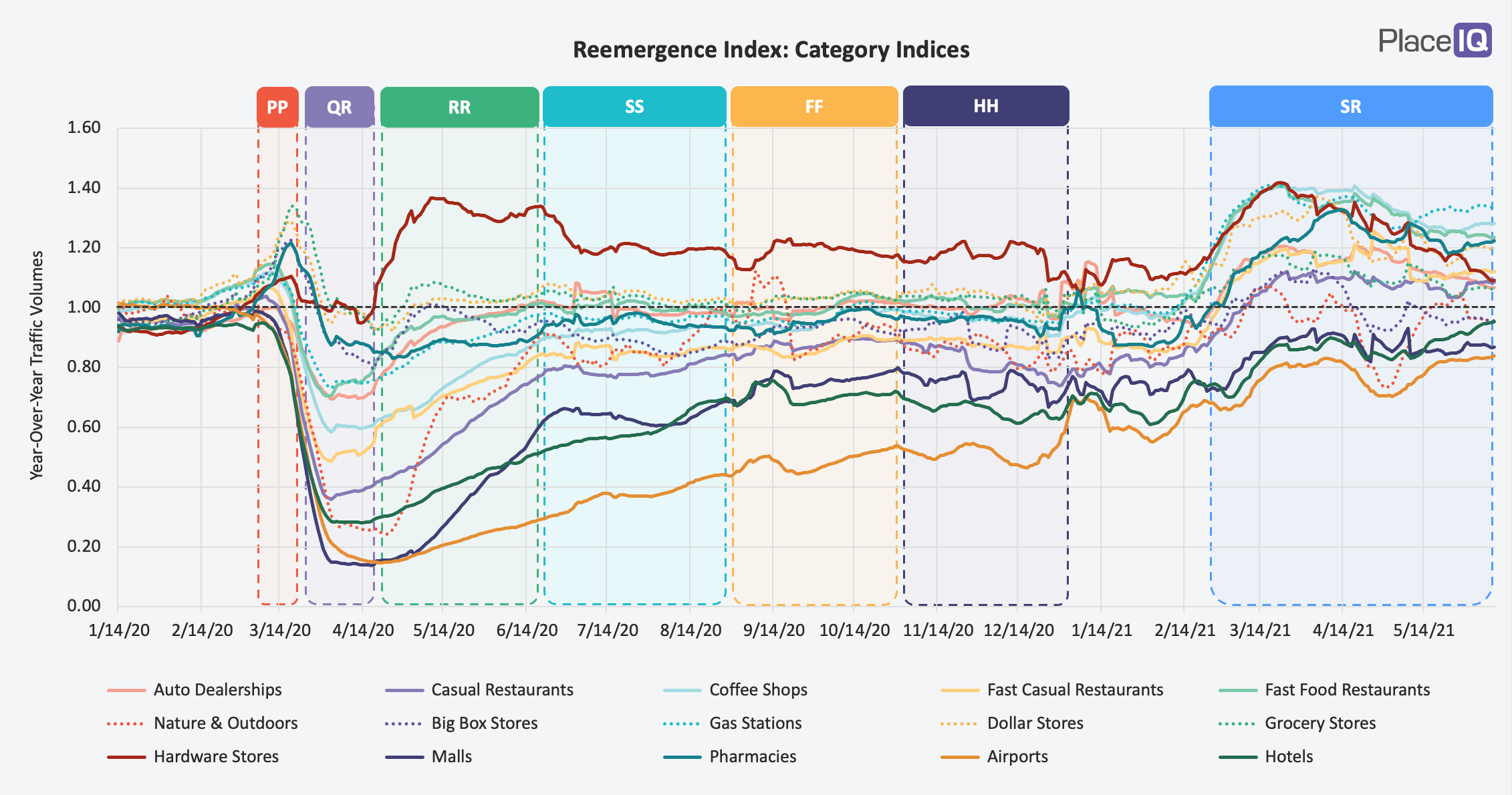

Last week felt like a big one in California. Vaccination rates are up, cases have slowed to a trickle, and the state has now fully reopened. Across the US, our initial spike of foot traffic enthusiasm has subdued a bit.

