With the first set of restaurants allowed to open for indoor dining in the UK May 17th, we are taking a look at how things have changed since outdoor dining opened on April 12. We examine shifts in popularity for different restaurant subindustries as well as how much momentum online ordering has been able to retain. These trends provide important insight into how the next few weeks may evolve as additional restrictions are lifted.

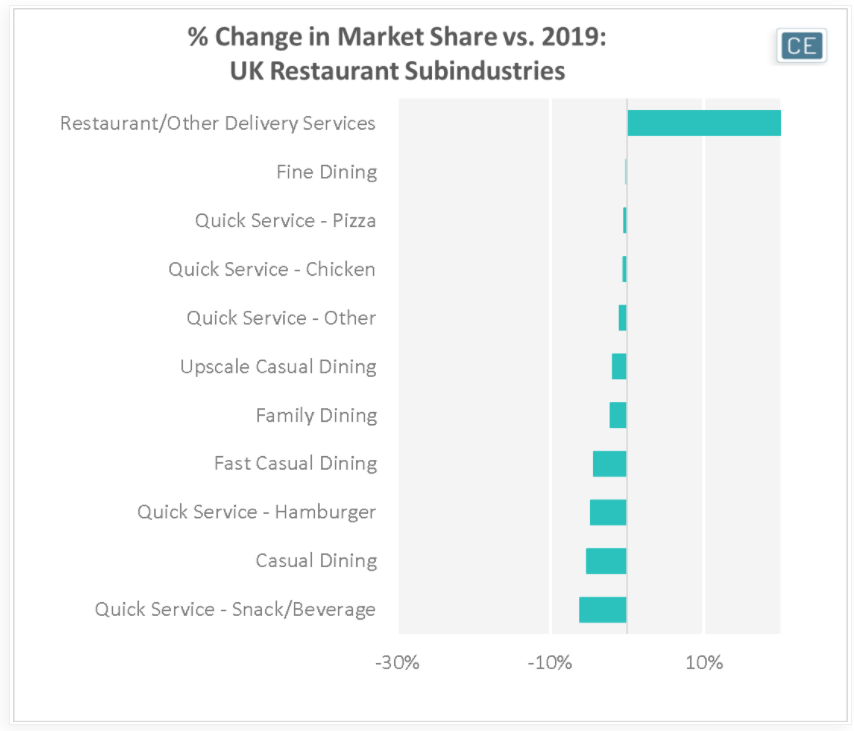

Versus the same time two years ago, orders via Restaurant/Other Delivery Services saw 26% higher market share, indicating that some pandemic trends are here to stay. The biggest declines in market share came from direct sales at Quick Service Snack/Beverage establishments at -6% and Casual Dining venues at -5%.

