Source: https://str.com/data-insights-blog/hotel-performance-recovery-china-isnt-just-faster-its-different

Like many markets worldwide, Mainland China has worked diligently to establish a new, albeit temporary, normal. That has included tight border controls, enhanced testing measures and small but strict lockdowns to prevent new surges in COVID caseloads. As a result, travel in China has quickly rebounded in both the leisure and business travel segments. Sure, performance declines have occurred during lockdowns, but rebounds have quickly followed, and through the first half of 2021, hotel performance has remained pretty much near normal based on the market’s historical trends.

At the same time, China’s somewhat unique mitigation efforts have produced hotel performance recovery that differs significantly from many parts of the world. That difference is well represented when analyzing the market’s segments.

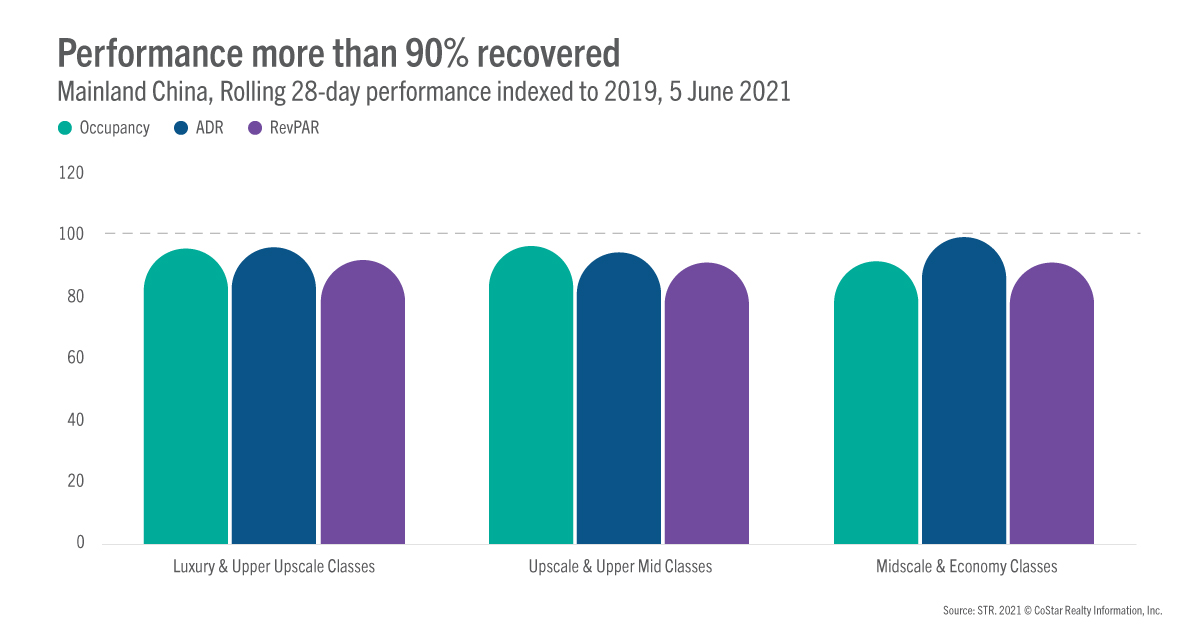

Recovery strong across all classes

The resilience of Midscale and Economy hotels headlined global hospitality news in 2020, as essential workers and other sources of essential demand chose budget-friendly options for their hotel stays. More recently in 2021, lightened restrictions have helped to improve performance across the other segments. Luxury and Upper Upscale hotels, in particular, have struggled to rebound from the pandemic due to their reliance on business and group demand, which has yet to return in many regions. In China, however, the gap between low- and high-end performance is nearly non-existent.

Border closures have been one of the key factors in driving high-end hotel recovery. Prior to the pandemic, high-spending travelers opted to vacation abroad, but as the pandemic hindered outbound travel, these consumers searched instead for domestic alternatives. The shift into domestic travel stimulated Luxury and Upper Upscale hotel demand, especially in resorts surrounding major metros, particularly in the Yangtze River Delta and Pearl River Delta.

