As one of the strongest performing retail sectors during the pandemic, the grocery sector showed exceptional offline strength by quickly adapting to a new pandemic-influenced reality. Yet, nearly halfway through 2021, it is increasingly clear the return to normalcy is in full swing, and with that, the need to adapt to a changing environment once again. To leverage last year’s surge and position themselves up for longer-term growth, grocers must understand which trends are here to stay and which are not.

In our latest Grocery Deep Dive whitepaper, we dove into the location data of leading grocers to uncover some of the key trends shaping the sector and the brands that are positioned for long-term success.

Shopping Time Preferences are Returning to ‘Normal’

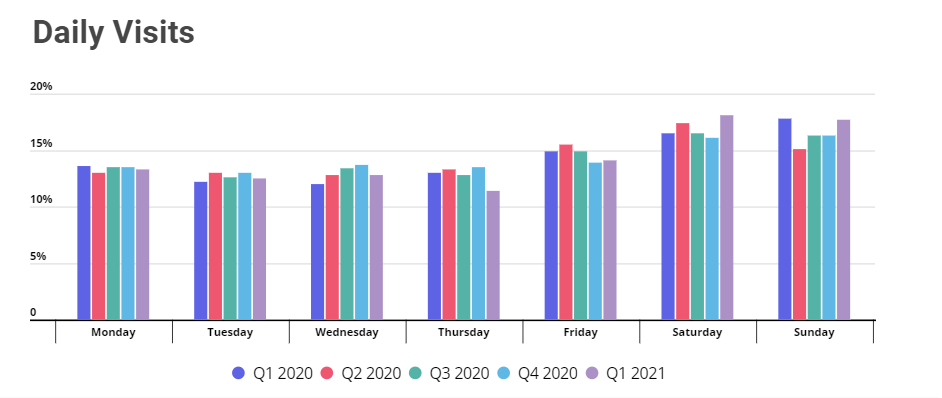

One of the first big changes that grocers experienced with the outbreak of COVID was a shift in their customer’s preferred visiting day, a direct result of a massive change to work settings and routines. In Q2 of 2020, many shoppers transformed their weekend visits to weekday visits, with Sunday visits accounting for only 15.1% of all visits, nearly 3% less than their proportion in the previous quarter. Q3 and Q4 of 2020 showed a slight increase in Sunday visits which accounted for 16.3% of visits. But by Q1 of 2021, Sunday visits returned to become 17.8% of all visits, the same percentage it stood at in Q1 of 2020, pre-pandemic. A similar pattern could be seen with Saturday visits as well.

This ‘normalization’ of behavior emphasizes the importance of routine – whether centered around work or school – to shopping preferences. While slight shifts in these routines could have major implications for grocery, the reality is that much of consumer decision-making is guided by the limitations presented by routine rather than true preference.

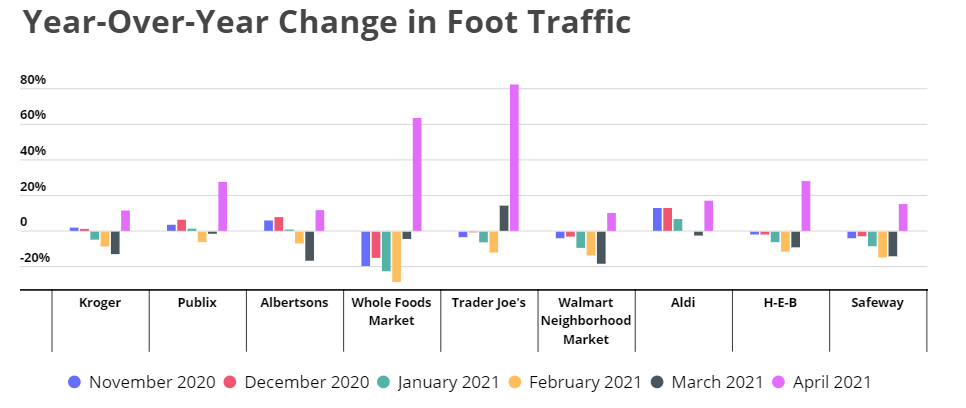

Traditional Grocers are Still Showing Strength

Q1 of 2021 was a difficult quarter across grocery brands, with many experiencing year-over-year declines driven by a combination of inclement weather, difficult year-over-year comparisons, and lingering pandemic concerns. Yet, despite these challenges, several leading traditional grocers like Publix and Aldi saw minimal year-over-year drops followed by strong April growth. In January, Publix and Aldi saw year-over-year growth in visits of 0.2% and 2.0%, while other non-traditional grocers like Whole Foods Market, Trader Joe’s, and Walmart Neighborhood Market saw year-over-year declines in visits of 21.7%, 1.8% and 6.3%, respectively.

