Department stores faced a uniquely challenging environment in the last year with COVID limiting visits to malls, retail stores and more product brands looking to emphasize DTC channels.

And while signs of a recovery are popping up for the sector, there are still fundamental questions about the true power of the model from a long term perspective. So how is the department store sector faring now, and what could this mean moving forward?

A Clear Recovery

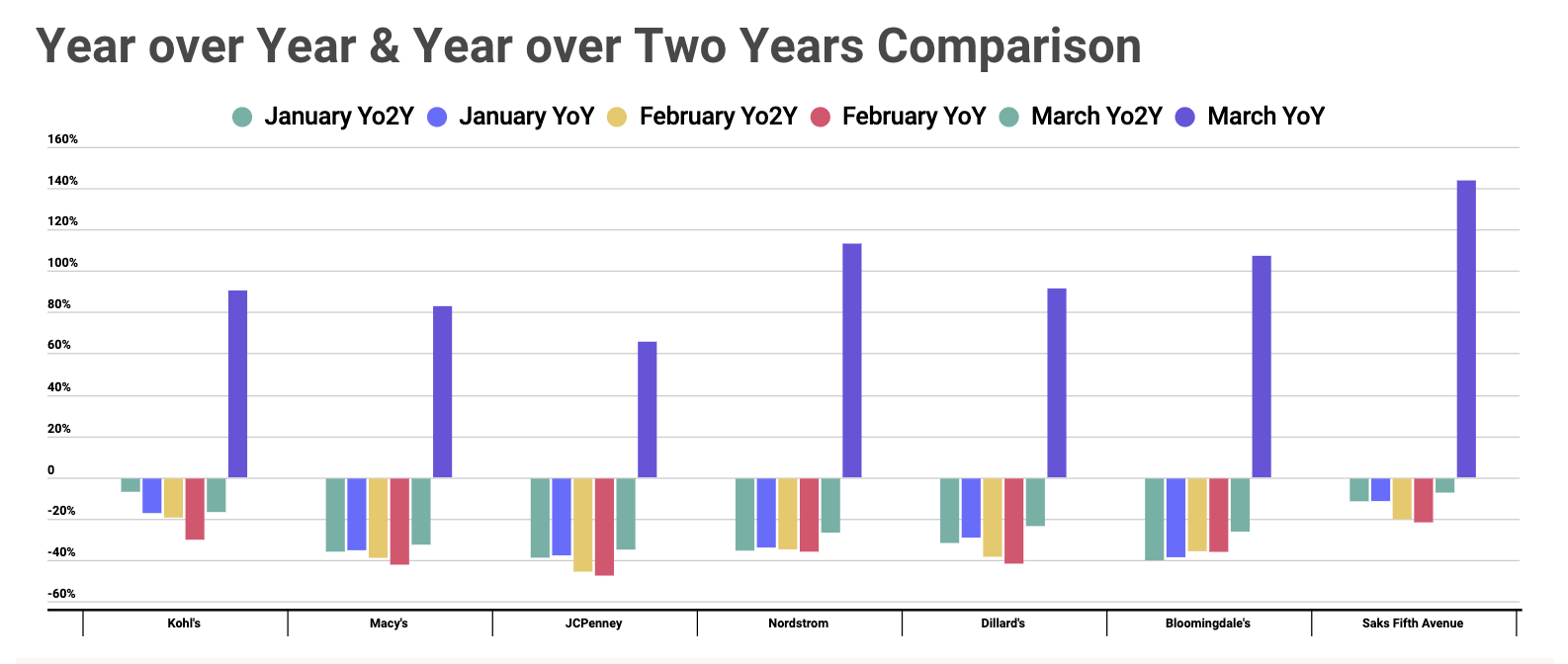

Looking at monthly visits in 2021 compared to 2020 and 2019, shows that the sector is in the midst of a significant recovery. Visits for all of the brands measured were up in March year over year, and while this was heavily driven by the comparison to an especially challenged 2020, all of the brands analyzed also saw the visit gap with 2019 shrink significantly when compared to February. Yet, the 2019 comparison in March is important as well, because it shows that many of these brands are still seeing significantly less visits than they were during ‘normal’ times.

