The wider retail recovery is well underway, but a more nuanced perspective is necessary to properly appreciate the relative rebounds of specific brands. Some sectors saw significantly greater challenges, while others benefitted from the unique retail circumstances driven by the pandemic.

We dove into the data to uncover some of the more impressive retail rebounds.

Department Stores

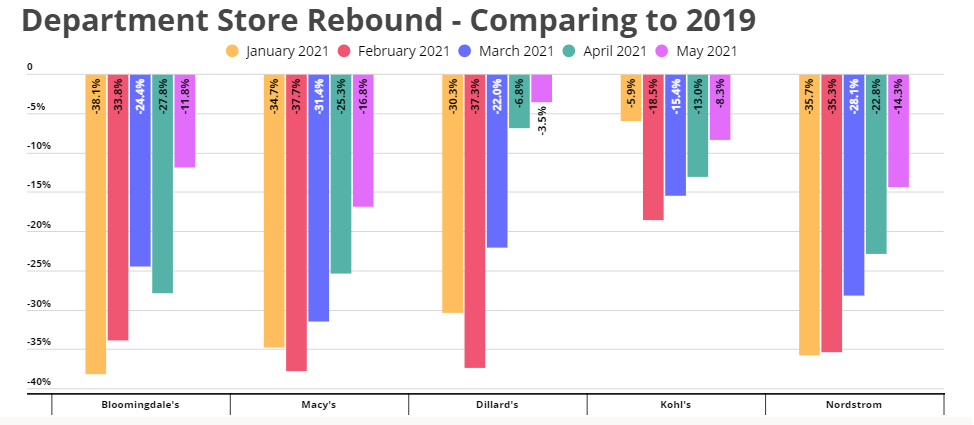

The ‘death’ of the department store was an oft-reported trend before and during the pandemic. And while the sector has certainly experienced its fair share of challenges, the overarching narrative of doom and gloom seems to miss out on the lingering strength and potential of leading players. In May 2021, visits to brands like Kohl’s and Dillard’s were down just 8.3% and 3.5% respectively when comparing visits during the equivalent month in 2019. Even Macy’s and Nordstorm – two of the companies often associated with the negative feeling around the sector – saw visit gaps improve dramatically in May with visits down just 16.8% and 14.3% respectively. These marked the strongest months for the two brands by far since the onset of the pandemic’s retail impact.

The coming months may be even brighter for the department store sector with a critical back to school season around the corner and continued reopenings taking place in key states like New York and California. Kohl’s appears to be particularly well positioned, but even the mall based department stores seem to be better positioned than expected. Critically, this doesn’t overcome foundational challenges within the approaches of some of these brands, and a continued evolution for the sector is still likely necessary. However, it does put the performance into context, showing that these department leaders still carry a lot of strength that can be leveraged to driving a fuller and longer-term turnaround.

Grocery Laggards

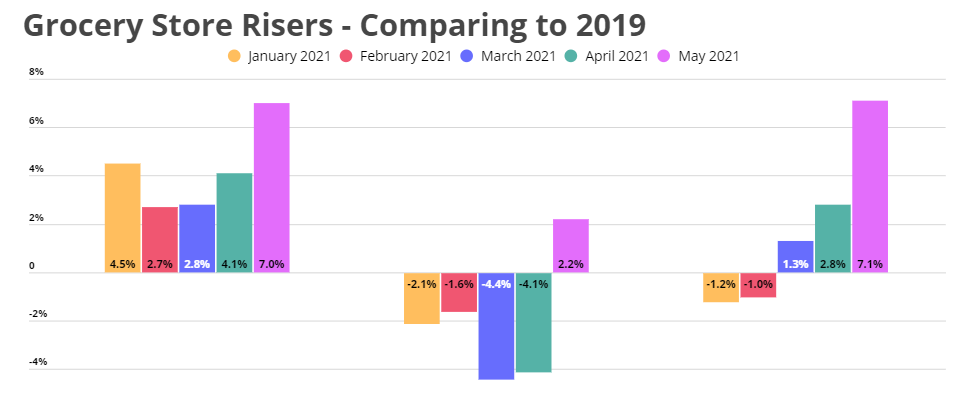

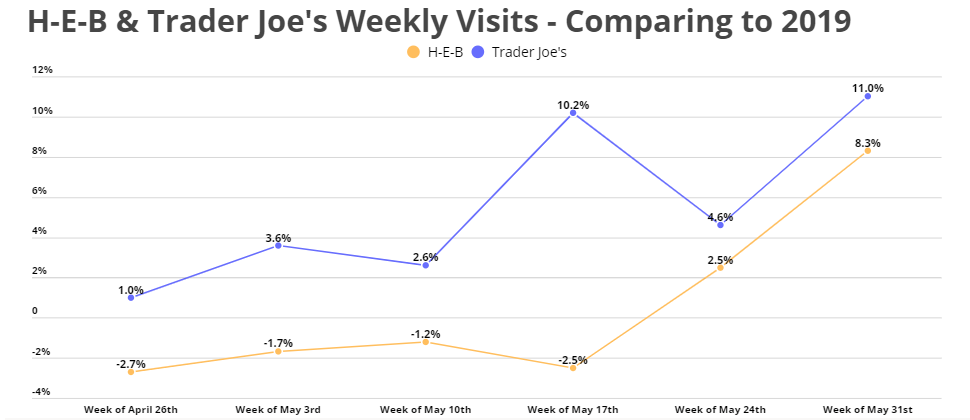

Grocery was one of the segments that saw a renewed sense of strength throughout the pandemic. Yet, not all brands were treated equally. Trader Joe’s was one of the hardest hit brands in the early months of the pandemic with visits plunging. H-E-B, one of the wider sector’s leaders, also saw weaknesses with visits down significantly. However, both brands are on the rise with visits in May 2021 up 7.1% for Trader Joe’s and up 2.2% for H-E-B when compared to the same month in 2019. The recovery speaks to the strong standing of these brands and their unique ability to weather the storm of COVID. Essentially, while visits declined in the short term, the strong relationship developed with customers over time was resilient enough to drive shoppers back as ‘normalcy’ returned.

