Source: https://www.creditbenchmark.com/forestry-and-paper-credit-recovers-as-lumber-prices-skyrocket/

Lumber prices have tripled since June 2020, adding an average of $24,000 to the price of a new US home; and reports from Canada show that timber poaching is increasing as a result.

Sawmills were idle during the pandemic lockdown, so the usual inventory build over winter did not happen. These technical constraints on supply are colliding head on with a spike in demand as housebuilding restarts, with the added pressure of the post-COVID desire for larger houses.

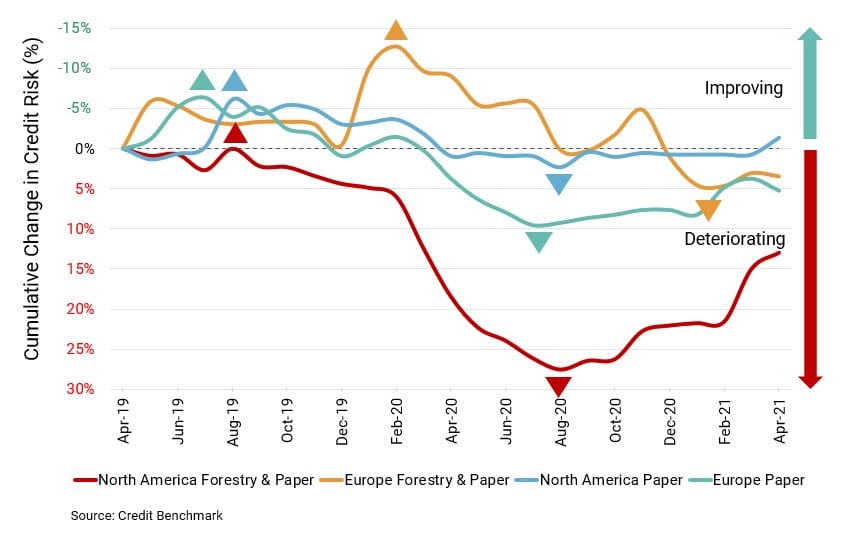

Figure 1 shows Forestry and Paper credit trends over the past two years.

Figure 1: Consensus Credit Trends in Forestry and Paper by Region

The impact of COVID was uneven – North American Forestry and Paper deteriorated by about 25%, whereas North American Paper showed no change; suggesting that Forestry took the brunt of the downgrades. The recovery is almost as dramatic, with credit risk rapidly returning to pre-COVID levels.

European Forestry and Paper showed a mild increase in credit risk – just over 5% – and unlike North America, Paper increased slightly more – about 10%.

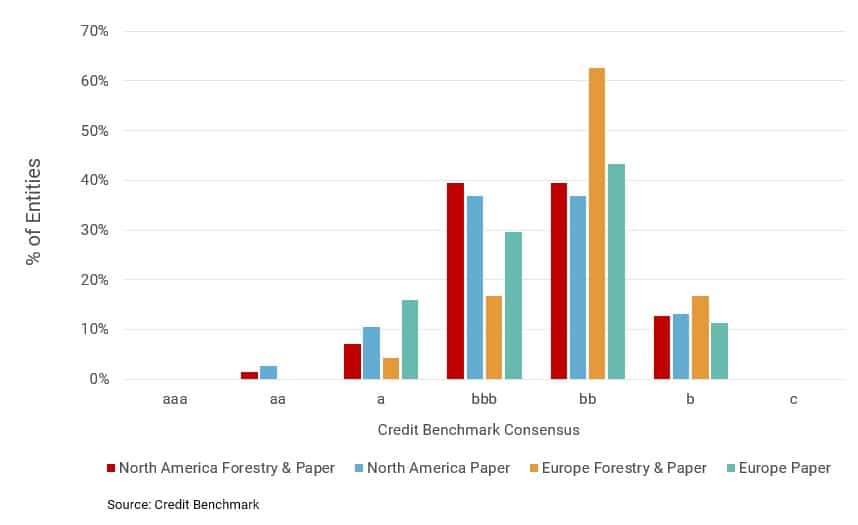

Overall, this industry is credit-robust – the majority of the North American Forestry & Paper universe is in the bbb or bb categories, with a few in aa, about 10% in a and another 10% in b. There are no names in the c category.

