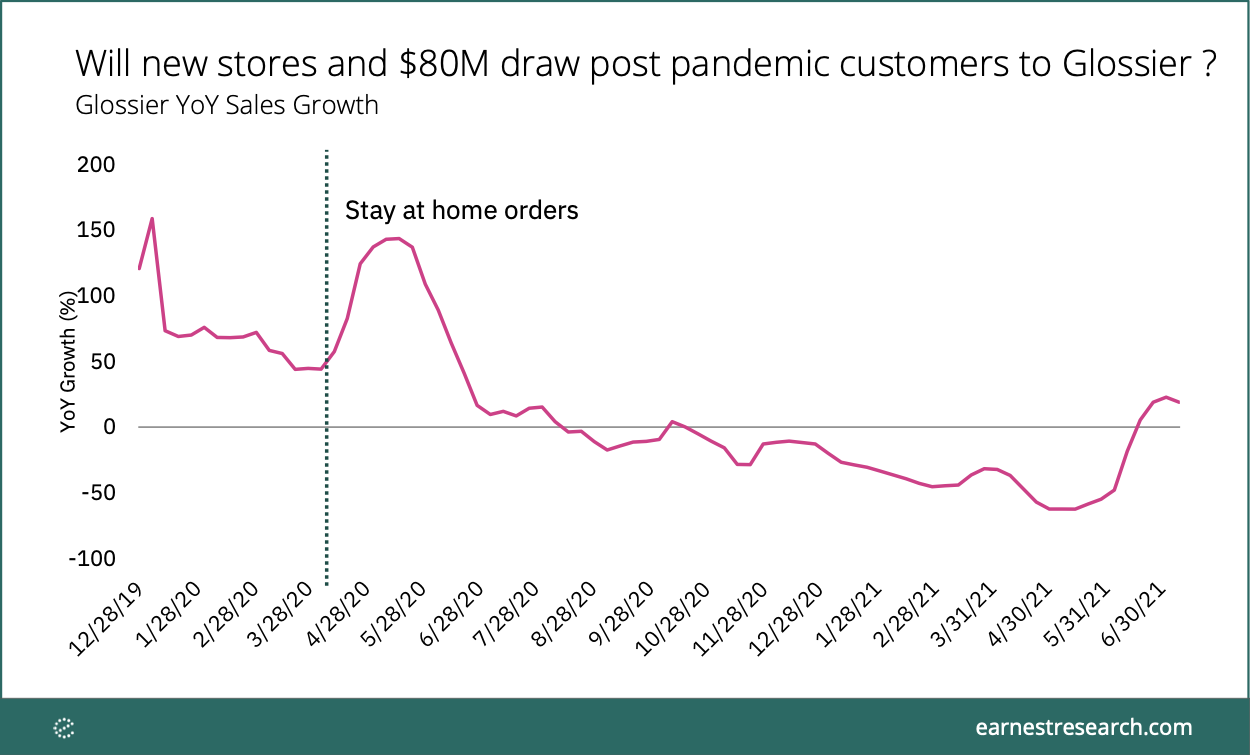

Will new stores and $80M draw post-pandemic customers to Glossier?

With news that Glossier recently closed a Series E round of $80M (led by Lone Pine Capital) now bringing the DTC company’s valuation to $1.2 billion, we looked at our spend data to see how the beauty brand has fared throughout the pandemic and beyond.

Glossier YoY sales peaked in mid-May growing 143%, coinciding with stay-at-home orders that left many shoppers with online marketplaces as the only place to checkout. As COVID cases continued to grow, Glossier’s sales declined, hitting negative growth by late summer 2020, perhaps a nod to the sweatpants and no makeup look of the WFH employee.

The company said they’ll use the new influx of cash to focus on retail expansion in select cities, a pivot from a mostly online DTC business model. They join an increasing roster of DTC brands aiming for exit strategies through IPOs and SPACs. As offices begin welcoming back employees as early as September, we’ll be keeping an eye on consumers’ makeup purchases and how back-to-office impacts the beauty industry overall.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.