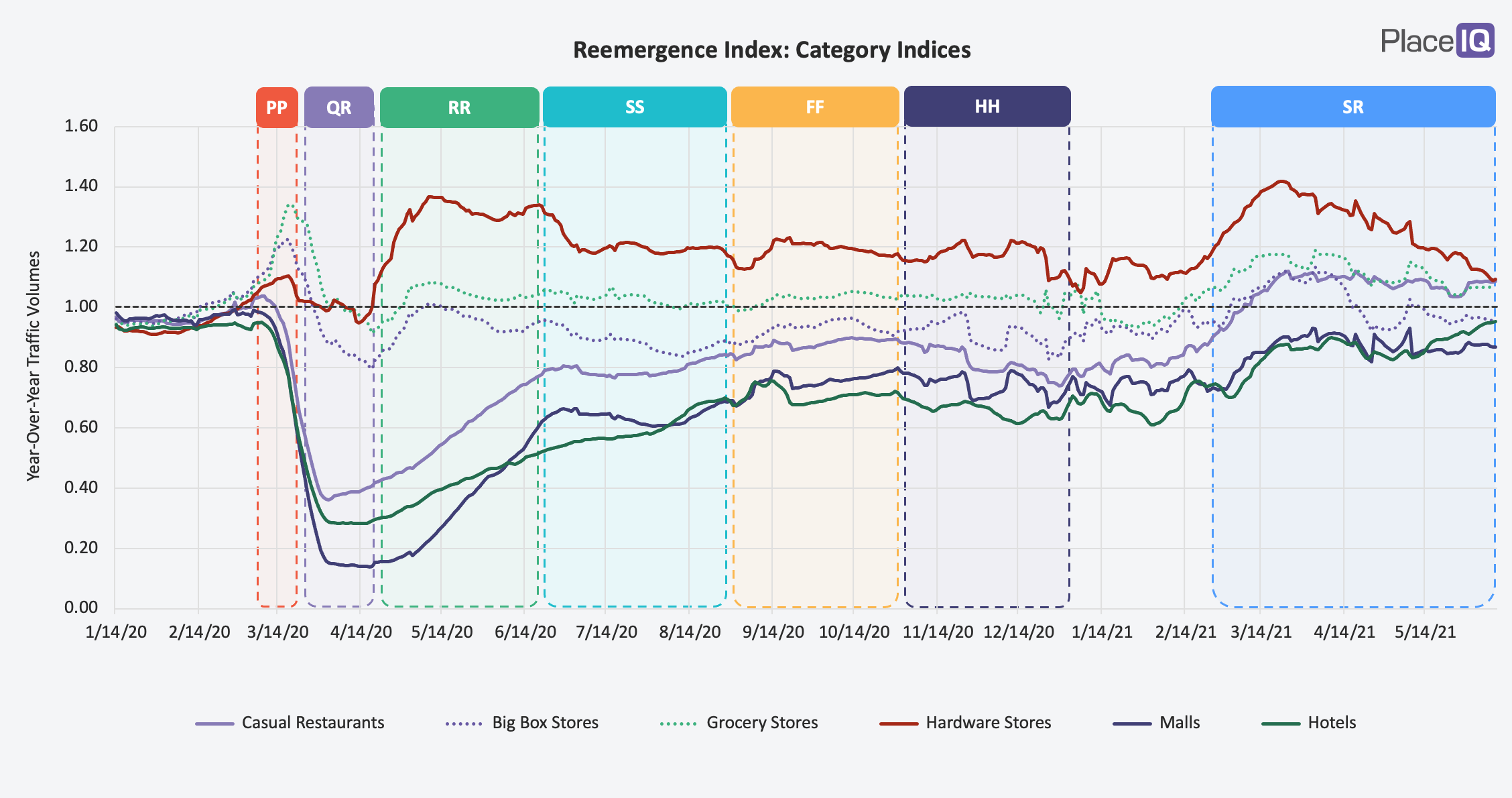

All the things we didn’t expect to pop — like grocery, big box, and dollar stores — have subsided to their usual levels. But the Vacillating category — the hotels, casual restaurants, entertainment venues, and bars — hasn’t given up its gains. And in some cases, traffic is still trending upward.

Note how big box, grocery, and hardware stores have all returned to their January traffic levels while casual restaurants, malls, and hotels are hanging onto their gains.

