It’s not news that B2B advertisers were forced to switch to digital marketing advertising last year.

With few print magazines being delivered to offices and the lack of in-person events, marketers were forced to redirect their marketing resources to new channels.

Print used to be a huge source of advertising investment in the B2B space—but as pandemic restrictions ease, will we see spending return to previous levels?

Digital interactions are more important for B2B companies now

B2B brands were slower than B2C brands to enter the digital advertising space—but the pandemic forced companies to quickly change their ways.

According to Google, 45% of B2B brands began to advertise digitally for the first time last year. Brands recognized that their buyers relied on web interactions and, with few other options, this is where they needed to be in order to build their brand and drive revenue.

At the same time, brands slashed their marketing budgets amid supply chain disruptions and economic uncertainty. Digital promised to be a more cost-effective way to reach prospects compared to traditional showy in-person experiences.

Even though B2B companies were new to the space, they were able to get over the initial learning curve. A McKinsey report found that B2B companies now perceive “digital interactions as two to three times more important to their customers than traditional sales interactions.”

Using digital technology, marketers can identify intent data to identify where customers are at in their buying journey. With these insights, marketers can develop better email and cross-channel campaigns for different personas and their stages of the funnel.

Tools like AI-powered chatbots and account-based marketing solutions power personalization in a more efficient way than traditional print or event-based advertising methods.

As digital advertising becomes a mainstay of B2B marketing, new technologies are quickly coming to market. Even CTV advertising, typically reserved for B2C brands, is now being used by B2B marketers.

Prior to 2020, print was where B2B brands invested most of their advertising spend. Even though digital has proved itself, is their space for both digital and print?

MediaRadar Insights

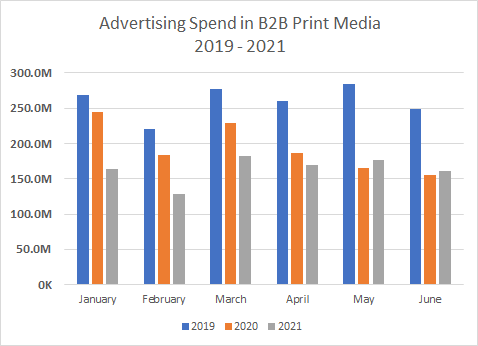

In 2019 and pre-pandemic 2020 (January 2019 – February 2020), print ad spend accounted for 75% of all advertising spend in B2B media.

Now, print share is down to 43% of all advertising spending in the B2B space (using data from January to June of 2021). It isn’t even close to pre-pandemic levels.

Between January and June of 2019 brands spent $1.6 billion in print advertising which fell to $1.1billion in 2020 and $979 million in 2021.

Though there is a slight yearly increase in print ad spend in May and June this year, this increase is not enough to be considered a ‘recovery.’ Print spending is still significantly lower than levels in 2019.

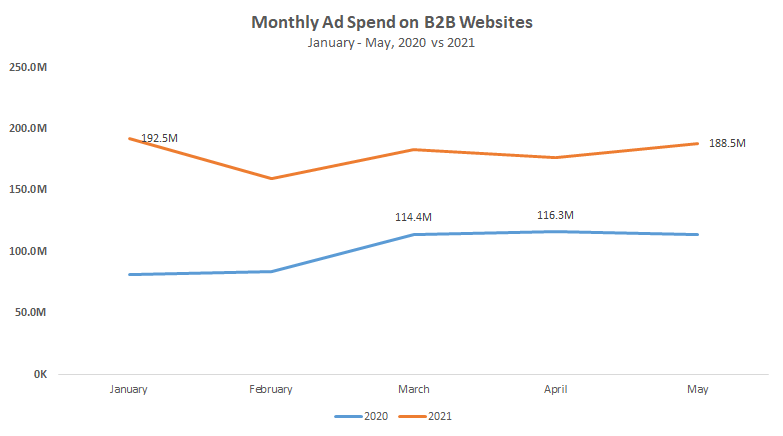

However, the increased spend in digital advertising did not completely offset the loss seen in print. Digital ad spending increased from $512 million in 2019, to $621 million in 2020, to $1 billion in 2021 (all ad spend from January – June).

Looking at months January through June (2019-2021) there was a loss of 8.1k print advertisers.

Meanwhile, digital retained 12.8k advertisers over the same period and added 22.7k new advertisers into the B2B space. Retention and loyalty aren’t the main drivers of increased ad spend in the digital format, but new advertisers who are breaking into the B2B space are.

As the number of digital advertisers continues to climb quickly, print is only losing advertisers. It appears the shift to digital in the B2B space is here to stay.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.