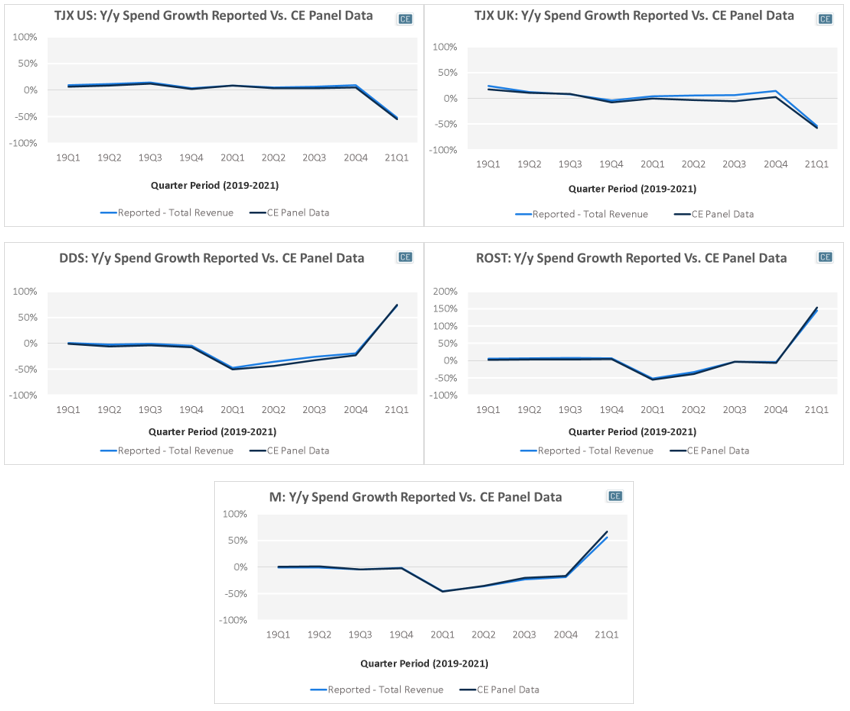

Two years ago, the death knell seemed to be sounding for department stores as shoppers gravitated towards e-commerce sites and shopping on their sofas. Post-pandemic, however, the couch has lost it allure and many department stores have seen sales gains above consensus in the most recent quarter. In today’s Insight Flash, we look at trends in the US and UK to see if the most recent pop has driven any fundamental changes in channel trends or market share leaders.

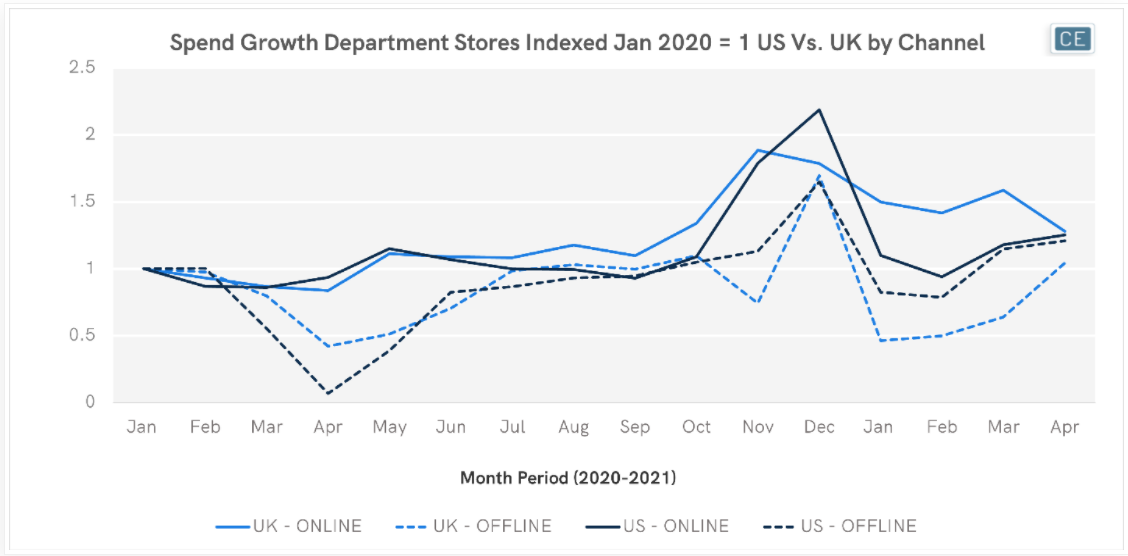

One of the most interesting aspects of the department store recovery is that both US and UK offline sales in April recovered to slightly above their January 2020 levels. At the same time, online sales retained much of their pandemic luster, up 25% in the US and 28% in the UK from January 2020.