Costco, hardly a struggling brand, is also showing a unique level of strength after watching a fundamental disruption to visit patterns throughout the pandemic. While year over year visits had been down throughout much of the pandemic, the optimistic case was that visitors were simply accomplishing more with fewer visits. And this concept does appear to be holding true as a wider retail reopening has driven significant visit growth each month of 2021 when compared to the 2019 equivalent.

Weekly visits further validate the returning strength for Trader Joe’s and H-E-B. The weeks beginning May 24th and 31st saw visits up 4.6% and 11.0% for Trader Joe’s and up 2.5% and 8.3% for H-E-B. The potential of this trend to carry into June and deeper into the summer should drive tremendous excitement around the recoveries for both chains.

Lifting Itself Back Up

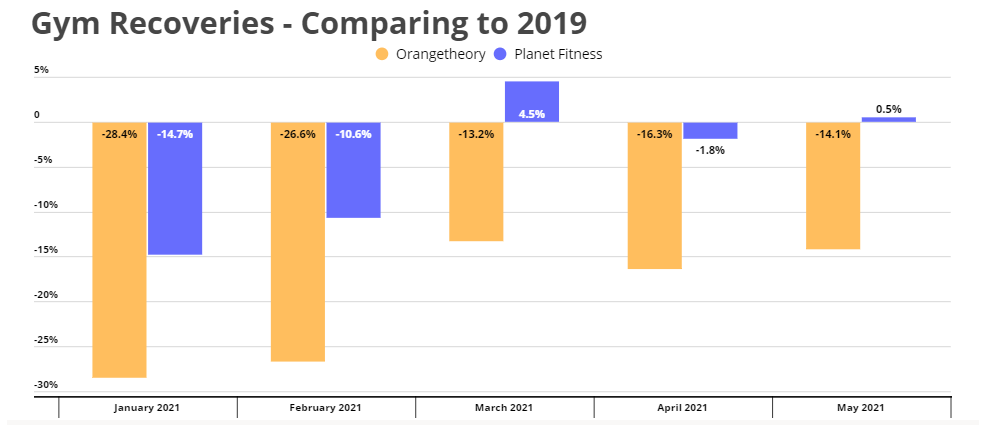

Another segment that faced uniquely difficult challenges throughout the pandemic was offline fitness. Gym visits were obliterated as COVID restrictions, health concerns and disruptions to routines created massive obstacles for the sector. Yet, Planet Fitness and Orangetheory have both shown the ability to recover. Visits to Planet Fitness locations were up compared to 2019 in both March and May signifying the unique power and pull of the brand. Orangetheory has seen visit gaps drop dramatically, with visits down just 14.1% in May.

And like the sectors mentioned above, this could be just the beginning. The consistency of these brands alongside their strong geographic reach could push visits even higher as reopenings continue and routines return, especially for the many people whose former gyms closed due to the pandemic.

Brands to Watch

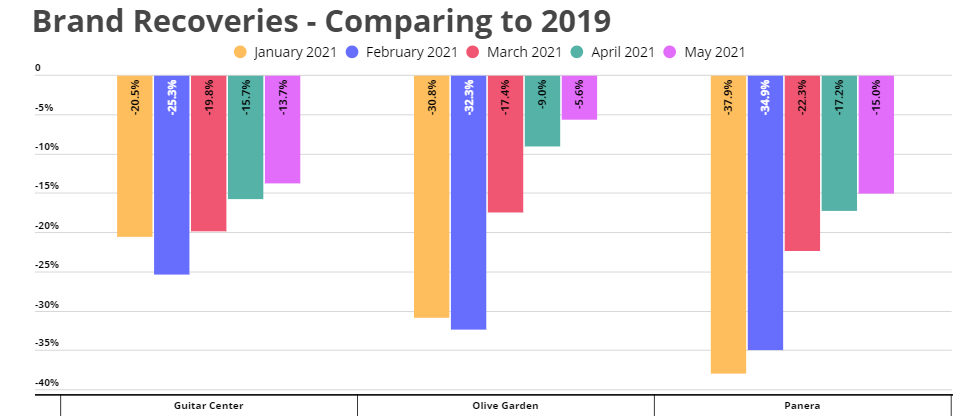

Other brands enjoying a strong and marked recovery include Guitar Center, Olive Garden, and Panera. The latter two are particularly interesting as they are part of a wider restaurant recovery that could have a significant impact on the wider sector. The ability of restaurant brands with a heavy focus on sitdown dining speaks to a potential revival that goes far beyond COVID. Should these players prove capable of leveraging the recovery to drive growth, the impact could very well reinforce the ongoing positioning for sitdown chains. As QSR was clearly privileged during the pandemic, a shift towards more drive-thru and takeaway was widely discussed. While this could end up being a greater part of the overall mix, the power of a dining recovery could create a far more favorable equilibrium.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.