Throughout the pandemic there were certain sectors that enjoyed a particularly strong showing, like Home Improvement and Grocery. But with the retail recovery continuing at a strong pace, we dove into three segments that could see a better than expected Back to School season.

Beauty – Recovery Buoyed by Returning Routines

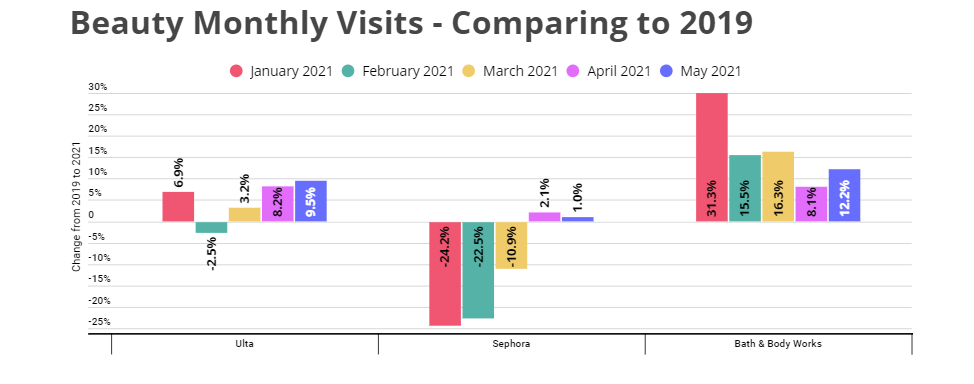

While beauty brands may have taken a hit during the pandemic, the recovery period has been especially kind to the segment. Ulta saw monthly visits up in four of the first five months of 2021 when compared to the equivalent periods in 2019, while Bath & Body Works saw strong growth each of the first five months when using the same comparison. Even Sephora, which saw visits down as much as 24.2% in January when compared to 2019, saw visits in April and May that were up 2.1% and 1.0% respectively.

The beauty recovery is likely being driven by a confluence of trends that highlight the unique merchandise these brands provide. First, an increasing focus on health and wellness has buoyed large segments of these product lines. Second, the return to school, work, and events has put makeup back on the agenda after these products were downgraded – if only somewhat – over the last “work from home” dominated year. With a key Back to School season on the horizon, and a more diversified approach coming from Sephora – expect the sector to see a strong boost.

Sporting Goods

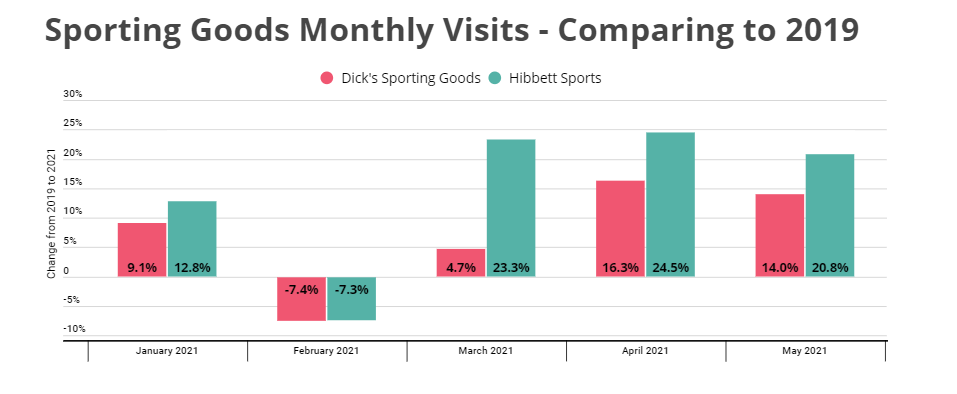

A second sector seeing strong growth is the Sporting Goods space led by Dick’s Sporting Goods and Hibbett Sports. Both brands have seen exceptionally strong numbers when comparing monthly visits to 2019, with May showing a 14.0% increase for Dick’s and a 20.8% jump for Hibbett. With team sports likely to see renewed interest and an overall rise in interest for athletic and athleisure wear, these brands look poised to carry the strength into the summer.

Office Supplies – One Last Try

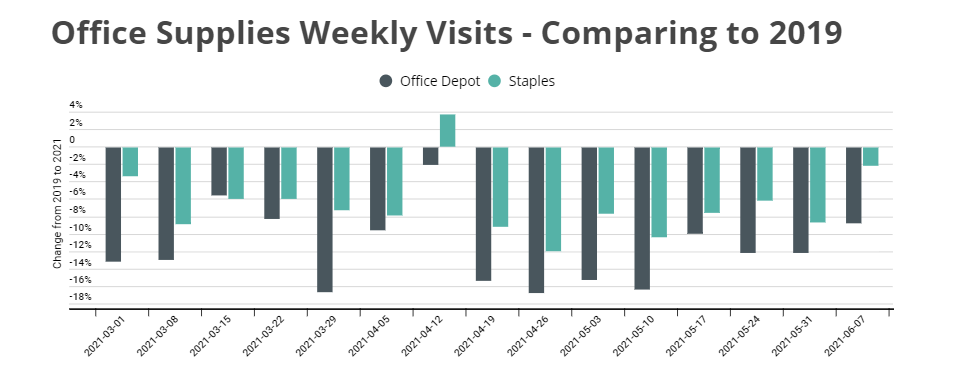

We’ve dedicated a significant amount of time to lauding the huge potential the Office Supply sector had during the pandemic and during the recovery period. And while it might be fair to give up on the segment and accept that it’s lost even more ground to eCommerce competitors, we’re not ready to throw the towel in just yet.

Looking at weekly visits compared to 2019 shows Staples and Office Depot at their strongest point in weeks with the former down just 2.1% and the latter down 8.7%. With an especially exciting Back to School season on the horizon, the sector could be situated to significantly overperform as students and professionals alike look to upgrade their home workspaces or stock up ahead of a new school year.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.