Investor interest in the industrial sector has leapt with the shift in consumer activity to online shopping, a situation that has helped the RCA CPPI for U.S. industrial properties outperform all other sectors. Industrial property prices are now at record high levels and investors note difficulty in sourcing deals. In response, will the market react with too much supply?

If you cannot buy it, you build it. The growing difficulty of sourcing deals in the industrial market can make development look like an attractive option. There are other reasons one might deliver new space, however. One notable issue is that while cap rates are at record lows, the premium on cap rates for the newest assets is at an extreme as well.

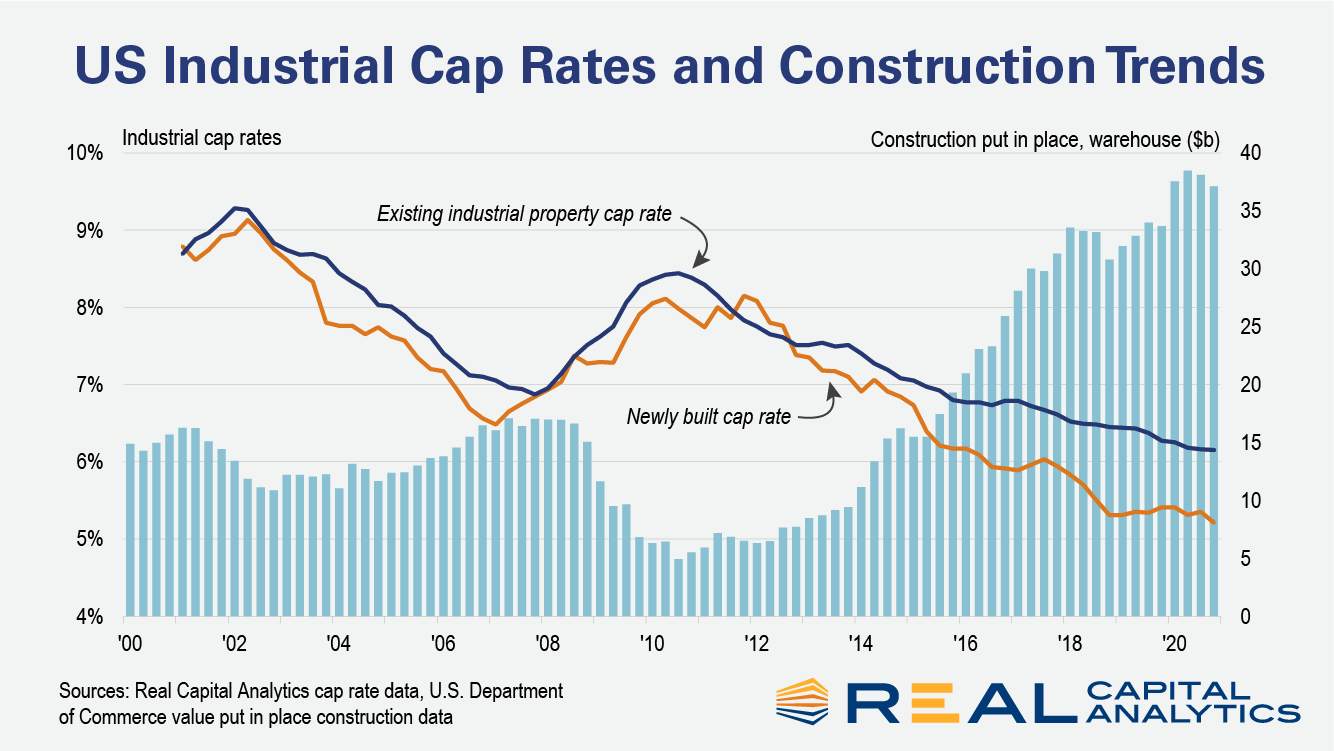

Make no mistake, new supply is coming to the market quickly. Data from the U.S. Department of Commerce shows that the value of new construction put in place for warehouse assets stood at $39 billion in February 2021. This figure is 2.6 times higher than the average annual pace of new supply from 1993. Even if one strips out the general inflation trend, this value of new supply is two times as big as the annual average since 1993.

Investment in new supply should follow trends in asset prices, and as cap rates plumb new depths, developers and investors will find it advantageous to construct new buildings. The DiPasquale Wheaton model — I won’t take offense if you aren’t familiar with it — captures an important behavioral reality in the market around the process that developers use to underwrite new construction.

Developers often underwrite a project as a function of a targeted return on cost where they are willing to move a project forward. If they know that this target return on cost is achievable at a 6.5% cap rate, but then the market unexpectedly moves to a 6.0% or even 5.5% level, all other things equal they will attempt to bring even more projects to the market to capture the unexpected profits in front of them.

That is where we are today with cap rates for the industrial sector falling well below previous record lows. There is an important distinction to consider on cap rates however, in that the market average cap rate is not the one a developer will use in underwriting a new project. A developer will be looking at the cap rates achieved on deals like the ones considered for new construction and these suggest the accelerating pace of new supply should cool.

Cap rates for newly built industrial properties averaged 5.2% at the end of 2020. This level is not much different than the average 5.3% seen since the end of 2018. Cap rates for existing properties, however, have continued to compress over this same time frame, falling 30 bps from the end of 2018 to hit 6.2% at the end of 2020.

The fact that cap rates for new assets seem to have hit a floor is also reflected in the growth of new supply coming to the market. New supply is still at cyclically high levels but had been growing at a 23% YOY pace as recently as midyear 2020. The value put in place has slowed to only a 7% YOY pace as of February 2021. Without that kicker to property values from the ongoing compression in cap rates, developers have a more difficult time hitting their targeted return on costs in an environment of growing material and labor costs.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.