The increased domestic leisure demand led to high hotel occupancy and increased pricing power for China’s most luxurious properties, but leisure travelers were not the only segment powering demand. Business travel and big events have returned to China, reflecting both company and event planner confidence in the government’s ability to control and contain the virus.

The return of rates

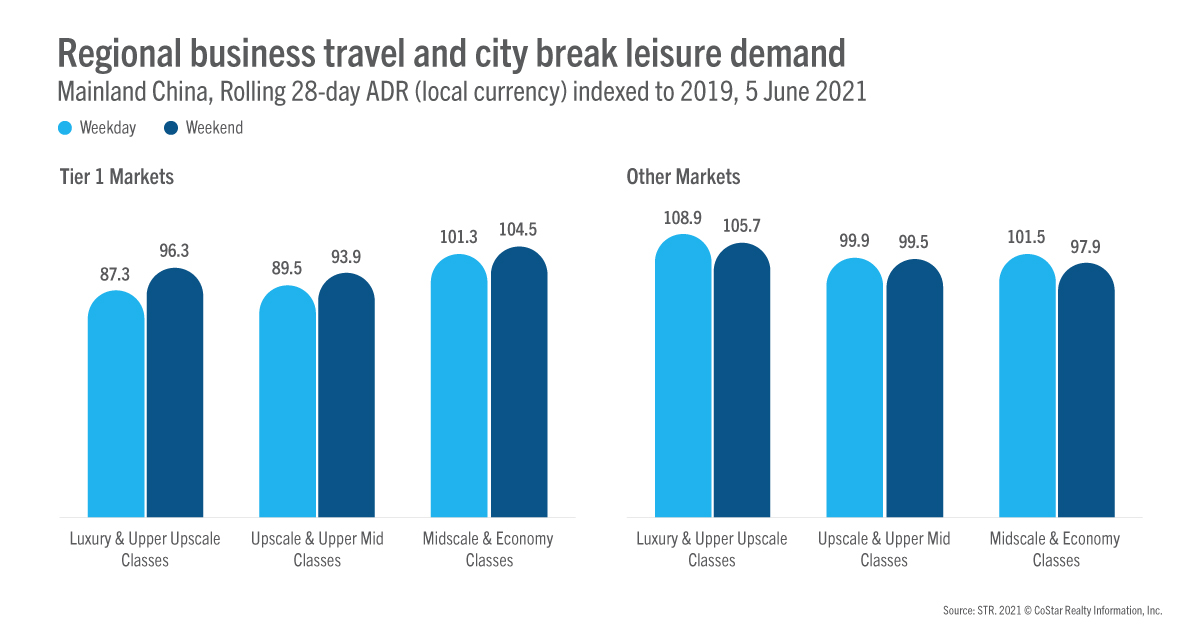

Reduced restrictions and low caseloads lifted Mainland China hotel occupancy to nearly normal levels by August 2020, with a short, sharp “V” in recovery as specific markets locked down and reopened. However, occupancy has not been the only metric to recover in Mainland China: In an unexpected turn of events, average daily rate (ADR) has recovered just as swiftly as occupancy.

ADR traditionally recovers from downturns much slower than occupancy, as hoteliers walk the balance between trying to induce demand and raising prices. With domestic demand guaranteed and the return of both business and leisure travel, Mainland China has avoided this struggle, although the manner in which rates have returned suggests some shifts in traveler patterns.

Even as travelers in much of the world avoids major cities, weekend rates in China’s four Tier 1 markets have rebounded faster than weekday rates across all class segments, pointing to leisure travelers heading into the major metros for a weekend getaway.

Meanwhile in markets outside of Beijing, Guangzhou, Shanghai, and Shenzhen, weekday demand has skyrocketed across the classes, a phenomenon first seen earlier in 2020, as businesses first considered it safer and later more cost effective to move corporate and group events to smaller, more suburban destinations.

Conclusion

Mainland China first emerged as the frontrunner in the race to recovery in mid-2020, after an intense and lengthy lockdown all but eradicated COVID-19. The market’s sustained strong performance and shifts in traveler patterns and preferences continue to set the market apart from the rest of the world in 2021.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.