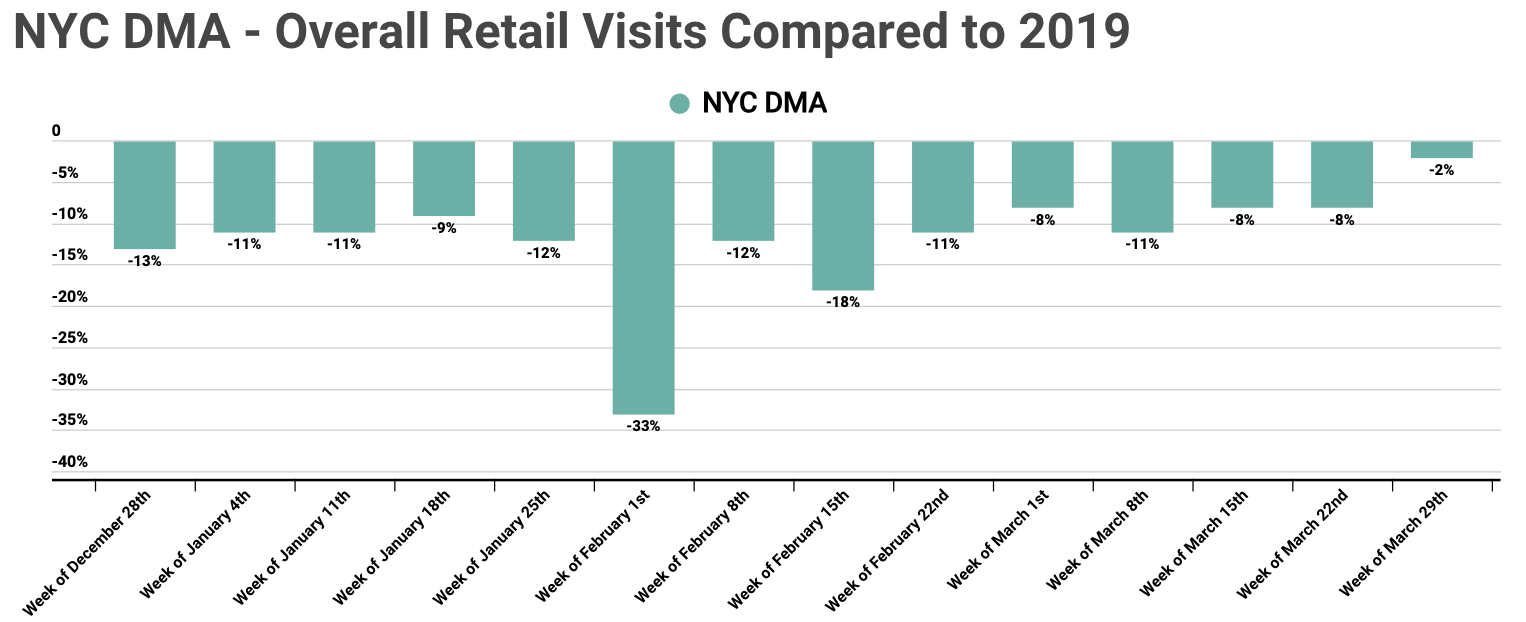

And it’s being seen in the wider retail segment as well with the New York City DMA seeing overall retail visits down just 2% the week of March 29th when compared to 2019. This is the strongest number since the onset of the pandemic retail impact in March 2020.

Will Starbucks continue to impress? Can New York continue to recover?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.