Beyond the ad-supported streaming platforms, broadcast networks compete for attention with platforms that distribute user-generated video content. And as audience attention shifts, so do advertisers.

As the social network with the most annual revenue, we know that Facebook is great at bringing in ad dollars. And from the data, we can see that they’re getting better at drawing in dollars that traditionally go to TV.

Large brands want flexibility and precision

Advertisers want the flexibility and precision that programmatic video ads offer. And though big brands were traditionally willing to trade targeting for reach by using linear TV, the pandemic drove adaptability to become the “new black.”

In 2020, TV Upfronts were cancelled due to the pandemic and much of the ad spend shifted to digital—especially programmatic. And that shift has continued into 2021.

“Last year, flexibility was such a big need for clients for financial reasons, with all the business implications brought on by the pandemic—that type of flexibility, in our clients’ minds, is a mainstay need now,” said SVP of strategic investment at Magna Global, Molly Finnerty, to Marketing Brew.

TV networks provide massive scale for brands, but with the disruptions to the entertainment industry and the continuing decline of cable, brands aren’t as willing to pay for less than quality reach anymore. More than ever, advertisers want to be able to plan short-term and trust that their ad will reach the right audience.

This is why many ad dollars quickly shifted to programmatic video advertising. Though there are many digital options, Facebook is a popular choice because it makes buying so easy and has one of the most engaged and massive audiences.

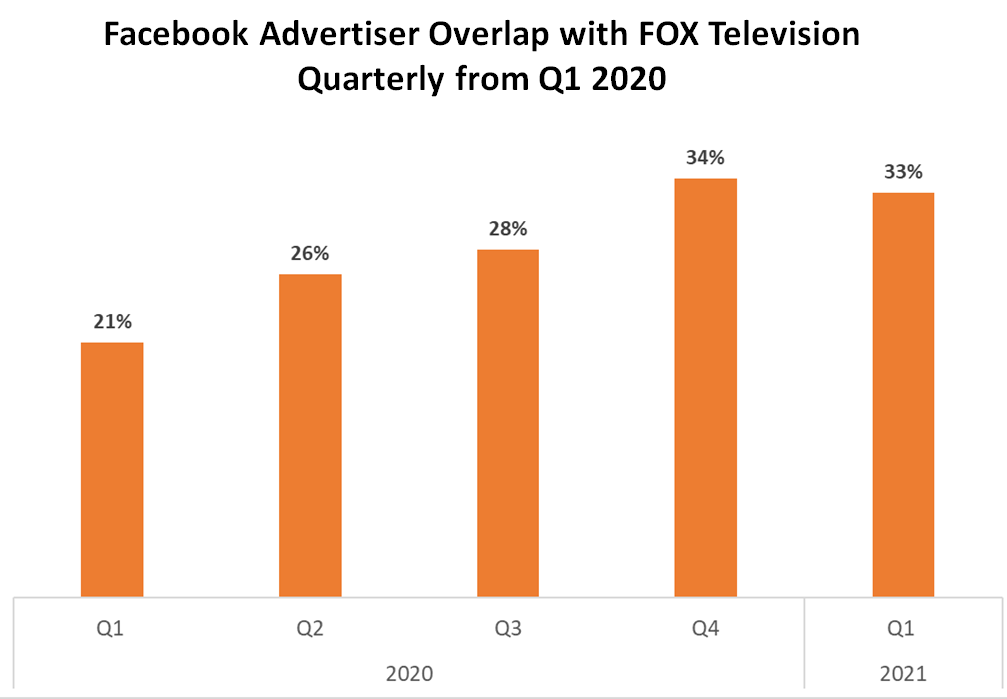

The overlap between Facebook and broadcaster advertisers continues to rise, suggesting Facebook may be getting better at winning these advertisers.

We focused on Fox in this case, but a similar story could have been shared from other major broadcasters. Of Fox’s advertisers in Q1 of last year, one out five advertisers also bought on Facebook. Now, five quarters later, it’s one out of three.

To us at MediaRadar, this means that Facebook is pulling some of the broadcaster’s share of ad dollars. This pattern can be seen across formats.

