Digital advertising plays an essential role in the modern-day brand’s success, from revenue and customer growth to driving brand awareness throughout a company’s lifecycle.

After a tumultuous year, several technology companies entered 2021 with plans for an IPO. One of the most anticipated brands to go public in 2021 was Coinbase, the largest cryptocurrency exchange in America. The national interest and conversation around cryptocurrency put a bright spotlight on the news as many saw the startup as an entry point into the blockchain market for everyday consumers.

We’ll be taking a look to see how Coinbase optimized its digital ad strategy ahead of the IPO. In addition to Coinbase, we’ll take a look at two other brands that went public this year, Bumble and Vizio, to see how all three digital ad strategies lined up.

To get a well-rounded view of each brand’s spend, we’ll be looking at the month leading up to the brand’s IPO and the week following the move.

Coinbase leans on Facebook and Instagram ads ahead of IPO (March 14-April 21)

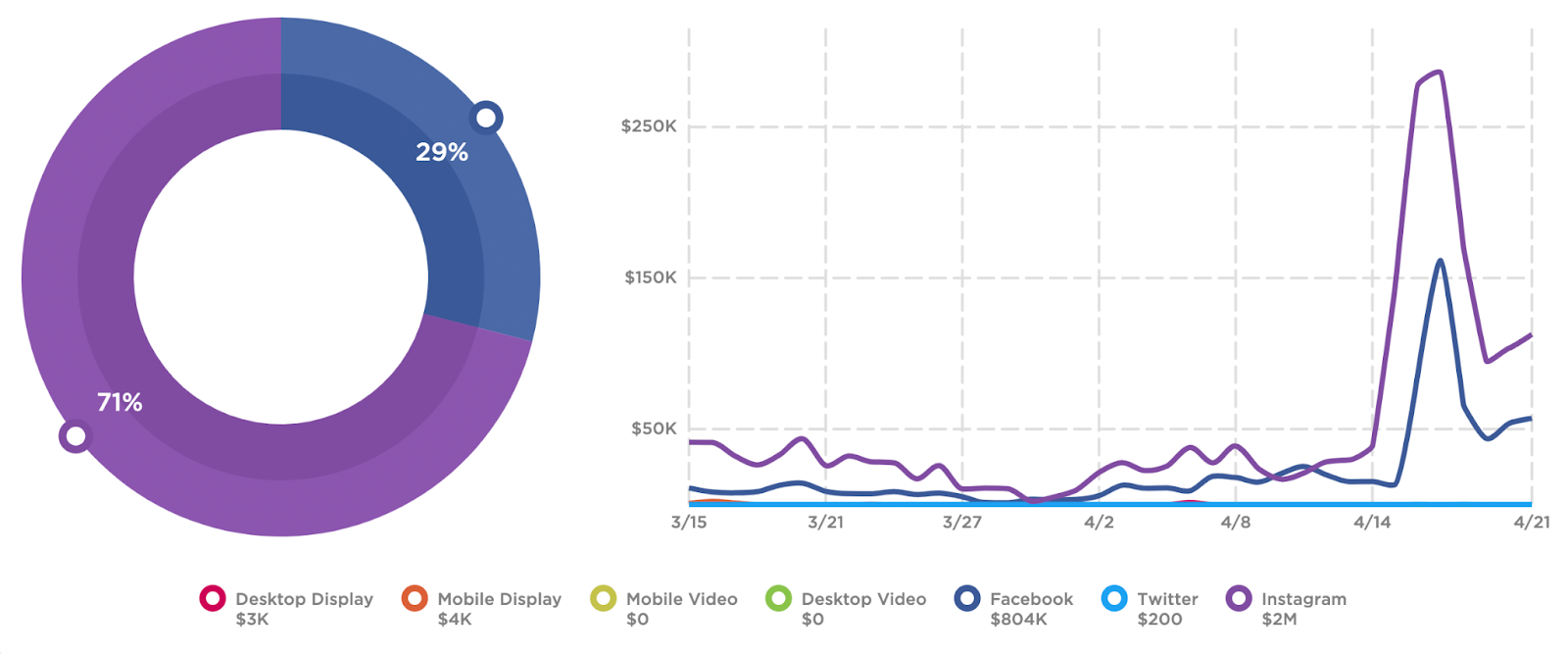

Coinbase went public on April 14th and the company led a social media-focused digital ad strategy. The brand spent over an estimated $2.8M around the IPO and Facebook and Instagram were the brand’s most invested channels with both making up 71% ($2M) and 29% ($804K) respectively.