Channel Trends by Geography

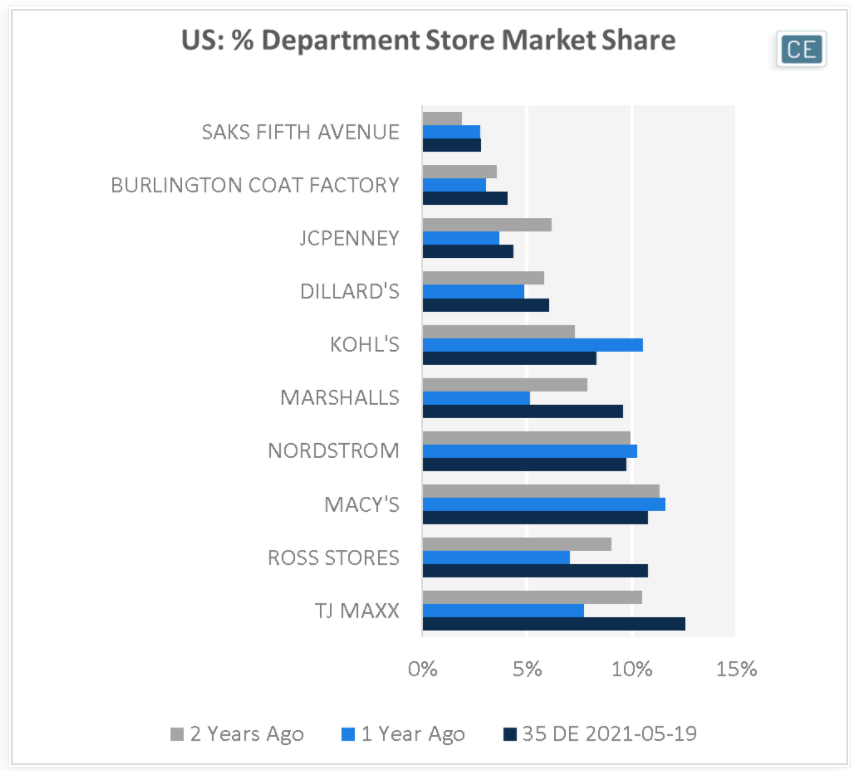

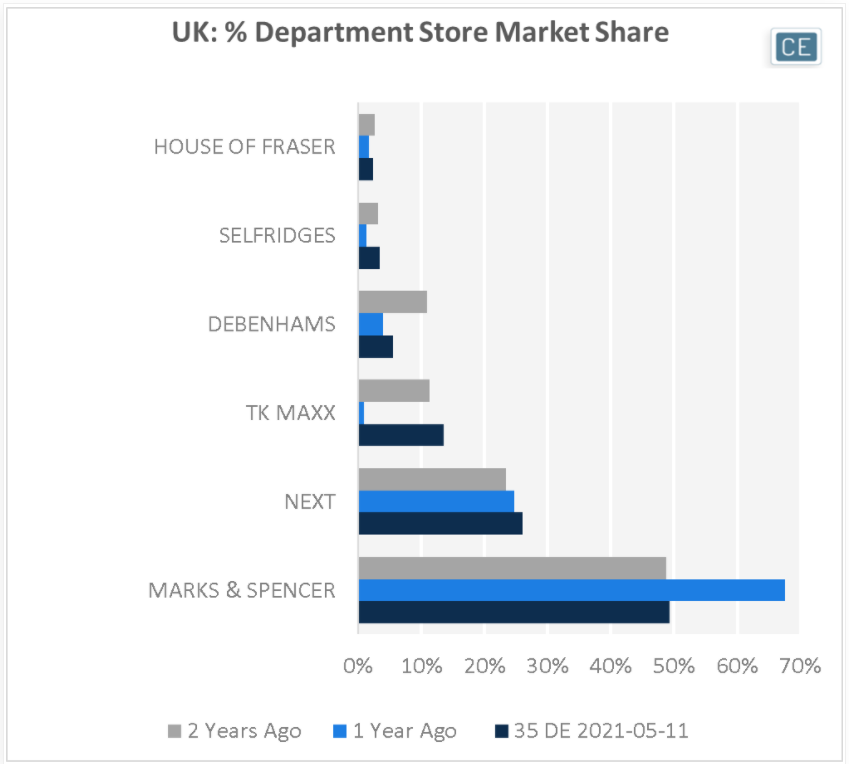

The more things change, however, the more they remain the same. In the US, off-price continues to be a department store winner, with TJ Maxx, Ross, and Marshalls all gaining 2% market share in the 35 days ending 5/19/2021 versus the same period in 2019. JCPenney lost 2% market share and Macy’s lost 1%. In the UK, for the 35 days ending 5/11/2021, TK Maxx was again a market share gainer with share up 2% versus the two years prior. Next saw an even larger 3% share gain. This was largely at the expense of Debenhams which is in the process of closing all its brick and mortar locations, whose share was down -5%