For example, when we look at Fox, the overlap in Q1 increased 12% between 2020 and 2021.

Facebook Advertiser Overlap with Fox Television Quarterly from Q1 2020

We see a similar story across broadcasters.

The overlap between NBC advertisers and Facebook in Q4 of 2020 is identical to FOX, with 34% of NBCs advertisers overlapping with Facebook.

Though Facebook’s main strategy is to attract super niche advertisers, this data may suggest Facebook is simultaneously going after linear TV advertisers. Because the data is similar across networks, it doesn’t seem that they are pursuing advertisers exclusive to any single channel.

Ad Placement Trends on Facebook vs TV

Overall, when it comes to ad buying behaviors, Facebook isn’t that different from broadcasters.

While Facebook is consistently expanding in broadcasting’s network of advertisers, the physics of how advertisers run campaigns is not that different from traditional media companies:

Retention rates: Year over Year (January – March) 2020 vs. 2021, 34% of advertisers remained identical, which is strong retention and similar to broadcasters

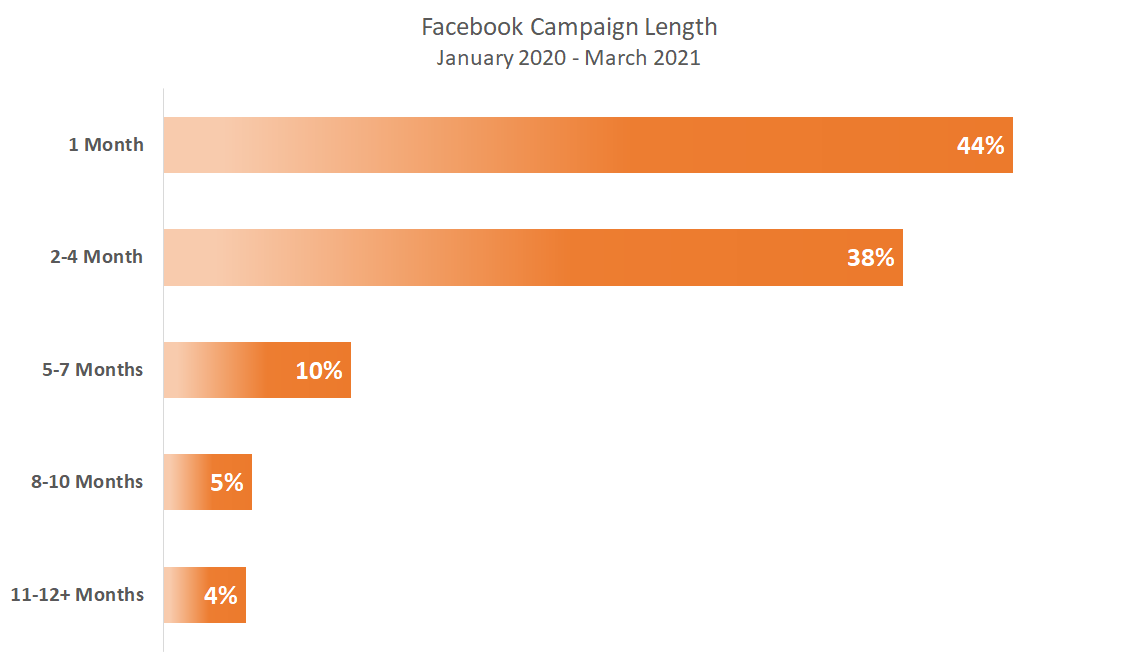

Campaign length: 44% of campaigns on Facebook last 1 month or less (over a 15-month period). Campaign lengths on Facebook are not different from other media formats.

Facebook Campaign Length January 2020-March 2021

Most companies understand their prime season for marketing. Though they may have some advertising throughout the year, they will invest heavily in campaigns for one or two months at a time.

The data suggests that Facebook is pulling some of the broadcaster’s share of ad dollars, but buying patterns from the advertisers remain very similar. This pattern can be seen across formats, and over the next few week’s we’ll be focusing on the overlapping trends between Facebook and other media formats.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.