The pandemic has been tough for department stores. Brands that were already struggling to adapt to the role of e-commerce and changing consumer preferences were pushed over the edge, while other department stores were forced to shed stores to stay in the game. Neiman Marcus, JCPenney, and Lord & Taylor filed for bankruptcy, joining their peers Sears and Barney’s New York that had filed for bankruptcy in 2018 and 2019, respectively. Macy’s and Nordstrom announced plans to permanently shutter several locations in an attempt to optimize their store fleet.

But is there a better future on the horizon?

Visits Rising Back

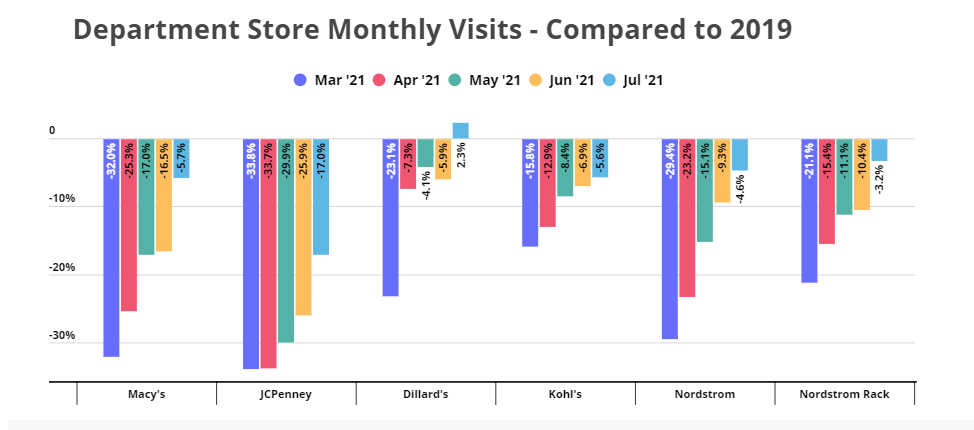

Looking at year-over-two-year foot traffic numbers provides a real reason to remain optimistic about the futures of these brands. Almost all the department stores analyzed managed to narrow their visit gaps significantly in July and are nearing 2019 foot traffic levels, while Dillard’s actually saw a 2.3% increase in visits compared to July 2019. And these brands are expected to get a further increase in visits in August with the start of Back-to-School shopping season, with Nordstrom likely enjoying an even larger boost thanks to its anniversary sale.

And while visits to JCPenney are still significantly lower than they were in 2019, the visit gap could be a product of the numerous stores the brand closed since filing for bankruptcy and less reflective of a drop in visits to the remaining stores.

Given the change in store numbers between 2019 and 2021 for many of these chains, a change in visits alone can only give us a partial view of the department store recovery. To complete the picture, we dove into some customer behavior data to understand how customers’ attitudes towards department stores have changed since the pandemic.

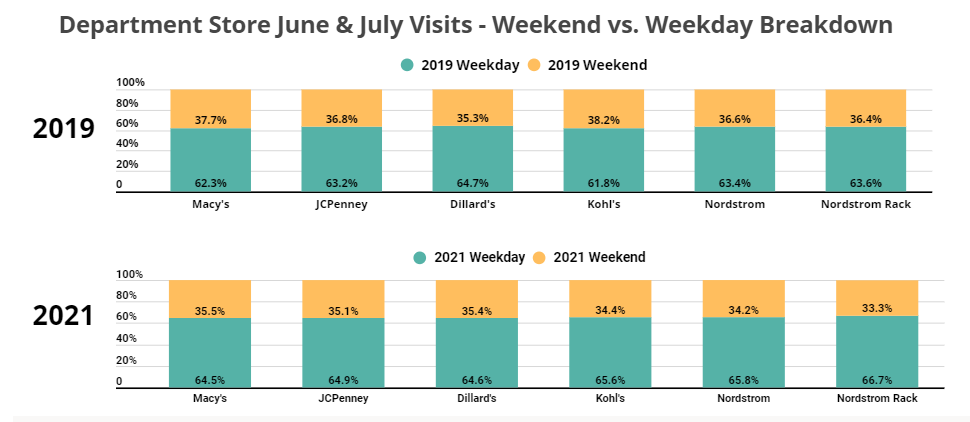

Biggest Decrease in Weekend Visits

It seems that consumer behavior with regards to department stores is slower to return to normal than in other sectors. The share of weekend visits compared to weekday visits is still lower across the board when comparing June and July 2021 to June and July 2019. Much of this is likely attributable to a slow but steady return to pre-pandemic behavior – indicating that as these behaviors ‘normalize’ the recovery could be given an added boost.