Market Share

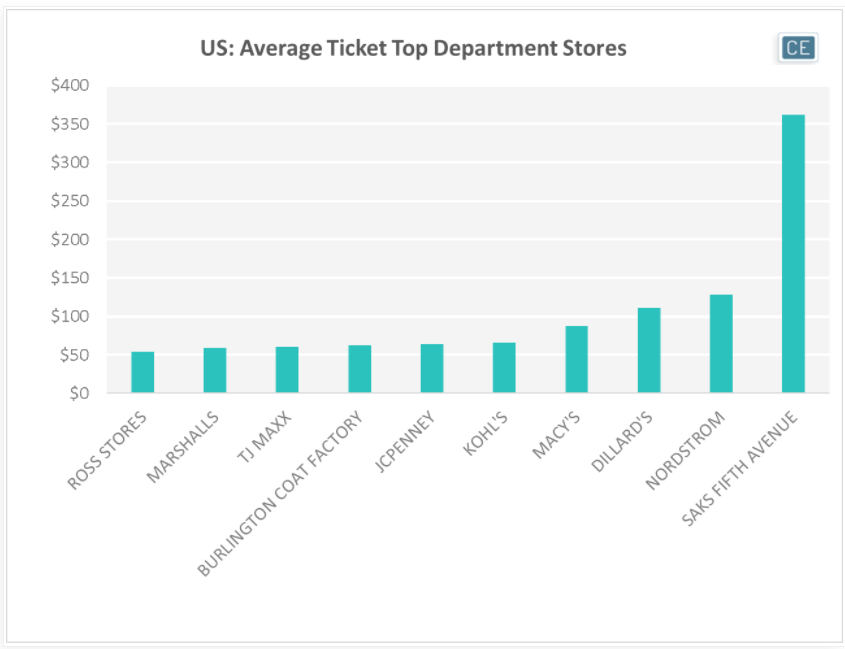

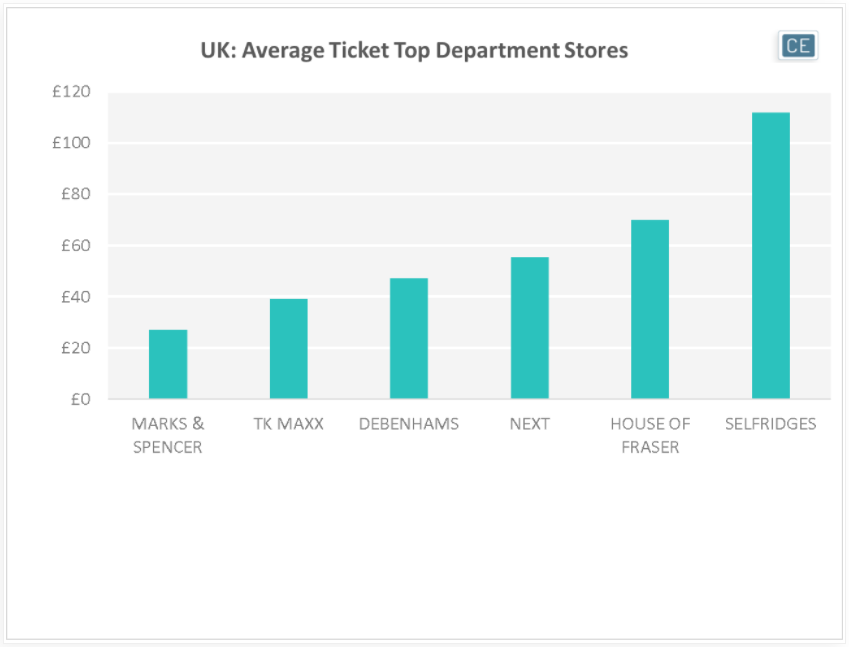

In the US, differences in price point haven’t driven much of a difference in average department store ticket. Six of the top ten department store brands have an average ticket ranging from ~$55-$65. Macy’s is only slightly higher with an average ticket of $87, while Dillard’s and Nordstrom see average tickets at 2x the norm – $111 and $128 respectively. Saks Fifth Avenue commands a much higher basket at $362. In the UK, differences in basket size for department stores are more pronounced. Marks & Spencer sees a lower average ticket of £27 (likely due to its grocery business), TK Maxx £39, Debenhams £47, Next £55, House of Fraser £70, and Selfridges £112.

Average Ticket

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.