Things are starting to coalesce around a score of 1, which is our pre-pandemic normal. We’re not there yet, though we are much more active than we’ve been in quite a while. People are figuring things out, deciding what they want to return to and what they’re happy avoiding. And, as usual, the picture becomes muddier when we start getting down to regional or subcategory levels.

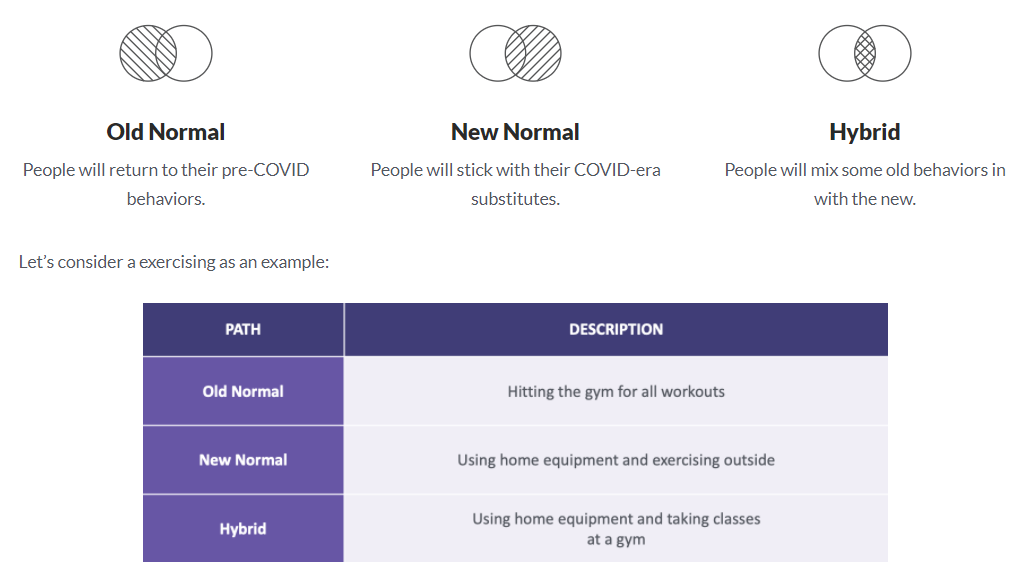

Today we’re going to talk about the complexity of consumer decisions as the threat from COVID subsides. Rather than everyone snapping back to their pre-pandemic norms, people are taking different paths. Many prefer their new normal to their old habits, or are embracing a mix of the two. Stick with us as today as we break down how reemergence doesn’t mean an end to consumer complexity.

New Normals, Old Normals, and Things In-Between

As case counts remain low and regulations relax, we’re faced with a question: do we return to our old behaviors? On the surface level this is a simple question for many, but as we get down to the individual categories and activities, nuance emerges. Many people find themselves preferring grocery delivery or doing more shopping online. Some enjoy working from home, others can’t wait to get back to the office, and many would prefer going in only a few days a week.

As we considered these options and compared them with the traffic data we’re observing, we landed on a simple framework.

As people feel less threatened and affected by COVID, they will take one of three paths:

At PlaceIQ, we have several people taking each of the paths above. Those taking the New Normal path developed a taste for outdoor activities and/or have enjoyed the flexibility and convenience of a home gym. Many taking the Hybrid path are mixing in classes because they miss the socializing and community that they used to get at their gym. (Fun fact: crossfit gyms have been posting foot traffic figures consistently above other types of gyms for the last several months, likely due to their community-based set up. It’s hard to replicate this at home!)

