The idea of shops anchored by a price point is an international phenomenon, with Dollar Stores opening up more new locations than any other retail concept in the US and One Pound Shops popular in the UK. In today’s Insight Flash, we compare these “Dollar” Stores across both geographies.

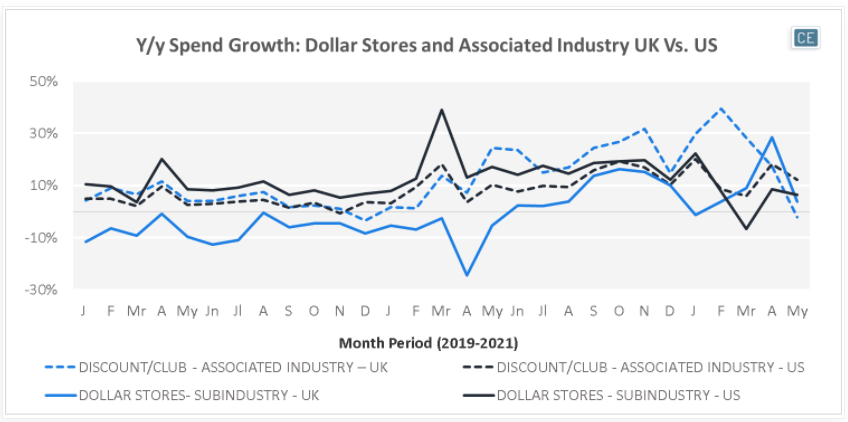

In the US, Dollar Store Growth outpaced the larger Discount/Club industry throughout 2019 and 2020. Since February, however, that growth has slowed and “Discounters” are seeing higher spend growth. In the UK, Dollar Store spend growth lagged behind not only US Dollar Stores, but also other Discount/Club stores through February 2021. In March, the slowdown in US growth allowed UK Dollar Stores to take the geographic lead, and in April and May they eeked out a stronger spend growth rate than UK Discount/Club stores.

