In this Placer Bytes, we dive into Torrid and its peers and take a look at the pet supply sector’s recovery.

Torrid’s IPO Announcement

Plus-sized retailer Torrid Holdings Inc. recently filed for an Initial Public Offering, two years after withdrawing its previous IPO filing. This is huge news for Torrid, and can signal good tidings for the plus-sized clothing sector as a whole. Since Torrid was acquired by Sycamore Partners in 2013, and the same private equity firm (through affiliate Premium Apparel LLC) recently acquired additional plus-size retailers Lane Bryant and Catherines, we dove into the data to compare the brands and find out – What’s so hot about Torrid?

Upward Trajectory

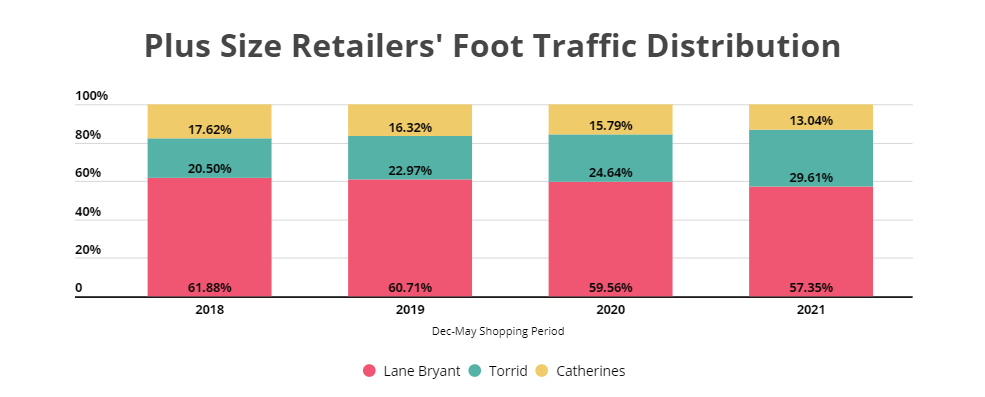

Compared to Torrid and Catherines, Lane Bryant is the market leader when it comes to visits, yet Torrid’s role is growing. During the period of December 2020 to May 2021, Lane Bryant attracted the highest share of visits – 57.3% were to Lane Bryant, followed by 29.6% of visits to Torrid and 13.0% to Catherines.

However, looking at the year-over-two-years change, Torrid’s upward trajectory emerges. In the same six month period two years ago, Lane Byant enjoyed 60.1% of visits, while Torrid and Catherines received 23.0% and 16.3% of foot traffic, respectively. Torrid has also been opening new stores as Lane Bryant and Catherines were closing locations even before the July 2020 announcement that all Catherines stores and more than 150 Lane Bryant stores would be shuttered.

Torrid’s Recovery

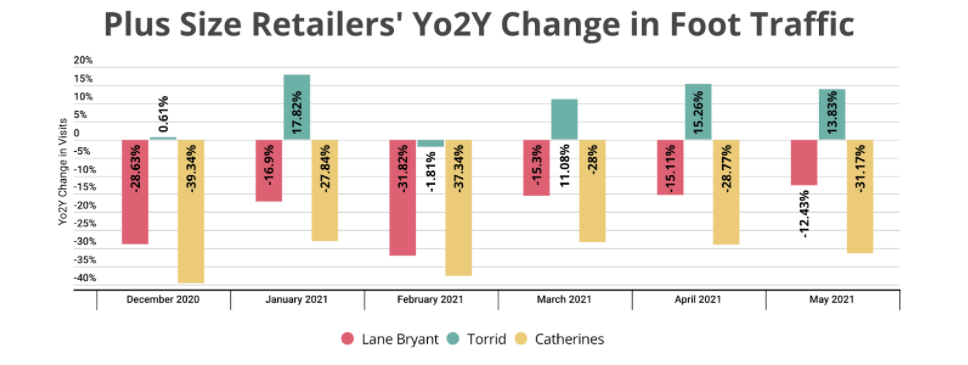

While many retailers have yet to reach 2019-levels of foot traffic, Torrid appears to have made a more than full recovery. With the exception of February, Torrid boasted higher foot traffic metrics every month for the last six months in comparison to those in 2019. These are impressive 2021 numbers for any apparel retailer, and they become particularly remarkable in the context of the plus-size sector’s slow recovery, and even more exciting considering the overall sector’s unique growth pattern.

