In this Placer Bytes we dive into the dining category with check-ins on Chipotle and Darden’s Restaurant portfolio.

Chipotle Returns

An emphasis on digital enhancements seemingly helped Chipotle weather the COVID-storm, but how is the brand performing post-pandemic?

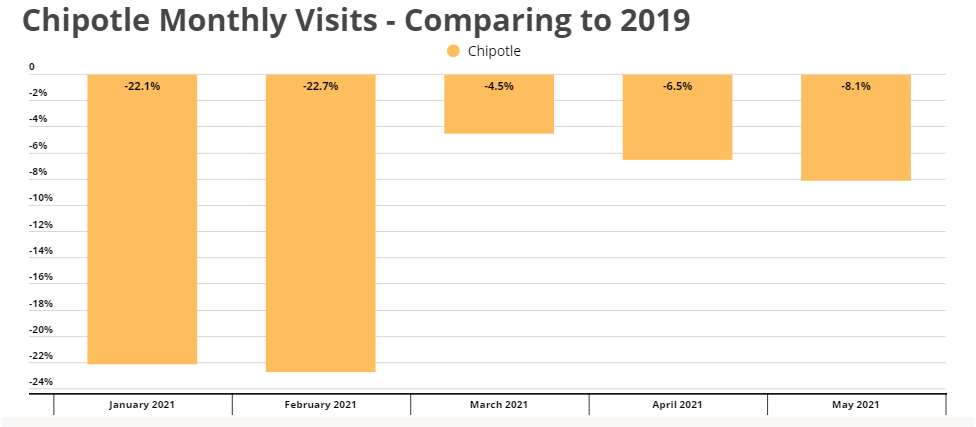

When comparing monthly visits to 2019 for one of America’s most popular chains, we see visits nearing pre-COVID levels. While visits were down 22.1% in January, that visit gap shrunk to just 4.5% for March amid lifted restrictions across the dining category. And while visits fell just a bit for both April and May at 6.5% and 8.1% respectively, weekly traffic for May going into June looks promising.

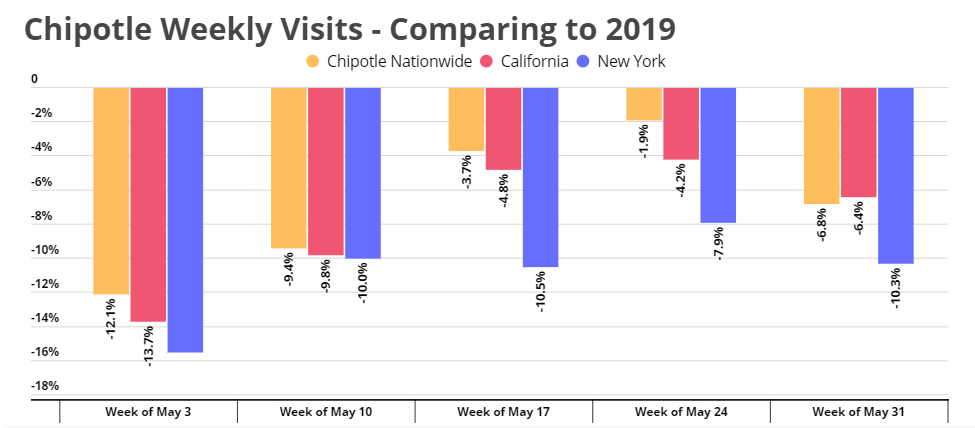

Looking at weekly visits in two key states, California and New York, confirms Chipotle’s rebound. Nationwide visits neared 2019 levels for the week of May 24 and visits to California and New York locations were not far behind the nationwide pace with visits down 4.2% and 7.9% respectively. Visits did drop the final week of May, but the decrease is likely attributed to all locations being closed on that Monday for Memorial Day.

Chipotle’s recovery will only continue to get stronger as California continues to rebound and New Yorkers get the chance to finally eat inside after in-restaurant dining comes back to the city.