The month ahead of Coinbase’s IPO, the company kept a low profile with its digital advertising by investing in both channels consistently. During this period, the brand’s Instagram spends ranged from $41K on March 15th and gradually dipped to $2.3K on March 30th and then going back up to $38.6K on April 14th. The company’s Facebook spend saw a similar trajectory starting at almost $11K on March 15th and gradually dipping to $1.1K on March 29th, then rising to $25K on April 11th.

The brand ramped up its advertising spend the day of its IPO. It reached its digital ad spend peak on April 17th where Coinbase spent $162k on Facebook and $286k on Instagram. The brand spent an estimated $44K on its top Facebook creative and $23K on its top Instagram creatives. Following this peak, both channels’ spend began to drop, bottoming out at $95K on Instagram and $44K on Facebook on April 19th. Seven days after the IPO, the digital ad spend was on the rise again, going up to $113K on Instagram and $57K on Facebook.

Bumble spends heavily on YouTube (Jan 10-Feb 17)

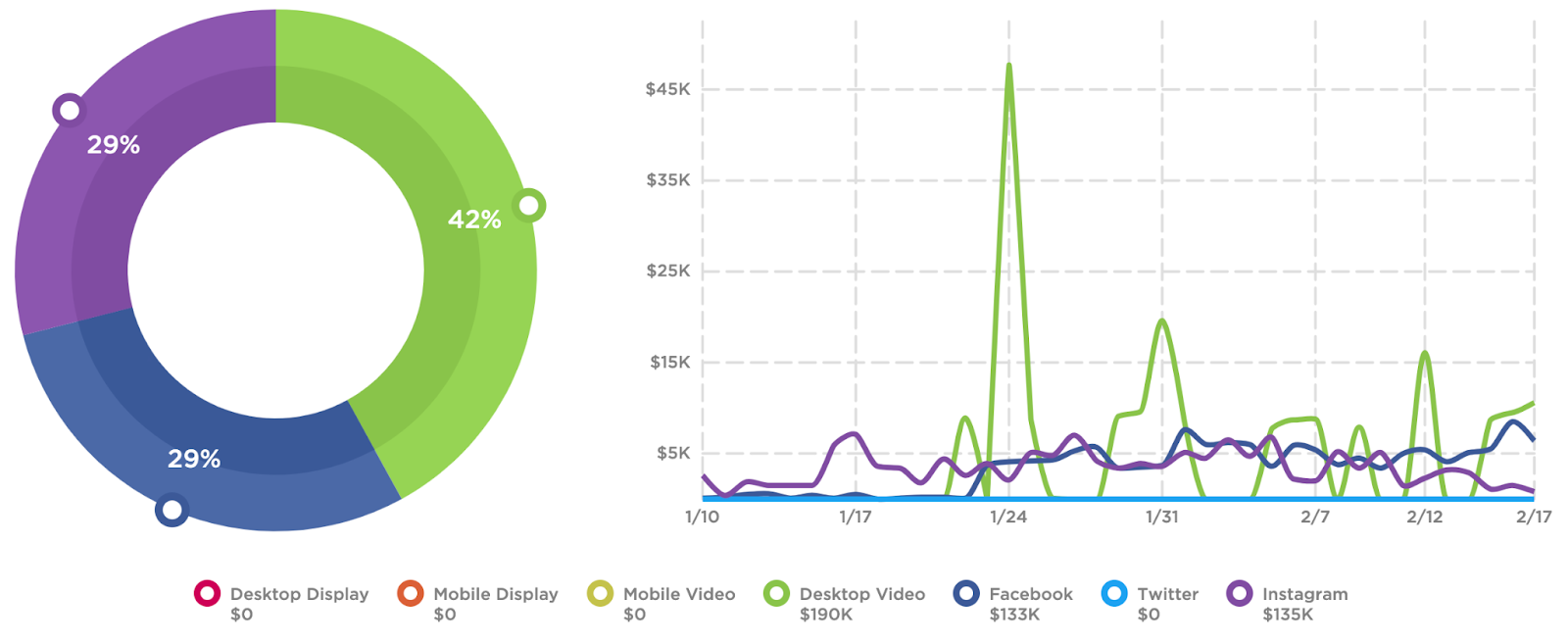

Bumble went public on February 10th and the dating app company relied on YouTube, Facebook and Instagram exclusively for its digital advertising. In total, the brand spent $459K around its IPO. The brand’s Facebook and Instagram spends were generally consistent the month leading up to the IPO date with an average spend of around $5K.