Dollar Store Trends

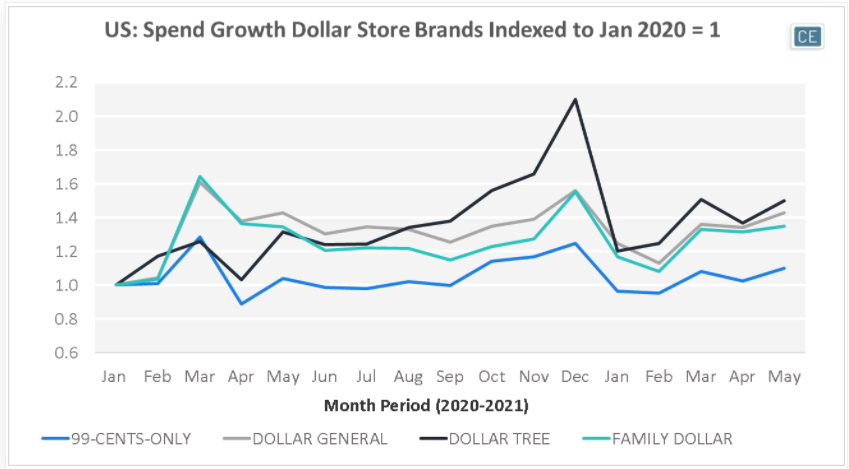

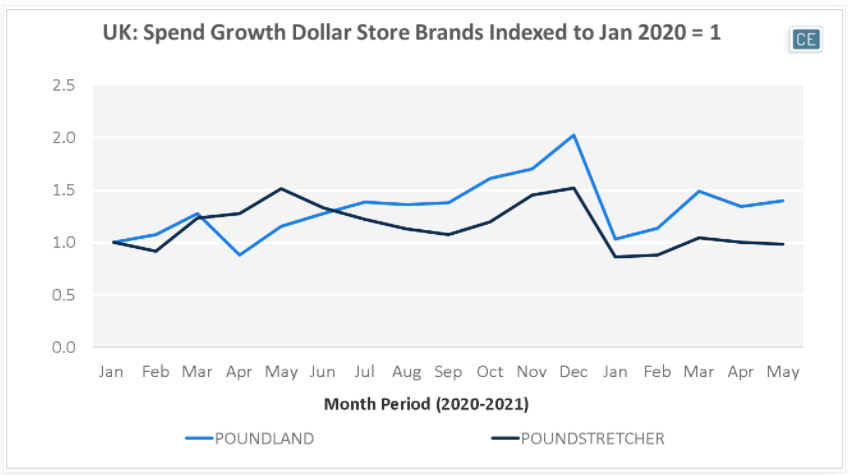

In the US, Dollar Tree has seen the most spend growth (including from new stores) since January 2020, up 50%. This has been closely followed by Dollar General at 43% and Family Dollar at 35%. In the UK, Poundland has been the leader with a 40% growth rate from January 2020, in line with its US counterparts. Poundstrecher has lagged with relatively flat spend since January 2020.

Brand Growth

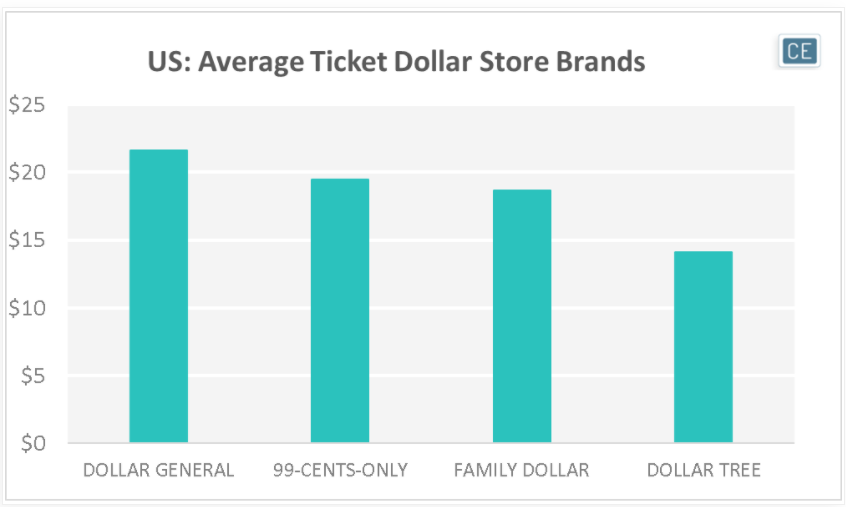

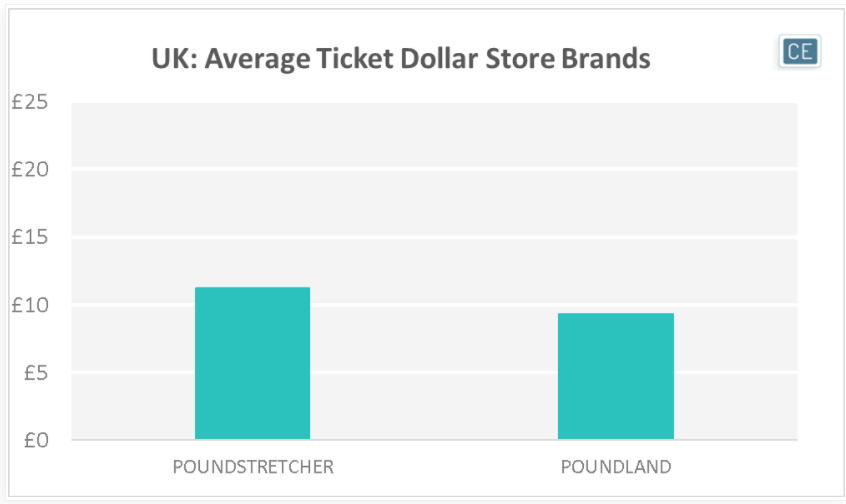

Most items at the chains aren’t actually a dollar or a pound. And as consumers fill their baskets, differences emerge in the average ticket of the total basket for credit and debit card spend. In the US over the last year, Dollar General has had the highest average ticket at $21.62. This is over 50% higher than Dollar Tree with the lowest average basket at $14.09. In the UK, the two main players have closer average tickets, with Poundstrecher at £11.25, only 20% higher than Poundland at £9.31. Interestingly, on a currency-adjusted basis, Poundstrecher’s average ticket is higher than only Dollar Tree in the US, while Poundland’s is lower than any US Dollar Store.

Average Ticket

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.