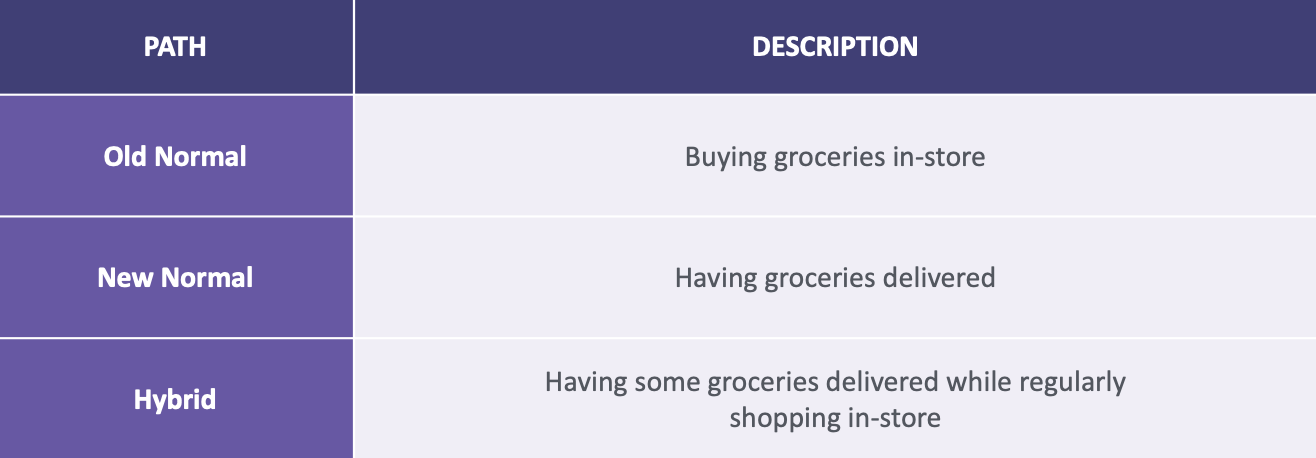

Another good example is grocery shopping:

Personally, my family and I have adopted the Hybrid approach towards grocery shopping. During COVID, we used various food delivery services to replace our in-store grocery shopping. Now that we’re comfortable returning to stores, most of our shopping takes place there. But we’re keeping our weekly CSA box of produce, which we greatly enjoy.

The fact that people are taking three very different approaches as COVID recedes can make things harder for marketers and businesses. Rather than a single, simple ‘return to normal’ consumers are taking one of three paths. And it’s even more complex than that: since many people sticking with their New Normal or adopting a Hybrid approach are doing so because of a newly acquired preference, not out of safety concerns, people might have different approaches for different activities. For example, my household is taking a New Normal approach to exercise (we won’t be rejoining our gym as we’re fully converted to biking) but a Hybrid approach to grocery shopping.

