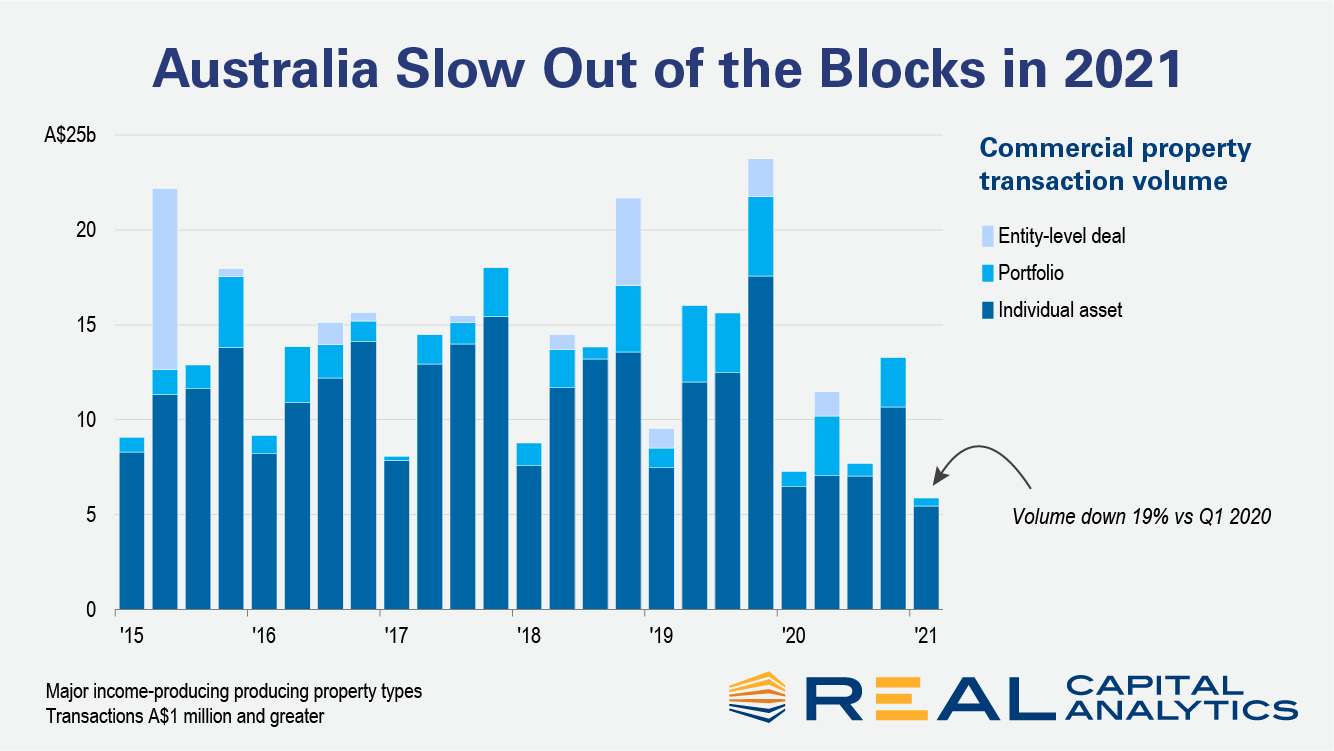

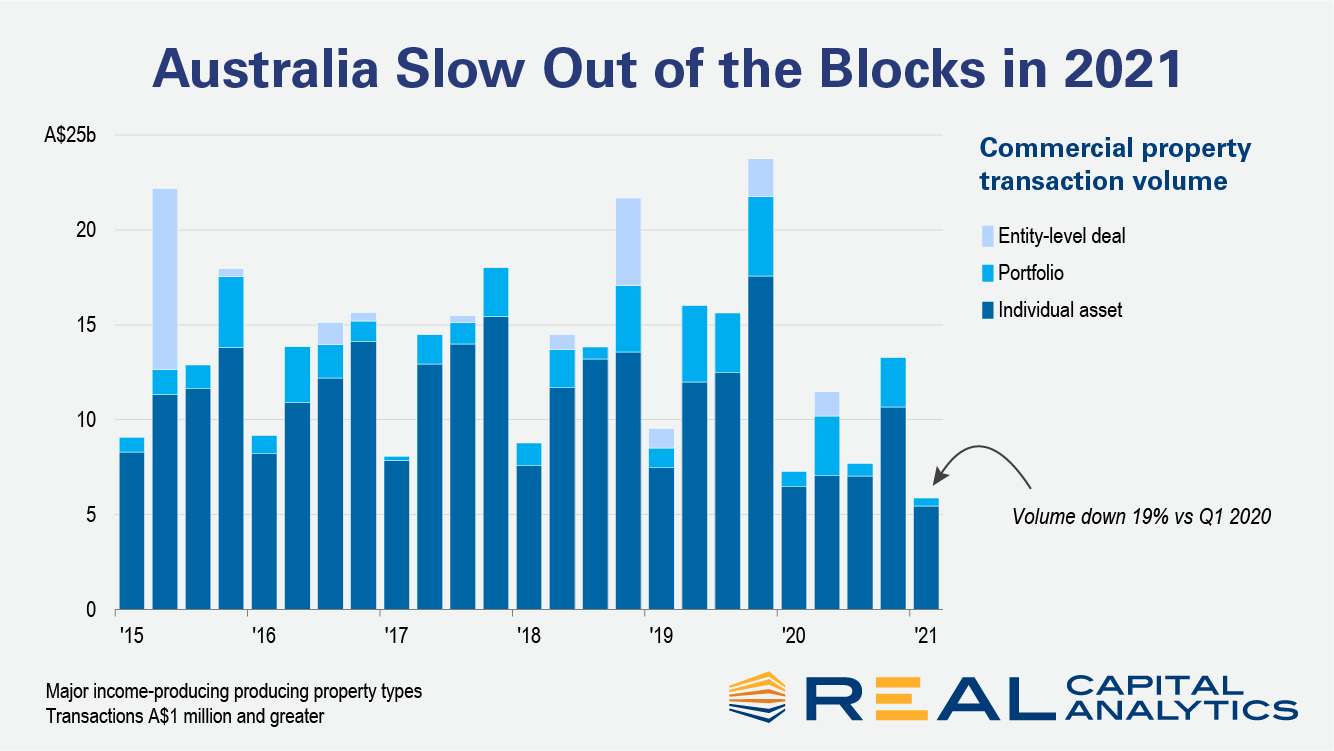

Commercial real estate activity in Australia started 2021 on a weak note, as the pandemic continued to weigh heavy on investor minds, the new edition of Australia Capital Trends shows.

Deal volume in the first quarter fell 19% from a year prior. The start of 2021 was expected to bring a flurry of deal closings which had been ostensibly delayed by slower approvals from the Foreign Investment Review Board, but the flurry did not materialize.

The industrial and hotel sectors fared badly at the start of the year, with transaction activity for industrial properties falling back 58% and for hotel assets by 78%. Whilst the industrial sector remains much in demand (and the multibillion-dollar Blackstone Milestone Portfolio in the pipeline), the hotel sector is still thwarted by uncertainty surrounding travel restrictions and border openings.

The office and retail sectors gained some ground after a torrid 2020 thanks to several notable deals. The largest deal of the quarter was one that fell through in 2020 with the onset of the Covid-19 crisis. The Martin Place South Tower in Sydney’s CBD was acquired by a joint venture between Investa Property Group and Manulife Financial. Retail sector activity in the first quarter outpaced three of the prior four quarters.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.