Housing prices continue to surge—frustrating potential homebuyers.

“It’s becoming clear that record-high price growth and an enduring shortage of available homes are beginning to hinder would-be homebuyers,” said Matthew Speakman, an economist at Zillow. “Sales volume continues to struggle to regain the momentum it built late last year.”

Residential homeowners and politicians are pointing fingers at investment firms, but data points to other culprits. At the same time, commercial real estate won’t fully rebound for another couple of years.

How does that stack up for ad sales opportunities?

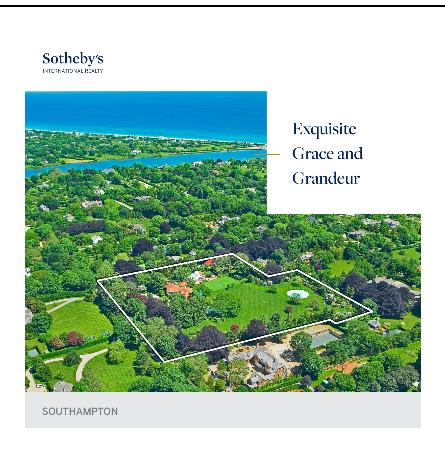

It’s a bizarre market out there… with rising prices and Wall Street boogeymen

Due to short housing supply, soaring lumber prices, and historically low mortgage rates, home prices continue climbing.

The median price of a new home increased 11.4% between March and April. And with this jump, asking prices became increasingly unreasonable to buyers: new home sales fell 6%.

“Soaring home prices are taking a toll on sales … and we expect the pace of sales to moderate further over the rest of 2021,” said Nancy Vanden Houten, lead U.S. economist for Oxford Economics.

It makes sense that buyers are choosing to wait it out until the market calms down. But they aren’t happy about it.

People on the left and right are eager to blame investment firms like Blackrock for buying up homes. Per this viral Twitter thread, people believe Blackrock is going after “every single family house they can find … and outbidding normal home buyers.”

As memories from the Great Recession linger with us collectively, it’s easy to jump to conclusions. Wall Street landlords must be the enemy here, right? But the reality is that institutional investors only account for an estimated 2% of single-family rentals.

Instead of accusing the “faceless Wall Street Goliath,” Derek Thompson at The Atlantic argues that we should take an honest look in the mirror. The bigger problem lies in the prevention of new housing development.

“From New York to California, deep-blue cities and states have amassed a pitiful record of blocking housing construction and failing to meet rising demand with adequate supply,” he writes.

Resolving this issue will not happen fast. It requires political and economic changes that increase housing supply.

As an important aside, the commercial real estate industry doesn’t face the same difficulties as consumer housing. There isn’t a shortage of existing buildings. And as a result, rising materials costs aren’t a big challenge right now. However, leaders still expect the rebound to take another two to three years.

MediaRadar Insights

Key Takeaways From Q2 2021

Note: Final June numbers are projected.

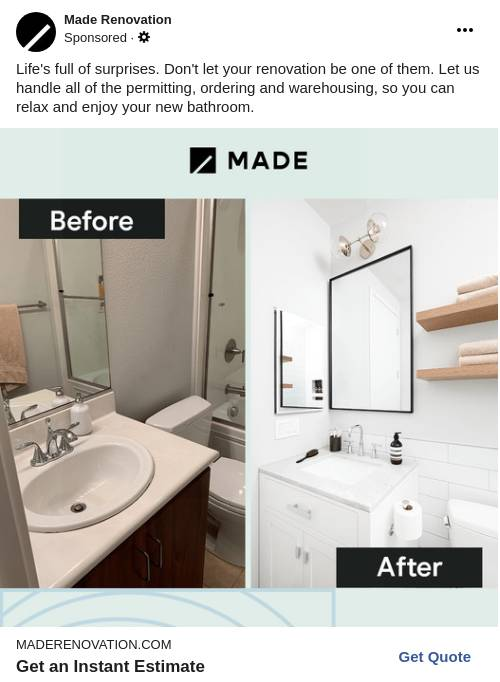

The drop in spend in 2021 can be directly attributed to the rising prices in the housing market. With more demand than supply, real estate marketers don’t need to advertise heavily to attract more business.

Other brands to consider are companies that build and sell raw material. While there is not much pressure on commercial companies to build real estate right now (there’s an excess of empty offices due to the pandemic), more home buyers are seeking to build their own house.

Investment firms aren’t strengthening their grip on the real estate market. But nonetheless, consumer-facing real estate companies can’t keep up with demand. While B2B real estate spending is increasing, consumer real estate spending is significantly down.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.