As the COVID threat diminishes, consumer behaviors become more complex, not less

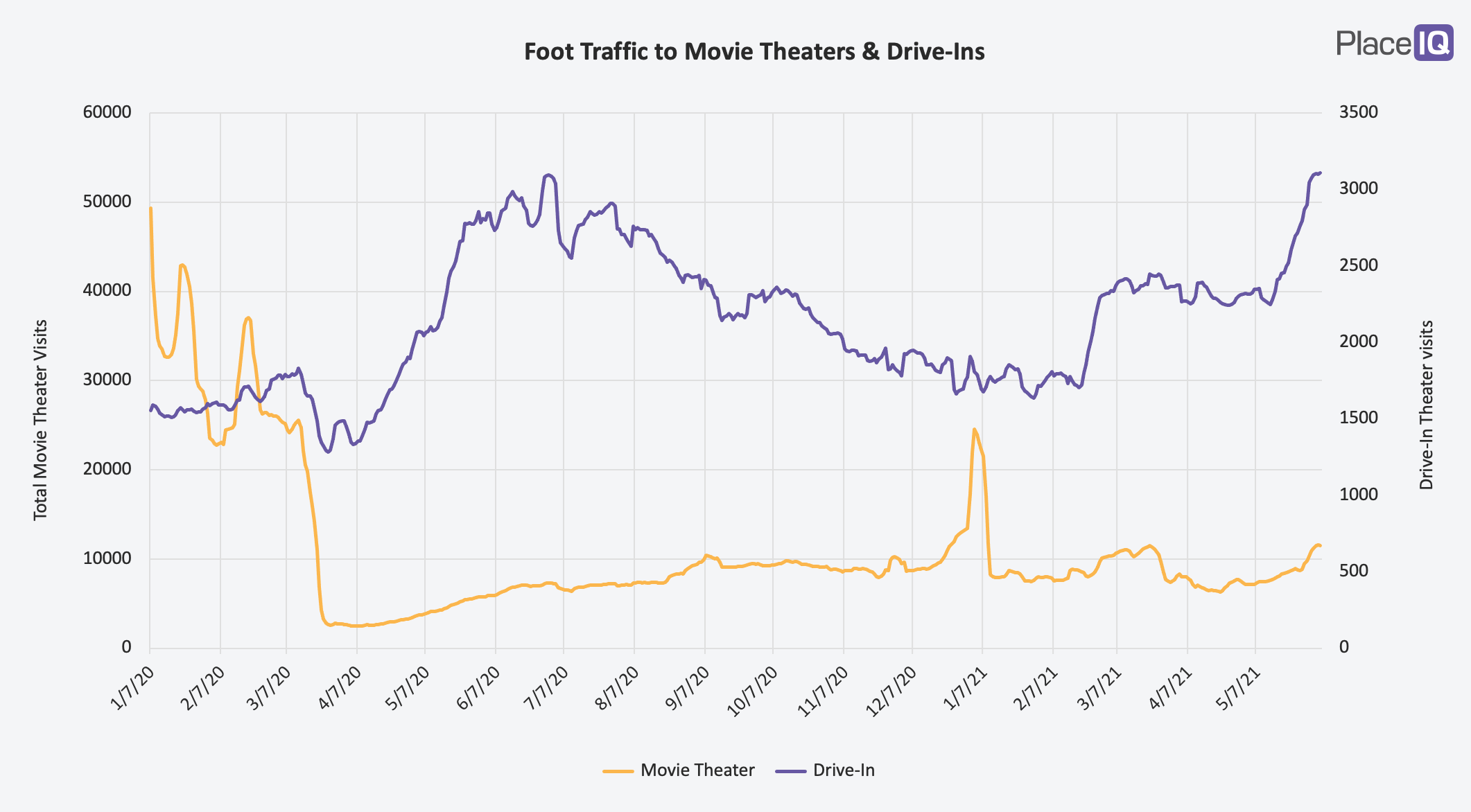

While it can be hard to spot this complexity while looking at aggregate foot traffic figures, some sector’s are showing this mix of behaviors clear as day. For example, take a look at movie theaters:

Please note: each line is plotted on a separate y-axis so we can more easily compare them.

Movie theaters remained shut as we reemerged from our first quarantine in April of 2020. People were both bored from being shut in their homes and worried about catching COVID, so they naturally found their way to drive-in theaters, which enjoyed a bit of a renaissance in 2020. New drive-ins popped up in disused lots, old theaters were cleaned up and reopened and traffic surged. Drive-ins made up more than 80% of movie ticket sales for much of 2020.

As our traffic spiked in February, indoor theaters certainly benefited. Popcorn-movie releases like Mortal Kombat and Godzilla vs. Kong arrived just in time to take advantage of our February spike, but indoor theater traffic is staging a nice consistent march upwards.

However, while indoor theaters are recovering, drive-in theater traffic is spiking like never before. We would have guessed that outdoor traffic would atrophy as indoor traffic returns, but we’re seeing both post and hold onto significant gains. During the pandemic people developed a taste for drive-ins and they see no reason to relent. A Hybrid model — a mix of the Old Normal and New Normal — is taking place for cinemas.