Torrid Stores Draw More Customers

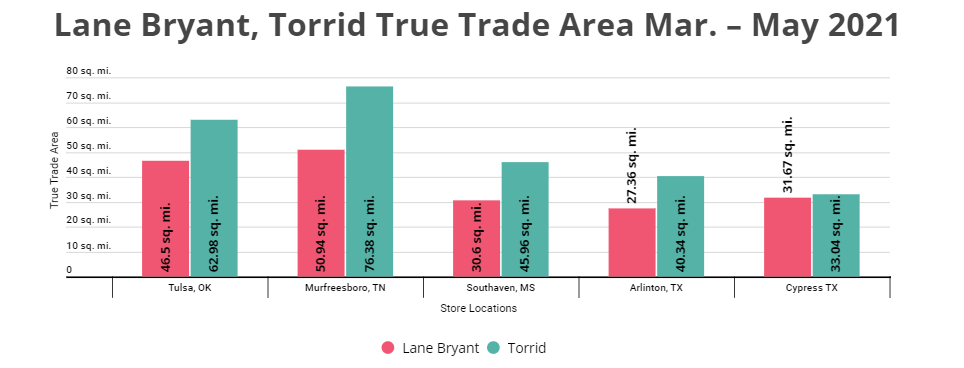

Torrid’s strength is further highlighted when we dive into specific Torrid and Lane Bryant locations. An analysis of five sets of neighboring Torrid and Lane Bryant stores over the past three months reveals that Torrid’s true trade area is, on average, 38.3% larger than Lane Bryant’s – meaning that customers across the country are willing to travel farther to Torrid locations than to similarly located Lane Bryant stores. Whether this speaks to a stronger reach or a more optimized retail footprint, the brand possesses a strength in maximizing the opportunity of each location.

As more traditional apparel retailers transition to more inclusive sizing, specialty brands such as Catherines and Lane Bryant that cater exclusively to plus size customers might take a hit. Despite the threats to the plus-size industry, however, one thing is certain – Torrid has had an exceptional start to 2021.

Pet Supplies Sector Update

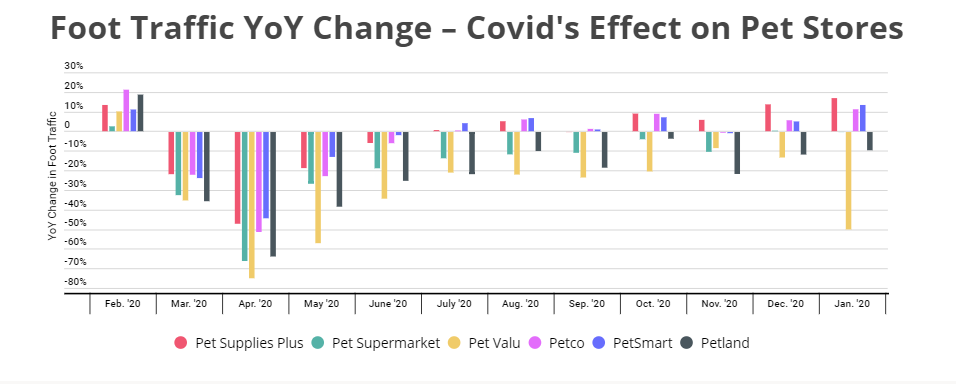

Although pet supply stores were deemed an essential business and allowed to remain open throughout the pandemic, the sector’s brick and mortar stores still took a hit. Many customers avoided unnecessary outings and turned to e-commerce channels for their pet supplies needs.

The Pandemic’s Effect on the Pet Supply Sector

COVID didn’t affect all chains equally: While Pet Supplies Plus, Petco, and Petsmart managed to recover relatively quickly, exhibiting YoY growth numbers already in July 2020, other chains such as Pet Supermarket and Petland made a slower comeback. And the sector’s relative strength did not guarantee anyone’s survival – Pet Valu, which was hit particularly hard by the pandemic, announced in November 2020 that they will close all of their US stores.