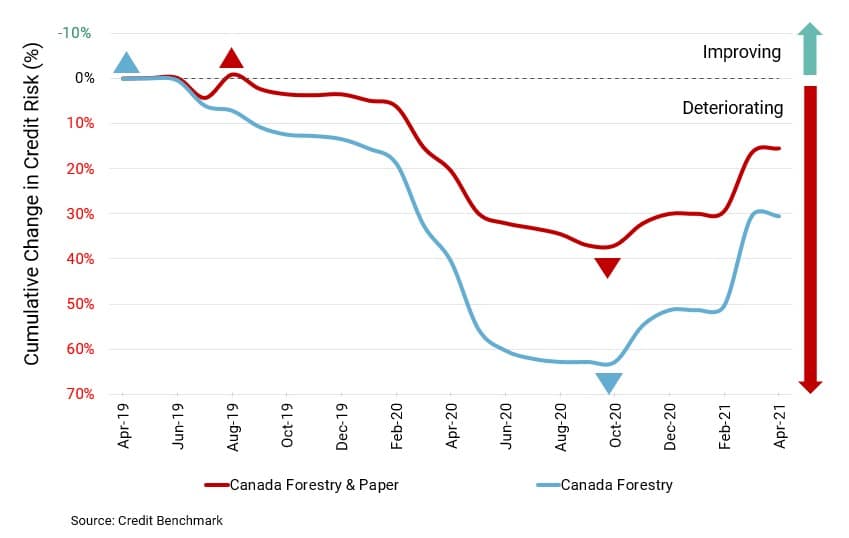

Canada and Forestry are inseparable; Figure 2 shows the impact of COVID on the Canadian Forestry and Paper sectors.

Figure 2: Consensus Credit Trends in Canadian Forestry and Paper

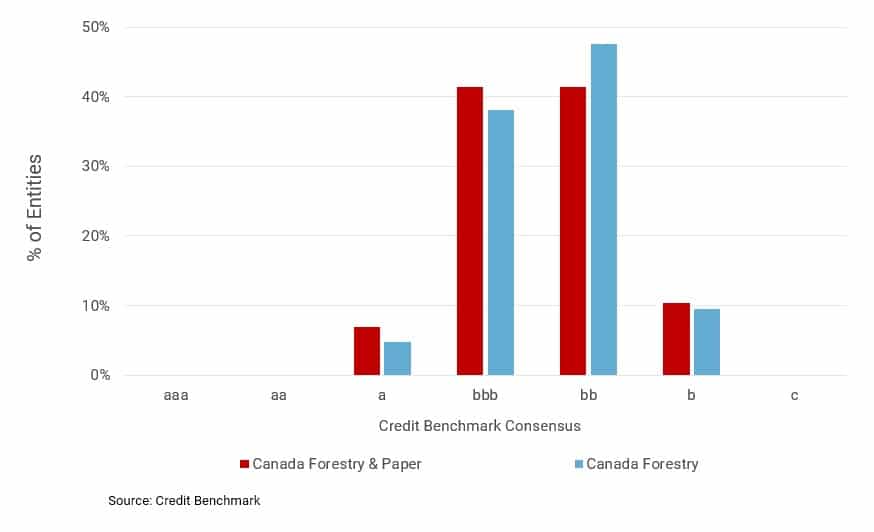

The credit distribution mirrors that of North American Forestry & Paper, but Canada’s Forestry sector shows a significant (+40%) increase in credit risk during the COVID period. As with the North American aggregate, the recovery has been rapid.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.