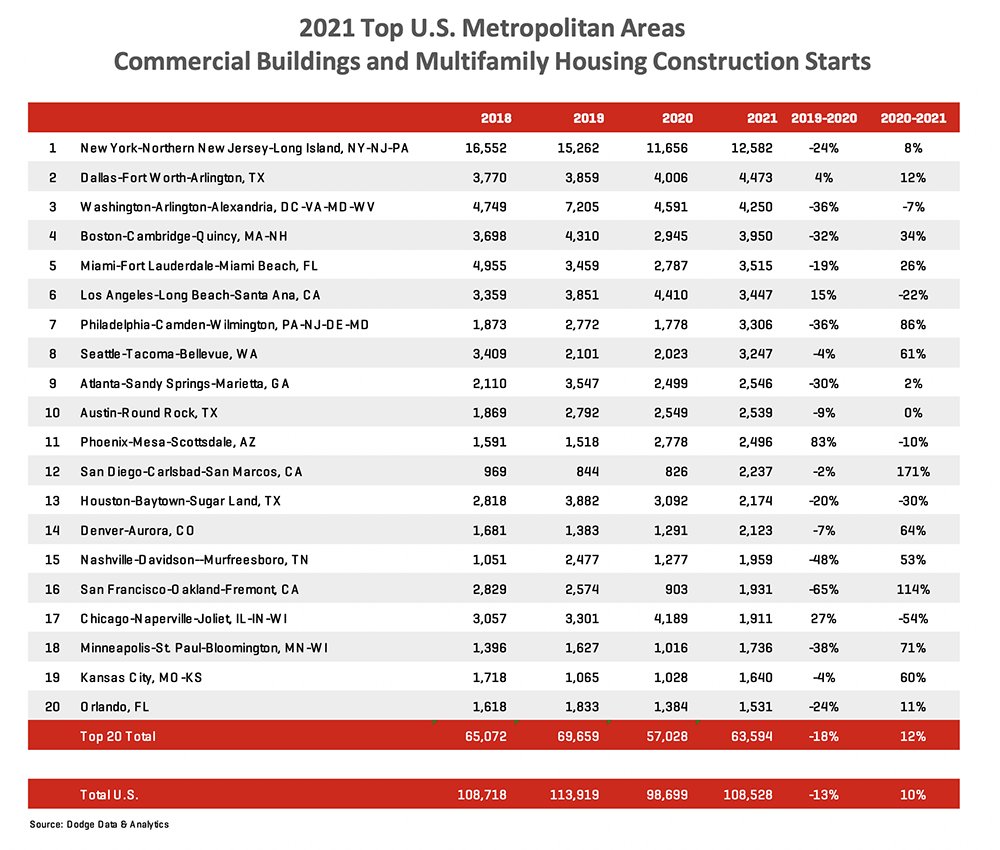

The value of commercial and multifamily starts in the top 20 metropolitan areas of the U.S. gained 12% during the first six months of 2021 relative to the first half of 2020, according to Dodge Data & Analytics. Nationally, commercial and multifamily construction starts were 10% higher on a year-to-date basis through six months. In the top 10 metro areas, commercial and multifamily construction starts were up 12% through six months, with only three metro areas – Washington DC, Los Angeles CA, and Austin TX – posting declines. In the second-largest group of metro areas (those ranked 11 through 20), starts improved 11% on a year-to-date basis, with only Phoenix AZ, Houston TX, and Chicago IL losing ground.

The early months of the pandemic led to construction moratoriums and project delays in many of the country’s largest cities, resulting in very low levels of activity in April and May 2020. Additional insight on the health of these markets can be ascertained by comparing the first six months of 2021 to the same period in 2019 – before the pandemic. On that basis, commercial and multifamily starts were down 9% in the top 20 metro areas. At the same time, nationally, they were 5% lower, indicating that the pandemic affected construction activity more dearly in larger cities. In the top 10 metro areas, commercial and multifamily starts were 20% lower than 2019 through six months, while in metro areas ranked 11 through 20, they were 13% lower.