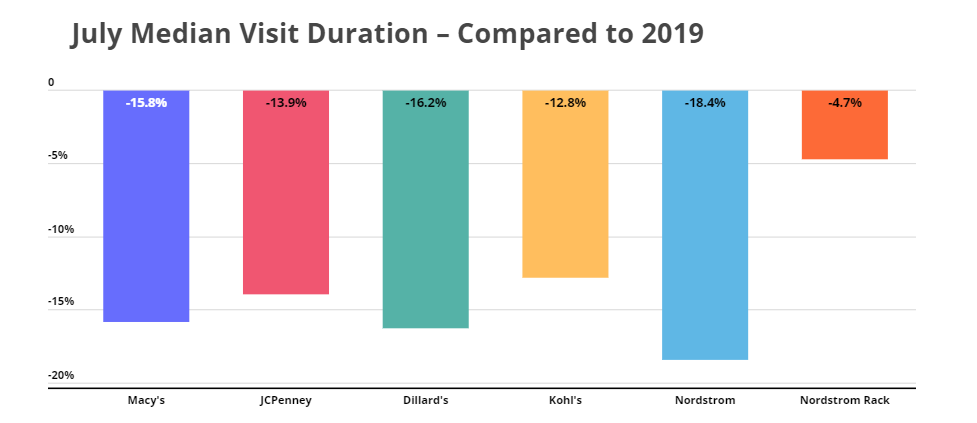

Median Visit Duration Falls Across the Board

Changes in median visit duration also indicate that shoppers are spending less time browsing. Comparing median visit duration in July 2021 to July 2019 shows that visits got shorter at all six brands analyzed. And even chains that exhibited strong July visit numbers, such as Dillard’s, saw their median visit duration decline.

It is possible that people are still wary of spending too much time in crowded enclosed spaces, especially given the emergence of new, more contagious strands of the virus. Since several states have dropped their indoor mask mandates, consumers who are willing to brave the department stores could be trying to actively cut their visit time as much as possible. As the return to normalcy (hopefully) continues, tracking changes to median visit durations will tell whether shorter visits are a pandemic-induced aberration or whether they are here to stay.

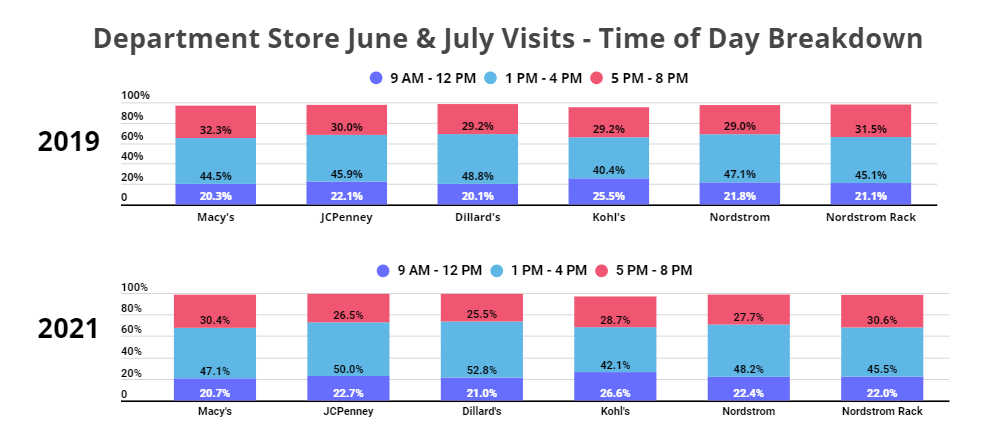

Visits Move from Evening to Morning and Mid-Day

The share of evening visits (between the hours of 5 PM – 8 PM) was still down across the board in June and July 2021 when compared to the same months in 2019, while morning and mid-day visits were up.

The reduced share of evening visits and weekend visits along with the shorter median visit duration seems to indicate that consumers are increasingly coming to department stores to shop with a purpose. The lack of a full ‘return’ in these key behavior metrics indicates that these brands still have more room for growth as normal shopping patterns recover.

With COVID cases back on the rise, there is an obvious and real concern that visits could be impacted in the coming month. The timing here is critical as the Back to School season was already shaping up to drive a major return for many brands. Should cases come under control and shopping patterns continue to return, expect a strong recovery for leading department players.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.