In this Placer Bytes, we explore the supplement sector’s brick and mortar recovery and dive into the liquor sector’s enduring expansion.

Supplemental Gains

Although brick and mortar health stores took a hit during the pandemic, rising interest in health and wellness led to increased supplement and vitamin use, with many consumers turning to e-commerce channels for their nutritional supplement needs. Now that restrictions have mostly been lifted throughout the United States, we dove into the data to find out – are customers returning to offline chanels for their supplement needs?

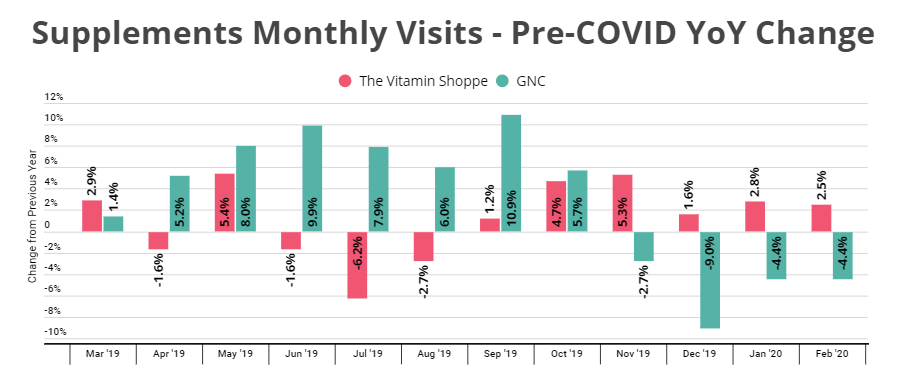

Pre-COVID Trends

Despite the rise of online supplement purchases through leaders like Amazon and iHerb, brick and mortar supplement stores were generally looking well in the year preceding the pandemic. Although performance was somewhat uneven, The Vitamin Shoppe and GNC still saw an overall increase in visits most months compared to the same month in the previous years, with monthly visits rising an average of 1.2% for The Vitamin Shoppe and 2.9% for GNC in the year immediately preceding the pandemic.

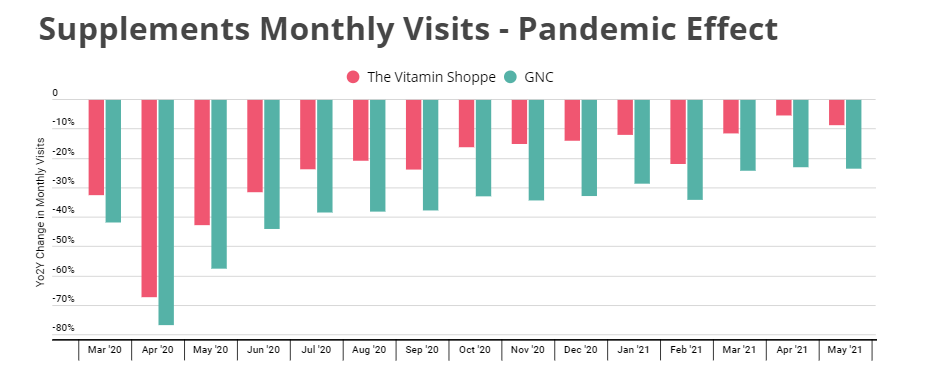

Pandemic Hardships, Rising Recovery?

Yet, since the pandemic’s retail effects began in the United States in March 2020, the brick and mortar supplement sector has been particularly hard hit. Even though supplement sales rose during the pandemic as Americans tried to do whatever it took to boost their immune systems and keep the virus at bay, the numbers of visitors to The Vitamin Shoppe and GNC stores dropped dramatically in April 2020 – 67.0% and 76.7% respectively – as stores closed throughout the country.

Now, the Vitamin Shoppe appears to be on the road to recovery, even reaching single digit visit gaps of 5.3% and 8.6% in April and May, respectively, when compared to the same months in two years prior.

But GNC is still struggling. Although the brand seems to be on an upward trajectory, with March-May average monthly visit gap shrinking to -23.5% from an average visit gap of -31.7% in December-February and -34.9% in September-November compared to the same months two years prior, there is still a long way to go to return to pre-pandemic levels. Though it is worth noting that GNC declared bankruptcy in June 2020 and announced that it will be closing up to 20% of its stores. Given the continued rise in consumer interest in wellness, along with the return to malls, the right sizing efforts could lead to a strong overall comeback.