The New York metropolitan area was the top market for commercial and multifamily starts through six months at $12.6 billion, an 8% increase from the first half of 2020. The Dallas, TX metropolitan area was in second place for commercial and multifamily starts, totaling $4.5 billion through six months, a 12% gain over 2020. The Washington DC metro area was ranked third through six months but lost 7% to $4.3 billion. The remaining top 10 metropolitan areas through the first half of 2021 were:

In summary, the top 10 metropolitan areas accounted for 40% of all commercial and multifamily starts in the United States – the same share as in the first six months of 2020.

The second largest metro group included:

This group of metro areas accounted for 18% of all commercial and multifamily starts in the United States through six months, the same share as in the previous year.

The commercial and multifamily total is comprised of office buildings, stores, hotels, warehouses, commercial garages, and multifamily housing. Not included in this ranking are institutional projects (e.g., educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works, and electric utilities/gas plants.

Through the first six months of 2021, total U.S. commercial and multifamily building starts rose 10% to $108.5 billion from the same period of 2020. Nationally, commercial starts were up 3% to $56.1 billion, while multifamily starts were 19% higher at $52.4 billion on a year-to-date basis. Within the top 10 metro areas, commercial building starts were 1% higher to $20.6 billion through six months, while multifamily building starts were up 23% to $23.3 billion. Within the second largest group of metropolitan areas, commercial building starts were 3% lower to $9.8 billion through six months, while multifamily starts totaled $9.9 billion and were 30% higher.

“The recovery from the COVID-19 pandemic has begun but is very uneven,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “Commercial construction has been buoyed by strength in the warehouse sector as large e-commerce companies build out their logistics infrastructure while office, retail, and hotel activity is subdued. Multifamily starts, meanwhile, have rebounded solidly following a weak 2020. The dollar value of commercial and multifamily starts should continue to improve over the coming six months; however, growth will remain muted due to high material prices and a shortage of skilled labor in the construction sector.”

In the New York, NY metropolitan area, commercial and multifamily starts were 8% higher through six months to $12.6 billion but remains 18% below the first six months of 2019. Multifamily starts were up 11% through six months. The largest multifamily projects to begin through the first half of 2021 were the $500 million 625 Fulton St mixed-use projects, the $349 million first phase of the Bronx Point mixed-use project, and the $242 million National Urban League mixed-use building. On a year-to-date basis, commercial starts were 4% higher, led by gains in warehouse and parking structures, while office and hotel starts were lower than the first six months of 2020. The largest commercial projects to get underway through six months were the $1.2 billion Terminal Warehouse conversion, a $316 million Amazon warehouse, and Two Penn Plaza’s $160 million renovation.

Commercial and multifamily starts in the Dallas, TX metro area were up 12% through six months at $4.5 billion and have also eclipsed the mark set during the first six months of 2019. Commercial starts rose 2% on a year-to-date basis, driven by gains in warehouse, office, and parking structures, while retail and hotel starts were down. The largest commercial projects to get started through the first six months of 2020 were the $150 million Hardwood No. 14 office tower, the $85 million JW Marriott hotel, and the $60 million Facebook Data Center Building 14. Multifamily starts were 30% higher on a year-to-date basis. The largest multifamily projects to get underway six months into 2021 were the $250 million Maple Terrace residential building, the $100 Urby residential tower, and the $90 million North Beckley Avenue apartments.

In the Washington, DC metropolitan area, commercial and multifamily construction starts dropped 7% to $4.3 billion on a year-to-date basis through six months but were down 41% from the first six months of 2019. Multifamily starts rose 12% through six months. The largest multifamily projects to get underway were the $267 million 1851 S Bell South and North residences, the $230 million Mather Senior Living Facility, and the $194 million Holiday Inn Rosslyn residential development. Commercial starts were 22% lower through six months, with only parking structures showing improvement from last year. The largest commercial projects to get started were the $450 million Sterling EdgeCore data center, the $100 million third phase of the Cannon House office building, and the $100 million Dulles Discovery 5 office building.

Boston, MA’s commercial and multifamily building starts posted a 34% gain during the first six months of the year, climbing to $4.0 billion, but they remain 8% below the first six months of 2019. Commercial starts have been particularly strong, increasing 47% with gains in all commercial sectors except the hotel sector. The largest commercial projects to get underway through the first half were the $466 million Amazon North Andover fulfillment center, the $225 million 171 Dartmouth St office development, and the $175 million 40 Thorndike office building. Multifamily starts meanwhile, were up 22%. The largest multifamily buildings to get started were the $200 million DOT Block residences, the $165 million Union Square residential tower, and the $165 million SCAPE Boylston residential building.

