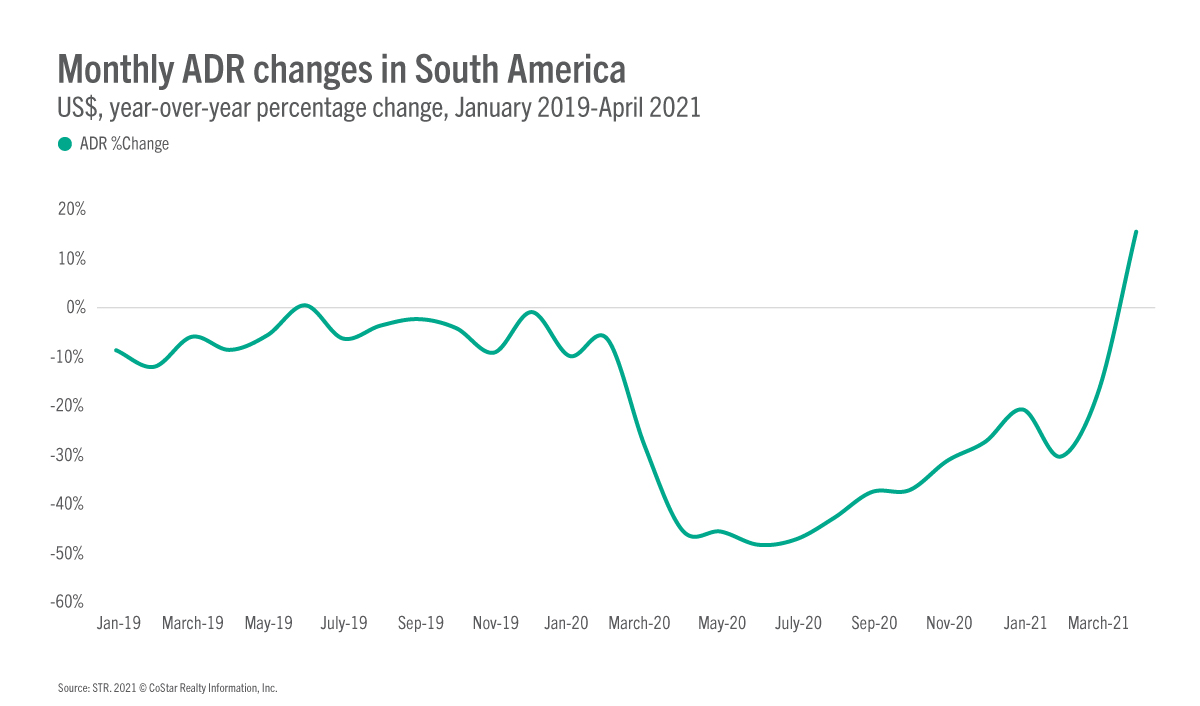

During the earliest days of COVID-19, hotel average daily rate (ADR) in South America was as low as 47.8% below pre-pandemic levels. One year later, rates in the region have improved slightly—April’s 15.7% increase was the first year-over-year positive in the metric since the middle of 2019—but still remain far from recovery. More specifically, South America’s April 2021 ADR level of US$56.99 was more than US$30 less than the pre-pandemic benchmark from April 2019 (US$89.55).

Key markets

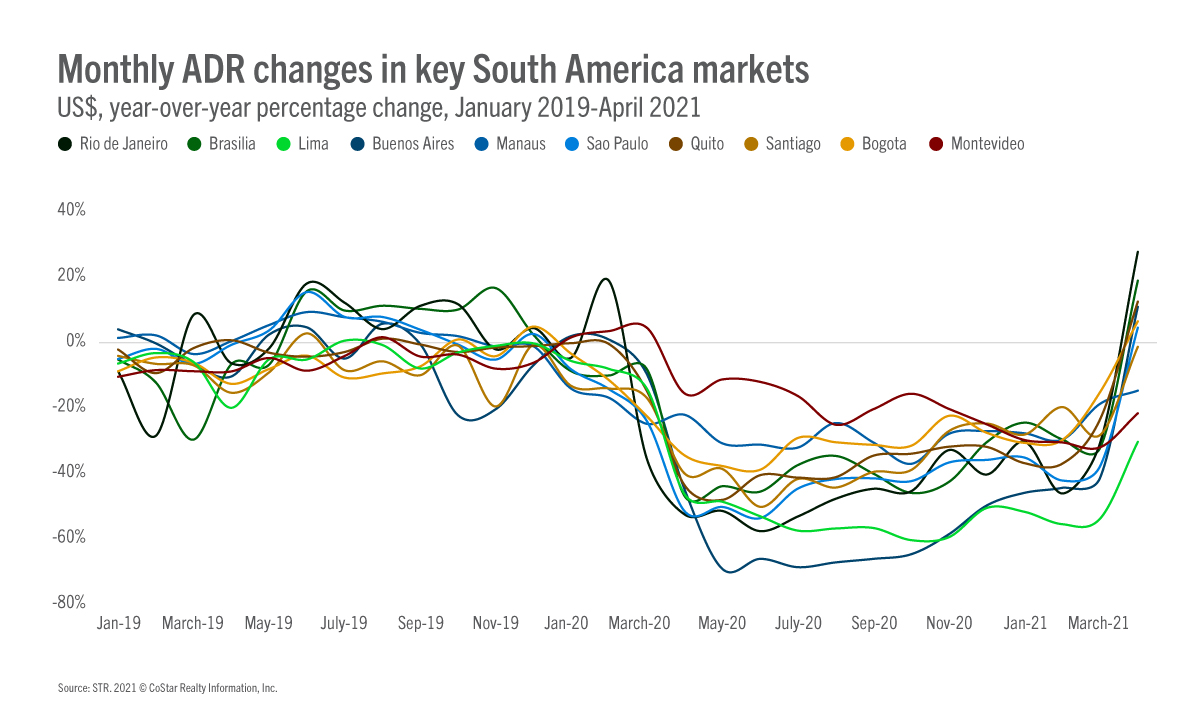

Key markets in South America have reflected a similar trend as the region overall. In April 2021, rates in Cartagena (+105.4%), Rio de Janeiro (+27.6%), Quito (+12.5%) and Buenos Aires (+11.0%) all increased year over year. Argentina and Brazil currency depreciation against the U.S. dollar is the main reason for increased in ADR in those countries’ markets. That is not the case for Quito, as the U.S. dollar is Ecuador’s currency. Regardless, absolute values for each market were down substantially in comparison with the 2019 benchmark.

For example, Rio’s ADR came in at BRL299.72 in April 2021, BRL234.75 in April 2020 and BRL365.61 in April 2019.

Lima is a bit different with ADR even further behind in the ADR recovery timeline as hoteliers offer strong group discounts for mining and other industries. The market reported a 30.3% year-over-year decline (to PEN47.29) in April 2021. Not only was that level down substantially from a pandemic-affected month last year, but it was also almost US$80 lower than April 2019 (PEN126.23).

Overall, South America has a long road ahead in recovering room rates. Hotel demand, which had improved late in 2020 and early 2021 has been stagnant the last three months with the threat of new lockdowns, the slow roll out of vaccines around the region and increased cases in countries like Brazil and Colombia. Additionally, social unrest after weeks of riots and blockages in Colombia limited the little domestic demand available. Most markets will pick up leisure demand as the situation improves, but demand that is substantial enough to significantly boost hotelier’s pricing confidence will not come until the return of large events and international travel.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.