In spite of pessimistic predictions made during the height of the pandemic, the fitness sector is experiencing an impressive offline recovery. And while the sector’s recovery pattern can undoubtedly be tied to an accelerated pandemic-influenced health trend, there is another significant contributor to its gradual growth in visits. Fitness brands are internalizing and quickly adapting to new challenges and shifts in consumer behavior patterns.

In our latest whitepaper, Fitness Deep Dive, we dove into the location data of leading fitness brands to uncover the key trends and the brands driving success.

Workout Hours have Shifted

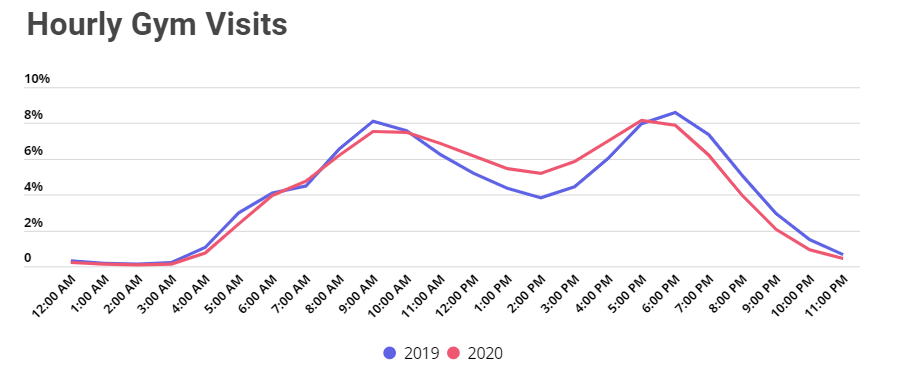

Like many other sectors, the fitness sector has been impacted by pandemic-driven shifts in the daily work-life routines of millions. A comparison of location data for 16 leading gym chains between 2020 and 2019 shows a substantial increase of 1%-2% in the amount of mid-day visits to gyms in each hour between 11 AM and 4 PM. This rise in mid-day visits seems to have come at the expense of evening visits, which have decreased by around 1% in each of the hours between 6 and 11 PM and early morning visits between 5 and 7 AM. In other words, many gym-goers transformed their early morning workout or their post-work evening visit to the gym into a short mid-day exercise break during work hours.

With that said, the time distribution of gym visits is likely to continue to change as daily schedules and work-life routines shift back to “normalcy.” Going forward, the continued tracking and regulation of hourly foot traffic can be game-changing for gyms dealing with challenging limitations on gym capacity.

Shorter, Focused Workouts

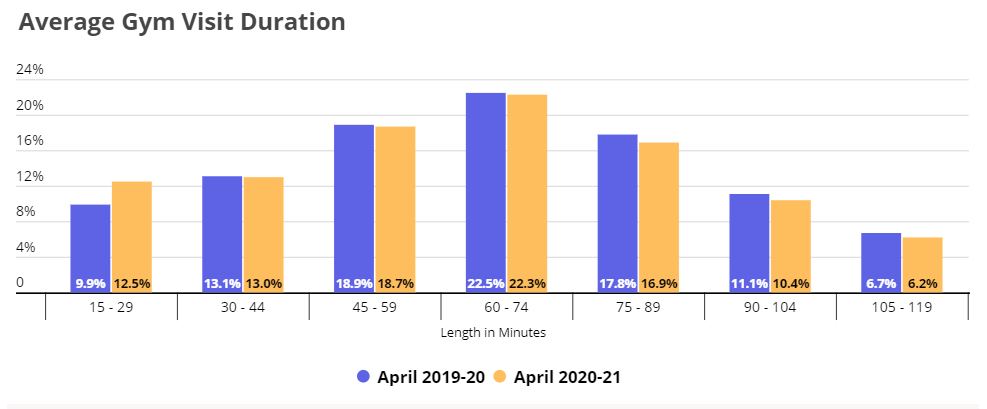

Exercising time preferences were not the only thing that changed during the past year; there was also a decline in the average length of stay in many gyms. Data for the same 16 analyzed gyms shows an increase of 2.6% in the proportion of short gym visits of 15-29 minutes compared to the previous year. On the other hand, there were small decreases in the proportion of 75 minutes and up visits.

This data aligns well with the rise in mid-day gym visits and strengthens the indication that the trend of shorter mid-day exercise breaks – in the middle of a workday or in-between errands – is growing. Gyms that are better-positioned for more short mid-day jumps, by being located near office and co-working spaces or within malls will benefit more from this shift. If leveraged, this shorter-workout trend can answer capacity challenges by allowing gyms to rotate members faster.

Affordable Fitness for All?

One of the biggest challenges that the fitness sector faces today is external competition in the form of cheaper gym alternatives. The competition was only accelerated by the pandemic, when many Americans discovered other exercising options, from fitness apps to outdoor activities to home workout equipment.

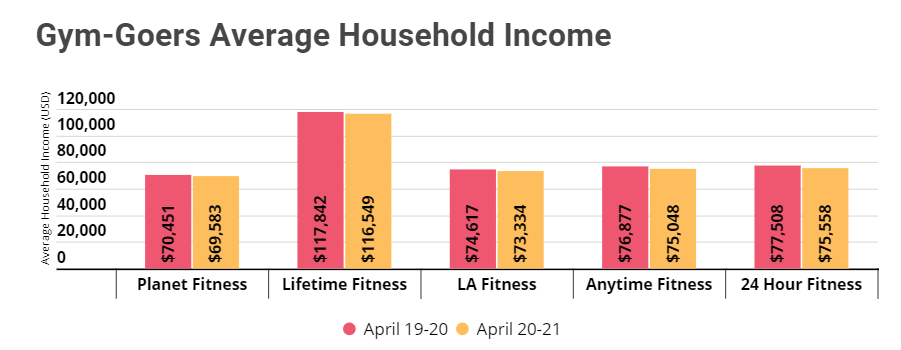

However, data suggest that gyms have been coping relatively well with the competition. An analysis of five leading fitness brands from April 2020 through March 2021 showed that the average household income of their visitors has declined by $1,444 compared to the previous year. This indicates that these gyms are attracting a larger audience and that it is including lower income audiences.

With that said, there is a question of whether this trend is a product of the pandemic that could quickly reverse. In the short term, value-oriented locations should have an advantage, though this may shift back as the year progresses.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.