Commercial and multifamily starts in the Miami, FL metropolitan area rose 26% through six months to $3.5 billion and were 2% higher than the first half of 2019. Multifamily starts were 38% higher through six months. The largest multifamily projects to get started through six months were the $250 million Five Park condominiums and apartments, the $200 million Downtown 1st apartment building, and the $164 million Natiivo mixed-use building. Commercial starts were 11% higher, driven by gains in parking and retail buildings, while hotel, office, and warehouse all pulled back. The largest commercial projects to get started were the $122 million Bridge Point warehouse project, the $75 million Boca Raton Resort, and the $65 million Collection Jaguar & Land Rover dealership.

Los Angeles, CA commercial and multifamily starts were down 22% to $3.4 billion through the first six months of 2021 and were down 10% from the first half of 2019. Commercial starts were 47% off on a year-to-date basis. However, this is entirely due to the office and hotel sectors which saw several large projects break ground in early 2020. All other commercial sectors were above water on a year-to-date basis. The largest commercial projects to get underway during the first half of 2020 were the $100 million Ovation Hollywood mixed-use complex, the $66 million second phase of the Spectrum Terrace office campus, and the $49 million Exposition 3 office building. Multifamily starts were up 6% through five months. The largest multifamily buildings to get underway during the first half were the $250 million 520 S Mateo Arts District mixed-use building, the $215 million Broadway Block mixed-use building, and the $125 million The Line at Burbank apartments.

In Philadelphia, PA, commercial and multifamily starts were up 86% to $3.3 billion on a year-to-date basis and were 19% higher than the first half of 2019. Multifamily starts were up 142% through six months. The largest multifamily projects started through June were the $287 million Schuylkill Yards West Tower, the $100 million 5th & Spring Garden mixed-use, and the $100 million 19th & Sansom apartments. Commercial starts, meanwhile, were up 43% through six months. All commercial sectors posted solid gains over 2020, with the largest increases seen in warehouses and offices. The largest commercial projects to start were the $143 Amazon warehouse, the $99 million Port Logistics Center at Logan warehouse project, and the $95 million Keystone Trade Center Building 1.

Seattle, WA commercial and multifamily construction starts were 61% higher at $3.2 billion through six months and were 54% higher through the first half of 2019. Commercial starts were up 69% due to strength in the office and warehouse sectors, while hotel and parking posted declines. The largest commercial projects to get underway were the $355 million Project Roxy Amazon distribution center, the $325 million Amazon Bellevue 600 Tower One office project, and the $270 million The Eight office project. Multifamily starts were 48% higher through the first half of 2020. The largest multifamily projects to get underway were the $150 million multifamily portion of the Block 37 Google Campus project, the $131 million First Light mixed-use project, and the $90 million U District mixed-use project.

In Atlanta, GA, commercial and multifamily starts were up 2% to $2.5 billion but remain 28% below the first half of 2019. Multifamily starts were down 7% through six months. The largest multifamily projects to get started during the first half of 2021 were the $73 million 1015 Boulevard mixed-use project, the $67 million Townes of Auburn townhouses, and the $58 million Verge apartments. Commercial starts, meanwhile, were 9% higher through six months. The hotel, retail, and warehouse sectors were all showing gains through six months, while the parking and office sectors were down. The largest commercial projects to get started through six months were the $271 million Signia Hilton Hotel at the Georgia World Congress Center, the $100 million 222 Mitchell Street Redevelopment, and the $59 million Northwest 75 Logistics Center Building B.

Commercial and multifamily building starts in Austin, TX, were down less than one percent through six months and were 9% below the first half of 2019. Commercial starts were 39% lower, with only stores showing growth through six months. The largest commercial projects to get started were the $75 million Applied Material Logistics Warehouse, the $62 million Amazon SAT6 distribution facility, and the $27 million Texas Bankers Association headquarters building. Multifamily building starts were 46% higher through six months. The largest multifamily structures to get underway were the $250 million Waller Apartments, the $232 million Travis Residential Tower Building 1, and the $150 million Hanover Brazos Street Apartments.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.