Youtube is the brand’s top channel at $162K (41% of overall spend) but is also the most volatile in terms of investments. While Coinbase held off on an advertising blitz until the day of its IPO, Bumble did the opposite, hitting peak spend on YouTube at $48K on January 24, before dipping back down to $0 three days later. The spending gradually increased back up to almost $20K on January 31, but again dropped to zero the next day.

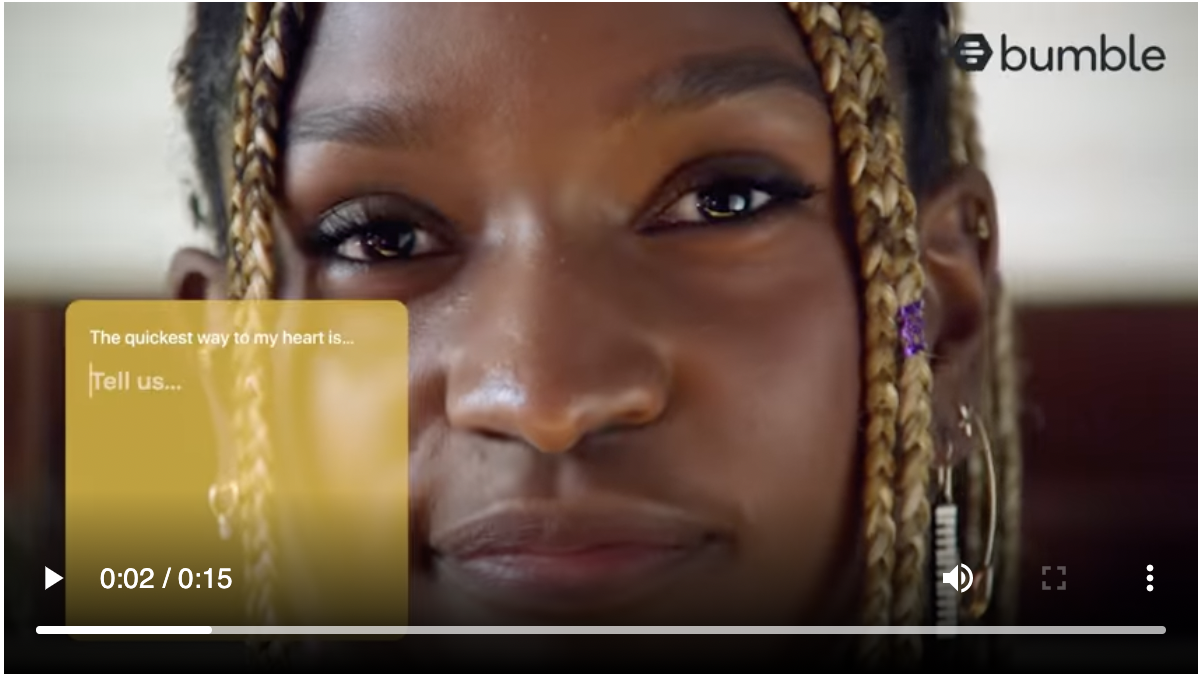

The platform’s top video ad creative (with an estimated spend of $79K) depicted a diverse group of millennials and Gen-Zers looking for love. While the IPO date was just before Valentine’s day, Bumble did not dramatically boost their digital ad spending ahead of the romantic holiday.

