The Facts Behind the Lumber Shortage

The rapid increase of lumber prices has been all over the news throughout the COVID-19 pandemic, and everyone seems to have their own explanation of why this trend has been occurring. From increased demand, to the lack of timber, to the Mountain Pine Beetle destroying trees, or to the impacts of clearcutting, each of these explanations are true to varying degrees.

But they’re also not the complete picture.

When it comes to pricing, it’s important to distinguish between demand for lumber and the supply chain for lumber products. And because of the differing final uses of these products, the impacts can vary extensively.

The Impact of High Demand

As lockdowns and quarantines from the COVID-19 pandemic began to interrupt businesses last year, jobs were lost in the lumber industry. Many former sawmill workers turned to do-it-yourself projects around their own houses and other undertakings.

Additionally, new residential building is up. U.S. home builders started new home construction in March 2021 at a 19% increase from previous months. These factors created a great demand for lumber and contributed to the rise in prices.

Notably, demand for wood and the price producers received for timber were lower in 2020 than in 2019. Raw wood material consumption from January 2020 to July 2020 was 6.7% lower than the same period in 2019, representing a 13% reduction in value of the delivered wood, although this figure does not account for demand from August 2020 and forward.

The Impact of Supply Chain Disruptions

While rising demand played a substantial role increasing prices, disruptions to supply chains have also been a key contributor. The disruptions have been unevenly distributed across many sectors and regions. For instance, pulp and paper industry prices have remained similar to prices in 2019. In contrast, lumber markets have experienced supply shortages and historically high prices as consumers and producers struggle to anticipate and adjust to the pandemic’s effects.

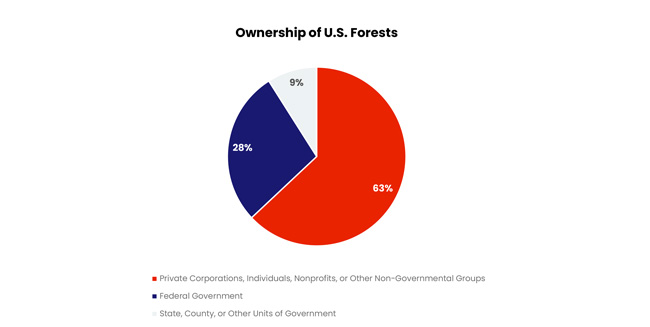

A key factor affecting lumber prices is the ownership of the land from where the timber is harvested. The timber supply chain[4] is composed of many small forest landowners. Privately owned corporations, individuals, nonprofits, or other non-governmental groups own 63% of U.S. forests and woodlands.

The remaining 37% is publicly owned by the federal, state, county or other units of government. The federal government comprises 28 percentage points of this share.

Land not owned by government entities does not have standards imposed regulating the prices of timber. Therefore, the non-government entities, private, nonprofits, individuals control costs as they see fit, often following market trends, personal and corporate decisions, leading to higher pricing.

After timber is harvested, it is transported and processed. Making final products out of timber may be a single or multi-stage process. In general, the first step is transforming timber into a primary product such as lumber, wood chips, or wood pulp. Additional processing may or may not be undergone, and this can impact the final pricing.

It has been reported 10% of pulp and paper related facilities in the U.S. curtailed production temporarily or permanently closed between March and September 2020 due to COVID-19. This has a direct effect on pricing.

The U.S. is a net importer of timber and wood products. As of 2017, Canada was the U.S.’s most significant source of timber imports, and China was the largest single U.S. timber export market. In addition, a portion of the wood produced and exported from the U.S. is processed into intermediate and finished products overseas, particularly in China, and imported back into the United States.

Wood products are highly traded commodities in world markets, and these supply chains are integrated across regions and trading partners to varying degrees; the disruption to these areas has also affected pricing.

In Conclusion

Considering all things involved, directly or indirectly, including the pandemic, the disruptions to supply chains, the increase in demand, and the general uncertainty of the markets all played a role in pricing. There is no one trigger to zero in on when it comes to why the cost of lumber has escalated but rather the contribution of many factors operating all at once.

The economy thus far is not following or supporting this trend to a large extent, and we aren’t seeing substantial increases in the labor market for salaries or hourly wages.

With the facts presented, many things contribute to price increases across the nation; however, there is one common factor embedded in all: COVID-19. It is now evident with the availability of vaccinations and subsequent COVID-19 cases declining, prices of building materials and other commodities are slowing falling. This is a firm indication that the increase in lumber prices will not be a permanent fixture for the U.S. or world markets.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.