The Recovery in Context

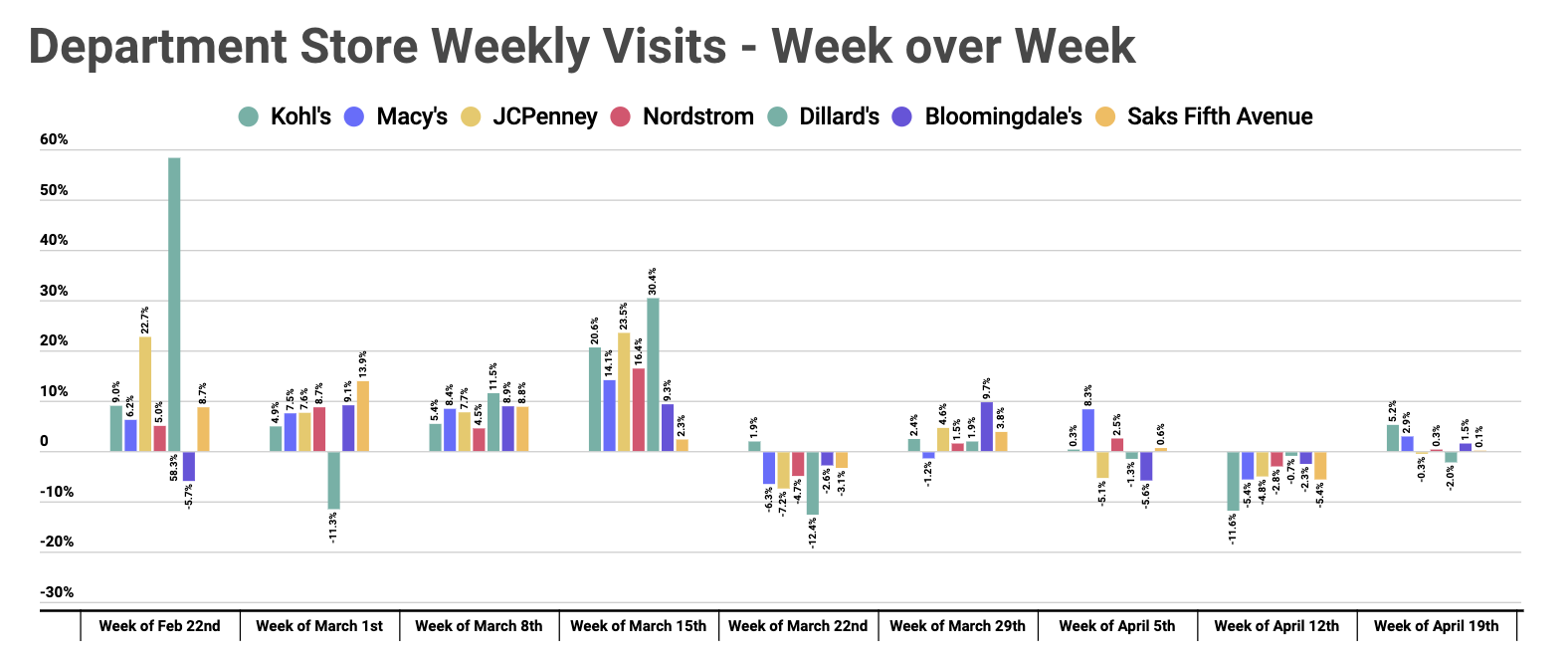

Analyzing weekly visits helps to further understand the recovery, identifying the challenges that come from making comparisons in this environment. While the visit gap shrunk significantly for many bands in mid March and early April, the gaps actually increased later in the month. And while the spike driven by pent-up demand likely dissipated, there are far more compelling reasons for the increasing gap. For example, Easter weekend drove a significant surge for the sector in 2019, and the misalignment of holidays dates combined with the unique nature of the recovery had an impact. Additionally, elements like the slower return in key states like California and New York, all contributed to the growing visit difference.

This idea is only strengthened when looking at weekly visits week over week. Most of the brands analyzed saw strong weekly growth from late February through mid-March before seeing a balance of smaller increases and declines through mid-April. Were there a fundamental reason for the visit gap, the week over week change would be far more significant. Instead, the resulting picture is of a sector that bounced back to a new stage in the recovery process and is currently seeing steady visit rates.

Moving Forward?

First, the recovery is underway. The wider department store sector is in the midst of a recovery and the return is both welcome and exciting. The initial visits spikes speak to the pent-up consumer demand and the unique brand equity these companies still carry with shoppers.

Second, it’s unfair to color the entire sector with a single brush. Kohls is an especially well-positioned brand with a combination of new concepts, and outdoor orientation and a strong foundation contributing to a very bright outlook. On other hand, brands like Macy’s are far more impacted by continuing regulations in key states like California and New York.

Third, the recovery is going to unfold in stages. The department store sector is in the midst of ‘levelling up’ to a better place than it has been as a whole since the onset of the pandemic’s retail impact in the US. And while this is a major step forward, it isn’t a full recovery just yet. Regional differences, and ongoing concerns will likely continue to limit the full power of the recovery until at least the summer.

Finally, there is a long term challenge to be dealt with as well. While visits are definitely recovering, the sector was already facing questions about how to evolve and remain relevant even before COVID. While much of the ‘doom and gloom’ has been overblown, it is still important to monitor the brands willing to test new concepts and ideas, and give added credit for those pushes.

The end result? The department store is on the rebound, but the magnitude of the recovery will be determined not only by a return to ‘normalcy’ but by brands willing to take the next step forward in their retail evolution.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.