Subindustry trends

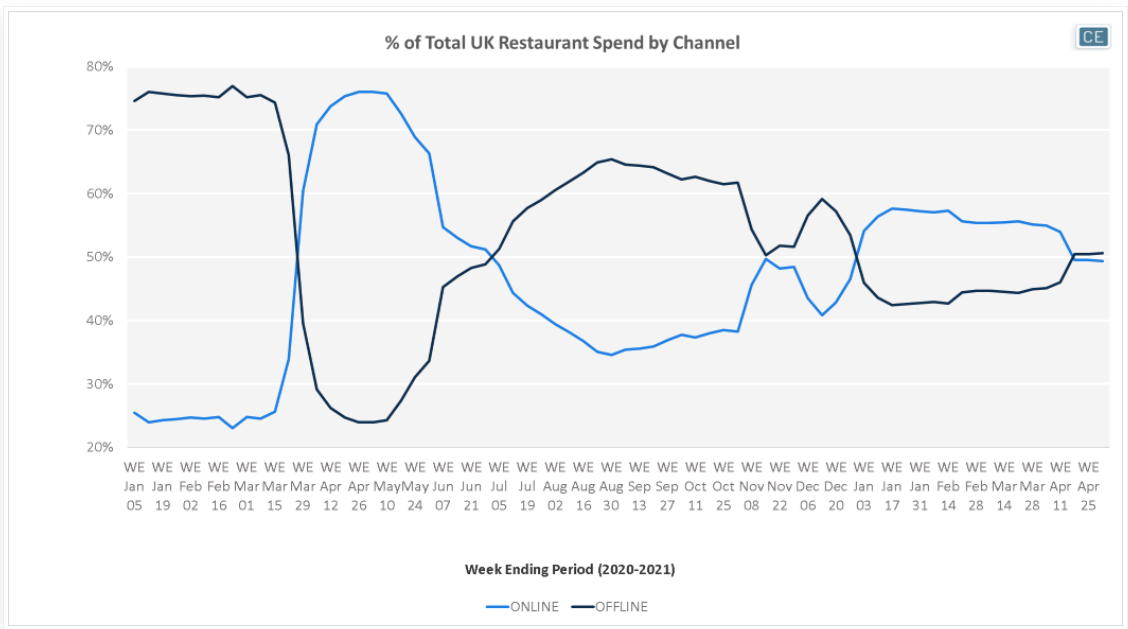

Indeed, the pandemic lit a fire under online restaurant spend that shows no sign of being put out. For the first eleven weeks of 2020, only about a quarter of restaurant spend in the UK was online. This trend inverted during April and May of 2020, with 75% of spend online and 25% of spend offline. As businesses reopened over the summer of 2020, however, the mix did not return to status quo. Online sales kept at least 35% of restaurant spend through Winter 2020, jumping up again with new shutdowns but retaining 50% of spend since outdoor restaurant reopening.

Channel Mix

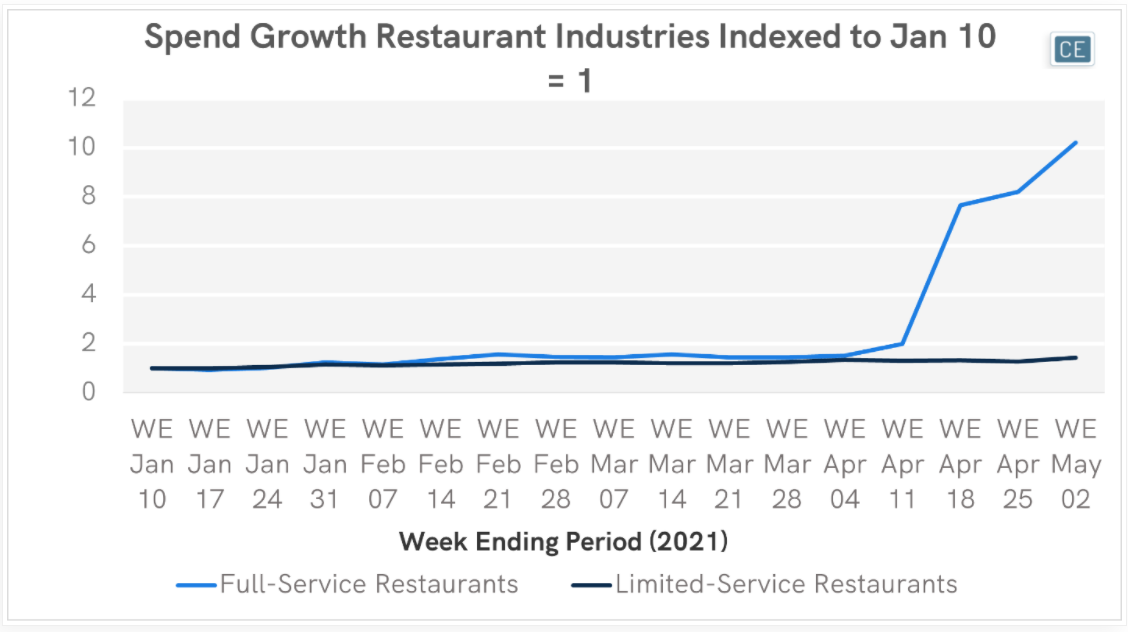

The outdoor reopening helped Full-Service Restaurants more than Limited-Service Restaurants, unsurprising since these restaurants were more likely to have borne the brunt of shutdown losses. Full-Service Restaurants saw spend the week ending April 18 that was 7.6x the size of the week ending January 10, growing to 8.2x the week ending April 25 and 10.2x the week ending May 2. Meanwhile, Quick-Service Restaurants only saw spend the week ending April 18 of 1.3x the week of January 10, falling slightly the week ending April 25 before rising to 1.4x the week ending May 2.

Full-Service vs. Limited-Service Restaurants

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.