Cross-border commercial property investment by Chinese firms has been on the wane since China’s government implemented curbs on capital outflows in 2017, and there’s no indication that these capital controls are going to be lifted any time soon.

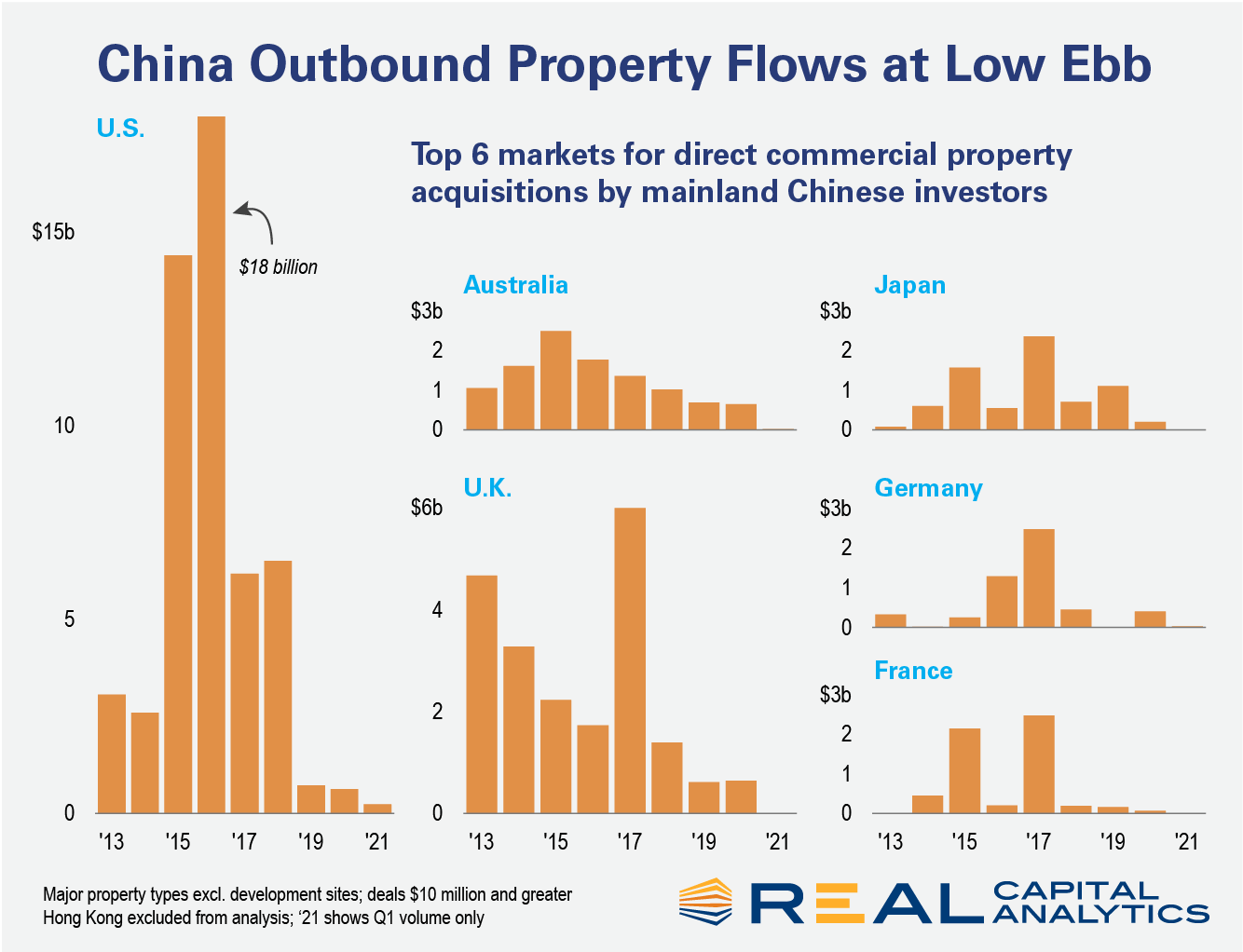

The charts below show just how significant the impact on overseas investment has been. Between 2015 and 2017, mainland Chinese investors deployed just over $91 billion into income-producing commercial real estate globally. Over the subsequent three years the outlay dived to just under $35 billion.

Declines were not limited to just a handful of countries as all regions worldwide registered dramatic falls in investment activity from Chinese companies. Still, the countries which had previously seen the highest levels of direct acquisitions experienced the most significant falls.

Commercial property investment in the U.S. went from a high of $18 billion in 2016 to just $727 million in 2019. In the U.K., direct acquisitions had spiked to $6 billion in 2017 but dwindled to $617 million in 2019. Rounding out the top three destinations for Chinese commercial property investment is Australia. Here, Chinese investment peaked in 2015 at $2.5 billion before tumbling to less than $700 million in 2019. (This analysis excludes acquisitions in Hong Kong.)

Over the last few years, China has been entangled in trade wars with several traditional investment destinations for Chinese players, which may have been detrimental to commercial real estate flows. However, given that Chinese cross-border investment had been declining significantly prior to these skirmishes, it is clear they are not the root cause.

One significant acquisition that is in the pipeline is by Chinese sovereign wealth fund CIC. The government-owned entity wants to purchase a larger interest in Sydney’s Grosvenor Place office tower; the deal is awaiting approval from Australian regulators.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.