Darden’s Recovery

Last time we checked in on Darden, the restaurants within its portfolio were slowly recovering. Now, with 2021 in full swing, we see some of its top chains on a steady road back to pre-COVID levels.

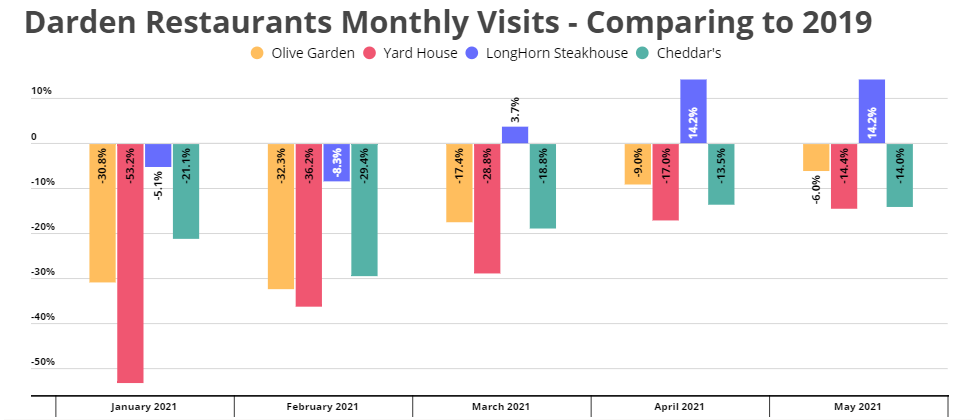

Monthly visits to each restaurant analyzed have pushed closer to 2019 levels since the beginning of the year. Year-over-two-year visits in January were down 30%, 53%, 5%, and 21% for Olive Garden, Yard House, LongHorn Steakhouse and Cheddar’s, respectively. Yet, by May, those visit gaps stood at just 6.0%, 14.4%, and 14.0% for Olive Garden, Yard House and Cheddar’s, with Long Horn Steakhouse up 14.2% compared to the equivalent month in 2019.

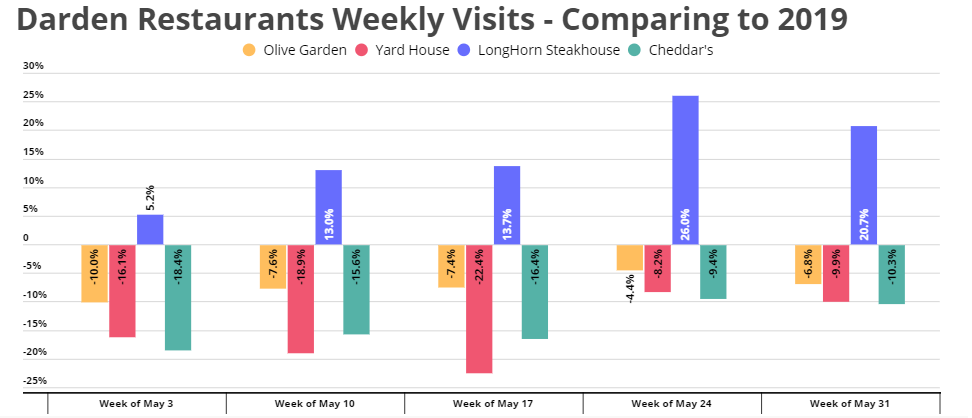

Weekly visits in May only strengthen Darden’s recovery narrative. LongHorn Steakhouse continued its dominance throughout the month with visits again surpassing 2019 levels each week in May. Olive Garden, Yard House, and Cheddar’s also neared pre-COVID numbers for the week of May 24 with visits down just 4.4%, 8.2%, and 9.4% respectively. A majority of LongHorn Steakhouse’s locations are in states that have been open, with limited restrictions leading to a strong performance for the brand.

As in-restaurant dining returns to in full, expect Darden’s portfolio to have a strong comeback.

How will these brands fare during the second half of 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.