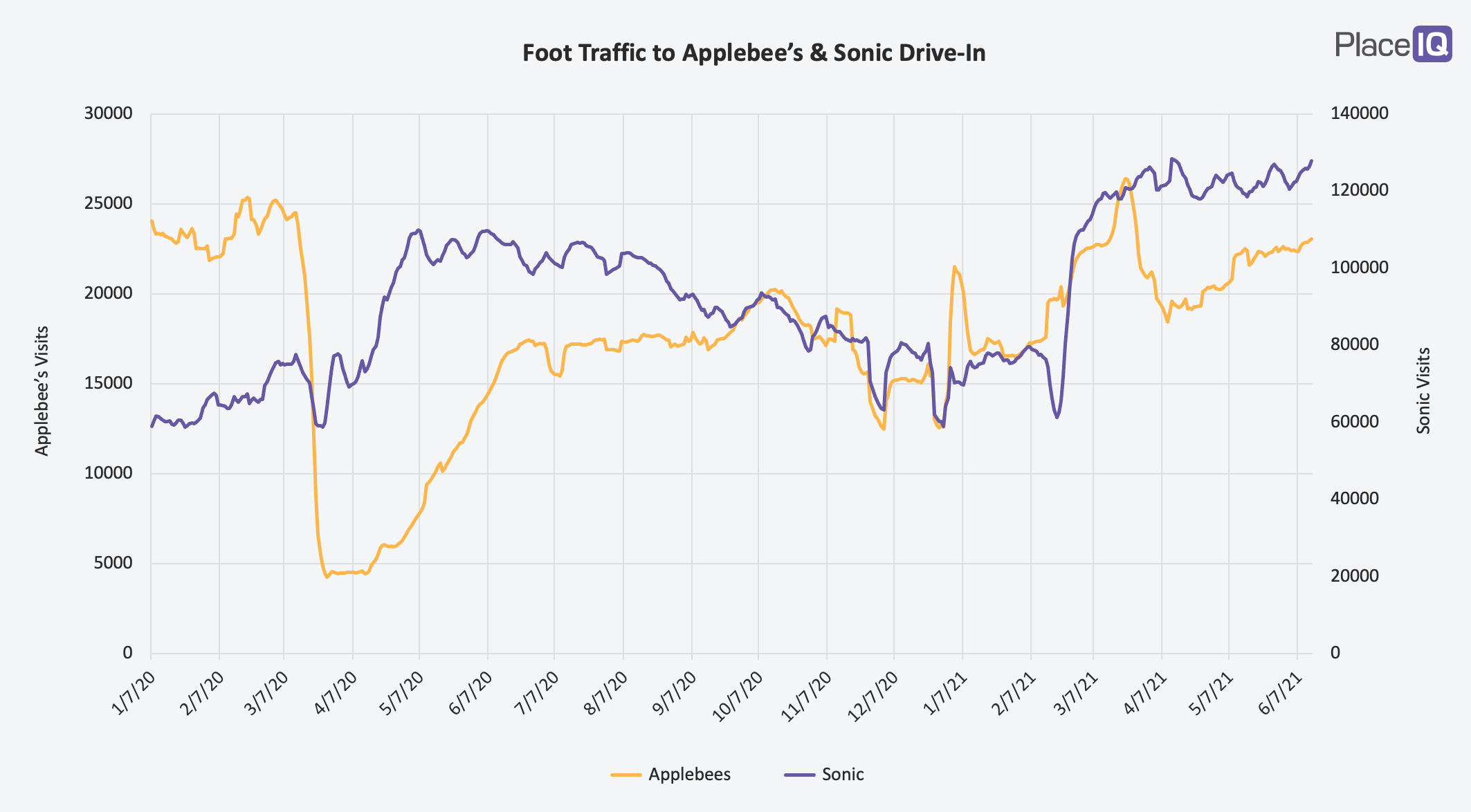

The situation is remarkably similar for another drive-in business which thrived during the pandemic: drive-in restaurants. We’ve frequently touched on Sonic Drive-In’s successes in the Social Distance Tracker, but we fully expected them to have a hard time maintaining their traffic levels as indoor dining reopened. Fortunately for Sonic, our assumption was very wrong:

We’ve included Applebee’s here as an example of indoor dining’s recovery, which has been steadily climbing upwards since February. But look at Sonic: after a traffic dip during Texas’ winter storms, volumes have skyrocketed upwards. Sonic has always been a seasonal business, posting their best figures in the warmer months. This cadence remains but the traffic levels are even higher than the ones we saw during the depths of quarantine.

In dining, we’re seeing an overall Hybrid approach: people are returning to Old Normal behaviors while keeping their New Normal in the mix. In future issues we’ll break this down to see if most customers are adopting this Hybrid model, or if it’s a mix of Old Normal and New Normal individuals balancing each other out. Either way: as COVID abates, consumer complexity is increasing in many sectors, not simply snapping back to old form.

For business leaders and marketing teams looking for a break from COVID-driven complexity, we have bad news. Declining case counts and rising vaccination rates look to be creating new challenges, not simply removing the ones we dealt with in 2020. After having our lives interrupted like never before, consumers are taking multiple paths forward driven by safety and preference, fracturing once stable market segmentations. Behavioral data can illuminate this complexity and make it manageable, turning it from a risk into a potential opportunity to find, retain, or recapture customers as they navigate COVID’s decline.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.