The Sector’s Recovery

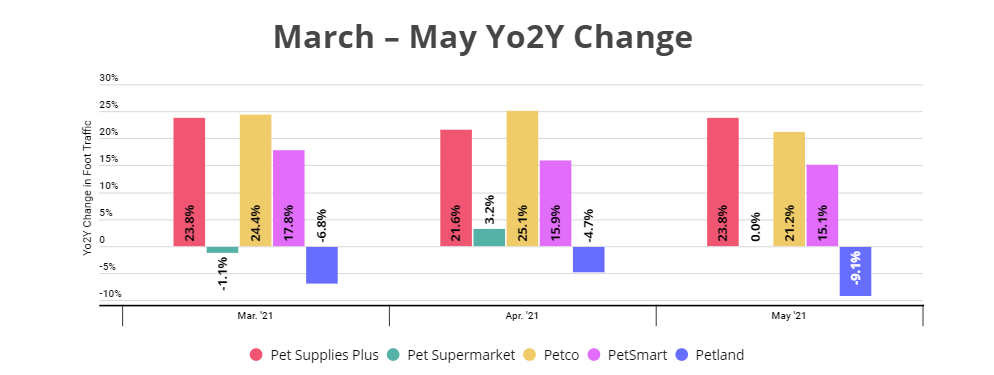

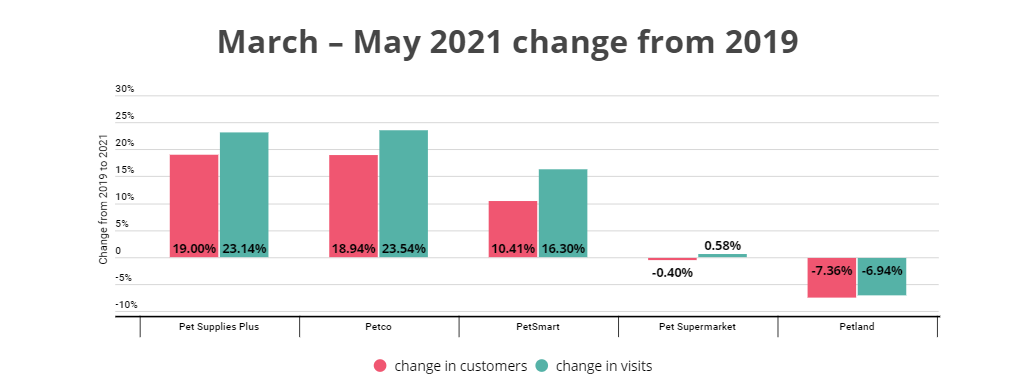

Despite naysayers predicting the end of in-person pet supply shopping, the sector’s brick and mortar stores appear poised for a strong return. But the recovery, like the COVID closures and social distancing practices, is uneven across the leading brands. Pet Supplies Plus, Petco, and PetSmart are showing impressive increases in foot traffic compared with pre-pandemic 2019 numbers. But while Pet Supermarket has closed the COVID gap, it is still not exhibiting soaring growth, and Petland has yet to recover fully from its rough 2020.

Why are most pet stores doing so well? One popular explanation is that pet ownership rose during the pandemic. But is this really the case? One data point driving this narrative was the apparent shortage of animals in shelters at the height of the pandemic. But according to Shelter Animal Counts, adoptions from shelters actually decreased by 17% over the pandemic. Since animal intakes at shelters also decreased, with shelters taking in 27% fewer strays and 23% fewer animals relinquished by their owners, the apparent stray shortage could be due to a fall in supply as opposed to a rise in demand.

Another reason for the pet supply sector’s strong foot traffic numbers could be that pet owners are spoiling their pets more. After over a year of spending all day, every day at home with their pets, pet parents might feel the urge to purchase more toys, treats, and other supplies to keep their pets happy and entertained on a more constant basis. Indeed, the number of visits per customer has gone up across the board: On average, visits per customer increased by 3.5% for both Pet Supplies Plus and Petco, and by 5.3% for PetSmart. In the case of Pet Supermarket and Petland, visits per customer increased by 0.72% and 0.76%, respectively – not a dramatic boost, nevertheless inline with the general trend.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.