Vizio turns up the volume on Instagram (Feb 26-Apr 2)

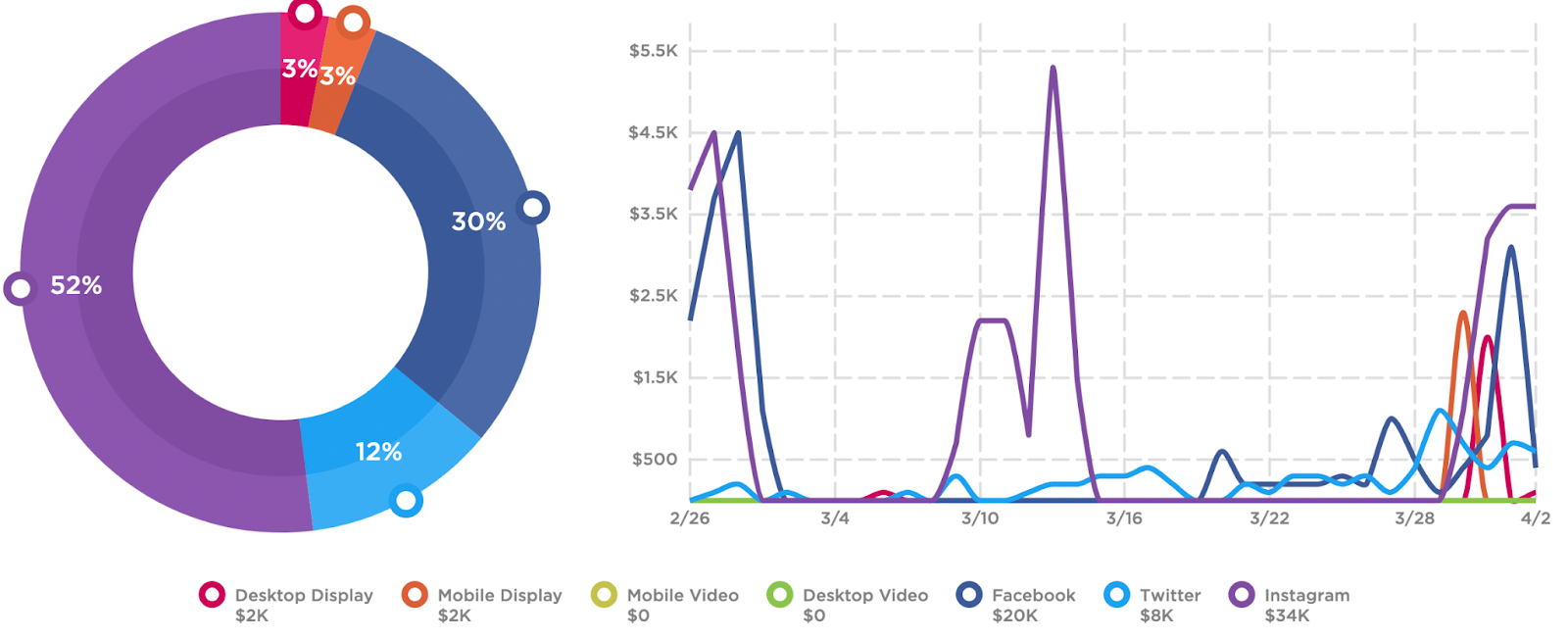

Following an attempted IPO in 2015, the consumer technology company finally went public on March 26th. Vizio spent the least on digital advertising out of the three brands, with an estimated total spend of $66K around the IPO. Vizio took a social media-focused approach, similar to Coinbase, and invested most of its budget in Facebook ($20K) and Instagram ($34K).

Ahead of the company’s IPO, Vizio echoed the spending of both Coinbase and Bumble by investing in its peak spend on Instagram (about $5K) while consistently spending less on Facebook and Twitter (both ranging daily from $100-$1000). On the day of the offering, Vizio’s digital ad spend almost dropped to zero and didn’t pick up until four days later with an average spend of $2K-$3K on each channel.

Can digital advertising patterns suggest an upcoming IPO?

IPOs are a testament to a brand’s notoriety and success. Coinbase, Bumble, and Vizio are companies that offer different types of products and services for the general public. All three brands consistently dialed down their digital ad spend ahead of their respective IPOs, and each one targeted consumers on social media.

But is this trend a mere coincidence, or could a reduction in spend be a telltale sign of an upcoming change for brands? We’ll be keeping our eye on future IPOs to better understand these trends.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.