Liquor Sector Still Going Strong

Alcohol consumption surged during the pandemic. Now that COVID is hopefully on its way to becoming a thing of the past, we surveyed the sector to find out – have pre-pandemic alcohol purchasing patterns returned?

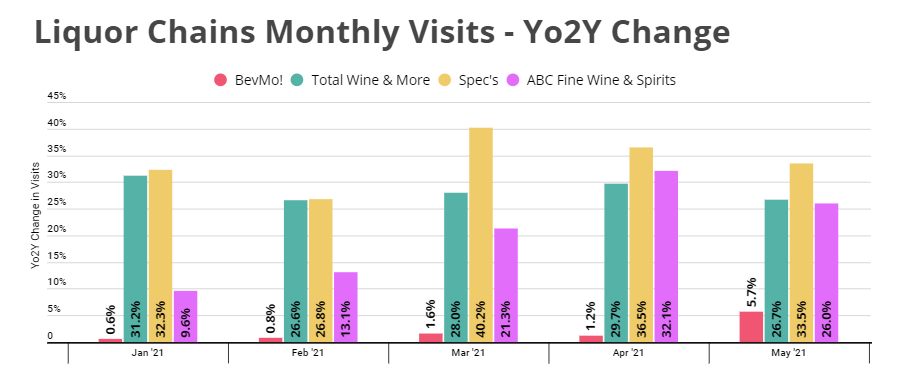

The increase in retail alcohol purchases over COVID was often attributed to the stress of life in the shadow of a global pandemic. But the economic recovery, easing of restrictions, and renewed opportunities to patronize bars and restaurants does not seem to be weakening the sector. An analysis of three regional chains (BevMo! on the West Coast and Arizona, Spec’s in Texas, and ABC Fine Wine & Spirits in Florida) and a national chain (Total Wine & More) indicate that alcohol sales are still very much on the rise.

Comparing visits in January through May of 2021 to the same months in 2019 shows that Spec’s monthly visits rose by an average of 33.9%, followed by Total Wine & More, ABC Fine Wine & Spirits, and BevMo!, with average increases of 28.4%, 20.4%, and 2.0%, respectively.

BevMo!’s relatively weak performance could be due to its bet on e-commerce in the early days of the pandemic, culminating with its sale to digital convenience store GoPuff in late 2020. And indeed, with restrictions lifted and most customers back to their pre-pandemic routines, visits to BevMo!’s have also taken off – from 0.6% increase in visits in January 2021 to a 5.7% increase in May when compared to the same months two years prior.

No COVID? No Problem!

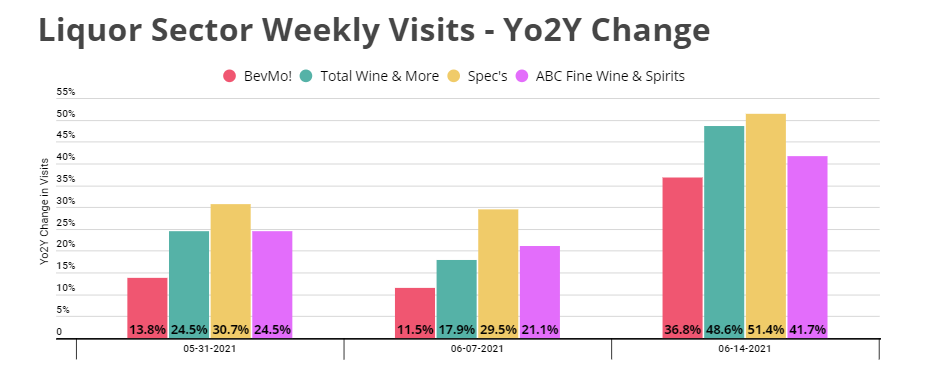

Comparing weekly visits in the first half of June with the same period in 2019 continues to reveal double-digits visit increases across the board, with no sign of slowing down: The first three weeks of June brought an average increase in weekly visits of 20.7%, 30.3%, 37.2%, and 41.7% for BevMo!, Total Wine & More, Spec’s, and ABC Fine Wine & Spirits, respectively.

BevMo! in particular has recovered from its offline pandemic slump, with early data indicating that June might be its strongest month yet since the beginning of the year. It seems, then, that Americans’ heightened alcohol consumption is here to stay – at least for now.

Will offline alcohol sales continue to rise? Will GNC make a comeback?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.