Dollar General has been accused of causing food deserts in low-income areas. While there is an abundance of anecdotal evidence on this, there has been little empirical evidence. By tracking Dollar General employees and comparing them to traditional grocery store employees, we are able to better understand the relationship between Dollar General and food deserts.

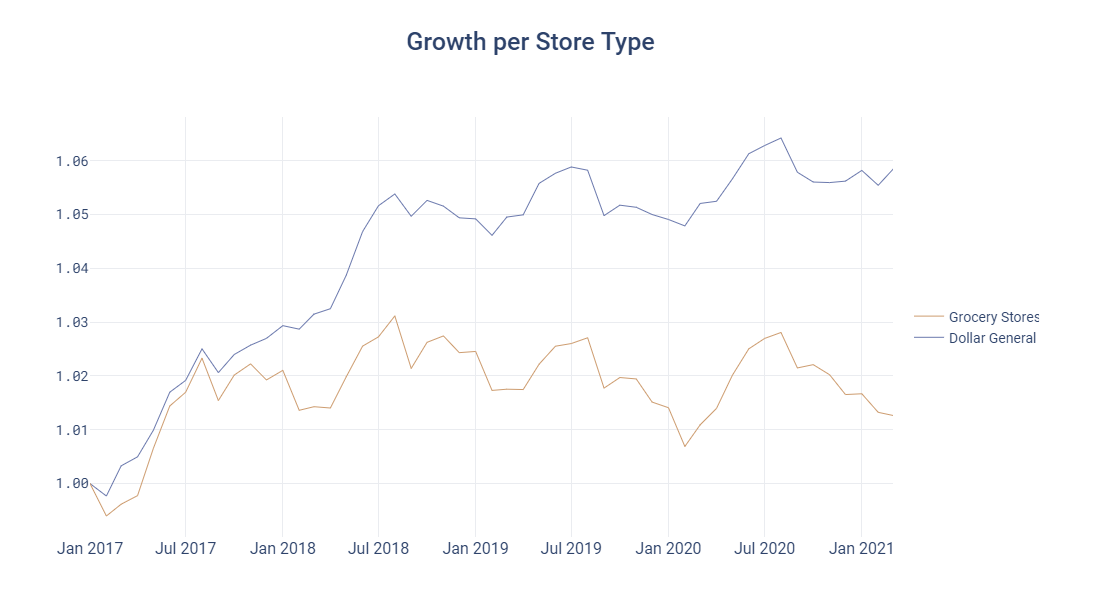

Although both Dollar General and traditional grocery stores have been growing steadily, in recent years, Dollar General has grown at a faster rate:

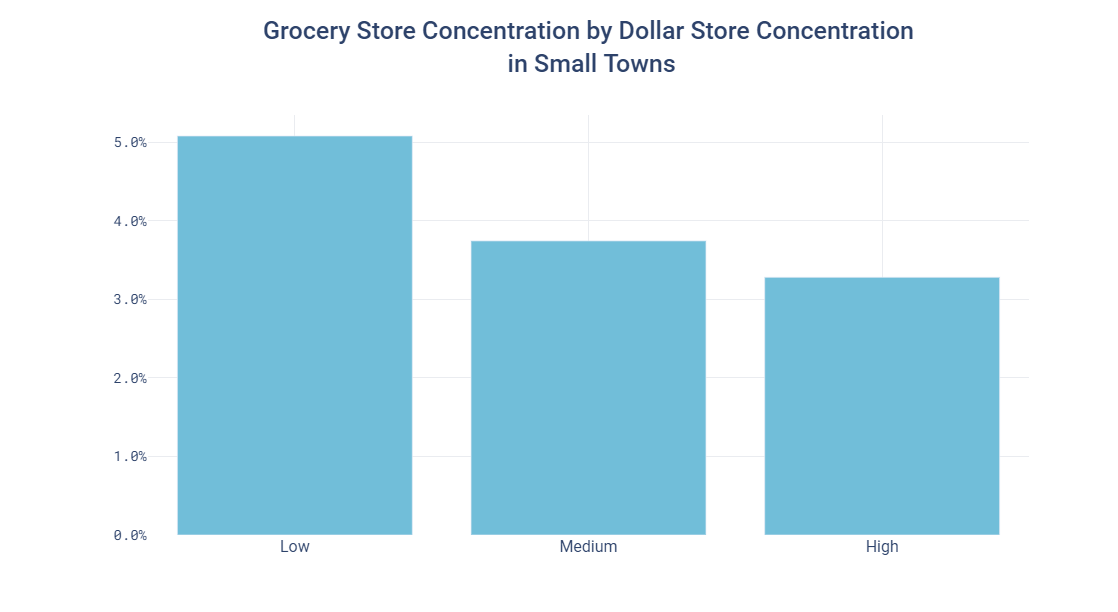

Given the increasing market share of Dollar General, we measure the availability of grocery stores by looking at the ratio of grocery employees to non-grocery employees. If Dollar General is driving grocery stores out of business, we would see lower grocery store employee ratios in places with a higher percentage of Dollar General employees.

In the plot below we see a negative relationship between these two quantities, suggesting that Dollar General stores contribute to the decrease in groceries and the formation of food deserts.

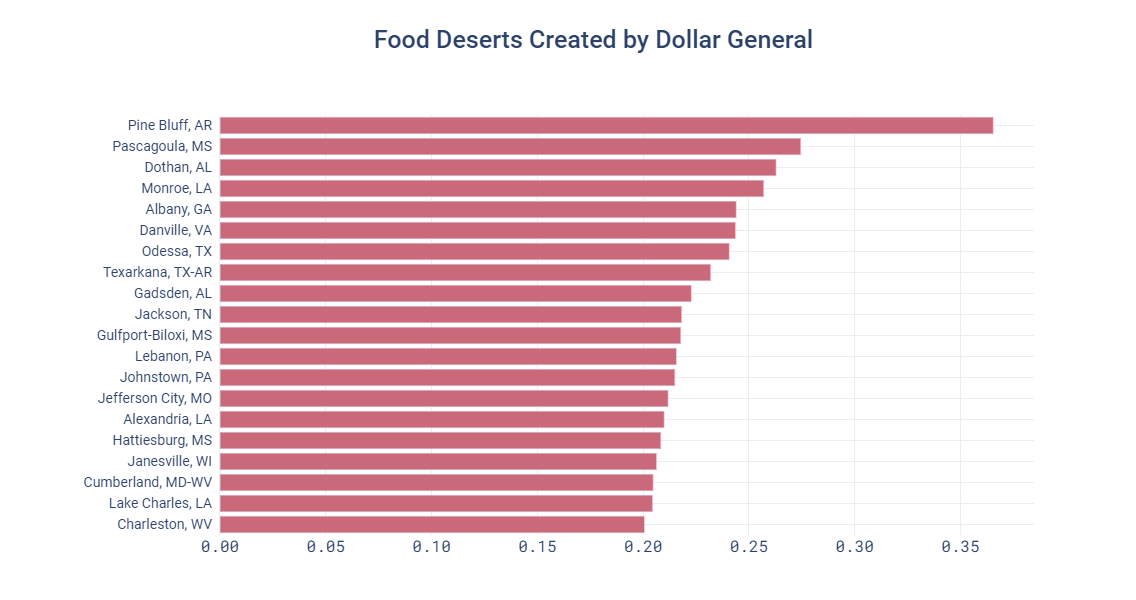

Further, the figure below is a list of MSAs that have the highest ratio of Dollar General employees to grocery store employees, representing the worst cases of food deserts that are being driven by Dollar General stores.

Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.