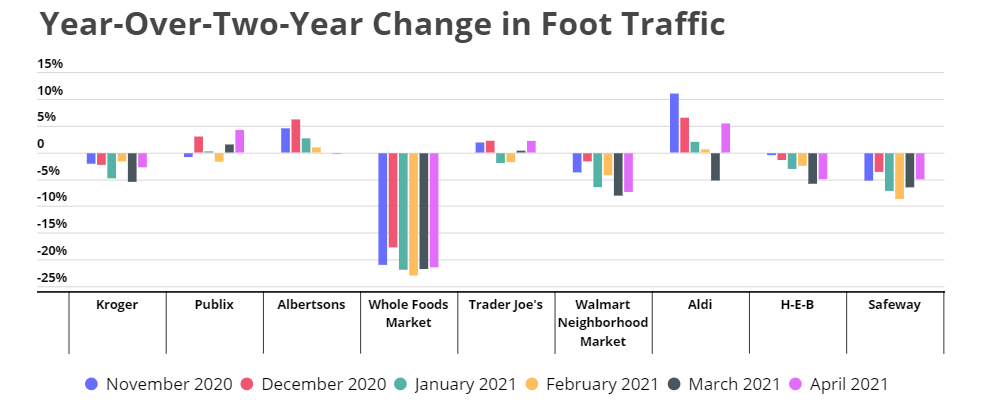

A comparison to 2019 further emphasizes the unique strength of leading traditional grocers. Publix and Albertsons, marked growth compared to the equivalent months two years prior, throughout much of late 2020 and early 2021. This deepens the concept that the surge experienced by traditional grocers could spur a larger trend of ongoing success.

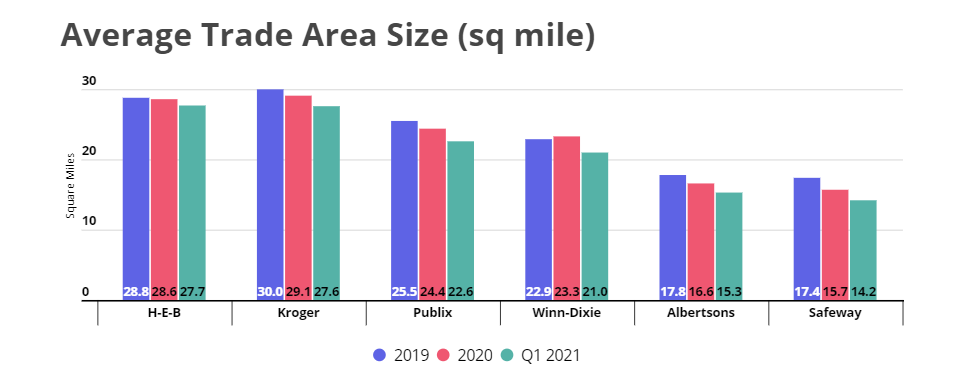

Trade Areas Remain Smaller

The importance of store proximity was another interesting pandemic-driven shift in grocery shopping behavior. During the pandemic, shoppers proved to be less keen on traveling farther distances and preferred doing their shopping closer to home. The average trade area size of grocery stores shrunk accordingly. Interestingly, most leading grocers saw this trend continue into 2021, with yet another decrease in their average trade area size during the first quarter of the year. The average trade size had shrunk by 10.6% from 2019 to 2021 among the analyzed brands.

Although there could be several explanations for this trend’s continuation, from inclement weather during Q1 to the development of loyalty to closer options during the pandemic, it is undoubtedly a pattern that requires further tracking. With the percentage of hybrid omnichannel grocery shoppers growing and more grocery stores allocating part of their physical space as mini fulfillment centers and curbside pickup stations, changes in trade area size could have significant and wide-reaching implications.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.